Summary:

- We think longer-term investors will find better entry points into Tesla, Inc. down the road, as the stock is currently already pricing in better-than-expected China deliveries and Robotaxi event hype.

- Despite this, Tesla’s EV market share is declining to 49.7% from 59.3% last year, with annual revenue growth slowing significantly since 2020.

- Tesla’s positives (pricing power, economies of scale, and potential benefits from global macroeconomic easing and China’s aggressive stimulus plan) remain at play for 2025.

- The Robotaxi event presents a hit-or-miss scenario, in our opinion.

- Tesla’s premium valuation against the large cap peer group and shrinking market share make it too expensive at current levels.

Emanuel M Schwermer

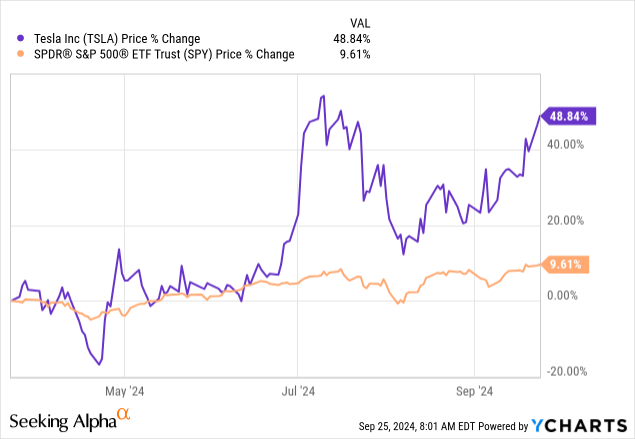

We’re downgrading Tesla, Inc. (NASDAQ:TSLA) to a hold after the mini rally created by better-than-expected delivery coming out of China for coming 3Q24 results and hype around the Robotaxi event on October 10th; the stock popped 10% over the past five days versus the S&P 500 up 1.34%.

The company continues to be the face of the EV industry, although now Chinese EV and other auto competition are squeezing its share, with Tesla accounting for 49.7% of the EV market from April through June, a decline from its 59.3% share in a year ago period and a 79% share back in 2020. Tesla’s share dipped below 50% for the first time, according to Cox Automotive. The company’s annual revenue acceleration has also slowed down since 2020, with Tesla’s annual revenue for the twelve months ending June 30th, 2024, up 1.37% Y/Y compared to an annual revenue increase of 18.8% in 2023, 51.35% in 2021, and 70.67% in 2020.

Tesla remains the leader at face value, but the numbers are shifting amid increased EV competition with price wars and a muted end demand backdrop for the year pushing prices further south. Our downgrade is based on our belief that there is a missing catalyst for Tesla in the near-term, not counting Robotaxi, which, in our opinion, presents a hit-or-miss scenario.

Tesla has positives working in its favor, still. The company continues to hold pricing power in the EV market with the advantage of economies of scale. Additionally, macro headwinds show potential signs of easing globally, although it’ll take time. The start of interest rate cuts this month signals a step in the right direction by the Fed that should lead to better deliveries in 2025 with less pressure on consumer budgets and more comfortable economic expansion. China’s central bank announced its most aggressive stimulus plan since the pandemic earlier this week in an attempt to ease deflation and reaccelerate economic growth to hit government targets. Considering that China remains the largest end market for EVs (with 56% of the BEV sales) this could potentially benefit Tesla’s sales in the nation (although there is a new move to favor local EVs). These are the two midterm positives we see working in Tesla’s favor. Our near-term outlook is more bleak, and that’s largely because too much depends on the upcoming Robotaxi event.

YCharts

Let’s get into it: Robotaxi

Investors haven’t really gotten anything, or at least not on time, about Tesla’s Robotaxi plans. They first grabbed public attention in 2019 due to a half-hour video of remarks CEO Elon Musk made on Tesla’s first Autonomy Day, noting, “All cars being produced have all the hardware necessary, compute and otherwise, for Full Self-Driving.” Since then, there’s been little tangible evidence of where the project is headed before the upcoming October event (which was also delayed from its original date in August).

Musk made promises about the Robotaxi (more specifically, full self-driving) multiple times over the past decade and has managed to disappoint; Tesla expected the features necessary to be ready by end of 2019, then anticipated regulatory approval toward the end of 2020 – none of which happened but all of which moved the stock price. Musk went so far as to promise analysts that “the number of self-driving Teslas on the road would exceed 1 million by the middle” of 2020.

In theory, Robotaxi is great — we’re big fans of Musk’s promised autonomous fleet. Our only concern is that this has been dangled at investors, but we still have limited visibility of its timeline and/or success. Considering this with the other factors relating to Tesla’s contracting margins, price and share pressure, we don’t think there is enough reason to be buy-rated on the stock just for the sake of Robotaxi. We’re well aware that the October 10th event may prove us wrong.

We also think that even positives from Robotaxi will take longer to show up on earnings. Other attempts at this faced some headaches; Alphabet’s Waymo experienced traffic violations and crashes even which stopped 700 driverless cars, while General Motors’ Cruise had to halt its business last year “after a cab hit a pedestrian.” We think Musk will provide unique software and products, but we also think this will be an uphill battle even after it gets started.

Some more fundamental factors to consider:

The start of October won’t only serve as a reality check for investors on the Robotaxi event, but also on the company’s third-quarter deliveries, scheduled to be announced on Wednesday, October 2nd. There’s some concern that expectations and upward revisions for Tesla’s delivery estimates may not be as conservative as they should be for Q3; currently, analysts are expecting Tesla’s deliveries to be up 6% Y/Y to ~460,000 EVs, and others are expecting even higher deliveries at an 8% Y/Y growth to ~470,000 following the company’s better-than-expected deliveries of 440,000 last quarter. The higher investor confidence in Tesla’s Q3 deliveries is largely based on Tesla’s registrations in China, which are up 20% from last quarter, up +18% from a year ago period, and 1% higher than its best-ever quarter in China during 4Q23. The upward revision indicates that this good news out of China has been factored into delivery expectations, making it a little trickier for the company to comfortably beat consensus.

Valuation & Word on Wall Street

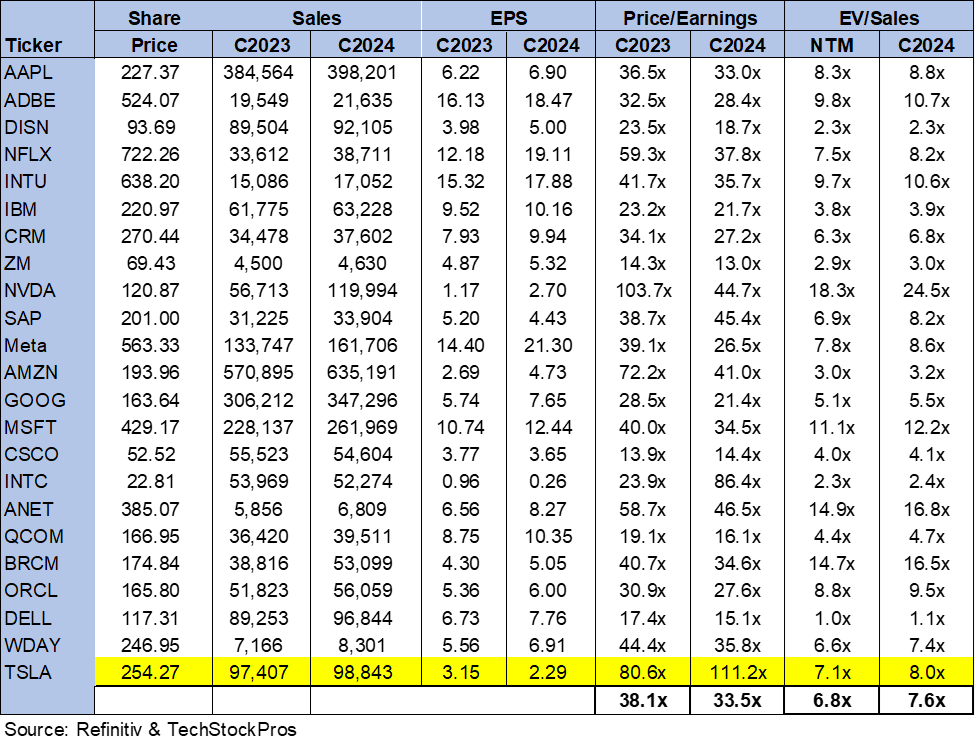

We’re discussing Tesla’s valuation relative to the large-cap peer group, and the reason is that Tesla falls somewhere between a tech company and an auto one. On an EV/Sales ratio, the stock is trading at 8.0x C2024 compared to a previous ratio of 6.7x from last December and a group average of 7.6x. The company also trades well above the peer group average on an P/E basis. The company’s higher valuation would be justified if it weren’t for its shrinking market share and lack of near-term catalysts, aside from the secular tailwinds that could work in the company’s favor.

The following chart outlines Tesla’s valuation against the peer group average.

TechStockPros

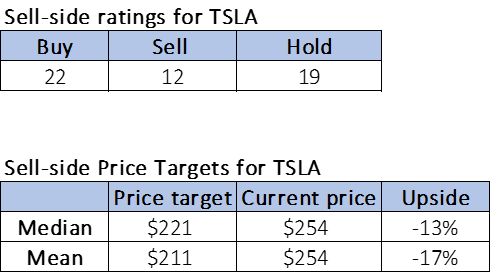

Interestingly enough, Wall Street is more positive on Tesla than it was last October. Of the 53 analysts covering the stock, 22 are buy-rated, 19 are hold-rated, and the remaining 12 are sell-side rated. This comes in contrast to the 46 analysts last October, who were broken down into 18 buy-rated, 21 hold-rated, and the remaining seven sell-rated. The stock’s sell-side price targets tell another story; the stock is currently priced at $254 per share, with a median price target of $221 and a mean of $211. Tesla’s current price is higher than both its median and mean price targets, which leads us to believe the market is valuing Tesla higher than analysts believe is justified based on the fundamentals. This could mean that analysts are too cautious, or the market is too optimistic; we think that it’s more of the latter.

The following charts outline sell-side ratings and price targets for TSLA.

TechStockPros

What to do with the stock?

Tesla isn’t going anywhere, but we also don’t think investors should rush to be in this name, considering the odds working against it for the near-to-midterm. We think short-term investors can explore entry points into the stock ahead of the first week of October to ride the upward trend of what might be investors jazzed by Musk’s event and results.

However, from a fundamental perspective, the reality is that Tesla is navigating a slowdown of EV end demand and more Chinese customer interest in domestic options. We think there is a lot of potential with Robotaxi for 2H25 and ahead, but we’re skeptical on any real and implementable updates on October 10th and don’t see data points to change our take there. In our opinion, Tesla is too expensive to have its near-term catalyst amid weak end demand be hopes about Robotaxi.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.