Summary:

- Tesla, Inc. CEO Elon Musk confirms plans to reveal a robotaxi service in August 2023.

- Tesla’s potential entry into the ride-hailing market could be profitable, given its technology and production capacity.

- However, Tesla faces challenges such as scaling costs, competition from other car manufacturers and ride-hailing companies, and the need to improve its autonomous driving technology.

- Add on top of this how pricey shares still are, and investors have reasons to be pessimistic.

simonkr/E+ via Getty Images

These are interesting times for the electric vehicle market. As I just wrote about in an article published recently, Rivian Automotive (RIVN) seems to be facing an existential crisis, while other companies like Ford Motor Company (F) are bracing for weak demand. Increased competition is pushing prices down, and consumers are not wholly sold on the transition from internal combustion engines and hybrids to electric vehicles. Amidst all of this uncertainty, the CEO of Tesla, Inc. (NASDAQ:TSLA), the controversial Elon Musk, recently came out and confirmed that the company will be revealing a robotaxi service in August of this year.

Historically speaking, I have been very skeptical of Tesla. The first article that I wrote about the company after the “strong buy” through “strong sell” recommendations came out on Seeking Alpha was an article, published in June of last year, in which I rated the enterprise a “sell” because of how expensive shares looked. So far, that call has proven effective. Shares are down 32.4% at a time when the S&P 500 (SP500) is up 17.6%. I reiterated that rating in an article published in early February of this year. And shares are still down from that time, while the S&P 500 has risen. But these weren’t the first times that I wrote about the company. I did have one article that came out in August 2018. And it tackled this very topic.

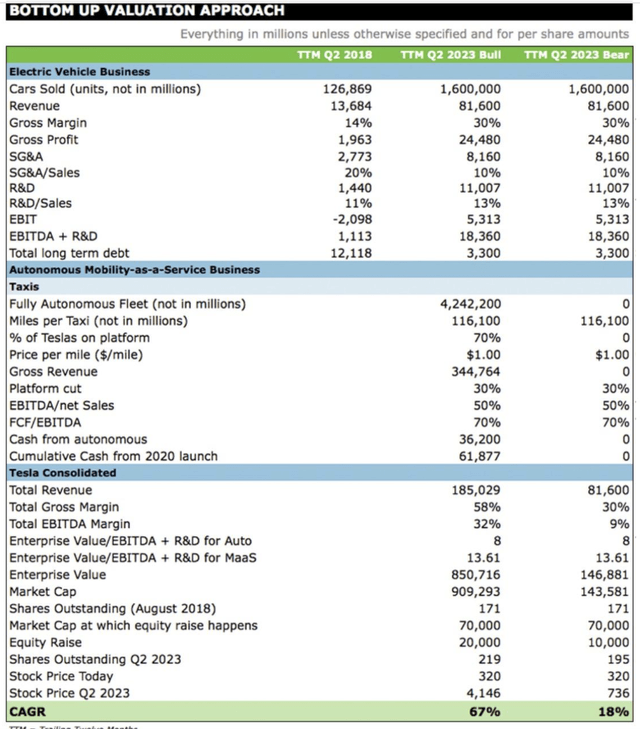

At the time, the thought of Tesla growing to be as large as it ultimately became was absurd. But that wasn’t the primary focus of my article. The primary focus was addressing an open letter and analysis conducted by Catherine Wood, the CEO of Ark Invest, that detailed how the company could be worth far more than it was at the time if it went in the direction of offering an autonomous taxi service. I found the analysis to be reasonable, though certainly a long shot.

Interestingly, there were many things that the analysis got right. The prediction was that, by the second quarter of the 2023 fiscal year, the trailing 12-month production of the business would be around 1.60 million vehicles. In 2023 as a whole, the company produced 1.85 million vehicles and delivered 1.81 million. Revenue figures were also not terribly off when it came to automotive sales, though the analysis at the time did not factor in declining prices. At that time, the expectation was an average price per vehicle of $51,000. But they ultimately have averaged around $43,399. This translated to automotive sales of $78.51 billion instead of the $81.60 billion predicted.

The analysis painted a very interesting picture of what the future might hold. But much of what was in it failed to come to fruition. In the bullish case where the company would go on to focus on autonomous taxis, it was expected that it would have a fleet by a now of 4.24 million vehicles. They would be driving 116,100 miles a piece each year and generating around $1 per mile in revenue for the service. Operating cash flow from that business model alone would be around $36.20 billion.

But alas, none of that has come to pass. At that time, I felt as though moving in that direction might ultimately create some real value for investors. But now, the picture is different. On the one hand, the company does have some things going for it that would make this move into autonomous taxis more feasible. But on the other hand, the environment today does look more challenging and the company’s competitive position is, in many respects, lacking.

The case for robotaxis

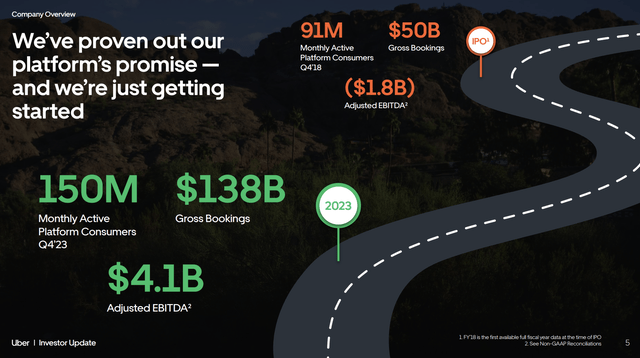

20 or 30 years ago, the thought of using your phone to hail a vehicle driven by some random person as opposed to calling up a legitimate taxi service would have been seen ridiculous to many. I know it would have then to me. But nowadays, we have massive companies dedicated to that particular line of business. At the lead of the pack is Uber Technologies (UBER), with Lyft (LYFT) not terribly far behind.

To put in perspective just how large this market currently is, consider Uber’s standing. Using data from its 2023 fiscal year, the company claims to have 150 million monthly active platform consumers in the markets in which it operates across the globe. It boasts $138 billion in gross bookings. And yet, when it comes to monthly users, it claims to have only an 8% stake of its total addressable market, or TAM.

The company is expanding into other niche pieces of the market. For instance, it believes that focusing on transporting people to and from airports alone could be a $10 billion opportunity. And last year, it generated $37.28 billion in sales. According to multiple sources, around 55% of all people in the world live in cities right now. This number is expected to grow to between 68% and 80% by 2050, depending on the source. Increases in population density will also make not owning a vehicle more appealing, and it will make any sort of ride hailing service more economical.

A case could be made that there are two primary costs when it comes to the ride hailing market. One of these is the vehicle. The other is the person behind it. And one thing that we know about the modern era is that, when possible, cutting costs by cutting people is always on the menu. The more sophisticated technology becomes, the more likely someone’s job is at being at risk.

The recent advances made in AI are likely to supercharge these efforts. To be fair, there are legitimate reasons why moving away from human-operated vehicles and toward autonomous ones makes a lot of sense.

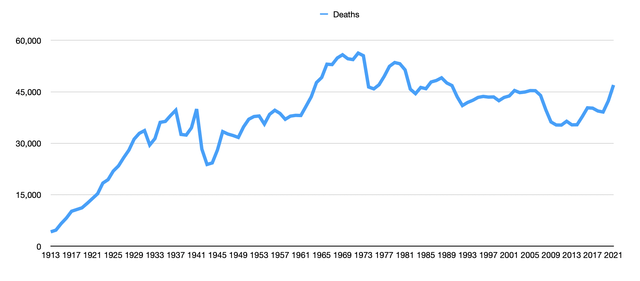

Author – Data From National Safety Council

First and foremost, driving is deadly. As illustrated by the chart above, the number of vehicle fatalities have fallen from their all-time high of 56,278 back in 1972 to around 46,980 by 2021. That’s an improvement, but that’s still more people dying, just in the U.S. alone, than the number who die from the flu and pneumonia, hypertension and related diseases, septicemia, Parkinson’s, and even suicide. And it’s not just the lives lost. It’s the total economic cost, such as repairing and replacing vehicles, fixing roads that are damaged, medical care, and so much more.

According to one source, the economic cost of motor vehicle crashes in 2019 was $340 billion. No doubt, that number is higher today. At the time, though, that worked out to $1,035 for every person in the U.S. And what makes matters worse, is that somewhere between 94% and 96% of the fatalities are the result of human driver error.

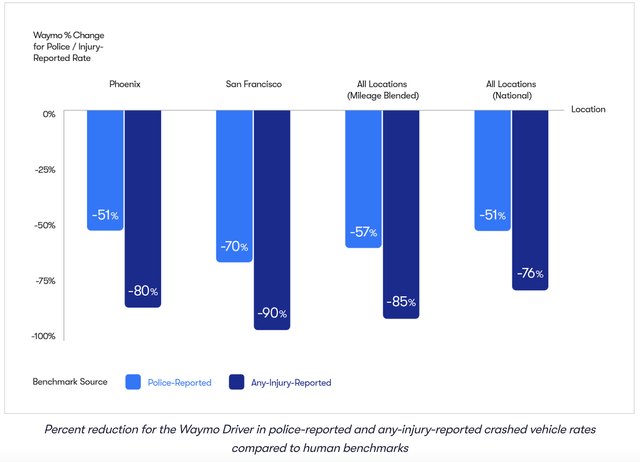

Though it will not be perfect, the expectation is that autonomous driving technology will significantly reduce these kinds of issues. But don’t take my word for it. There is some data starting to emerge that backs this up. Since its inception, Alphabet (GOOG, GOOGL) subsidiary Waymo has driven over 40 million miles on the road. Over 7 million miles of this has been with the company’s driverless cars. Admittedly, these have been in carefully selected markets like Los Angeles, Phoenix, and the Bay Area. All the same, this has worked out to over 700,000 ride hailing trips with public riders and no human drivers. The company even published a paper on the matter that reveals that its autonomous technology appears to be responsible for an 85% reduction in injury-causing crashes.

What Tesla has going for it

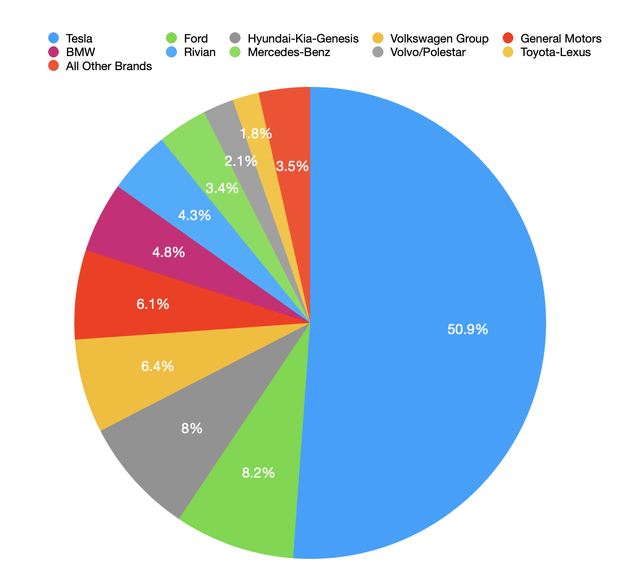

Clearly, this is a massive market opportunity for any players able to get into it. And there are some things that Tesla has working in its favor. The company has always been a technology-oriented one in a way that other major automotive manufacturers like Ford and General Motors (GM) have struggled with. This has helped the company grow to have a 50.9% market share in the domestic electric vehicle space. The next largest competitor is Ford at 8.2%.

It stands to reason that the wave of autonomous vehicles will not involve those using internal combustion engines. Instead, it will involve electric vehicles. Tax incentives, cost reductions, environmental concerns, and more, are all making this far more likely. There’s also the fact that the range of these vehicles continues to grow. Back in 2021, the average range was around 220 miles per charge. Today, Tesla and other players in the space have vehicles that can last for more than 300, and even approaching 400, miles.

Tesla also generates a sizable amount of cash. Last year, the company generated $13.26 billion in operating cash flow from $14.97 billion in profits. As I stated earlier, it surpassed the expectations that Catherine Wood had regarding the number of vehicles produced. And the company has also been one of the earlier advocates for autonomous driving through its Autopilot, Enhanced Autopilot, and Full Self-Driving (“FSD”) features. Though it is worth noting that none of these offerings is meant to be interpreted as being completely self-driving features where the person in the vehicle does not need to be behind the wheel and attentive.

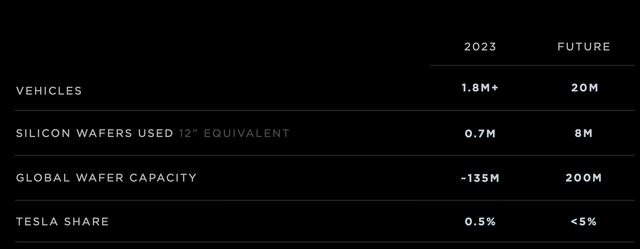

The company is also in the process of further scaling up its production capacity. Management has not said a specific time on this that I can tell, but it seems, by sometime around 2030, Tesla is aiming to have around 20 million vehicles produced each year. That would be over 10 times what it produces today.

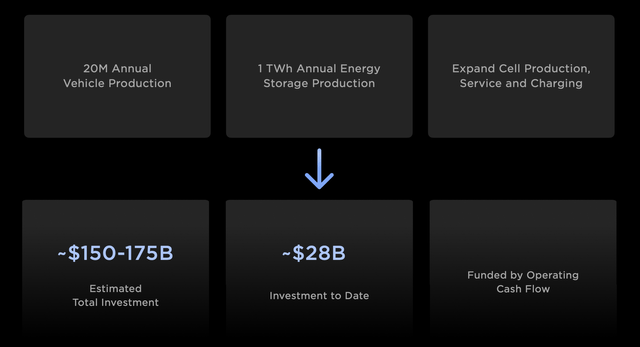

Of course, this will cost a lot of money. From the foundation of the company through the time of the firm’s 2023 Investor Day, management had allocated $28 billion toward the company’s initiatives. But the total cost for them, as shown below, will cost a combined $150 billion to $175 billion.

Part of the company’s investments have been to focus on lower priced vehicles. For instance, management is pushing for the release, probably sometime next year, of the lowest price point model yet. This seems to be known as the Model 2 and is expected to cost about $25,000. That’s far below the $39,000 of the company’s current cheapest model, the Model 3 sedan.

However, the business is facing some uncertainty on this front. The same Reuters report that prompted the company to confirm the robotaxi service also indicated that this is being done in place of the low-priced model. The mercurial Musk alleged that, on this point, Reuters is mistaken. But only time will tell what ultimately transpires. The reason for the company’s decision, supposedly, to abandon the lower priced models is due to increased competition from China. Some Chinese vehicles can be produced and sold for $10,000. And trying to capture a little bit of profit on small purchase prices tends to be a bad business strategy for those focused on the long haul.

Economically speaking, there could be a lot of opportunity for Tesla if it can go this route. If we use the same assumptions as what were used in the article back in 2018 in terms of the number of vehicles that Tesla would have in its fleet, 4.24 million in all, and we assume a $1 average price per mile, with 116,100 miles traveled per taxi each year, along with a few other assumptions, you would be looking at $344.76 billion of gross revenue for the company each year. Net revenue to the company would be around $103.43 billion, with cash flows coming in at about $36.20 billion. That’s well above what the company is currently making.

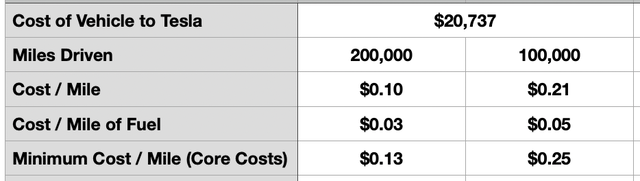

I wouldn’t be worried about the $1 price per mile being low, either. With the human element involved, the average price per mile for Uber’s ride hailing seems to be between $1 and $2. Though some estimates do peg the number north of $2. If we assume that Tesla does build out a fleet of low-priced vehicles at $25,000 for the sales price, and we strip out the gross profit it would generate from adding these into its fleet, we can get some interesting results. A typical electric vehicle should get between 100,000 and 200,000 miles during its lifetime. This implies a cost per mile, for the low-priced Tesla, of between $0.10 and $0.21. The price per mile for the power needed to charge the vehicles seems to be between 2.9 cents and 4.5 cents. So it’s not unthinkable that the company could offer up its services for even less than $1 per mile while still making a tidy profit.

Tesla also has challenges that lie ahead

As interesting as the robotaxi service is to me, and as profitable as it could be for shareholders, there are a number of issues that Tesla has to contend with if it wants to have a good chunk of this market. Keep in mind how much time has passed since my original article on the topic. In that time, the landscape has changed for electric vehicles in general and for autonomous driving. The first issue relates to the cost of scaling. Even if the company can capture the same kind of margins that it can on its existing vehicles with the low-priced ones that I am suggesting it use, we are still looking at a price per vehicle of approximately $20,737. To grow to even 1 million vehicles would cost the company $20.74 billion. Given the amount of cash flow the company is generating now, this is not out of the question. But it will be a massive investment.

There’s also the issue of competition. While Tesla might be the leader in electric vehicles currently, its market share is declining at a rather rapid pace. In the final quarter of 2021, the company had a market share in the US of 72%. But the introduction of even more domestic and foreign players into the space has caused this to decline to 50.9% as of the end of the 2023 fiscal year. That trend is likely to continue.

But it’s not just investments in electric vehicles. It’s also investments being made in autonomous driving. Back in 2017, Ford made a $1 billion investment in Argo AI, with the goal of developing a virtual driver system for its autonomous vehicle. This was followed up by a $2.6 billion investment made in the same company by Volkswagen. Ultimately, after acknowledging in 2022 that profitability would be “a long way off,” Argo AI shut down. However, other investments have been made over the years to achieve this future that all the car manufacturers seem to be focused on.

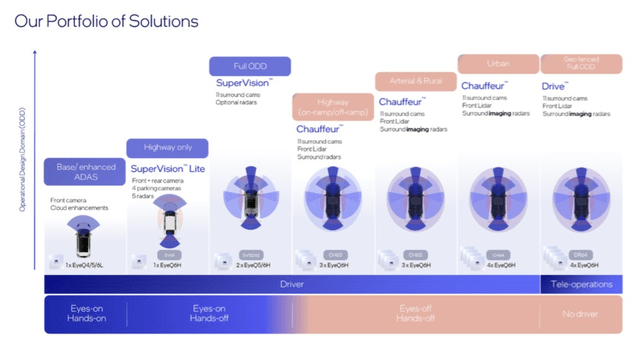

One of the leaders in autonomous driving today is Mobileye Global (MBLY). Although its shares have taken a hit over the past year, the company is still worth $25.57 billion. And it seems to be on the move. On March 20th of this year, for instance, the company struck a deal with Volkswagen that followed up an “extensive pilot phase with road testing” in Germany and the U.S. In short, Mobileye is developing and supplying software, hardware components, and digital maps to Volkswagen for the purpose of achieving more advanced autonomous vehicle functionality. Earlier in the article, I also discussed the progress that Waymo has achieved.

Now, to be fair, neither Mobileye nor Waymo produce their own vehicles. They instead rely on strategic partners such as the major car companies out there. I do believe that the producers of this specialized hardware and software will most likely be major winners because they can choose to be car-agnostic. It doesn’t matter to them which vehicles come out on top, so long as they can connect to them.

But another potential winner, and something that Tesla needs to address if it wants to capture this market, are the ride-sharing companies themselves. In its latest investor presentation, Uber lauded the move toward autonomous driving. In May of last year, the company even partnered up with Waymo to offer autonomous vehicle deliveries in seven different cities. Creating a true autonomous taxi service will require significant investments in scaling beyond just manufacturing vehicles. Uber found this out the hard way. Admittedly, much of its spending went on incentives for drivers and riders alike. But the company spent billions of dollars creating its network. And today, that network remains intact.

By entering into this space, Tesla will be competing with not only car manufacturers and providers of autonomous software and hardware, it will also be competing with the ride hailing players. That’s a lot of enemies to take on at once.

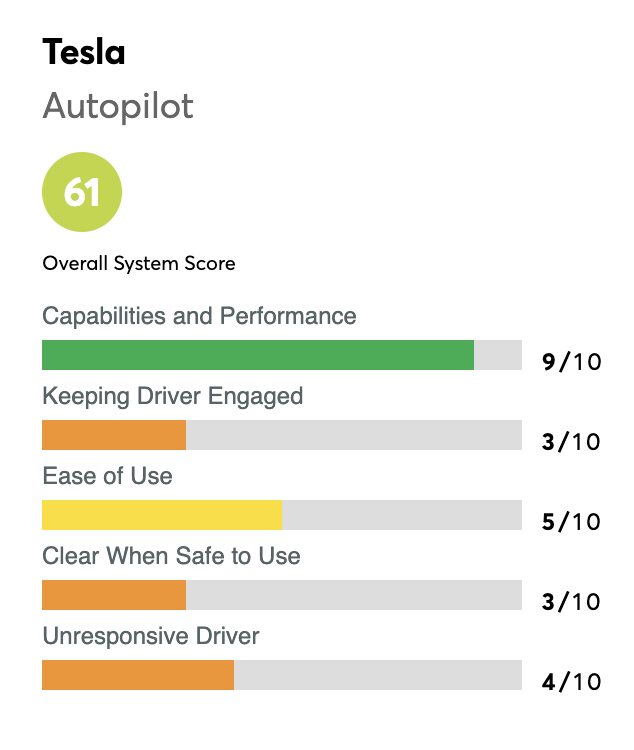

Consumer Reports

It would be one thing if Tesla’s existing technology was top class. But that doesn’t appear to be the case. According to Consumer Reports, for instance, there are a number of other players with better driver assistance programs on the market today. At the top of the list for car manufacturers happens to be Ford, with a scale of 84. In fact, with a score of 61, Tesla’s Autopilot came in eighth. The only redeeming feature for its Autopilot feature was that it scored a 9 out of 10 when it came to capabilities and performance. But when it came to issues like keeping the driver engaged, ease of use, clearing when it is safe to use, and dealing with unresponsive drivers, it scored quite low. Admittedly, there are other technologies that the company has like Enhanced Autopilot and Full Self-Driving, but unless the company has achieved significant progress as of late, its technology is unlikely to stand out compared to some other offerings that are out there.

When it comes to the Full Self-Driving feature the company offers, there have been a number of concerns that should worry investors and drivers alike. In an analysis that The Washington Post conducted using data from the NHTSA (the National Highway Traffic Safety Administration) last year, with data extending through the first quarter of 2023, it was determined that there were at least 736 car crashes involving Tesla vehicles since the company started rolling out its Autopilot feature in 2019, with 17 accidents being fatal. However, what the newspaper cited as an “aggressive rollout” of Full Self-Driving, taking it from 12,000 users to almost 400,000 in a little over a year, corresponded with about two-thirds of its driver assistance crashes taking place.

This is not the only scrutiny to come its way. The first study of its kind, conducted by the Insurance Institute for Highway Safety, resulted in Tesla’s Autopilot and Full Self-Driving functions both receiving “poor” safety ratings. Though, to be fair, 11 of the 14 different driving automation features tested received that rating, with the other 3 receiving an “acceptable” rating and none of them receiving a “good” rating. Of particular concern for Full Self-Driving was its lane change function and lane centering function. And in October of last year, the car manufacturer received a subpoena from the US Department of Justice regarding claims it has made involving both Autopilot and Full Self-Driving.

Even if the company does come out with something convincing on this front, the regulatory approval process could prove problematic. Today, there are few guidelines that need to be followed at the federal level. Most issues occur at the state level instead, though federal regulators are looking into the picture at this time. Take Waymo as an example. They are currently authorized by California to operate their autonomous taxi service in San Francisco. But because of concerns over safety, their application to expand the service to San Mateo and Los Angeles was put on hold by the California Public Utilities Commission’s Consumer Protection and Enforcement Division for 120 days in February of this year. This was even though, in January, a different agency, the California Department of Motor Vehicles, approved such an expansion. In all likelihood, any sort of move to offer a major robotaxi service will require significant collaboration with multiple regulators in each state in which a firm might choose to operate.

Additional thoughts

None of this is to say that the company won’t have potential, especially if it can gain traction in the robotaxi space. If management can come out with a fantastic plan that can result in a significant ramping up of a fleet of taxis and can be convincing when it comes to its ability to compete with established networks that are out there from ride-sharing companies, my mindset could change.

I don’t have a lot of faith that this will come to pass, however, because I see it as a Herculean effort that would be needed. Obviously, if the company can achieve rapid growth in this market, shares could become attractively priced at some point. But even now, the stock is expensive. Using data from 2023, the firm is trading at 35.9 times its adjusted operating cash flow. That compares to the 2.9 times that General Motors is going for and the 3.5 times that Ford can be purchased for. Meanwhile, it’s also trading at an EV to EBITDA multiple of 39.3. That dwarfs the 6.5 and 13.6, respectively, that the other two car manufacturers are trading for.

It would take a great deal of cash flow generation to bridge that gap. And it’s just more likely that shares will fall given the challenging conditions that I have already covered, than for the alternative to happen.

Takeaway

Eventually, if Tesla can truly pull off a robotaxi service, the upside for it and its investors could be quite appealing. As excited as I am to see this kind of technology become mainstream, I still have significant doubts. Particularly, I have doubts regarding Tesla and its ability to do anything meaningful in this space. Add on top of this just how expensive shares remain, and until I see some sign that the picture is changing for the better, I believe that the “Sell” rating I have had it at still holds.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!