Summary:

- Google’s Waymo is doing more than 150,000 robotaxi rides per week, but Tesla still doesn’t offer driverless rides to the public.

- FSD 12.5.4 offers hands-free driving but still sometimes struggles with common-sense issues and navigation errors.

- Tesla’s valuation includes significant potential from semi-supervised FSD licensing, robotaxi and Optimus.

jetcityimage

Introduction

Per my April article, Tesla, Inc. (NASDAQ:TSLA) self-driving is improving, and it is getting closer to something which can be licensed to other carmakers. My April article was for full self-driving (“FSD”) version 12.3.3, and my vehicle is up to version 12.5.4 now. New information has come out from the 3Q24 period, including hardware discussions in the 3Q24 call.

My thesis is that despite continual improvement by Tesla, Inc., they remain well behind Waymo (GOOG, GOOGL) with robotaxis. However, I am optimistic that Tesla can become a leader in semi-supervised self-driving tech in the near future, which should bring about licensing opportunities.

Developments

One of the things I like the most about FSD 12.5.4 compared to FSD 12.3.3 is the freedom to keep my hands off the steering wheel. Not having to worry about micro-decisions is a massive relief on long drives! I still have to keep my eyes on the road at all times, which is a little puzzling if the software is almost ready for use as a robotaxi. An inflection point for me would be if we could go from fully supervised FSD to semi-supervised FSD. It would be nice to be able to turn to the passenger while talking. I would appreciate it if the driver could use the screen while driving to change the radio station or find a supercharger. Having the freedom to check a text message would be excellent on long drives. I don’t think we’ll go straight from fully supervised FSD to robotaxis; I won’t believe we’re close to robotaxis until we see some semi-supervised FSD benefits.

FSD 12.5.4 feels very safe, and the numbers show it has fewer accidents than human drivers. It is smoother and more practical than previous versions, but it still is not as smooth and practical as a Waymo. My FSD 12.5.4 is a big improvement in many ways, but one area where it still struggles is regarding mimicking the type of common-sense humans sometimes take for granted.

For example, the other day a motorcycle was approaching quickly from behind as he was lane splitting. I saw him approaching through the rearview mirror, as did Tesla’s rear-facing cameras. There was no danger as he passed my vehicle and entered the view of the front-facing cameras, yet my car braked. There was no need to brake; the motorcycle was never directly in front of my vehicle, and he was accelerating away from it.

This lane splitting issue also occurred on previous FSD versions, but I thought it would be addressed in this one. From talking to another Tesla owner, this could also be a hardware issue. My cameras are from the hardware 3 (“HW3”) stack, while newer Teslas are on HW4. Another issue I still experience regularly is navigation errors – particularly on freeways. We can’t be too hard on Tesla here because Waymo has a history of staying off freeways, and an October 25 Waymo update mentions freeway driving in Phoenix and San Francisco but not Los Angeles. Another issue I’ve still experienced in 12.5.4 is its tendency to pull up next to an 18-wheeler and stay right next to it. Humans typically don’t do this, we avoid being right next to big trucks.

Tesla does not yet have any robotaxis for paying customers, but Waymo has them in Phoenix, San Francisco, and Los Angeles. Soon, Waymo will also have them through the Uber (UBER) app in Austin and Atlanta. Per comments from CEO Musk in the 3Q24 call, Tesla has ride-hailing for employees in the Bay Area of California, but there is a safety driver:

We have, for Tesla employees in the Bay Area, we already are offering a ride-hailing capability. So you can actually with the development app, you can request a ride, and it’ll take you anywhere in the Bay Area. We do have a safety driver for now.

Timothy Lee from Understanding AI explains in a May article how Waymo is ahead of Tesla with robotaxis. Reader Brad Templeton commented about the difference being understated, seeing as Waymo does tens of thousands of rides daily with hardly any reports of incidents. Waymo is now doing more 150,000 robotaxi rides each week per Google CEO Sundar Pichai in their 3Q24 call. Their growth is astounding right now, seeing as they mentioned 100,000 rides per week on August 20th. It wasn’t long ago, in May, when they mentioned just 50,000 rides per week.

CEO Musk said in the 3Q24 call that Tesla ride-hailing should happen in states like Texas and California in 2025, but details on regulation are sparse (emphasis added):

And we do expect to roll out ride hailing in California and Texas next year to the public. Now California is somewhere – there’s quite a long regulatory approval process. I think we should get approval next year, but it’s contingent upon regulatory approval. Texas is a lot faster so it’s – we’ll definitely have it available in Texas and probably have it available in California, subject to regulatory approval.

CleanTechnica guest contributor Charlie Doyle went too far in February when he said Tesla has “no plan” on the regulation side, but he has a point about regulation uncertainties in each state:

The bottleneck for scaling a robotaxi business is getting licenses from the regulators in each area, which Tesla has no plan for.

A recent Hard Fork interview revealed a great deal about the differences between Tesla and Waymo. Uber CEO Dara Khosrowshahi said he thinks Tesla will eventually get to a viable scale with robotaxis, but Uber is betting on Waymo for the next 5 years (emphasis added):

I mean I think that hardware costs scale down over a period of time. So sure Waymo has a hardware problem but they can solve it. I mean the history of compute and hardware is like, the costs come down very, very significantly. The Waymo solution is working right now so it’s not theory, right? And I think the differences are bigger, which is Waymo has more sensors, has cameras – has lidar. So there’s a certain redundancy there. Waymo generally has more compute so to speak. So the inference of that computer is going to be just better, right? And Waymo also has high definition maps that essentially makes the problem of recognizing what’s happening in the real world a much simpler problem. So under Elon’s model, the weight that the software has to carry is very, very heavy versus the Waymo and most other player’s models.

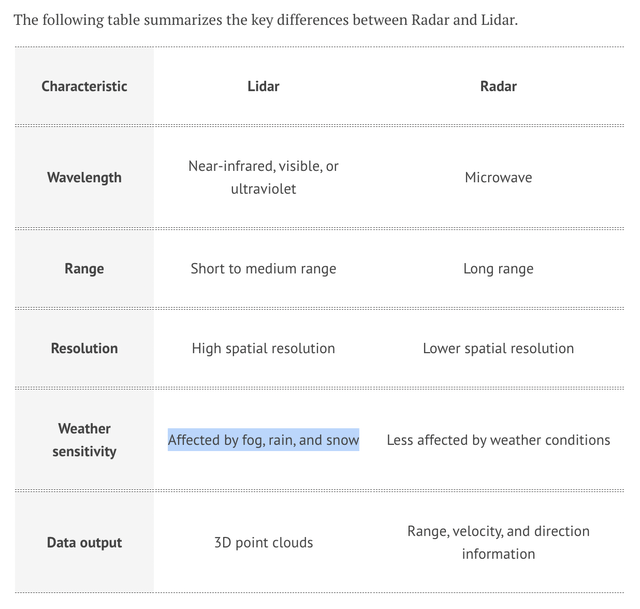

Both Tesla and Waymo use cameras, but Waymo also uses other systems such as radar and Lidar. Radar is nice for bad weather such as rain, while Lidar excels for mapping. Wevolver has a nice breakdown of radar and Lidar:

Given Waymo’s use of radar, it isn’t surprising to find videos of them driving well in rainy conditions. This isn’t the case for my camera-only Model Y where FSD 12.5.4 forces me to take over when the rain is severe. A recent WSJ article talks about how radar can remain working in fog and this is important for Waymo in the San Francisco area which is notorious for fog:

Take fog, which looks like an obstacle to both camera-based and lidar-based systems, potentially causing vehicles to stop when they shouldn’t. In research published in 2020, radar-based automotive sensors had no trouble penetrating fog and correctly identifying stopped vehicles hidden within it, says Dinesh Bharadia, an assistant professor of engineering at the University of California San Diego who contributed to the work.

In the above Hard Fork interview, Uber CEO Dara Khosrowshahi seemed puzzled as to why Tesla hasn’t added Lidar to their stack (emphasis added):

The cost of a solid state lidar now is $500, $600, right? So why wouldn’t you put that into your sensor stack? it’s not that expensive, and for a fully self-driving specialized auto, I think that makes a lot of sense to me.

A Cybertruck owners club post from @cyberos who works at Google but not Waymo says Tesla’s lack of Lidar is an issue in the robotaxi race:

In one sentence, robots need “laser imaging, detection and ranging” (LIDAR) to accurately perceive depth, occlusion, etc. Longer answer is that LIDAR facilitates building a 3D point map of the world. Initially cameras were meant only for object detection. Tesla admirably expanded camera-based computer vision into FSD, but the lack of LIDAR is still problematic.

Like other Teslas before early 2023, my Model Y uses HW3 and the HW3 suite may not be powerful enough for robotaxis. Here is what CEO Musk said about this and HW4 in the 3Q24 call (emphasis added):

Hardware 4 has really several times the capability of Hardware 3. It’s easier to get things to work with then it takes a lot of effort to sort of squeeze that box analyst hat [to] Hardware 3. And there is some chance that Hardware 3 is – does not achieve the safety level that allows for unsupervised FSD. There was some chance of that. And if that turns out to be the case, we will upgrade those who bought hardware 3 FSD for free. And we have designed the system to be upgradable.

In addition to the replacement of HW3 cameras with HW4 or HW5 cameras, it isn’t 100% guaranteed that cameras alone will satisfy all regulators in all states. It’s possible radar may need to be added back into the mix, and Lidar can’t be ruled out either. Seeing as HW3 probably needs to be upgraded, it is likely a good thing Tesla didn’t use Lidar and radar over the last few years when it was pricier than it will be in the future.

Valuation

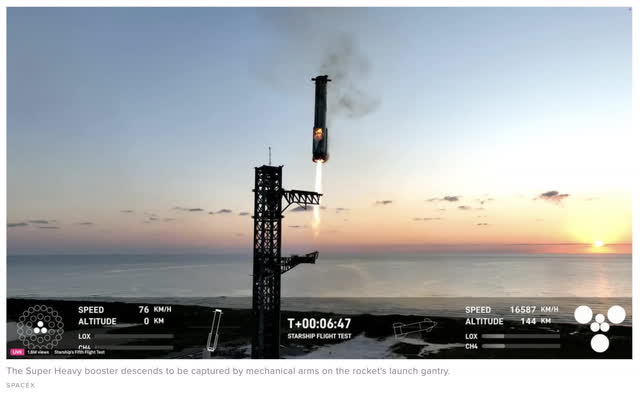

CBS News has a recent article about one of the key accomplishments for Tesla CEO Musk when his SpaceX company successfully used giant “mechazilla” mechanical arms for a Super Heavy Starship booster capture on October 13. The engineering feats of companies led by Tesla CEO Musk are mind-boggling, and they influence my valuation thoughts:

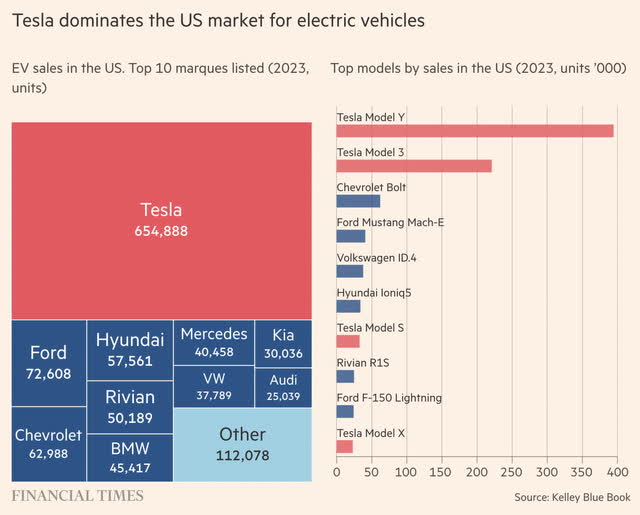

Tesla has grown prodigiously with very little in the way of advertising. CEO Musk is now more open to ads, and I’m hopeful Tesla will have more FSD upgrades done in time for a cool Super Bowl commercial. It will be nice if they could show things like Actually Smart Summon to help get their unit sales increasing again. Per Tesla’s 3Q24 presentation, their trailing twelve-month (“TTM”) global deliveries were 1,778,163 units. During the 3Q24 call, CEO Musk made the point that Tesla makes 35 thousand vehicles per week while Waymo has fewer than 1,000 vehicles in their fleet. A June article from the FT has a nice visual showing the way Tesla dominates battery electric vehicle (“BEV”) sales in the US:

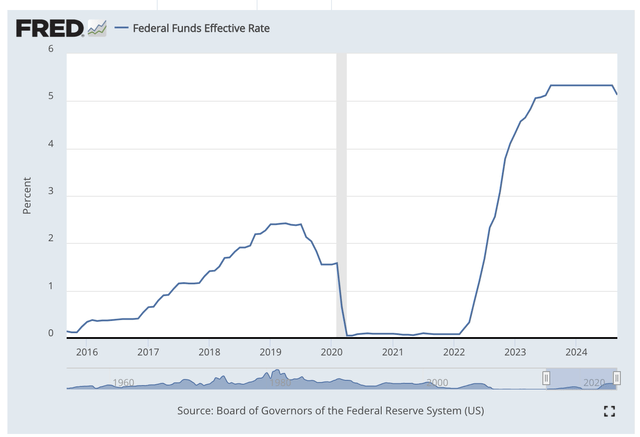

It is typical for Tesla’s automotive gross margin to have an inverse relationship with interest rates, and we saw this in 1Q23 when the gross margin went down following rate increases in 4Q22:

Before we look at TTM financial numbers, it is important to go back to an inflection point in 1Q23, when gross margins took a big hit. Per the 1Q23 presentation, the overall gross margin dropped substantially from 23.8% in 4Q22 down to 19.3% for 1Q23. During the 1Q23 call, Deutsche Bank Analyst Emmanuel Rosner asked about the lower automotive gross margin due to price cuts. CEO Musk blamed higher interest rates and uncertainty in the economy as follows (emphasis added):

Yes. I mean, there are really 2 macro factors that are tricky, the biggest being the interest rate. So if there’s a very high Fed rate or interest rates are very high, that – that is – every time the Fed raises the interest rates, that’s equivalent to increasing the price of a car. It makes the cars less affordable because people are able to buy cars as a function of what they can afford on a monthly basis. So that’s – so it’s just almost directly equivalent to a price increase is any kind of interest rate increase. Then the other factor is whenever there is uncertainty in the economy, people will generally postpone new – big, new capital purchases like a new car.

Looking at the 3Q24 10-Q and the 2023 10-K, TTM automotive segment gross profit was $15,038 million or $11,403 million + $16,030 million – $12,395 million for a 19.1% margin on segment revenue of $78,835 million or $57,272 million + $82,419 million – $60,856 million. This doesn’t compare well with 2022 when the automotive gross profit was $20,354 million because of the higher 28.5% margin on segment revenue of $71,462 million. FSD falls under this segment, but it isn’t yet available in Europe and China, and it isn’t yet a large part of the economics. Charging is lumped into this segment as well.

Incentives should never be underestimated, and they are a key part of Tesla’s auto business prospects relative to legacy companies. CEO Musk explained this in the 3Q24 call (emphasis added):

This is where a Tesla structure, I think, a strong advantage relative to the rest of the auto industry because we make the cars and we service the cars, whereas I think there’s a bit of a conflict of interest with the dealer model and the traditional OEM and dealer model where the dealerships make most of their money on service. And so they don’t – they obviously [don’t give] assistance to reduce the servicing cost, whereas in our case, we are incented to reduce the service and cost because we carry that servicing cost. And we’ve got good feedback with our cars.

I think Tesla’s auto business including charging is worth 15 or 16x TTM gross profit, which gives us a range of $225 to $240 billion when rounding to the nearest $5 billion.

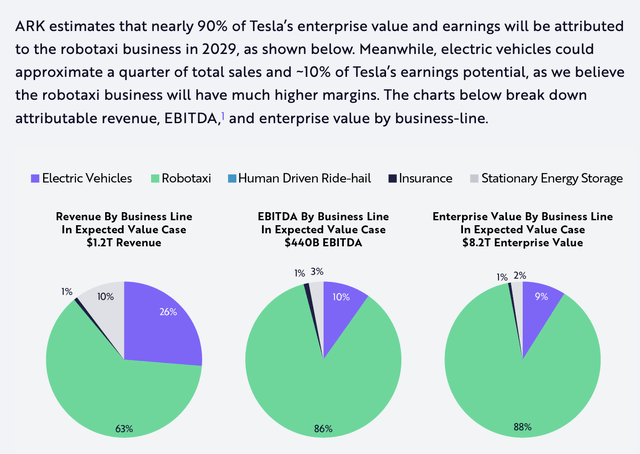

One of the things I like about ARK Invest is the way they show us the many possibilities for Tesla beyond the core business of building electric vehicles. Like ARK, my overall valuation for Tesla is based on much more than their global auto business prospects. A June 2024 ARK Invest article says nearly 90% of Tesla’s 2029 valuation will come from the robotaxi business. They think this robotaxi business will have less than 2/3rds of Tesla’s overall revenue but the bulk of the EBITDA and enterprise value because of outstanding segment margins:

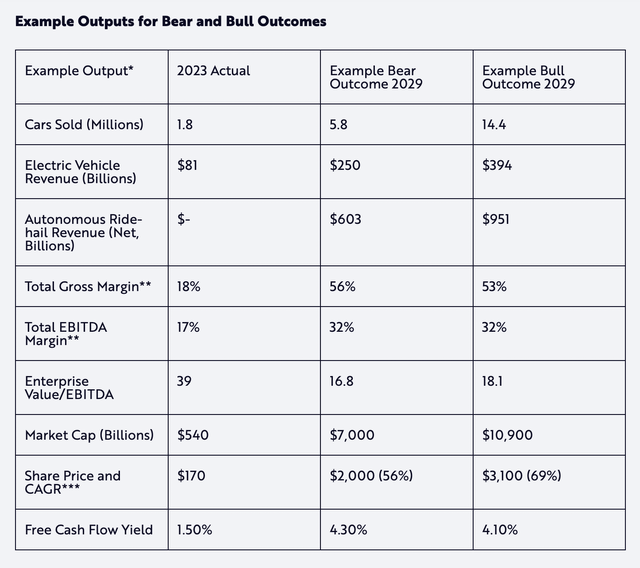

Ark breaks out their key numbers out in a table:

I agree with ARK that Tesla will have valuable segments outside the core auto business in the years ahead. I’m more bullish than ARK on semi-supervised FSD licensing and Optimus, but less bullish with the robotaxi business. Once Tesla does get to the robotaxi stage, I’m not sure about these margin projections discussed by ARK, given the way Waymo is going through Uber in Atlanta and Austin:

From a modeling perspective, we previously estimated that Tesla’s take rate would be ~40-60% on average, higher than Uber’s ~20-30% take rate.

Regarding licensing, there is a silver lining regarding HW3 limitations. These HW3 considerations force Tesla’s engineers to spend time looking at what needs to happen when a vehicle’s hardware has to be updated. Vehicles from other OEMs will need to be modified to be ready for FSD licensing, and I believe Tesla engineers will work to make the process as smooth as possible. If Tesla can have an FSD subscription on 10 million vehicles with each vehicle paying $1 thousand per year, then we have an annual revenue of $10 billion. The margins here should be excellent, and I’m optimistic $7.5 billion can make its way to the bottom line. If we use a multiple of 20x, then this licensing business will be worth about $150 billion.

In the 3Q24 call, CEO Musk said Optimus could be extremely valuable (emphasis added):

As I’ve said on a few occasions before, I think Optimus will ultimately be the most valuable product. So I think it has a good chance of being the most valuable product ever made.

Here is my sum of the parts valuation:

$225 to $240 billion auto and charging

$600 to $650 billion semi-supervised FSD licensing, robotaxi, Optimus, and other

————————————

$825 to $890 billion total

The 3Q24 10-Q shows 3,210,059,659 shares outstanding as of October 18. Based on the October 29 share price of $259.52, the market cap is more than $830 billion. The market cap is within my valuation range and I think the stock is a hold right now.

Forward-looking investors should keep tabs on FSD updates along with news developments on the regulatory side.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, BYDDY, GOOG, GOOGL, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.