Summary:

- Tesla, Inc. Q2 earnings beat estimates, but margins continued to compress and free cash flows were weak, leading to suggestions that selling shares to lock in gains could be a good move.

- Despite record deliveries and revenue growth, the company’s gross margins dropped from 25% to 18% during Q2.

- Tesla’s energy business performed well, with storage deployment up 200% YoY, but this was not enough to offset falling gross margins in the automotive business.

Justin Sullivan

Article Thesis

Tesla, Inc. (NASDAQ:TSLA) reported its second quarter earnings results on Wednesday afternoon. While the company beat estimates on both lines, margin compression continued and free cash flows were pretty weak. Due to a very high valuation, I believe that selling shares in order to lock in gains makes sense.

What Happened?

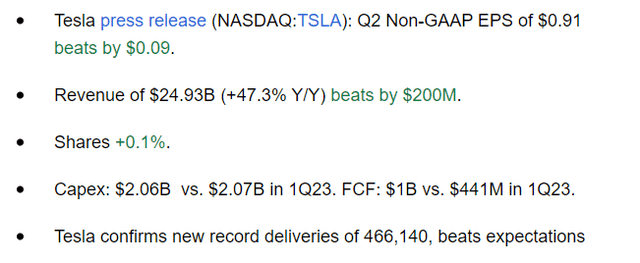

On Wednesday afternoon, Tesla, Inc. reported its second-quarter earnings results, which can be seen here. The headline numbers looked like this:

The electric vehicle (“EV”) player beat estimates on both lines, which naturally was a positive surprise. Record deliveries had been announced in early July already, thus this was not a surprise any longer. The company’s revenue growth rate was very attractive, but that was, at least partially, due to the easy comparison to the weak results from the previous year’s second quarter. On a quarter-to-quarter basis, revenues were up around 7% — which is still very meaningful, but which annualizes to around 30%. This implies that Tesla will experience a significant growth slowdown once the comparison to the previous year’s quarters becomes tougher again. Or, seen differently, growth is slowing down — although it is still well north of the growth that legacy auto players are experiencing.

Margins Continue To Compress, Free Cash Generation Is Weak

When we look beyond the headline numbers, there were a couple of things in Tesla’s report that did not look great at all. Let’s start with Tesla’s margins, which continued to compress. Tesla bulls have, in the past, argued that the company had massive competitive advantages due to its high margins and that this would warrant a premium valuation versus other automobile companies. The high margins were, according to some Tesla bulls, the result of an excellent operational structure and highly advantaged production technologies. But it seems that these tailwinds have either vanished, or, alternatively, they never existed in the first place, and Tesla was just benefitting from a demand overhang in the EV space.

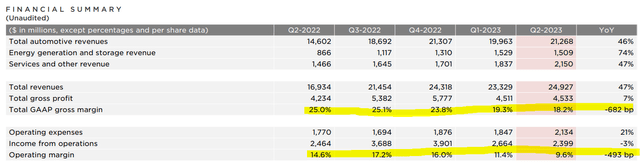

Over the last couple of quarters, Tesla’s margins have only been moving in one direction — downward:

We see that gross margins have dropped from an impressive 25% to just 18% during the second quarter, which implies a hefty 700 base point margin hit. Even worse, margins continued to decline on a sequential basis, which implies that further margin contraction is possible — we have not passed the nadir yet. While operating margins declined by a little less in absolute terms, dropping 500 base points over the last year, the operating margin decline, in relative terms, was extraordinary, as Tesla’s operating margin dropped by 34%. This means that Tesla now has to generate revenues that are 52% higher than one year ago in order to generate the same amount of operating profit [1/0.66]. This, in turn, explains why Tesla’s operating profits are down year over year, despite the substantial increase in the company’s revenues and deliveries over the last year.

While the year-over-year decline has not been very high during the second quarter, it looks like we could see more substantial profit declines during the second half of this year. H2 of 2022 was better profit-wise compared to the first half of 2022, which means that the comparison will become harder for Tesla in H2 of 2023. Since Tesla has experienced a profit decline during the second quarter despite a relatively easy comparison, a more substantial profit decline during Q3 and/or Q4 would not be surprising, I believe.

Operating income did also fall versus the first quarter, despite higher deliveries. To me, this suggests that Tesla’s strategy of lowering the price of its vehicles in order to sell more vehicles is not generating any value for shareholders — deliveries climb, but when profits are declining, that’s not really helping anyone (at least not investors, which should care about profit).

Tesla has a very clean balance sheet, but the cash flow picture is far from good. Despite profits being much higher, the company generated just $1 billion of free cash flow during the second quarter, and around $1.4 billion during the first half — that’s a little less than $3 billion annualized, which is far from appealing, considering Tesla is valued at well north of $900 billion. If H2 is comparable to the first half of the current year, Tesla trades at a 300x free cash flow multiple, which is, I believe, incredibly expensive. In other words, for every $1 investors put into Tesla stock, they have a claim on one-third of a cent of free cash flow. Considering that $1 dollar put into short-term treasuries generates around $0.05 per month in interest, the cash flow yield of Tesla stock is pretty weak (and this does not yet factor in that Tesla doesn’t even pay out any of the free cash flow it generates).

There were also some positives in Tesla’s report, of course. While solar deployment was very weak (down 40% year over year), the other, more important, part of Tesla’s energy business performed well. The company deployed 3.7 GWh of storage, which was up more than 200% year over year — which is a very strong growth rate for sure. While the energy business showed a much weaker revenue growth rate of 74%, that was still strong in absolute terms. The energy business is profitable on a gross cost basis, before factoring in operating expenses, as the gross margin of this unit was 18% during the second quarter. This represents an improvement versus the previous quarter, during which Tesla Energy’s gross margin was 11%.

Unfortunately, the gross margin improvement in the energy business is not sizeable enough to offset the headwinds from falling gross margins in the automotive business, which is why the company-wide gross margin dropped, as shown earlier. Still, if Tesla is able to ramp up the energy business at a compelling pace in the coming quarters while also growing the gross margin over time, this should have a positive impact on Tesla’s company-wide financial results.

While the energy business is small for now (around 7% of Tesla’s automobile revenues), it’s a fast-growing unit with long-term potential, although there are also some uncertainties — we don’t know yet how large this market will ultimately become, and which company will win out.

Do New Models Justify This Valuation?

Tesla has gotten a lot of attention in the recent past due to speculation about a $25,000 model that could be manufactured in Mexico, while Tesla also has manufactured the first Cybertruck this summer. How impactful these models will become is up for debate. It is pretty clear that a $25,000 model has a substantial addressable market, as not too many people can (or want to) buy an EV for a much higher price. This holds especially true in emerging markets.

But on the other hand, there is not a lot of charging infrastructure in some emerging markets, and a $25,000 price may still be too high for many consumers around the world. It is also highly likely that selling a vehicle for a price of $25,000 would not help boost Tesla’s margins — in general, higher-end vehicles have higher margins than lower-end vehicles. This explains why some of Tesla’s competitors, such as Mercedes-Benz Group (OTCPK:MBGYY), are getting rid of some of their lower-end models in order to focus on higher-end models, as this is where these companies are generating much higher margins. Mercedes, which has been moving in the opposite direction of Tesla when it comes to focusing on profit instead of volume, has higher gross margins than Tesla.

Tesla could presumably sell a very substantial number of vehicles at $25,000 per car. However, it is far from guaranteed that this would boost Tesla’s profits — after all, we have seen earlier that volume growth does not translate into earnings growth, and may even go hand in hand with a profit decline (see the Q2 numbers).

The Cybertruck will be sold at a substantially higher price and should generate higher margins. But we still don’t know yet how profitable this vehicle will be for Tesla, as the manufacturing process is rather different from Tesla’s other vehicles, and since there are many consumers that don’t like the Cybertruck’s unconventional design.

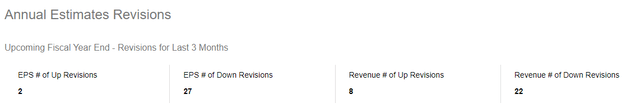

Looking at Wall Street estimates, the profit outlook isn’t great for Tesla:

There were barely any EPS upward revisions over the last quarter, while many analysts have lowered their estimates due to the margin pressure Tesla is experiencing. Not even the company’s revenue estimates are moving in the right direction. Earnings per share are forecasted to decline by double digits this year, and while Tesla profits are forecasted to improve in 2024 and beyond, Tesla still looks quite expensive even when we look at profit estimates for the coming years. Tesla trades at 46x 2026’s earnings per share estimate, for example — that’s three years from now, and still, the earnings yield is just 2%.

Final Thoughts

Tesla beat headline estimates, but the underlying margin picture isn’t pretty. Free cash generation remains rather weak as well, especially compared to the very high market capitalization. Tesla has rallied massively year-to-date (congrats to those that bought at the lows), but I believe it is not a good investment at current prices. Locking in gains today could make sense, which is why I rate Tesla a sell today — a 300x free cash flow multiple for an automobile company with declining margins and declining profits is just too expensive.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!