Summary:

- Aside from the underwhelming “Cybercab” announcement, Tesla, Inc. also has a lot to prove on the Optimus robotics front to justify the stock’s sky-high valuation.

- At current valuations, Tesla stock is simply not worth the investment, while another top-performing stock is much more advantageously positioned to win big from the robotics secular growth story.

- Tesla shares are being downgraded to a “sell,” as investors are much better off owning a considerably cheaper technology stock instead.

Apu Gomes

Tesla, Inc. (NASDAQ:TSLA) stock rallied by 16% following the release of its Q3 2024 earnings report, buoyed by an improvement in profit margins. While the EV business remains a key revenue and profit driver at present, the main determinant of the stock’s valuation hinges on its autonomous robot endeavors.

Tesla wants to prove that it is not just a car company, but a full-fledged technology company, and revealed its latest AI-powered autonomous machines at the “We, Robot” event earlier this month. Much has been said about its underwhelming “Cybercab” announcement and vague timeline, while competitors like Alphabet Inc.’s (GOOG) (GOOGL) Waymo are already commercially monetizing their fleet of autonomous vehicles in select cities. Though, the company also showed off another important product at the event, namely the Optimus Generation 2 humanoid robot, which is what we will be covering in this article.

In the previous article, we delved deeply into Tesla’s end-to-end AI strategy, whereby:

“Tesla is shifting away from software codes, and instead just relying on a single, large neural network responsible for all aspects of driving.”

CEO Elon Musk has been proclaiming that this same approach can be applied to its humanoid robot development and training.

This new approach had lifted market expectations for speedier advancements. However, the underwhelming demonstrations at the ‘We, Robot’ event have culminated in a mismatch between real progress and the stock’s sky-high valuation, inducing a downgrade of the stock to a “sell” rating.

A reality check on Tesla’s robotic endeavors

TSLA currently trades at a Forward P/E multiple of around 100x, making it the most expensive Magnificent 7 stock.

A key element of the bull case has been Tesla’s pivot to the end-to-end AI approach, raising expectations of a much faster iteration cycle, and consequently bringing forward the anticipated timeline for commercial launch.

At “We, Robot” on October 10th, Tesla showcased impressive advancements in the dexterity of its humanoids. However, the revelation that the Optimus robots at the event were being teleoperated by humans, rather than the humanoid machines dancing, serving drinks, and interacting with guests on their own, was a disappointment for many investors. It raised questions around Tesla’s actual progress on autonomous AI functionalities.

CEO Elon Musk has been making some bold predictions around its Optimus robots. At the “We, Robot” event, Musk suggested that all 8 billion people on the planet will want one. Of course, that could be said for practically any product. Back in June 2024 at a shareholder meeting, Musk said that its humanoid robot business line could drive the company’s valuation to $25 trillion one day, without any specific timeframe. The CEO is known for selling a big vision to its shareholders to buoy stock market performance. In his defense, sustaining strong share price performance is key to keeping stock-based compensated employees motivated to continue innovating at Tesla.

Nonetheless, to sustain a lofty valuation of 95x forward earnings, market participants would rightfully expect more details around the commercial viability of the product. These would include such as any improvements in power efficiency, given that electrical consumption costs are one of the key hindrances to robot adoption.

The rapidly developing automation technology can help speed up operations and lift some of the burden off human workers, but the tools have a new set of requirements such as access to far more electrical power and a strong internet signal.

Building that capability can be particularly difficult for industrial operators that are located in rural areas far from existing infrastructure, or those in urban areas where there are heavy demands on the power grid.

Furthermore, at the event, Musk offered a vague target price range over an unspecified period:

I think at scale this would cost something like I don’t know $20,000 to $30,000. Probably less than a car is my prediction long term.

Now, stating how much the product could cost in the distant future is of little value for a company that already has a track record of missing their predicted product price targets.

He is talking about scale. What does scale mean? That is the question for him. He has a long history of saying these products will cost ‘X’ and twice as much when they actually come out.

– Tim Higgins, business columnist at the The Wall Street Journal in an interview with CNBC.

Given Musk’s unclear timeframe for achieving the $20,000-$30,000 price range, it is fair to assume that it will likely be a long way off until they are affordable enough to induce mass-scale adoption.

Furthermore, back in June, CEO Elon Musk also shared that he expects the company to begin selling its Optimus robots commercially to other companies by 2026 while extending internal use in Tesla’s own factories during 2025.

The company has already highlighted that two Optimus robots have been deployed in Tesla’s own factory, enabling the company to test out how these humanoids function in industrial environments and resolve any issues before external commercialization. This offers a notable advantage over competitors in the space that doesn’t have their own auto manufacturing (or other industrial) business lines for internal testing and iterations.

Nonetheless, it is worth considering the fact that rivals have been forging partnerships with leading auto manufacturers to test out their humanoids for such manual labor and learn together how best to deploy these robots at a mass scale in the future. For instance, competitor Apptronik has cultivated a partnership with Mercedes-Benz Group AG (OTCPK:MBGAF) and plans a broader commercial launch of its humanoid in 2025. Nvidia-backed Figure AI boasts a similar partnership with Bayerische Motoren Werke Aktiengesellschaft (OTCPK:BMWYY), which has already been delivering some fruitful progress.

During a trial run lasting several weeks at BMW Group Plant Spartanburg, the latest humanoid robots Figure 02 from California company Figure successfully inserted sheet metal parts into specific fixtures, which were then assembled as part of the chassis. The robot must be particularly dexterous to complete this production step.

…

During the trial run, the BMW Group gained valuable knowledge of what requirements must be met in order to be able to integrate so-called multi-purpose robots into an existing production system. This includes how humanoid robots communicate with the system under real conditions. After the first use in automobile production, the experts at the BMW Group and Figure are collaborating to prepare Figure for future applications in production and continuing to develop the robots, based on the findings. – BMW Group.

Given the progress rivals are making in readying for commercial launch, Tesla is unlikely to benefit from a wide moat when Optimus enters the market. It could end up having to engage in a price war to take market share in a crowded space, similar to its current plight in the EV market. Consequently, this puts at risk Tesla’s ability to sustain such an expensive valuation multiple of 95x forward earnings.

Counterarguments to the bearish thesis

Now taking the “glass half full” perspective, the outlook for robotics demand is improving, with Goldman Sachs estimating that the total addressable market for humanoids could reach $38 billion by 2035, revised upwards from a $6 billion estimate previously. Hence, the pie to be shared among the various robotics vendors is growing.

Considering current technological capabilities, we view humanoid robots as having visible demand from jobs in structured environment such as manufacturing (e.g., EV assembly and component sorting). Given its likely adaptability to dynamic environment enabled by AI algorithms, we believe humanoids look particularly appealing for special operations such as dangerous and hazardous tasks, considering the associated fatality rate and people’s low willingness in doing such jobs thus customers’ likely willingness to pay a higher price than typical manufacturing work.

Indeed, robot vendors like Tesla could still benefit from strong pricing power. Industrial companies could be willing to pay higher prices for the robots as long as the Return on Investment (ROI) is appealing, in the sense of higher productivity and redundant health insurance (and other employee-related) costs.

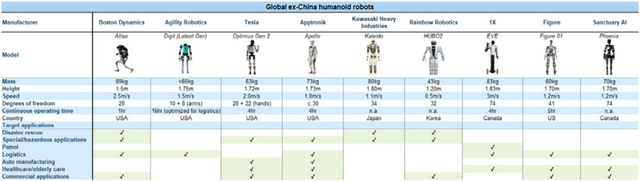

Furthermore, the Tesla Optimus robot is better positioned relative to most competitors’ products, in the form of possessing more capabilities that can be deployed in industrial environments.

Nevertheless, competition should not be underestimated, as Apptronik’s “Apollo” robot still boasts the widest array of targeted applications.

That being said, the presence of more players in the market actually brings advantages to Tesla as well. Unlike when the company pioneered the commercialization of EVs, which incurred Tesla having to do most of the heavy lifting in cultivating the manufacturing process and subsequent supply chains, the robotics market is benefitting from a more concerted effort. This is conducive to speedier supply chain developments. It has resulted in faster declines in the cost of manufacturing robots, relative to the earlier days of the EV market.

We are seeing stronger commitment from the supply chain, start-ups in the US and Asia, multiple listed players setting up new robot divisions and potentially more government support (i.e., from China).

…

We note the manufacturing cost for the humanoid robot has dropped significantly from likely $50-250k per unit last year to $30-150k (range of low spec to high spec) now, or around a 40% decline (vs. our prior assumption of 15% to 20% p.a decline) mainly driven by the availability of cheaper components with a broader scope of supply chain options

So while there is skepticism around Tesla’s ability to achieve the targeted product price range of $20,000 to $30,000 profitably given Tesla’s history, declining component costs certainly offer the hope that Tesla can achieve its targeted business economics in the robotics segment.

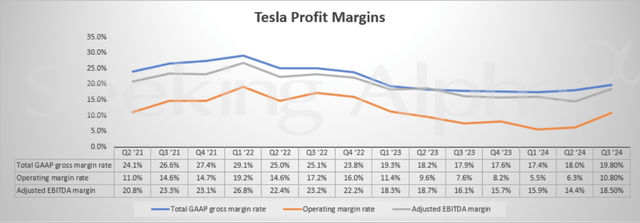

Keep in mind also the fact that the company has been witnessing profit margin compression over the past several quarters as it fights a price war in the EV market.

Tesla is investing heavily in NVIDIA Corporation (NVDA) GPUs to power its Dojo supercomputer, which in turn powers its autonomous vehicle and Optimus robot endeavors. Such heavy CapEx investments are putting pressure on Tesla’s bottom line.

That being said, the company did deliver a bounce in profit margins in Q3 thanks to improvements in cost efficiencies.

The growing total addressable market (“TAM”) for robotics and Tesla’s competitive positioning that could accentuate future pricing power should be supportive of the company’s profitability prospects going forward.

In fact, on the Q3 2024 Tesla earnings call, Elon Musk emphasized the company’s scaling prowess over its competitors:

We’re moreover the only company that really has all of the ingredients necessary to scale human robots. Because the things that other companies are missing is that they’re missing the AI brain, and they’re missing the ability to really scale to very high-volume production.

Nonetheless, these claims will be put to the test once the Optimus robots officially hit the market, competing against fiercely competitive Chinese manufacturers as well.

Forget Tesla, just own Nvidia instead

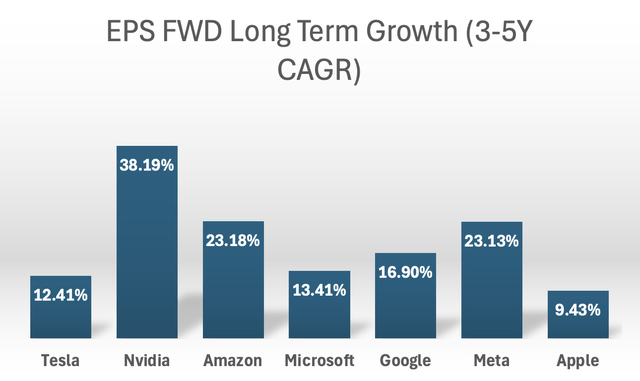

While the Forward P/E ratio is a popular valuation metric, a more comprehensive measure is the Forward Price-Earnings-Growth (Forward PEG) multiple, which essentially adjusts the Forward P/E by the anticipated earnings growth rate going forward.

Nexus Research, data compiled from Seeking Alpha

Out of all the Magnificent 7 stocks, Tesla has one of the lowest projected EPS growth rates at 12.41%.

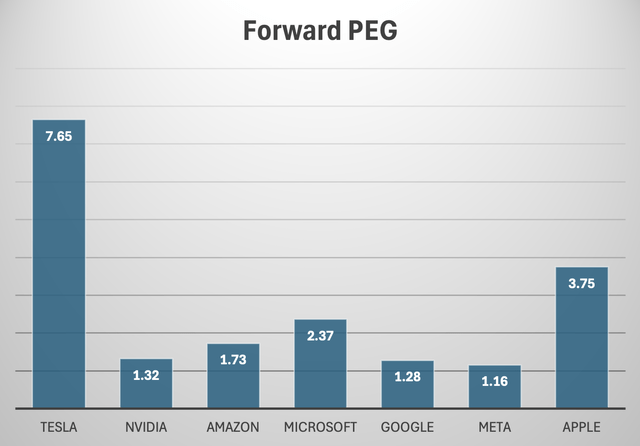

Now, adjusting each stock’s Forward P/E ratio by the anticipated earnings growth rates gives us the following Forward PEG multiples.

Nexus Research, data compiled from Seeking Alpha

Tesla is by far the most expensive Magnificent 7 stock at a staggering Forward PEG multiple of 7.65x. TSLA simply does not deserve to trade at such a lofty premium over other prominent AI winners, most notably Nvidia.

In fact, in a recent article, we delved into Nvidia’s strong positioning to capitalize on the robotics revolution. The semiconductor giant is not only benefitting from selling increasingly powerful chips and supercomputers to power these robotic workloads, but is also shrewdly setting itself up for long-term recurring software revenue through the “Omniverse” operating system.

So while robot vendors like Tesla, Apptronik, Figure AI, and Boston Dynamics are yet to commercially launch their products, and will inevitably end up fighting for market share, Nvidia is already profiting. This is given the number of robotics companies that are relying on the company’s technology. Over the coming years/ decades, as these vendors continuously iterate their products, both on the hardware and software level, to make them compatible for industrial/consumer use, demand for Nvidia’s technology should sustainably grow. This is regardless of which robotics company ultimately comes out on top in the end market.

NVDA also offers a more ethical investment option to ride the autonomous robotics wave, given the reports of fatalities during Tesla’s testing of “Full Self-Driving.” I, personally, refuse to profit from the shares of a technology company that has been putting people’s lives at risk.

On the whole, if you are looking for strong exposure to the robotics secular growth story, you’re better off owning NVDA at 1.32x Forward PEG than TSLA at an astounding 7.65x.

Tesla stock has been downgraded to a “sell” rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.