Summary:

- Tesla, Inc.’s fundamentals have deteriorated, with slowing revenue growth, declining margins, and a softening EV market.

- Growing competition from other automakers, particularly in China, poses a challenge to Tesla’s market share.

- I present seven reasons to short the stock.

wellesenterprises

Dear readers,

I’ve been a Tesla, Inc. (NASDAQ:TSLA) bear for well over a year and have published a number of articles on the stock here on Seeking Alpha. Most recently, following disappointing Q4 2023 earnings, I issued a STRONG SELL rating at $177 per share and informed readers in the comment section that I initiated a (substantial) short position shortly after publishing the article.

My short thesis was based on deteriorating fundamentals, in particular (1) revenue growth slowing, (2) margins declining, (3) a softening EV market, and above all (4) an expensive valuation with limited upside and had plenty of potential downside.

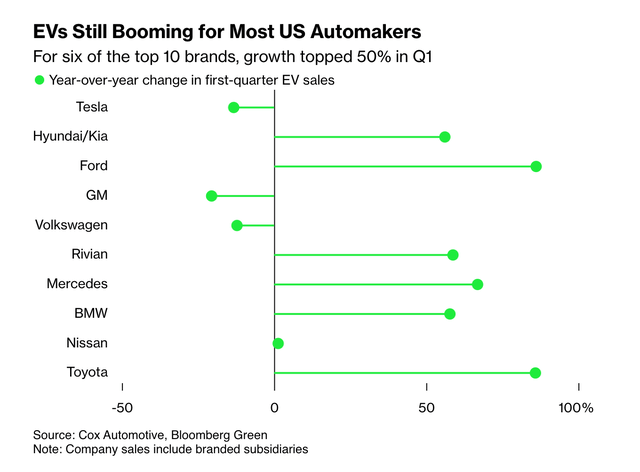

Since my last article, Tesla’s stock price hasn’t moved much, but the overall performance of the business has been quite poor. More importantly, the fundamentals have only got worse, especially following the Q1 2024 earnings and a relatively recent Cybertruck recall. Tesla has also slipped relative to its competitors as it went from a leading and fastest growing EV automaker to one of only a few brands with a YoY decline in sales in Q1.

Following Musk’s unannounced visit to China in late April and rumors that Tesla might partner with Baidu (BIDU) to help launch full self-driving (“FSD”) in China, the price jumped by 11% to around $190 per share and I increased by short position.

Following these developments, a continually inflated valuation, and what, I believe, was an overreaction to Musk’s visit to China, I am now more confident than ever in my short. Below, I present seven reasons why (I believe) Tesla may not be a good investment today and why it makes a good short candidate from the current price of around $176 per share.

1 – Declining demand

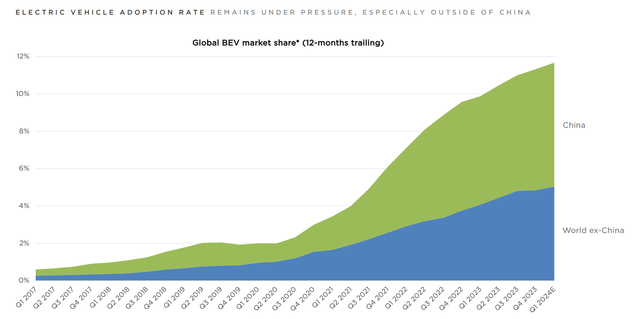

Demand for EV vehicles has slowed substantially since the pandemic, as inflation and interest rates increased, people became more conscious of their spending and the early adopter market has likely become quite saturated.

CEO Elon Musk himself said the following about the current state of affairs:

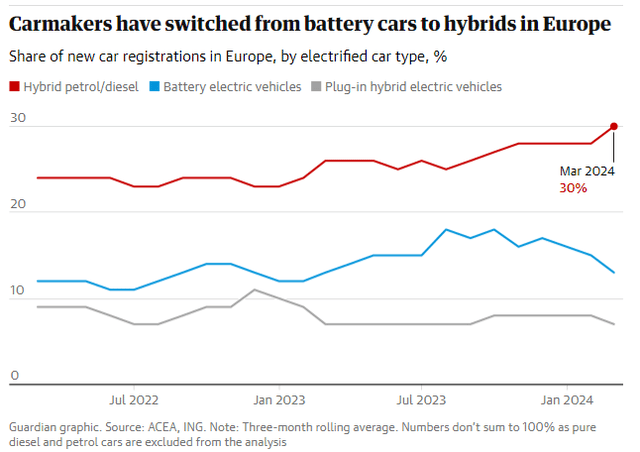

The EV adoption rate globally is under pressure, and a lot of other auto manufacturers are pulling back on EVs and pursuing plug-in hybrids instead.

This suggests that automakers anticipate stronger demand for hybrids, as opposed to pure EVs. Musk has opposed this view many times and seems certain that pure EVs are the future of transportation. But meanwhile, despite the long-term expected CAGR of the industry of 16%, it seems that in the short to medium-term the trend has shifted and as a result demand for EVs could be lower than expected.

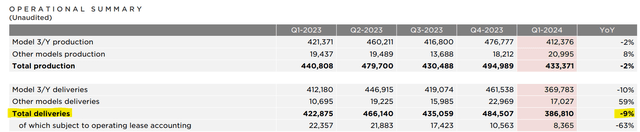

Recently, Tesla’s deliveries during the first quarter missed expectations by a wide margin of 13% and fell quarter-over-quarter for the first time in four years to only 386,000 vehicles.

And Tesla wasn’t alone as their biggest competitor – BYD Company (OTCPK:BYDDF) experienced an even bigger QoQ drop as sales fell from 526k vehicles in Q4 to just 300k in Q1, handing back the top EV seller title to Tesla.

2 – Growing competition

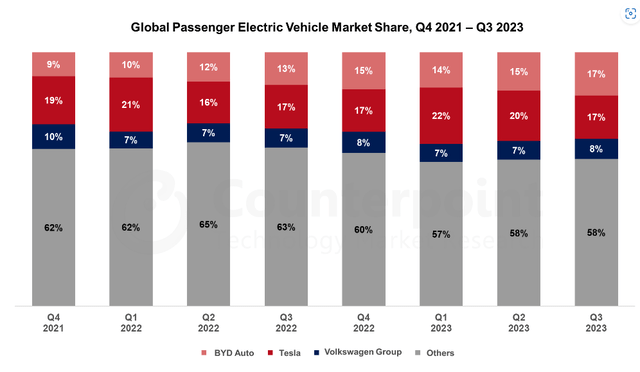

With questionable short to medium-term demand for pure EVs, maintaining and growing market share is as important as ever. Tesla now has about a 50% market share on the U.S. EV market. Worldwide its market share is much lower, around 20%, similar to that of BYD. But growing (and even maintaining) the market share will not be easy.

Despite poor Q1 results, BYD remains a formidable competitor and is heavily focused on China, which benefits from being the fastest growing major EV market in the world in terms of penetration, which gives BYD a competitive advantage.

Beyond BYD, other carmakers are also making a run to gain market share, most notably Ford (F), General Motors (GM), NIO (NIO), Volkswagen (OTCPK:VWAGY), and Rivian (RIVN), all of which offer well-priced EV options today.

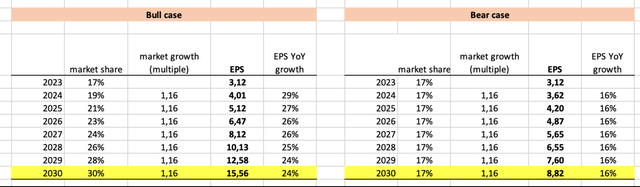

In my last article, my bull case assumed that Tesla would reach a 30% market share by 2030, while my bear case assumed a more conservative 17%, in line with today’s penetration. I continue to stand by these numbers in the long term, but recognize that getting there might be a bumpy ride and that the short to medium-term prospects are not great, especially considering the recent lower than expected GPD growth and a weakening consumer.

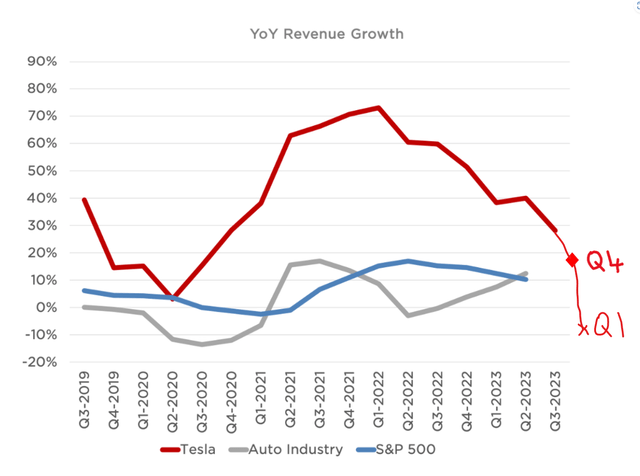

3 – Declining revenue growth

The aforementioned weakening demand, combined with forced price cuts, has led to a year-over-year revenue decline of 9% and marked an eight consecutive quarter of slowing growth.

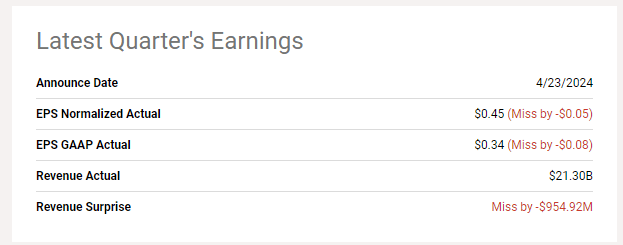

Musk had previously indicated that revenue growth may be “notably lower” in 2024, but the actually results were worse than the already low expectation, as both earnings and revenue missed expectations in Q1.

SA

In the past, for a while, Tesla was able to grow its revenues by 40-70% per year, which put it miles ahead of its competitors and played a major role in justifying the stock’s premium valuation relative to peers from the auto industry which tend to grow by at most 8-10%. Following the decline, however, it’s clear that, at least in the short-term, Tesla has failed to deliver on its promise of being more than a car company.

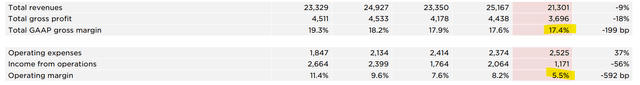

4 – Declining margins

The theme of not being all that special, after all, is further reinforced by declining margins.

Following a major dip in profitability last quarter, Q1 results delivered an even lower gross margin of 17.4% and an operating margin of only 5.5%, significantly below the auto industry average of 8%.

I mentioned in my last article that some analysts were expecting the declining commodity prices to drive the cost of manufacturing down and therefore ease the pressure on margins. My expectation, however, was that the savings would more likely have to be passed onto the consumer in a form of lower sale prices – a view which, in light of the declining margins, has turned out to be correct.

In response, the company announced that it would lay off 10% of its global workforce (about 14,000 workers) to boost profitability.

5 – Cybertruck fiasco

I previously argued that before a major production ramp up, the Cybertruck was unlikely to translate into higher earnings over the next 12-24 months, putting further pressure on margins. This has been true.

To make matters worse, Tesla recently called back all 3,800 Cybertrucks it managed to deliver to date, due to a faulty accelerator which could get stuck.

This, in my mind, is yet another nail in the coffin for a product which can be at best be described as an expensive distraction from Tesla’s core products.

6 – Expensive valuation

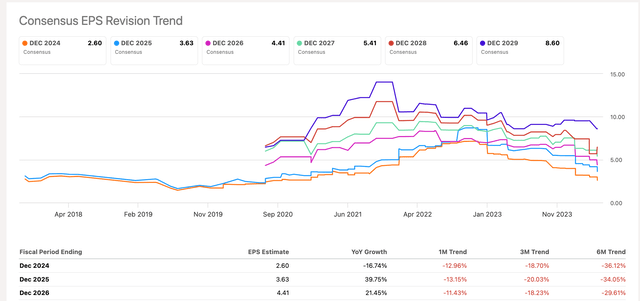

I want to start by pointing out that today, all of Tesla’s earnings come from selling cars. This is because neither of the other segment (Energy and Services) are yet profitable. Last year, Tesla’s car production generated an EPS of $3.12 per share. My expectation was that this year, earnings had the potential to grow $4 per share, a target which was below consensus at the time. But following poor Q1 results and a worse near-term outlook, consensus estimates for this year’s earning have now dropped to just $2.60 per share.

At $177 per share, the stock effectively trades at 68x forward earnings. Is that justified for a company with declining revenue and a 5.5% operating margin? I certainly don’t think so. So, let’s assess Tesla’s valuation in two ways.

First, Tesla is overvalued relative to peers as BYD trades at 20x earnings, despite having similar growth prospects and a similar operating margin. Sure, BYD may not be as invested in other segments, but since neither of these are profitable today, it’s difficult to stomach the 3.5x higher valuation multiple.

Second, going back to the bear and bull case from my previous article and given the much lower expected growth in 2024, Tesla’s growth would have to accelerate, meaning fully above what I assumed before. Recall that my bull case called for an increase in market share to 30% and EPS of $15.50 by 2030. That’s annual EPS growth of 25-30% over the next six years. With lower expected 2024 earnings, if Tesla is to hit that EPS, growth beyond 2024 will have to accelerate to 35%. For the bear case, which assumed a more conservative 17% market share, the 16% growth which was assumed to deliver EPS of $8.82 by 2030 will have to accelerate to 22%.

Is such acceleration in growth possible? I guess. But I don’t think it’s likely.

Assuming a 12x P/E exit multiple, which is above the 8-10x average of traditional auto manufacturers such as Ford or GM, and an 8% discount rate, the bull case yields a fair value of $110 per share. The bear case yields a fair value of $62 per share. Both of these are deeply below the current price, leaving plenty of downside potential for my short.

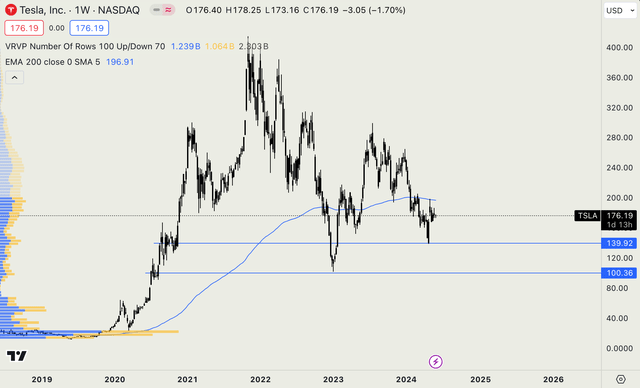

7 – Dangerous technical level

While the upward jump in price on Musk’s surprise visit to China has been nice, it doesn’t invalidate the short. From a macro perspective, Tesla’s chart has been making lower highs. Moreover, we continue to trade below the 200-moving average which is likely to form meaningful resistance around $200 per share and most importantly, there isn’t a lot of support below the current price. With only a bit of support around $140 per share, if shares sell-off, the price has the potential to fall to $100 per share rather quickly. At that point, I would consider scaling out of my short position.

Risk

If you simply decide to pass on the opportunity to invest, your risk is limited. Sure, you may miss out, but you won’t suffer losses. If you short the stock, the biggest risk is that (1) the EV outlook will improve, which could spark a stock rally or that (2) Musk will create some sort of hype around a new product, a surprise visit, a tweet etc. which could send the price higher. I fully expect my trade to be volatile and intend to hold it for at least several months, if not quarters. Over time, I believe the market will recognize that Tesla has underdelivered on its promise and is vastly overpriced.

Bottom Line

Tesla, Inc. faces a difficult macroeconomic environment, growing competition and a slowing demand for EVs. As a result, the company reported poor Q1 numbers. Despite this, TSLA stock trades at a fairy-tale valuation of 68x forward earnings. I reiterate my STRONG SELL rating for Tesla, Inc. stock following Q1 earnings and the announcement of Musk’s surprise visit to China here at $177 per share, with a price target around $100 per share.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want to access my entire Portfolio and all my current Top Picks, feel free to join ‘High Yield Landlord’ for a 2-week free trial.

We are the largest and best-rated community of real estate investors on Seeking Alpha with 2,500+ members on board and a 4.9/5 rating from 500+ reviews:

![]()

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.