Summary:

- Tesla, Inc.’s stock performance has been impressive, but investors are questioning if the stock price is too high compared to the company’s value.

- Tesla’s success in the automotive industry is due to low costs and attractive designs, making their vehicles profitable and appealing to consumers.

- Tesla’s future profitability depends on volume growth, with plans to build over 2 million vehicles by 2024 and potentially another million in Mexico by 2026.

- If Tesla can meet its growth objectives while remaining profitable, Tesla shares should appreciate over time even if they sell off in the short term.

y_carfan

Tesla, Inc. (NASDAQ:TSLA) share performance has been breathtaking over the past decade, and investors are wondering if the stock price has gotten too far ahead of the underlying (often called “intrinsic”) value of the company. In the highly competitive automotive industry, and with strong Chinese competitors like BYD Company (OTCPK:BYDDF), which produces more electric vehicles (EVs) than Tesla already, that question is difficult to answer.

As an old-time auto industry CEO (albeit a parts company CEO), I have watched CEO Elon Musk with nothing short of amazement as he has led a company to produce outstanding vehicles in a short time frame and do it profitably while competitors like Ford (F) and General Motors (GM) ship thousands of dollars of losses on the hood of every EV vehicle they sell, and start-ups like Rivian (RIVN) and Fisker (FSR) teeter on the edge of failure. Ultimately, success in the automobile assembly business results from two factors – cost and design. To make money, costs have to be low enough to permit reasonable profit margins, and designs have to be attractive not only in appearance but also in form and function. Tesla vehicles meet both tests – great looks, great performance, and profitable at a price that many consumers can and do pay.

Building volume requires major investments in assembly capacity and future profits, and the current market valuation of Tesla seem both to depend on volume growth. Tesla’s current assembly capacity is as follows:

- Freemont California – 650,000 vehicles per year

- Shanghai – 750,000 vehicles per year

- Texas – 250,000 vehicles per year

- Berlin -350,000 vehicles per year

- Mexico – at least 1,000,000 vehicles per year (still in the planning stages).

Capacity is an elastic measurement, since assembly plants can run one, two, or three shifts, can run on overtime, and can run seven days a week if needed. Labor force agreement is typically needed for anything but normal shift patterns, and disputes over scheduling usually resolve themselves in agreements involving compensation and size of workforce.

It is safe to conclude that in 2024, Tesla can build more than 2 million vehicles, and when the Mexico project starts up (probably in 2026), another million or so, assuming demand is there for the cars.

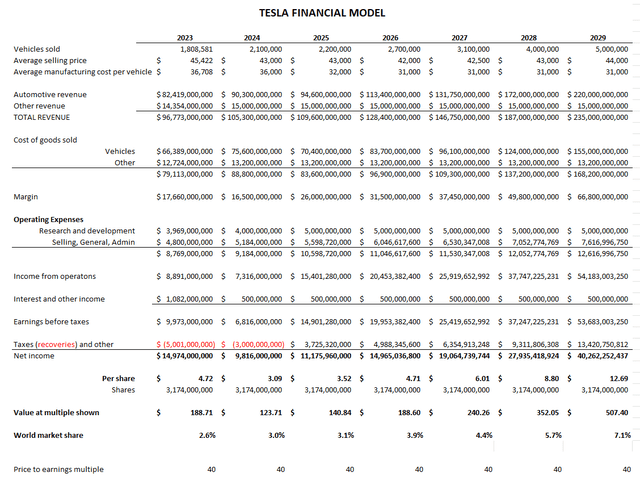

The Mexico plant is expected to use the latest manufacturing technologies and produce an “affordable” Tesla for mass markets, which I believe will reduce the average selling prices of the Tesla fleet but at the same time reduce average costs per vehicle. While I project Tesla research and development costs to rise and selling, general and administrative cost to increase about 8% a year, I believe Tesla will remain quite profitable, able to use higher assembly efficiencies to offset cost inflation of vehicle assembly and input materials, and more or less keep car prices competitive with rivals. Here is my shot at a forecast for the next few years.

Tesla financial model (Blair analysis, company reports)

Last year and 2024 benefit from income tax recoveries, but I expect the company to be taxable thereafter. As a result, I project lower net income in 2024 and 2025, but higher net income thereafter as the company takes share and increases volumes. Assuming investors continue to value the company at about 40 times net income, a 2029 share price of over $500 seems possible.

Tesla, Inc. is a high-risk stock in a high-risk industry suffering from strong global competition. Rivals trade at single digit multiples of earnings, so the assumption of a forty-time multiple is aggressive even if consistent with past investor enthusiasm for the company. At a market multiple of about 20 times net income, Tesla, Inc. 2029 share value would drop to about $250.00.

I am a big fan of Elon Musk, think his vehicles will continue to impress consumers, and don’t see major barriers to Tesla continuing to increase market share. Having said that, whether the company can more than double vehicle output in five years while maintaining profit margins is a challenge, and Tesla investors need to give the risks pause.

But, if Tesla shares sell off from their current roughly $200 per share to the $150 range, I would be a buyer.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.