Summary:

- Tesla investors are trying to get into another hype cycle again before its upcoming Robotaxi event.

- Tesla’s growth prospects have weakened considerably as its cyclical automotive business hits major stumbles.

- Elon Musk knows he needs to focus the market’s attention on its autonomous driving ambitions. But we are nowhere close.

- Wall Street remains uncertain about Tesla’s ability to realize what has likely been priced into its unjustified valuation.

- I explain why, no matter how I look at Tesla’s growth optionalities, I can understand why TSLA is still well below its 2021 all-time highs. Read on.

Apu Gomes/Getty Images News

Tesla: Navigating Its Next Highly Uncertain Growth Wave

Tesla, Inc. (NASDAQ:TSLA) investors have enjoyed a remarkable revival, although I’m not so sure whether it’s sustainable. CEO Elon Musk’s attempts to place more emphasis on Tesla’s autonomous driving (FSD and Robotaxi) efforts are critical for determining its long-term valuation. Musk’s belief that the company is at the intersection of “two major growth waves” underscores the criticality of Tesla’s autonomy push. In other words, unless Tesla can demonstrate significant traction in winning over Wall Street’s confidence in its FSD autonomous driving capabilities and Robotaxi ambitions, its long-term valuation could be at risk.

In my cautious TSLA article in June 2024, I urged investors to be wary of its growth thesis and autonomous driving ambitions. I emphasized the hype surrounding its Robotaxi thesis. However, buying momentum has been more robust than anticipated, suggesting the market isn’t as worried as I had envisaged.

Analysts are not in sync about the viability of Tesla’s autonomous driving potential. While the EV leader has continued to accumulate priceless driven miles on its FSD, it might not necessarily translate into fully autonomous driving. Given TSLA’s significant growth premium, achieving Level 4 autonomy as quickly as possible isn’t just a “good thing” but likely fundamental to its bullish thesis. In addition, solving the autonomy conundrum efficaciously will likely spur the potential success of Tesla’s Robotaxi ambitions. Ark Invest’s base case valuation of TSLA is mainly predicated on the success of its Robotaxi network.

Deepwater Asset Management believes that Tesla might achieve “widespread adoption of FSD by late 2027,” driving another significant growth wave for the company. In addition, the opportunity to license Tesla’s FSD capabilities must also be considered, suggesting that a new considerable growth vector could be unlocked. As a result, I concur that Tesla’s ability to actualize its autonomous ambitions will be highly critical to a valuation re-rating. However, it also makes sense for me to consider that a steep valuation de-rating might be in the cards if Tesla fails to do so.

Tesla Is An Automotive Company, Not An AI Company

Tesla has several growth optionalities likely not fully reflected in its valuation. These include the success of Optimus’s potential commercial deployment (from 2026?) and its fledgling energy storage business. However, based on the most updated sum-of-the-parts valuation for TSLA, its energy storage business is assessed to account for under 5% of its stock valuation. While it has experienced a welcome growth boost for its Q2 earnings from its energy storage segment, it was not enough to mitigate the hiccups experienced in Tesla’s core automotive business. I also assess that the market will likely assess a significant premium on its autonomous driving business over the more cyclical and commoditized energy storage segment.

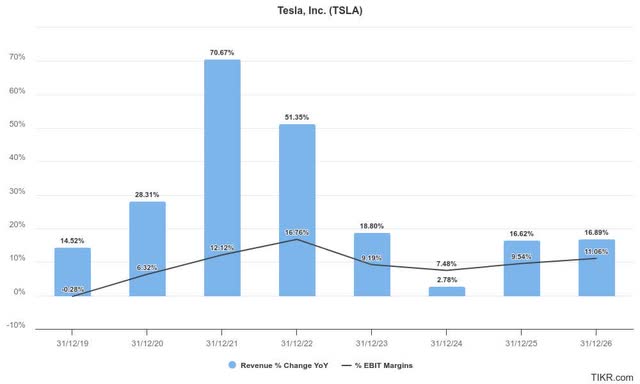

As seen above, Tesla’s cyclical operating performance is observed clearly. As a result, considering it as a pure-play AI company is foolish, to say the least. After its revenue surge topped out in 2021, it has struggled to replicate its EV growth success. Therefore, I don’t think the market is wrong in assessing significant risks to the company’s growth prospects. As a result, TSLA remains over 45% below its 2021 all-time highs, while the S&P 500 (SPX) (SPY) has recovered very close to its July 2024 ATHs.

Given Tesla’s challenges in navigating the EV growth slowdown that has hammered its peers, I believe caution must be heeded. Ford’s (F) decision to reduce total EV CapEx and adjust the rollout strategy and cadence of its EV models point to the challenges in sustaining EV profitability.

Wall Street has projected a potential inflection in Tesla’s growth profile from FY2025. Given the increasing likelihood of an interest rate reduction by the Fed in September 2024, it should lower the headwinds that affected EV spending by consumers. However, I urge caution as it doesn’t necessarily translate to a significant uplift in consumer demand for EV models.

Notwithstanding the price discounting in the industry and the collapse in battery prices, it suggests that early EV adoption has not broadened as quickly as the EV evangelists would want us to believe. With that in mind, TSLA’s buying momentum will likely depend on whether Elon Musk can provide vital clues into its mass-market model and autonomous driving ambitions at its upcoming Robotaxi Day in October 2024.

TSLA Stock: Unjustified Optimism

TSLA Quant Grades (Seeking Alpha)

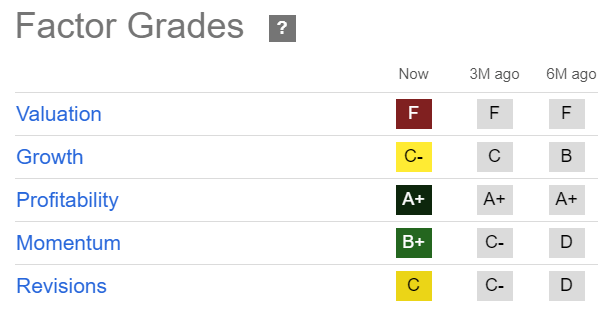

TSLA’s growth grade has weakened considerably over the past six months (from “B” to “C-“), corroborating the weakness observed in its operating performance. In addition, analysts are justifiably less optimistic about surfing another “smooth” TSLA growth wave that bolstered its prospects earlier in the EV adoption curve.

Autonomous driving will increasingly find its way into our streets over the next decade. However, whether the Robotaxi developments are sufficient to justify the current optimism in TSLA’s “F” valuation grade remains to be seen.

TSLA’s forward adjusted PEG ratio of 8.6 is substantially above its consumer discretionary sector median of 1.4. Considering its software prowess, even if I assess TSLA as a “tech” stock, it’s still significantly over the tech sector median’s forward PEG ratio of 1.94. Therefore, I find TSLA’s valuation highly unjustified, notwithstanding the optimism of a possible growth inflection from FY2025. The market seems to have priced in substantially higher confidence in TSLA being able to hit another major surge in its growth milestone over the next five years. Is that possible? I’m not about to bet against TSLA yet, but I think there are considerable uncertainties for us to consider.

Furthermore, while TSLA is still well below its all-time highs, it has yet to move into a decisive downtrend. Therefore, betting against TSLA while the market has yet to indicate a corroborated downtrend bias isn’t astute. TSLA’s “B+” momentum grade underscores the need for bearish TSLA investors to pick their short-selling entries very carefully.

Consequently, I’ve assessed that staying on the sidelines and watching how TSLA’s thesis unfolds is appropriate for now. We don’t have to partake in every opportunity out there as TSLA attempts to navigate its next major growth wave unless the risk/reward is attractive. For now, we are still far from that possibility.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!