Summary:

- Today, I will share with you my view of the Tesla, Inc. business, which is predicated on firsthand experiences and cold, indisputable data.

- I will explore with you each pillar of my Tesla thesis, including an examination of Tesla EVs, Full Self-Driving, and Tesla Energy.

- While Tesla stock isn’t exactly cheap, I do believe it will be a solid investment for those with a 5-10 year time horizon.

Sjo

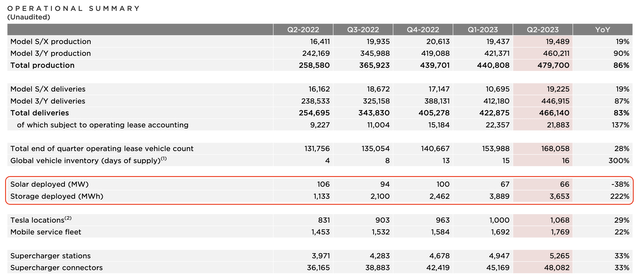

Tesla FSD Reaches New Heights

Tesla Q2 2023 Investor Presentation

Foundational Pillars Of My Tesla Thesis

To summarize my Tesla thesis, below, I delineated four foundational pillars:

Please note that these are my opinions, and others will disagree. I believe they are my opinions predicated on the aggregation of data in my mind. Others will disagree with that. That’s what makes a market!

- Tesla electric vehicles (“EVs”) are arguably the only genuinely attractive EVs to buy as daily drivers.

- Tesla Supercharger Network is arguably the only genuinely attractive Supercharger Network in the U.S. to use.

- Tesla Full Self-Driving (“FSD”) is the best, most viable self-driving product on the market.

- Tesla Energy should 100x its batter deployments, if not more, from here and could usher in a new energy generation/storage paradigm.

Let’s consider each of these individually together today.

Tesla EVs Are Arguably The Only EVs That Make Sense To Buy As A Daily Driver

I recently shared with a friend that I was convinced that Tesla’s electric vehicles [EVs] don’t have genuine competition.

Again, this is my opinion after years of data aggregation. Others may disagree! That’s okay. I disagree with them.

In my recent flagship note on Tesla (Teslas (Mostly) Drive Themselves), I provided all of the data underpinning this assertion, but I think it’s worth discussing what drivers experience when they use Teslas/EVs as their primary means of transportation.

Here are a couple of vignettes to illustrate what I mean:

- While a Honda Accord might get 400-500 miles from one tank of gas/petrol with the AC on high, a Tesla Model 3 might only get 200 miles. What was a 4 hour drive in one direction for a Honda Accord becomes a 6+ hour drive for a Model 3. Additionally, Superchargers are still somewhat sparsely distributed. Should a driver need to charge in a big city, they may find themselves passing by 10 gas stations to drive to the fifth floor of a parking garage to charge their Tesla for nearly an hour (as opposed to refueling for just 3-5 minutes at a gas station).

- In a Facebook (Meta Platforms, Inc. (META) Stock Price Today, Quote & News) group for Model Ys, an individual shared that they drove 70 miles while towing two jet skis, and their battery went from 90% to 33%. Considering an EV cannot go to 0%, lest battery components get damaged permanently, this is effectively the depletion of a full charge, and, as I mentioned, charging infrastructure remains sparse. Comparably, a Jeep Grand Cherokee could make that trip 5-6 times, with AC on high, and there’d still be gas/petrol left in the tank.

Now, you may be thinking that I’m advocating against Tesla ownership via these vignettes.

Quite the contrary, I believe they are the best vehicles on earth presently, but I am sober about the realities of EVs.

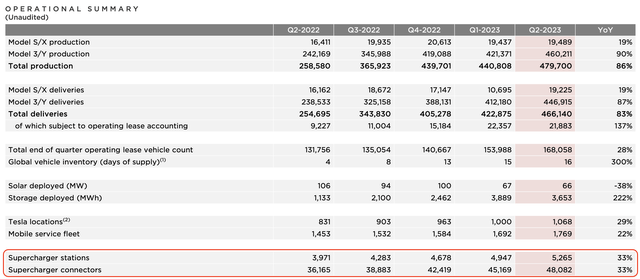

I am sober about the reality that Tesla’s supercharger network still needs to expand to a large degree for even Teslas to truly reach mainstream adoption (to be sure, supercharger locations continue to grow.).

Tesla Supercharger Network Grew 33% in Q2 2023

Tesla 2023 Q2 Investor Presentation

My point in sharing this is that, if Tesla, which is indisputably the best EV on earth from every conceivable perspective (I provided the stone-cold, indisputable data for this in my previous article linked above), barely makes sense as an individual or family’s only vehicle, then no other EV comes even close to making sense at present.

It simply makes no sense to buy another EV if it barely makes sense to buy the indisputably best one, which actually has a very robust charging network built across the world.

If there’s still doubt as to whether people can buy a Tesla and make that their only vehicle, considering that it blows the competition out of the water (according to the data! e.g., $/range, acceleration, safety, etc.), then, fundamentally, no other EV on earth makes a lick of sense to buy.

Now, to be sure, Tesla has opened its Supercharger Network to other EVs.

Some other highlights. Our global Supercharging network now stands at over 50,000 — roughly 50,000 connectors and over 5,000 locations. As I think a lot of people are aware, the Tesla Charging Standard, which we made open source and it’s now called the North American Charging Standard. We’re deeply honored that Ford, GM, Mercedes and many other OEMs have signed up to use our connector and gain access to our charging network. We strongly believe in helping other car companies to accelerate the EV revolution and just trying to do the right thing in general. So, that’s the goal there.

I believe this has been the right decision, especially when we consider the game is about FSD. That is, as we will explore in a moment, the game is no longer about building a good EV. The game to be won is autonomy.

In short, while it may appear that there’s competition, the reality, even with Tesla providing use of its Supercharger Network, is that there still is no genuine competition (my opinion based on data! Others may disagree), and, in some sense, the gulf between Tesla and its competition has never been wider, which is the perfect segue into our next discussion: Tesla FSD.

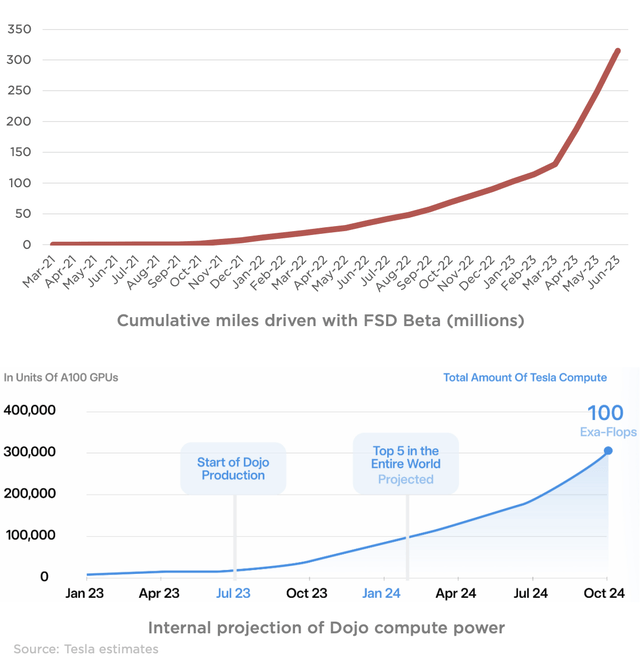

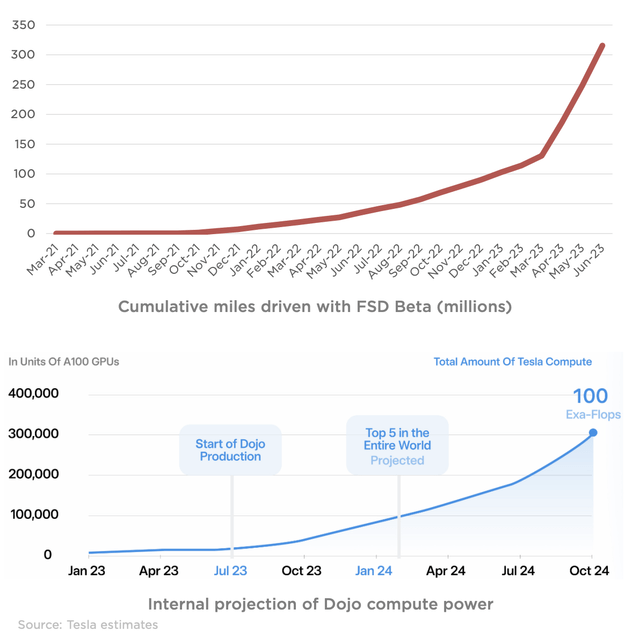

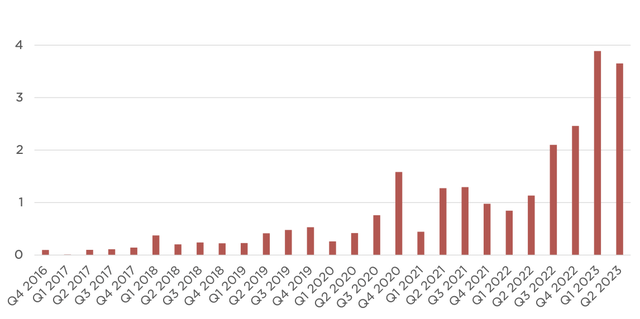

FSD Usage Continues To Grow

Tesla 2023 Q2 Investor Presentation

In my previous article, I asserted that the game to be won was no longer about range or acceleration or brand equity; instead, the game to be won has become about autonomy.

I’ve been sharing lately that Tesla’s FSD product is a “must try” product that “everyone should try before they die.” I do not believe there is another consumer product on earth that rivals FSD from the perspective of “the future is here, and it’s pretty damn mind blowing.”

I do not believe Mercedes has fielded a viable product that could genuinely rival Tesla’s FSD product.

And, while some may debate whether other EVs are actually viable as a person’s only vehicle, there is no debating that Tesla’s FSD stands totally alone, and, with the rate at which FSD accumulates data, it is likely that it only gets lonelier from here.

(Please feel free to engage in a debate with me over this in the comments section, and I will share data, videos, anecdotes, etc., supporting this claim. I have painstakingly researched the two products and have tested Tesla FSD extensively. I will gladly discuss this assertion with you in the comments).

And I really just don’t know how anyone could do what we’re doing, even if they had our software and had our computer, if they did not have the training data. So, speaking of which, our Dojo training computer is designed to significantly reduce the cost of neural net training. It is designed to — it’s somewhat optimized for the kind of training that we need, which is a video training. So, we just see that the need for neural net training — again, talking — speaking of quasi-infinite things, is just enormous. So, I think having — we expect to use both, NVIDIA and Dojo, to be clear. But there’s — we just see demand for really vast training resources.

And we think we may reach in-house neural net training capability of a 100 exaflops by the end of next year. So, to date, over 300 million miles have been driven using FSD beta. That 300 million mile number is going to seem small very quickly. It’ll soon be billions of miles, then tens of billions of miles. And FSD will go from being as good as a human to then being vastly better than a human. We see a clear path to full self-driving being 10 times safer than the average human driver, so.

Elon Musk, CEO, Tesla Q2 2023 Earnings Call.

At this stage, Tesla simply needs to complete the product.

I think it’s lost on the general public, amidst the controversy of the product, that there are only about 500k FSD beta users out of 1.45B vehicles on the road presently.

We are still very, very early in the adoption and evolution of this product, though, as I mentioned, it’s already so good as to be a “must try before you die” type of product.

Tesla Will License FSD

On Tesla’s Q2 2023 earnings call, Mr. Musk announced that Tesla would begin licensing FSD.

I believe this is smart because:

- FSD needs to ingest almost unfathomably large amounts of data to be perfected.

- The only way to do this quickly is to accumulate more training data via as many vehicles as possible, even if that means competitor’s vehicles.

- FSD could be licensed at $2,400/year, which I believe to be very inexpensive for the value it offers, and, if we multiply that by 100M vehicles over the long run, this will represent a massive, high-margin stream of revenue for Tesla.

- If other OEMs use Tesla FSD, they will very likely not build their own, giving Tesla a monopoly on the industry.

Then something I think, I want emphasize, like very strongly, this is a very important point is that Tesla — just as with the North American Charging Standard, although we’re not license — in that case not licensing, we’re just making it available, but we are very open to licensing our full self-driving software and hardware to other car companies. And we are already in discussions with — early discussions with major OEM about using Tesla FSD. So, we’re not trying to keep this to ourselves. We’re more than happy to license it to others.

Elon Musk, CEO, Tesla Q2 2023 Earnings Call.

I think he makes it sound like an act of a good Samaritan, but the reality is that it’s the logical move to make in “maximizing the net present value of Tesla.”

In this vein, earlier on the call, Mr. Musk remarked (emphasis added):

In the long-term, autonomy we think is going to just drive volume through the ceiling next level. And our sort of future robotaxi products — dedicated robotaxi products we think have like quasi-infinite demand. The way we’re going to manufacture robotaxi is, is also itself a revolution. So, it’s revolutionary design made in a revolutionary way. It’ll be by far the highest units per hour of any vehicle production ever. So, very excited about that.

With respect to Autopilot and Dojo, in order to build autonomy, we also need to train our neural net with data from millions of vehicles. The more — I mean, this has been proven over and over again. The more training data you have, the better the results. And, I mean, there are times where we see basically — in a neural net, basically it’s sort of at 1 million training examples, it barely works; at 2 million, it slightly works; at 3 million, it’s like wow, okay, we’re seeing something, but then you get like 10 million training examples, it’s like — it becomes incredible.

So, there’s just no substitute for a massive amount of data. And obviously, Tesla has more vehicles on the road that are collecting this data than all of the companies combined by, I think, maybe even an order of magnitude. So, I think we might have 90% of all — or a very big number. So, the success in AI endeavors is a function of talent, sort of unique data and computing resources. And we have outstanding capabilities in all three arenas.

Elon Musk, CEO, Tesla Q2 2023 Earnings Call.

Further, it’s clear to me, in some sense, that Tesla is not doing this as some sort of 3D chess move, but rather almost out of pure necessity.

True full autonomy is a brutally difficult goal to achieve, though it’s well within the realm of possibilities if Tesla’s software trains on tens of millions of vehicles in the decade ahead.

Licensing the software will also allow Tesla to build its robotaxi platform, which, as we know, is a bit late (to put it mildly based on timelines Tesla has provided in the past).

Tesla Energy: Ushering In Our A New Energy Paradigm

While this line of business is much more nascent; therefore, these ideas are more speculatively, I think it’s worth considering what Tesla is up to in its Tesla Energy business.

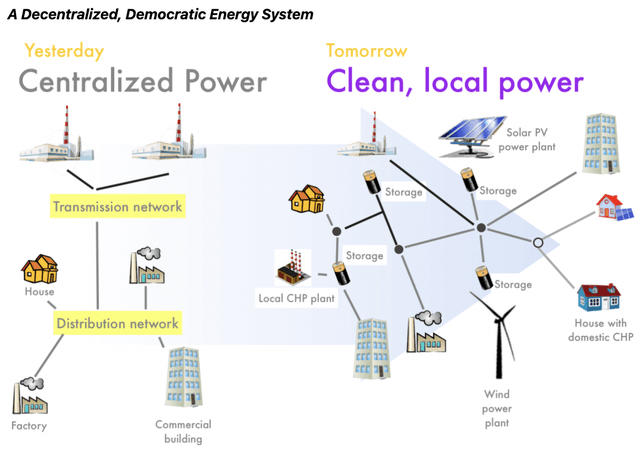

In the past, I’ve discussed this thesis with you. Specifically, I delineated a few ideas:

- The decentralization of energy storage and generation

- The need for AI-centric software to govern this new energy paradigm

- The incredibly difficult problem of energy storage at utility-scale.

Notably, Tesla has built products for each of these three ideas.

Without much fanfare, at least from what I’ve seen, Tesla described this new, future energy paradigm on its Q2 2023 call (emphasis added):

On the residential side, we have some fun things happening.

We recently surpassed 0.5 million Powerwalls installed. Just this week, we are launching Charge on Solar, which allows Tesla Powerwall and vehicle customers to charge their vehicles using their excess solar and drive only on the sunshine that hits their roof.

Yesterday, we began paying customers in Texas for participating in our virtual power plant to provide grid support to ERCOT. We expect these credits to lower our median customer’s annual bill by a third and to increase these credits over time as ERCOT expands market access. And today, we are expanding Tesla electric enrollment to new Model 3 owners in Texas, followed by all Texas vehicle customers over the rest of the quarter.

Unfortunately and somewhat similar to Tesla Insurance, bringing Tesla electric and BPP capabilities to our customers requires working through a fractured regulatory environment on a jurisdiction-by-jurisdiction basis. In the long run, the value of residential energy software and hardware will be driven by the level of market access that utilities, market operators and regulators permit.

For Powerwall that’s eligible to provide the full stack of energy services, like peaker capacity and system buffering, such as in Australia, we can more than double the value of ownership relative to a typical system today.

Tesla Q2 2023 Earnings Call.

I mean what he described is incredible. It is, indeed, a new energy generation and storage paradigm at a grid scale.

For those who have studied the potential decentralized energy paradigm, you’ll also recognize the term “virtual power plant,” which is a cloud-native marketplace for energy storage, usage, and distribution, predicated on a decentralized energy paradigm.

The above idea could be graphically depicted as follows:

In a Tesla energy future (depicted graphically above), each house will possess the following characteristics:

- Solar energy generation. This will allow each building to be a node on the energy generation network, making the entire grid more resilient and dynamic.

- Energy storage (Powerwall). This will allow each building to be a storage node. Buildings will generate electricity, with which they power themselves, and they will store excess energy in the Powerwall storage units. This excess power could be sold back to the grid by way of the aforementioned virtual power plant.

- Autobidder software. AI-centric software will manage the decentralized grid of energy generation and storage. The software will autonomously create a marketplace of energy that will serve to allocate energy where it is needed most at the least expensive cost.

In addition to this vision of the future, Tesla is also solving the problem of utility-scale energy storage, which, as we discussed at the end of TGSGT VII, is arguably the hardest problem humans face presently (alongside AI-driven cancer therapeutics).

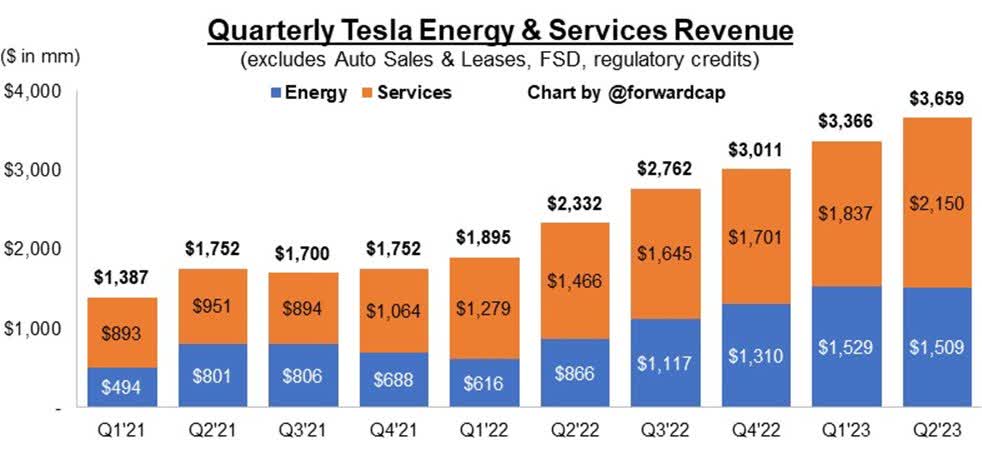

Tesla’s Utility-Scale Energy Storage Deployments Continue To Grow At Incredible Rates

Tesla 2023 Q2 Investor Presentation

Tesla’s Utility-Scale Energy Storage Deployments Continue To Grow At Incredible Rates

Tesla 2023 Q2 Investor Presentation

As I shared in one of my most recent Tesla reviews,

- Tesla plans to 100x its energy storage business, from ~4B GWH of deployment to ~400B GWH of deployment. They plan to achieve mid-20% gross margins on this business, so the free cash flow margin will likely come in somewhere roughly in the 10-15% range over time. We can simply take current revenue, then 100x it; then apply the 10-15% free cash flow margin, and we’ll get our long run “fcf/share” from this business.

- We could imagine the company reaching 400B GHW of stationary storage deployment, which would equate to about $150B in sales (100x $1.5B, at which Tesla Energy currently operates from a revenue perspective). Management shared on Tesla’s most recent call that it will look to achieve mid-20% gross margins for the business. This suggests about 10-15% free cash flow margins.

And the recent growth of Megapack (i.e., storage) deployments substantiates as much.

Over the long run, I believe a 15% free cash flow margin on this business will be more than achievable, which suggests that this business could one day generate tens of billions in free cash flow for the Tesla conglomerate, and, of course, this is just one component of the entire conglomerate.

To further quantify Tesla’s business outside of EVs and FSD, I found the following chart useful:

Tesla’s Other Businesses Are Large And Rapidly Growing

@forwardcap on X

As we can see, Tesla’s businesses outside of core EVs/FSD currently operate at an annualized run rate of $15.7B run rate and are growing at 57%.

And this is on the heels of the fastest repricing of credit in American history!

Concluding Thoughts: Tesla Is Principally A Bet On AI

I will conclude with two thoughts regarding Tesla:

- Like Amazon circa 2003, the future of Tesla is almost unimaginable (my opinion!). I would say less than .1% of humans fully grasp the decentralized energy storage and generation model, which is likely the solution to the claim that “alternative energies just aren’t viable” over the long run (again, simply an opinion of mine). I think it’s still hard to see that this could become the prevailing energy paradigm by 2040. I would say less than .1% of humans (only 500k FSD subs, so we have data here) understand what goes on inside a Tesla presently. FSD is mind blowing. It’s almost impossible to really fully appreciate what Tesla FSD will look like by 2040, though we have the building blocks for that future, and I am very happy to be along for the ride.

- At the core of each Tesla business, AI is fundamentally the technology that will usher in those businesses/the future. Tesla will be seen as one of the largest, if it’s not already, and most desirable institutions for AI-focused entrepreneurs, scientists, and researchers.

Like virtually all of the businesses I own, Tesla is a bet on the creation of unique AI that will spawn unique products/solutions for consumers, and, by extension, unique business models.

With $23B in cash and just $900M in low-interest debt, alongside healthy free cash flow generation, Tesla is exceptionally well-positioned to usher in this incredible future with some “mind blowing products” therein.

Zachary Kirkhorn: I fully agree with you. I mean, I think the only thing in the short term that matters is what I said in my opening remarks, which is are we generating enough money to continue to invest. And the portfolio of products and technologies that the technical teams are investing in right now, this is intense. It’s intense in terms of investment; it’s intense in terms of potential.

Elon Musk: Frankly, I think it’s ridiculous that we have positive free cash flow in a capital-intensive business, while investing massive amounts of money in new technology. That is super hard.”

Tesla Q2 2023 Earnings Call (emphasis added).

With a giant cash hoard, virtually no debt, and robust free cash flow despite very aggressive reinvestment in the business and despite the fastest repricing of credit in American history, I believe Tesla will perform well in the decades ahead.

Thank you for reading, and have a great day.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.