Summary:

- Tesla, Inc. is admittedly between growth waves.

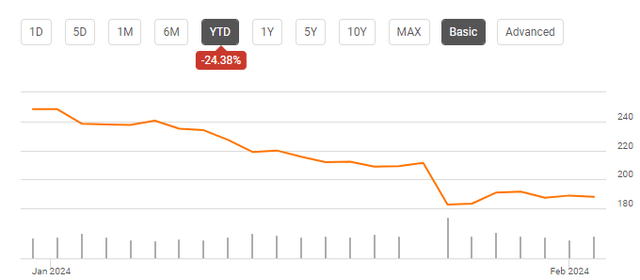

- As the company feels margin pressure, Tesla stock has lost 25% YTD even as the market is off to a great start.

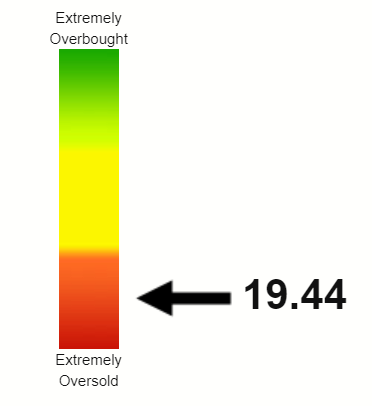

- The stock is extremely oversold technically and a bounce could be due.

- CEO Elon Musk sounded optimistic, realistic, and a tad humble on the Q4 call.

Xiaolu Chu

It is time for my quarterly review of Tesla, Inc. (NASDAQ:TSLA), where I rate the company and stock on 13 different parameters ranging from business to macro to stock fundamental to technical reasons. In my last review, three months ago, I had rated the stock a “Hold.” Since then, the stock has lost more than 11% compared to the market’s 18% run. Does that change my rating on the stock? How have these 13 factors changed meanwhile? Let us find out below while I also assign a rating to each of these 13 factors based on whether they’ve gotten better or gotten worse or stayed the same.

Four Business Reasons

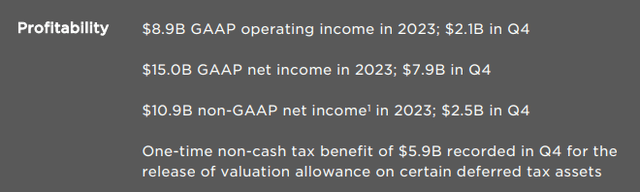

- Margin Erosion: Tesla reported $2.1 billion in Q4 operating income, with an operating margin of 8.20%. Q4 2023 net income was down 46% YoY from the $3.9 billion reported in Q4 2022, clearly highlighting the company’s current struggle: needing to spend more to sell at a lower price. Average Selling Price [ASP] went down, while operating expenses increased. Until this trend is reversed, the stock is unlikely to reverse up. Despite that, for the context of this article, I am rating this section as “Gotten Better” because Q3 2023’s YoY fall in operating income was more 50%. (Gotten Better: #1)

TSLA Q4 Operating Margin (digitalassets.tesla.com)

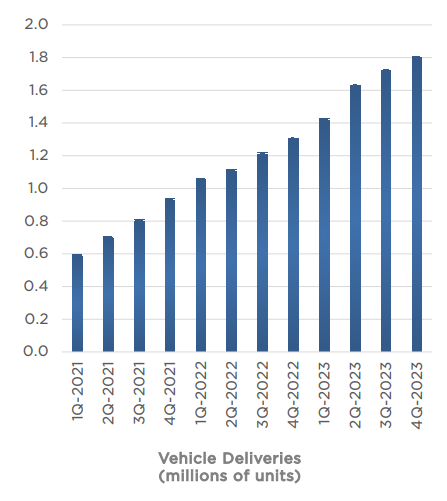

- Demand Erosion: Q4’s total revenue was up almost 3.50% YoY, with the price cuts likely driving demand up. Overall deliveries surged nearly 20% YoY to reach 484,507 with Model 3/Y deliveries surging nearly 19%. Interestingly, Tesla continues its streak of delivering increasing deliveries on Trailing Twelve Months [TTM] basis with roughly 1.8 million deliveries in the last 12 months. Q4 once again showed that at the right pricing, Tesla still has the demand it needs to sustain itself for the long haul. (Gotten Better: #2)

TSLA TTM Deliveries (digitalassets.tesla.com)

- Market Share: Tesla’s market share in Q4 increased to 50.9%, up a hair from the 50% at the end of Q3 but still down from the 59% share it had in Q2, which was down from the 62% in Q1. Total electric vehicle (“EV”) sales in the U.S. reached 317,168 in Q4, making it the 2nd consecutive quarter that the 300,000 barrier was breached. Q4 also saw an exponential 40% YoY growth in total EVs sold. Overall, with market share hovering around 50%, I’d rate this section as “Stayed Same.” (Stayed Same: #1)

- The Elon Musk Problem: As someone who follows news about CEO Elon Musk and Tesla closely, I don’t recall the last time we had headlines about Musk’s distractions outside of Tesla. If anything, we’ve seen more of Musk’s involvement with Tesla, including his demand for more voting control and his $55 billion pay package getting voided. Say what you may about the man, but I have no doubts that a fully-focused (on Tesla) Musk is worth the distractions he brings as a result of his win at all costs attitude. (Gotten Better: #3)

Four Stock Fundamental Reasons

- Forward Multiple: Almost directly as a result of the stock’s 12% decline since my last review, Tesla stock’s forward multiple has fallen down a bit to reach 58, from 65 during October review. However, the stock is still overvalued by this metric. (Stayed Same #2)

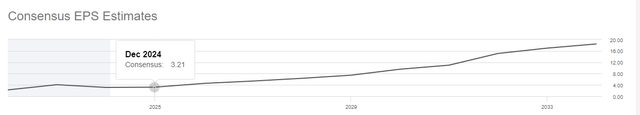

- PEG: Growth at Reasonable Price (“GARP”) investors like me tend to look at the Price-Earnings/Growth (“PEG”) multiple, as it tells us how fairly valued a stock is relative to its growth prospects. Tesla stock has gotten considerably better on this metric since my last review, as the current estimated growth rate of 9%/yr gives the stock a forward PEG of 6, while it was 18 during my October review. This clearly belongs to the “Gotten Better” category, with the expected earnings growth rate increasing. (Gotten Better: #4)

- Price Target: At the current price per share of $188, the stock is nearly 20% away from its median price target of $225, which is 5% below the 25% during the October review. (Gotten Worse: #1)

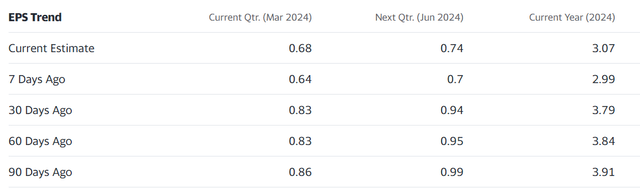

- Estimates: 2024’s estimates have fallen from $4.01 during my last review to $3.07 now, a 23.50% reduction using Yahoo Finance’s estimates, and by 22% using Seeking Alpha’s estimates. Either way, this section has worsened considerably. (Gotten Worse: #2)

TSLA 2024 Estimates (Yahoo Finance) TSLA 2024 EPS (Seekingalpha.com)

Three Macro Reasons

- Market Complacency: While the market in general is off to a pretty good start in 2024, Tesla has lost nearly 25% YTD. The general mood around Tesla is nothing but complacent right now. The stock is on the list of most oversold names on Wall Street and the Tesla-dominated ARK Innovation ETF (ARKK) is underperforming at the beginning of 2024. Since this section is about complacency, I am going to rate it as “Gotten Better.” (Gotten Better: #5)

- Recession or Fears of One: This section has clearly “Stayed Same” as there are legitimate arguments to both ends of the aisle. For example, the dip in transportation stocks may signal rough times ahead for the economy, while a recent survey showed that just 40% of the business leaders surveyed fear a recession now compared to the 65% one year ago. (Stayed Same: #3).

- China: Tesla’s China-made EV sales grew almost 70% in December even as Tesla lost the EV top spot to China’s BYD Company (OTCPK:BYDDF). While the threat is undeniable, so much that Musk calls for trade barriers to stop Chinese EV firms from demolishing other players globally, Tesla is showing that it is up for the challenge with moves like upgrading its Model Y and dropping prices (a key factor in the Chinese market). I am rating this as “Gotten Better,” because when Musk calls you out, you know he is serious about you, and if I were BYD, I’d be watching my back. (Gotten Better: #6)

Two Technical Reasons

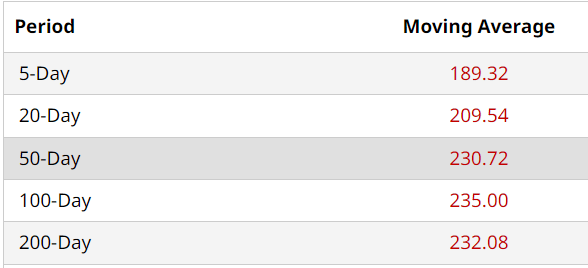

- Moving Average: Tesla’s 200-Day moving average has now risen to ~$235 from $215 in October, thanks to the run-up to about $260 in December. However, the stock is still lower than all the commonly used moving averages, with the 200-Day moving average nearly 25% away. The stock’s base is likely to shift lower before a meaningful reversal occurs. (Gotten Worse: #3)

TSLA Moving Avgs (Barchart.com)

- RSI: Tesla stock’s Relative Strength Index (“RSI”) of 19.44 right now is significantly lower than the 30.81 during October’s review. This is not a surprise given the stock’s weakness over the last month where it has lost nearly 25%. From a purely technical basis, this should fall under the “Gotten Worse” category as Tesla is a momentum stock. But I am slotting this under the “Gotten Better” category as the stock is extremely oversold and could see a bounce as a result. (Gotten Better: #7)

TSLA RSI (stockrsi.com)

Conclusion

For those curious about scores, this is how the 13 factors stack up now compared to October:

- Stayed Same: 3

- Gotten Better: 7

- Gotten Worse: 3.

Being a contrarian at heart, I like the fact that Tesla’s stock has lost 25% YTD while the S&P 500 (SP500) is up nearly 4%. Darling technology stocks are making new highs and are busy overtaking each other in the four-comma club, while Tesla has fallen to the 11th spot in terms of market capitalization. Not many may recall this, but Tesla breached the $1 trillion level in 2021 and has since lost 40% of its value. Competition is heating up, and while total deliveries and revenue are still going up, they come at the expense of margin. While Musk has often been faulted for being too optimistic, I’d rather have a leader who is overly optimistic and breaks the barriers of possibilities as a result.

However, reading the latest earnings transcript, I am heartened to see statements like the ones below from Musk, where he is acknowledging his optimism with a dose of realism as well. Do I also see a sense of humbleness in his statement about Chinese competitors? Bring on a focused, realistic, and slightly humble Musk.

“There’s a lot to look forward to in 2024. Tesla is currently between two major growth waves. We’re focused on making sure that our next growth wave, driven by next-gen vehicle, energy storage, full self-driving, other projects, is executed as well as possible.”

“I mean, I would certainly say things with they should be taken with a grain of salt, since I am often optimistic. I don’t want to blow your minds, but I’m often optimistic regarding time. But our current schedule shows that we will start production towards the end of 2025.”

“Well, our observation is generally that the Chinese car companies are the most competitive car companies in the world. So I think they will have significant success outside of China depending on what kind of tariffs or trade barriers are established. Frankly, I think if there are not trade barriers established, they will pretty much demolish most other car companies in the world. So they’re extremely good.”

As a current shareholder of Meta Platforms, Inc. (META) and a (sad) former shareholder of Nvidia Corporation (NVDA), I recall fondly the days that the market hated these names. The companies survived and their stocks came roaring back, at least quintupling in the process. I am not calling for Tesla to do the same from here. The margin pain is real. The competitive pressure is real. But, American capitalism has thrived for centuries, rewarding the risk-takers with deeper pockets.

There is not a better “risk-taker with deeper pockets” than Musk that I’d like to bet on. I am upgrading the stock to a “Buy,” backed by the fact that just 3/13 ratings got worse and due to my contrarian instinct.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.