Summary:

- Tesla’s aggregate deliveries forecast for 2024 and 2025 lowered due to declining sales in the US, China, and Europe, leading to a SELL rating.

- BEV sales in the US are falling due to tax credit changes and declining used Tesla prices.

- PHEV sales are rising faster than BEV sales in China, impacting Tesla’s market share and financial results.

3alexd

Investment thesis

We have covered the stock before and in this report, we present a detailed analysis of the electric vehicle market situation in three key markets for Tesla (NASDAQ:TSLA): the United States, China, and Europe.

- In the U.S., in addition to the age-old reason of a lack of public charging stations, we’re seeing a decline in the number of BEV models that are currently eligible for the tax credit program, which has been tightened since the beginning of 2024, as well as the relentless decline in used Tesla prices.

- In China, PHEV sales growth is confidently leading the way, raising the issue of switching to completely clean electric vehicles due to the outstanding characteristics of the new generation PHEV.

- In Europe, subsidies for EVs have been reduced in a number of countries, which has slowed their sales growth.

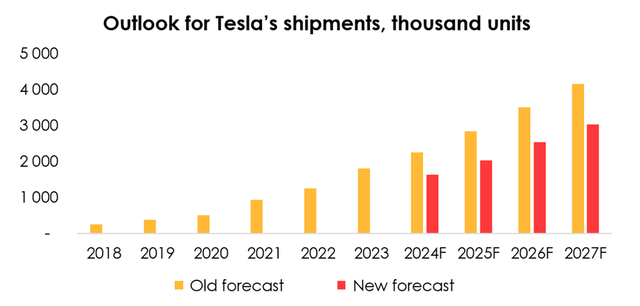

Therefore, based on the analysis provided in the report, we lower the forecast for Tesla’s aggregate deliveries in 2024 from 2.2 million units (+24% yoy) to 1.6 million units (-10% yoy) and in 2025 from 2.8 million units (+26% yoy) to 2 million units (+24% yoy). The rating is SELL.

4Q 2023 report overview

Our previous article is accessible via this link.

In the previous report, we expected that the Redwood model would become a highly sought-after product due to its low cost (not only in the Tesla EV line, but also among internal combustion engine or ICE cars) and a practical crossover model, which will give the company an incentive to increase production of this model. Among other things, it is expected that after the launch of such a low-cost EV, Tesla may find itself in a cannibalization situation, as a result of which sales of the 3/Y models will suffer. We still maintain this view and in the current report we will further describe that in our view it is the Tesla Model 2 “Redwood” that will become the key driver of supply growth from 2025.

We also understood that Tesla would lose its leadership in the Chinese market in 2024 due to more affordable BYD electric vehicles, but expected Tesla to continue to increase electric vehicle sales in China and other countries. This is happening, Tesla is finding it increasingly difficult to compete with domestic manufacturers in China. However, the introduction of Autopilot (testing of which was recently allowed on the streets of China) will allow the company to both increase the ASP of an electric car and generally attract more buyers, as in China, the consumer appreciates high technology in the purchased car.

Given the demand issues in the BEV market and the opposite situation in the PHEV market, we no longer expect high Tesla delivery year-over-year growth rates in 2024 – but the situation may change starting in 2025 due to the launch of the Tesla Model 2 “Redwood”.

Due to lower expectations for Tesla deliveries in 2024, we have lowered our expectations for the company’s financial results, which led to a reduction in the price target for Tesla shares and a SELL rating. For a more detailed analysis of the BEV market and Tesla’s delivery forecast, please see the report below.

Tesla’s shipments disappoint market

In 1Q 2024 Tesla shipped ~386 thousand EVs, compared with the average estimate of investment banks and analyst consensus of 450 thousand and our estimate of 513 thousand. That by far missed even the most bearish analyst expectations.

On March 22, 2024, it was announced that Tesla was reducing production in China in the face of increased competition from local manufacturers and a slowdown in EV sales overall since the beginning of calendar year 2024. The company has reduced the work week for employees from 6.5 days to 5 days, which represents a 23% reduction in production capacity.

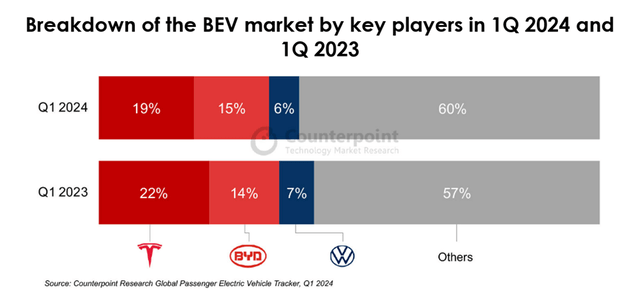

The company’s share of the global BEV (Battery Electric Vehicles, or pure electric vehicles that are powered solely by energy from battery packs) market reached 19% (-3 pp y/y) in 1Q 2024. The main reasons for the decline were competition from Chinese manufacturers in their domestic market and falling demand for Tesla’s electric vehicles in the company’s home market, the US.

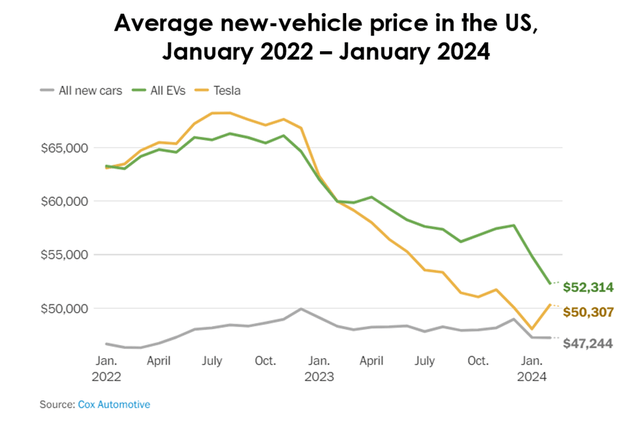

This is happening even after the average price of a new Tesla electric vehicle in the US slumped from $62.4 thousand to $48.1 thousand, or by more than 20% y/y, from January 2023 to January 2024, getting ever more closer to the industry-average price of any new car.

Why BEV sales are falling in the US

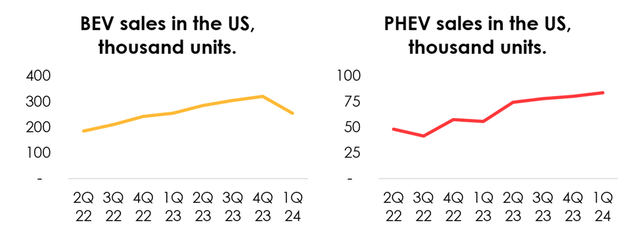

In 1Q 2024, total US demand for EVs expanded by a mere 2% y/y, with sales trends differing dramatically depending on the type of electric vehicle. Sales of BEVs in the US declined by 3% y/y, while sales of PHEVs (plug-in electric vehicle hybrids) soared by 50% y/y.

We believe this sharp decline in BEV sales in 1Q 2024 was driven by the tightening of the tax credit terms that took effect at the start of 2024. The percentage of imports of battery components and materials for EVs that manufacturers were allowed to import from other countries was lowered. In 2024, 60% of battery components must be manufactured or assembled in North America (up from 50% in 2023) for a vehicle to qualify for half of the $7.5 thousand credit. For the buyer of the vehicle to be able to receive the other half of the credit, 50% of the critical minerals that make up the battery must be processed or produced in the US (or a country that has a free trade agreement with the US) or processed in North America (up from 40% in 2023).

That meant the number of models eligible for this incentive program went down from 45 to 30 (including the Tesla Model 3 trims RWD and Long Range, which use Chinese-made batteries).

The updated rules do not apply to purchases of commercial vehicles (the terms for them are less stringent), which leaves a small loophole in the law as leasing companies can purchase electric cars that do not fit the updated terms and subsequently provide services to their customers with a discount on monthly payments. However, car rental companies are unlikely to show much interest in Tesla electric cars because, according to Hertz, many customers never before drove a Tesla EV and, due to a lack of experience, often got into accidents. And because Tesla models accelerate faster than the average passenger car, the risk of getting into accidents was higher.

Falling prices of used BEVs

The total cost of owning a new electric car, which will be sold off later, can be calculated, broadly speaking, like this:

{purchase price – resale price – maintenance costs – insurance costs – fuel/charging expenses}

Of course, the lower the potential cost of vehicle ownership, the better deal it is for a customer to buy that vehicle.

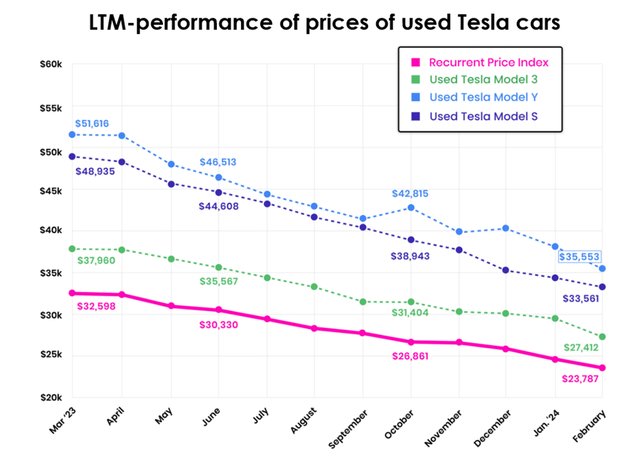

In terms of expenses on the maintenance, refueling/charging of an electric vehicle, out of PHEVs and BEVs, BEVs have the lower costs. At the same time, however, it is BEVs that has the worst post-sale value retention, and the reason for this is the prolonged price war that Tesla waged in 2023, which sharply brought down prices for the company’s models at dealerships. Used car prices followed the prices of new EVs, dropping by the same amount. We are still seeing this trend today.

We expect that the trend in the price of used Tesla EVs will not reverse to be upward any time in 2024. The reasons for this are as follows: high inventories of electric vehicles held by manufacturers and the possibility of further price cuts for new EVs in order to attract new buyers.

As such, even as they cost less to refuel and maintain, BEVs will ultimately be more expensive to own as their resale prices are on the decline. This could curb sales of new BEVs until the price trend for used electric vehicles turns around.

Shortage of chargers weighs on BEV sales

The most common reason that makes consumers choose hybrids over electric cars is a shortage of properly functioning and affordable public charging stations.

For example, one in five users of a public charging station (from a manufacturer other than Tesla) has problems using the charger.

Tesla has the largest and most reliable network of charging stations. It makes sense that without a charging network, the company will not be able to successfully implement its strategy of ramping up electric car sales. Also, until recently, Tesla’s Superchargers, the network of fast charging stations, were not available to drivers of other brands of electric cars. However, in 1Q 2024, Ford Motor began making the option of charging at Tesla’s network available to owners of its electric vehicles in the US and Canada via a special adapter. The vast majority of automakers in the US followed suit.

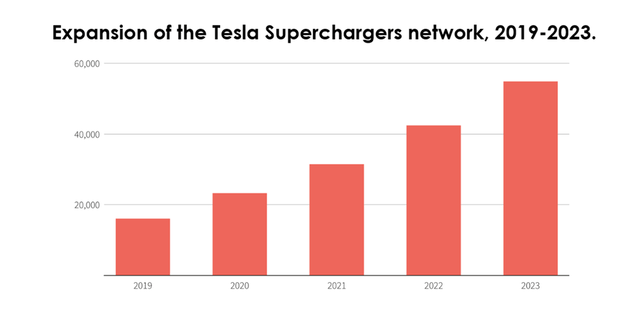

As a result of staff cuts, when Tesla laid off more than 10% of its employees (ranging from rank-and-file workers to top managers of the company’s certain segments who were let go along with their teams), the Superchargers team was almost completely eliminated, which stunned the entire EV industry, especially the newly minted partners of the charging network. Given the urgent need to expand the charging network, this decision seemed unreasonable, as it undoubtedly slowed the growth of the charging network. In an attempt to clarify the situation, Musk announced that Tesla would not drop the charging business and would spend more than $500 mln in 2024 to expand the Superchargers network (on top of the cost of supporting existing facilities). Notably, less than two weeks later, it was reported that Tesla has rehired some of the (nearly 500) laid-off employees – but the exact number of people that were hired back remained undisclosed. Therefore, because the development of this segment has been cast in doubt, one should expect the charging network to slow its growth at least in 2024.

Why BEV sales are falling in China

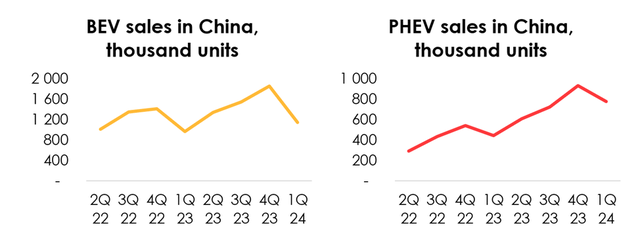

In 1Q 2024 total demand for EVs in China jumped by 28% y/y, and hybrids were also in the lead in terms of sales: BEV sales in China climbed by 18% y/y, while PHEV sales surged by 76% q/q.

In China, there is a seasonality factor at work in the first quarter due to Chinese New Year, which means a holiday season that lasts as long as about two weeks, so the sequential declines in BEV and PHEV sales in 1Q 2024 don’t matter. What matters much more are the y/y growth numbers.

The CEO of Aurobay (a joint venture between Volvo and Geely to develop and manufacture combustion engines) noted that hybrids could surpass BEVs by market share by the end of the year. He said that at the end of 2023, BEVs made up 23%, HEVs 4% and PHEVs 11% of the Chinese market. But in April 2024, the share of BEVs dropped to 21%, HEVs still hold 4%, and PHEVs went up to 15%, meaning hybrids now hold 19% of the market.

According to the China Automotive Technology and Research Center, although BEV sales are still more than double PHEV sales in absolute terms, their rapidly rising sales (and more importantly, the reasons for this, which we will explore further down) cast doubt on China’s transition to fully clean transportation.

Strong growth in demand for PHEVs, which solve the driving range issue and are more affordable than BEVs, has caused their sales to rise the fastest compared to all other electric vehicles in the Chinese market since EV subsidies were removed at the end of 2022.

In 1Q 2024, sales growth was driven by ongoing price wars in the Chinese market. For example, BYD cut prices of almost all of its models (both BEVs and PHEVs) to stay ahead of competition as soon as it spotted signs of slowing demand for EVs. Its rivals (XPeng, Zeekr and SAIC-GM-Wuling) took similar action in response.

Tesla also cut prices in China, but it can’t bring them down as much as competing Chinese manufacturers, so the company is positioned in the upmarket price range inside China.

PHEV sales to keep rising faster than BEV sales in China

Going forward, we expect PHEV sales to continue rising significantly faster than BEV sales in China due to the lower price of PHEVs (as their smaller battery means lower production costs, allowing a more affordable price tag compared with BEVs), and, to a greater extent, due to the release of new PHEV models in China, which have improved specifications and feature prices that are implausibly low (for the US).

The new generation of PHEV models offers a driving range that is many times longer compared with the previous generation, which offered only 20-30 miles of battery life, a distance that may be shorter than even a commute to work. The new generation of PHEVs also offers fast charging (the previous generation required several hours of charging, which could only be done at home or at work, but not on a long trip).

For example, BYD recently announced new PHEV models with a range of 2100 kilometers (1305 miles) and a record low fuel consumption of 2.9 liters per 100 kilometers. This was a real breakthrough in the industry, as BYD’s previous-generation PHEV offered a range of several tens of kilometers and a fuel consumption of 3.8 liters per 100 km. The starting price of both new-generation models is 99.8 thousand yuan (~$13.8 thousand).

China’s aggressive policy of developing the industry of battery electric vehicles has made the country the dominant producer of these vehicles worldwide. Behind this result is a story that began more than 15 years ago with BYD and Geely’s making their first experiments with batteries for electric buses and electric motorcycles. What the companies learned over many years of solving problems with their design and manufacturing ultimately laid the groundwork for the strategy of EV production in China. Thanks to this, Chinese battery companies now control the bottlenecks in the supply chain for battery production, allowing Chinese electric vehicle manufacturers to have a much lower production cost per one EV than it is for their rivals in other countries, and therefore set much lower selling prices and undercut competition in foreign markets.

The US continues to enforce a policy of protectionism for its automobile industry. In May 2024, the Biden administration imposed stiff tariffs on Chinese exports, quadrupling the tariff on Chinese electric vehicle imports from 25% to 100%. The White House said this was done in part to give the US manufacturing sector time to scale up production to the point where batteries would be produced domestically in sufficient quantities to meet consumer demand.

By imposing tariffs, the US has deliberately chosen to develop the electric vehicle industry on its own terms, even if the path will take more time.

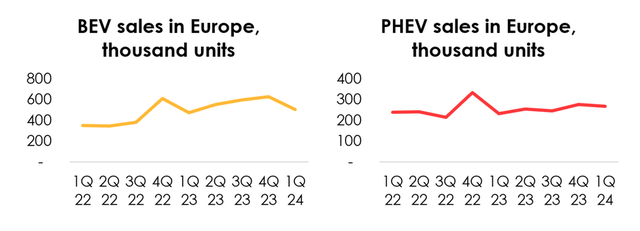

Why BEV sales are falling in Europe

Many countries in Europe have numerous incentives for BEV owners and smaller incentives for PHEV owners, so in Europe there was a significant increase in BEV sales while PHEV sales almost stagnated.

In recent months, some countries, such as Germany and Sweden, stopped or reduced subsidies for EVs, which slowed their sales growth in Europe. At the same time, some automakers are revising their EV plans: VW is developing more PHEVs, and Mercedes wants to produce internal combustion engine vehicles until the 2030s.

Despite the challenges, Tesla’s Model 3/Y continued to be the best selling BEV in Europe.

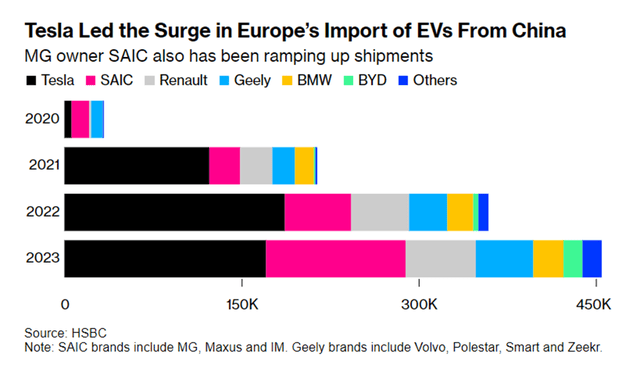

Europe is the most important overseas market for Chinese EV manufacturers. While competition in the domestic market demands ever more price cuts to sell EVs, causing margin compression, Chinese EV manufacturers (such as BYD, SAIC, Geely) can sell their cars in Europe at higher prices than at home.

This puts Chinese manufacturers in a unique position in the European market as they are able to cut prices if competition gets stiffer, while the other market players are very limited in this respect as on a daily basis, they struggle to increase margins.

Previously there was a 10% duty on imported Chinese EVs, but on June 12, the EU announced that it will impose additional tariffs of up to 38.1% on imported Chinese electric vehicles from July 4, unless the EU agrees otherwise with the Chinese authorities. Europe has proposed two types of tariffs:

- The tariff is for those who do not have local production in the EU. This tariff applies to SAIC, which owns the MG brand. For the company, it will be 38.1%.

- The tariff is for those who have local partnerships in the EU. For Geely, which owns the European Volvo company and the Zeekr brand, the tariff will be 20%. For BYD, which is building its own plant in the EU, the tariff will be 17.4%.

According to our calculations, even with the current tariffs in place, the price of Chinese EVs will still be lower than that of alternative manufacturers.

Tesla, which is currently the largest exporter of cars from China to Europe, has asked for a separate tariff for a specific company, arguing that it enjoys less substantial government support.

According to the Kiel Institute for the World Economy, if the tariff were raised to 20%, imports of Chinese electric cars into the EU would fall by a quarter (by ~125 thousand EVs). This measure will support the local production of electric vehicles and boost the production of electric vehicles in Europe.

Outlook for Tesla’s shipments

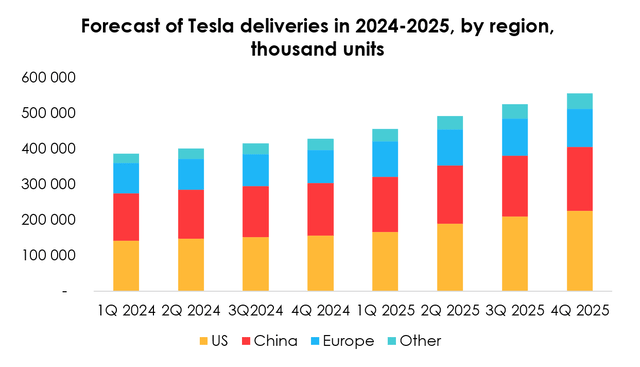

Based on the above analysis, we have changed our forecast for Tesla shipments. Previously, we split total shipments by the type of model, but now we have decided to disaggregate the forecast for each model by geographic sales region. Analysis along these lines will allow us to make high-quality assumptions for each country, depending on the state of its economy, the BEV industry as a whole, and Tesla’s position in the industry.

For example, we expect Tesla EV sales in 2024 to slow in three key sales regions – the US, China, and Europe – for the reasons described above. We are making a note that the situation in Europe may improve after the introduction of tariffs on imports, but it is not quite possible to make predictions at this time, and it is necessary to wait for the final tariffs to come into effect.

We expect production of the Model 2 crossover, codenamed Redwood, to start in 1Q 2025. In a conference call, Tesla’s CEO announced that the release of new models would be accelerated, without specifying the models, but we believe the model in question is Tesla’s budget model. Production will take place on both current and new production lines.

There were also long-awaited news about the Semi model: The first electric trucks are scheduled to roll off the conveyor belt at the end of 2025, and deliveries are planned to start in 2026. In the absence of news about the Roadster model, we are moving the start of its production to 1Q 2026.

As the company will have to expend resources to complete the development and start production of more affordable EV models, we have reduced the projected growth of Cybertruck shipments.

Therefore, given the lower forecast for Tesla’s EV shipments in 2024, the postponement of the start of production of the Redwood, Semi, and Roadster models, and the reduced forecast for Cybertruck shipments, we are lowering the estimate for Tesla’s aggregated shipments from 2.2 mln units (+24% y/y) to 1.6 mln units (-10% y/y) for 2024, and from 2.8 mln units (+26% y/y) to 2 mln units (+24% y/y) for 2025.

Let’s take a closer look at the supply forecast by geographic region. For the reasons described earlier, we have generally lowered our expectations for BEV sales (of which Tesla is a part) in all three major regions where the company is present, which has had such a significant impact on the supply forecast. However, with the launch of the low-cost Tesla Model 2 in early 2025, we expect an increase in deliveries to the United States (initially only there, with the possibility of building production lines in other regions later).

Full Self Driving

The company continues to improve the driver assistance system while trying to increase the number of FSD users by raising awareness of the product and its affordability:

- in late March 2024, it was reported that the company had required employees to demonstrate the capabilities of its driver assistance system during test drives for customers in North America before they purchase a vehicle;

- also since the end of March 2024, it has been possible for all current and new owners of the S/3/X/Y models in the US and Canada to activate a free FSD trial for 30 days (provided that the software is updated to the required version);

- in mid-April 2024, Tesla lowered the cost of a monthly FSD subscription from $199/month to $99/month for the first time since 2021;

- at the end of April 2024, Tesla reduced the cost of FSD from $12 thousand to $8 thousand and removed the option to purchase ADAS separately (which previously cost $6 thousand); its current owners have the option to upgrade ADAS to FSD for $2 thousand.

In a significant development, while previously it was available only in North America, there is now news of a potential rollout of the technology in China.

On April 28, Musk made a surprise visit to Beijing to seek the relevant approvals, and the results of the trip were not long in coming. On April 29, it was reported that:

- Tesla Inc.’s Chinese-made cars passed tests to ensure they meet key security and data privacy requirements.

- Tesla concluded an agreement with Baidu Inc. for road mapping and navigation.

As a result, Tesla Inc. received approval to introduce its driver assistance system in the Chinese market. The move could significantly improve the automaker’s situation in China, following a string of quarters of stiff competition with local manufacturers that caused a decline in Tesla’s market share in China and its financial results.

The driver assistance system will allow Tesla to not just increase average revenue per sale of electric vehicle in China, but also attract additional demand for its products in general, as gadgetization and driver assistance systems provide a serious competitive advantage in the Chinese EV market.

For now, in mid-June 2024, Shanghai will allow 10 Tesla vehicles to test the company’s most advanced autonomous driving software, setting the stage for its introduction in China.

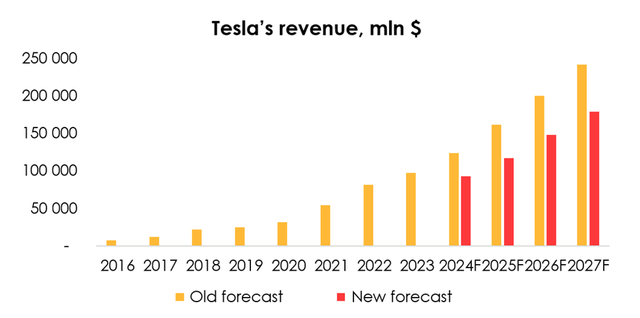

Tesla’s revenue

We are lowering the forecast for Tesla’s revenue from $123.5 bln (+28% y/y) to $92.6 bln (-4% y/y) for 2024, and from $160.9 bln (+30% y/y) to $116.6 bln (+26% y/y) for 2025 due to:

- the reduction of the forecast for Tesla’s aggregated shipments from 2.2 mln units (+24% y/y) to 1.6 mln units (-10% y/y) for 2024, and from 2.8 mln units (+26% y/y) to 2 mln units (+24% y/y) in 2025;

- the revision of the method of forecasting prices of each of Tesla’s models and greater country-by-country analysis;

- the increased forecast for revenue from FSD sales, as the prices of buying it and subscribing to it went down, which will prompt the number of FSD users to expand.

The financial results of the company’s other segments – Energy Generation and Storage and Services – continue to be broadly in line with our expectations. However, it’s worth noting that as of 1Q 2024, Tesla has removed from its reporting the line on the Solar segment. In Form 10-Q for 1Q 2024, we find that Solar Energy Systems continues to be listed as a company asset and that revenue in the Energy Generation and Storage segment increased mainly due to the rising average Megapack price, which was partially offset by a decrease in the number of installed solar panels.

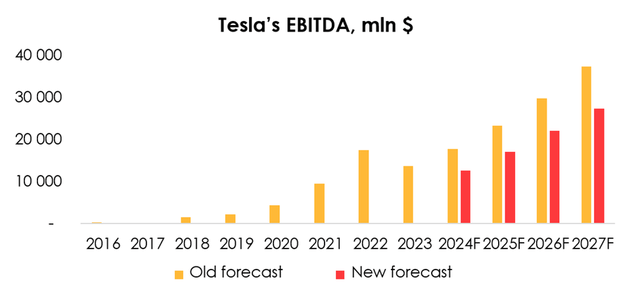

Tesla’s financial results

We are lowering the forecast for Tesla’s EBITDA from $17.6 bln (+30% y/y) to $12.6 bln (-7% y/y) for 2024, and from $23.2 bln (+31% y/y) to $17 bln (+35% y/y) for 2025 due to:

- the reduction of the revenue forecast from $123.5 bln (+28% y/y) to $92.6 bln (-4% y/y) for 2024, and from $160.9 bln (+30% y/y) to $116.6 bln (+26% y/y) for 2025 (negative impact);

- the reduction of the forecast for the company’s gross margin from 18.8% to 18.5% (negative impact) for 2024, and its increase from 19.4% to 19.8% (positive impact) for 2025.

The lower gross margin forecast for 2024 is due to the lower-than-expected level in 1Q 2024, as well as the ramp-up of Cybertruck deliveries and preparations for the production start of the Redwood model. In 2025, we expect a slight uptick on the back of the introduction of FSD in an increasing number of the company’s electric vehicles.

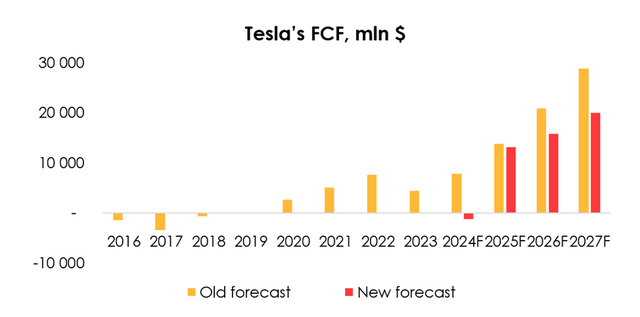

The forecast for free cash flow has been lowered from $7.8 bln (+80% y/y) to ($1.3) bln for 2024, and from $13.8 bln (+76% y/y) to $13.2 bln for 2025 following the reduction of the forecast for the company’s operating income, and the revision of the forecast for inventories, which now says they will be rising in the period from 2Q-4Q 2024, before declining steadily afterward.

Valuation

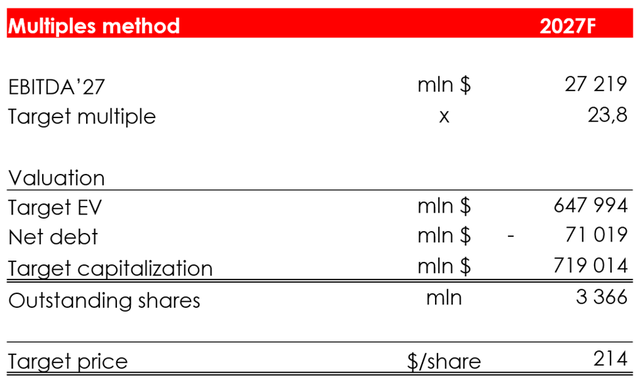

We are lowering the target price of the shares from $210 to $153 due to:

- the reduced EBITDA forecast for the period from 2024-2027, which caused a reduction of the EV/EBITDA multiple from 25.7х to 23.8х;

The target multiple of 23.8x was derived by multiplying the base multiple by the average growth rate of Tesla’s EBITDA over the valuation horizon to 2027. We use a higher multiple to value Tesla than traditional automakers because Tesla is not just an automobile company. In addition to manufacturing cars, Tesla is actively developing the infrastructure of charging stations, actively developing the energy segment through Megapack, and developing software for its Autopilot and Optimus robots. According to management, Tesla should be considered as a company working in the field of artificial intelligence and the production of “robots” and not as an ordinary car manufacturer.

- the increase in projected net debt from ($94.4) bln to ($71) bln , primarily due to a decrease in FCF forecast for 2024-2027;

Let us clarify that the brackets characterize negative numbers. Negative net debt is actually a positive monetary position. By subtracting the lower FCF from the actual current net debt (implying that the entire FCF amount will be used to repay it), we increase the net debt forecast.

- the shift of the FTM valuation period by 1 quarter, which means future financial results have gotten closer.

The rating for the stock is SELL.

The share price estimate of $153 has been achieved by computing the company’s valuation based on the multiples method, and discounting it at the rate of 13% per annum.

The discount rate of 13% is the average growth of the S&P 500 Index over the past 20 years. In other words, when we value a company based on its long-term results, it is important to us that the company’s growth exceeds the average growth of the index.

Conclusion

Due to lower expected EV deliveries, the impact of the price war, the ramp-up of the costly Cybertruck, and preparations for the launch of Model 2, we lower our price target and assign a SELL rating.

Speaking of other company news, as they place a big bet on AI, the company’s management, including the CEO, are saying that Tesla should be viewed as an AI or robotics company. However, these statements are a bit scary for investors because of their concern about the growth rate of electric vehicle sales.

To manage your positions, we recommend following Tesla’s earnings releases, EV market updates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.