Summary:

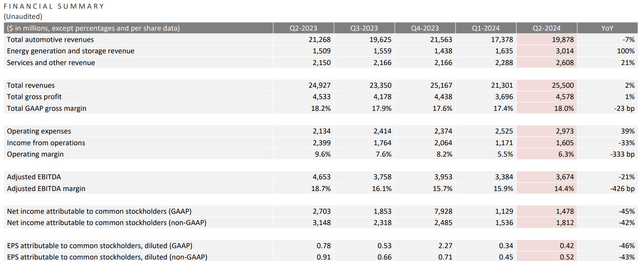

- TSLA stock rallied on 2Q deliveries, but the 2Q automotive revenue growth missed estimates, and the company expects significantly lower vehicle volume growth in FY2024.

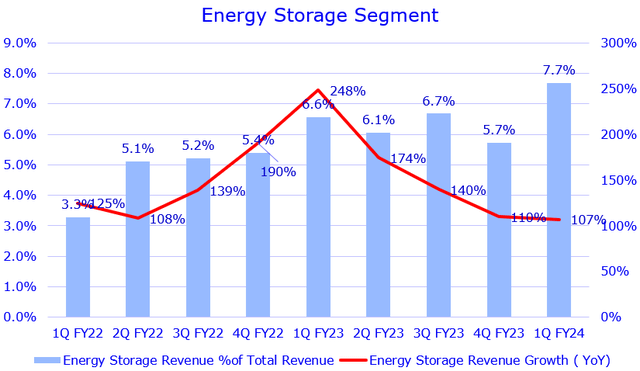

- The company’s total revenue exceeded consensus, largely driven by a 100% YoY growth in its energy storage revenue, indicating potential for significant growth contribution in the long term.

- Even excluding the $622 million in restructuring and other costs, EBIT margin contracted by 87 bps and adjusted EBITDA margin declined by 187 bps YoY, resulting in an EPS miss.

- Not only is TSLA facing intensified competition in China and Europe, but its 2Q FY2024 new car registrations also suffered a 24% YoY decline in California.

- Despite Elon’s optimism on autonomous driving, the stock is currently trading at 97x non-GAAP P/E fwd, and its EV/EBITDA fwd stands at 50.4x, 2% above the 5-year average, reflecting these growth tailwinds.

makasana

Investment Thesis

Despite more than 8% price drop after a mixed 2Q FY2024 earnings result, Tesla’s (NASDAQ:TSLA) (NEOE:TSLA:CA) stock had a tremendous bull run following its 2Q vehicle deliveries that beat the street estimates. I strongly believe that TSLA is still heavily influenced by market sentiment rather than fundamentals, as investors desperately gauge a potential growth inflection point. Any sign of positive news could convince them to pile into the stock.

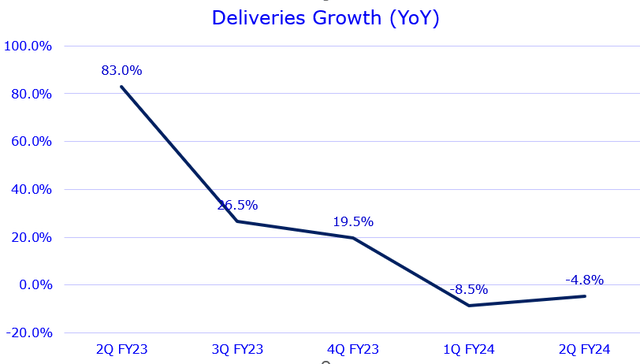

The company’s 2Q deliveries growth has declined by 4.8% YoY. Given its previous lofty valuation before the deliveries numbers were announced, the stock’s nearly 30% increase in less than a month appeared overdone. Considering its sluggish earnings growth potential over the next two years, the stock is currently trading at 52x the non-GAAP P/E for FY2026.

Therefore, I have downgraded the stock to a strong sell to reflect my concerns, which include a continued YoY decline in automotive revenue and margins in 2Q, a significant weak vehicle volume growth projected for FY2024, intensified competition, particularly in China, and its lofty valuation.

2Q FY2024 Earnings Takeaway

TSLA’s 2Q earnings results beat revenue expectations but missed the non-GAAP EPS consensus. I believe that the better-than-expected revenue was largely driven by a 100% YoY growth in energy generation and storage revenue, which significantly beat market consensus. In the 2Q Shareholder Deck, the company expects a significantly lower vehicle volume growth rate in FY2024 as the teams focus on the next-generation model. This may indicate that total automotive revenue will continue to decline on a YoY basis in 2H FY2024.

In addition, TSLA’s adjusted EBITDA margin showed a continued QoQ decline of 150 bps. While its GAAP gross margin and operating margin showed slight improvements from 1Q FY2024, the results still indicated margin contraction YoY compared to 2Q FY2023. Some might argue that the 2Q results included a one-time $622 million “restructuring and other” costs that impacted operating expenses. However, even if we completely excluded that cost, we still saw an 87 bps YoY contraction in the operating margin and a 187 bps YoY contraction in the adjusted EBITDA margin. Due to this disappointing trend, its non-GAAP EPS missed the consensus by $0.10.

Nevertheless, it is still positive to see a 34% YoY growth in FCF, driven by positive “changes in operating assets and liabilities.” Although the Shareholder Deck does not include details of this line in the Statement of Cash Flows section, I believe it might be a significant decrease in vehicle inventories from 1Q FY2024 (which is an asset account on the balance sheet) that boosted the OCF. We notice that TSLA has recently been working to lower vehicle prices as its inventory piles up.

During the 2Q FY2024 earnings call, Elon Musk emphasized that autonomous driving is expected to be a major driver of demand. However, with the current weak fundamentals, the stock’s lofty valuation has likely already priced in many of these anticipated tailwinds. Moreover, the company has postponed its plans to build a Gigafactory in Mexico due to uncertainties surrounding the U.S. election and potential tariffs if Donald Trump were to be re-elected. Additionally, the previously scheduled robotaxi event for August has been pushed back to October. Based on all these concerns, I doubt that the recent rally powered by the 2Q deliveries report will be sustainable. I’ll explain this in the next section.

2Q Deliveries Report Can’t Justify Recent Sharp Rally

Let’s recall the 2Q deliveries result. TSLA delivered 443,956 vehicles in 2Q FY2024, which was only 1% ahead of the market consensus. As shown in the chart, the YoY growth in deliveries slightly improved to -4.8% compared to -8.5% in the previous quarter, but the number still shows a decline. Some investors might argue that this “growth reacceleration” (decline less) will persist going forward. However, it’s important to note that TSLA is facing increasing competition in the global EV market.

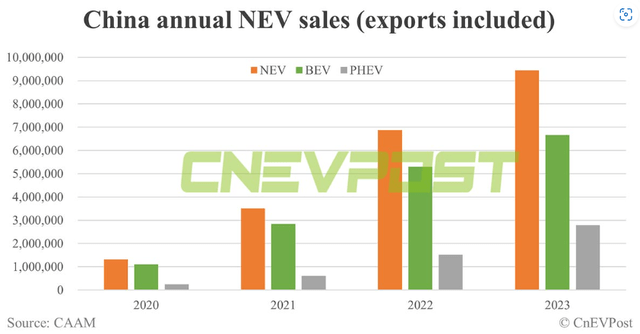

China’s NEV sales growth has been robust from 2020 to 2023. According to the latest report, China’s NEV sales will exceed the 10 million mark for the first time this year, showing a 22% YoY growth. However, TSLA has not appeared to be a beneficiary of this growth. In addition to challenges in China, the company is facing significant competition in major states in the U.S. as well. The company’s 2Q FY2024 new car registrations suffered a 24% YoY decline in California.

Moreover, we saw Volkswagen (OTCPK:VLKAF) and Stellantis (STLA) dominate car sales in Europe in the first half of 2024, while TSLA dropped to the tenth position. Without a new model coming to market, I believe TSLA’s market share will continue to be under pressure in the global EV market. The recent price action has already priced in a growth reacceleration in revenue and gross margin expansion over the next few quarters, which we did not see it in 2Q earnings results.

Therefore, I believe that the recent price moves merely implied a pure speculation on a near-term growth inflection, as we saw the investors who were bullish on TSLA faced a reality check after 2Q earnings results.

2Q Energy Storage Deployment Grew +100% QoQ

As shown from the chart, the energy storage revenue as a percentage of TSLA’s total revenue has been expanding, increasing from 3.3% to 7.7% over two years. Its YoY growth has consistently maintained a +100% momentum. While TSLA’s automotive business has not yet seen a major rebound in 2Q, the company’s energy storage products deployed 9.4 GWh in 2Q FY2024, marking a 129% QoQ and 157% YoY increase compared to 2Q FY2023. This growth is largely driven by the nearly 40-GWh annual production capacity at the Megapack factory in California.

Moreover, TSLA plans to build a second 40-GWh Megapack factory in China, starting in 1Q 2025. Although the energy storage business is still a small portion of TSLA’s total revenue, its impressive growth trajectory could significantly accelerate the company’s top-line growth in the long run. Therefore, the total revenue beating the consensus in 2Q was primarily driven by a 100% YoY growth in energy storage revenue, rather than by automotive sales.

Valuation

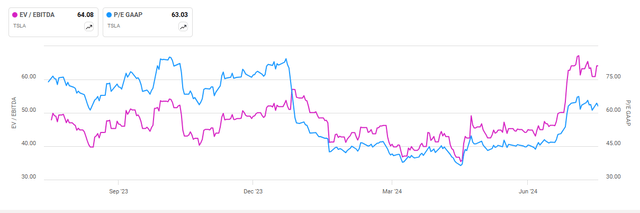

The stock is currently trading at 63x GAAP P/E TTM and 64x GAAP EBITDA, which are very lofty. With TSLA expected to experience an earnings decline in FY2024, its non-GAAP P/E fwd is projected to be higher, at 97x. According to Seeking Alpha, this multiple is 14% below its 5-year average. However, I believe the stock should be trading at a significantly lower level, as its forward EPS CAGR for the next 3-5 years is only 10.4%, which is 81% below its 5-year average. The current YoY decline in its automotive revenue and total deliveries warrants a lower valuation.

Additionally, due to the continued contraction in EBITDA margin, its EV/EBITDA forward multiple stands at 50.4x, which is even 2% higher than the 5-year average. Given TSLA’s lofty valuation profile, sluggish growth outlook in the automotive segment, and muted margin outlook, I believe the stock should be rated as a “strong sell,” at least for now.

Conclusion

In sum, despite TSLA’s 2Q FY2024 revenue beating expectations, this was primarily due to strong growth in energy storage revenue rather than a major recovery in automotive sales. The company’s automotive sector continues to struggle with declining year-over-year deliveries and increased competition in global markets. TSLA’s current valuation, with a forward non-GAAP P/E of 97x, seems excessive given the company’s weak fundamentals and sluggish growth outlook in FY2024. Assuming that Elon Musk’s optimism about autonomous driving will significantly boost demand in the long term, this potential has already been priced into the stock’s lofty valuation multiple. Additionally, uncertainties surrounding new models next year and the delayed robotaxi event further contribute to the stock’s volatility. Consequently, the recent strong rally based on 2Q deliveries appears overstated and unsustainable, leading to my rating downgrade to a “strong sell.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.