Summary:

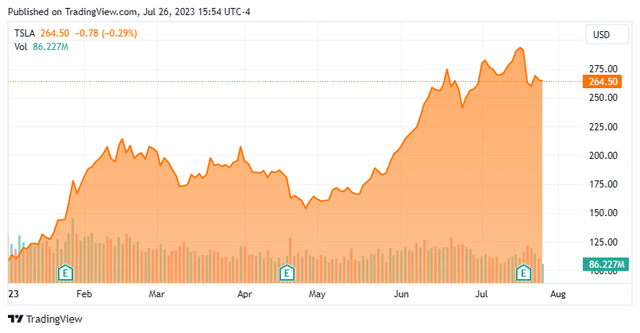

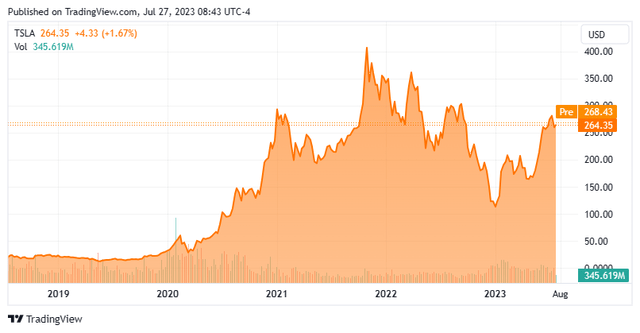

- The stock of Tesla, Inc. has risen nearly 150% in 2023 after a massive 14-month decline.

- By many key valuation metrics, Tesla shares appear priced for perfection even as the company continues to ramp up production at an impressive pace.

- Five key concerns shareholders should have around Tesla after the massive rally in its stock year-to-date are highlighted below.

juliannafunk

The moment you doubt whether you can fly, you cease for ever to be able to do it.”― J. M. Barrie.

Few stocks in the market elicit more passion, from both bulls and bears, than that of Tesla, Inc. (NASDAQ:TSLA). The shares in this electric vehicle (“EV”) concern have gone parabolic in 2023, rising approximately 145% even after last week’s 10% selloff following the company’s second quarter earnings report.

The shares seemed priced for perfection at current trading levels. I believe Tesla shareholders should be fully aware of five key concerns when determining whether they should take some profits off the table after the equity’s big rise year-to-date. They follow below.

Valuation:

I know bulls on TSLA don’t put a lot of stock into traditional valuation measures, reasoning that Tesla is in the vanguard of the huge paradigm shift from internal combustion engine (“ICE”) vehicles to all-electric ones. This is much like Amazon (AMZN) came to dominate the online retail market after many years of generating huge losses, rewarding shareholders massively in the process.

July Company Presentation

Earnings at Tesla are actually projected to drop by 25% in FY2023 on revenue growth of 10%. The equity sells for nearly 90 times forward earnings and nine times forward revenues. That seems extreme on any measure, but especially compared to traditional auto manufacturers. Ford Motor Company (F) trades at 8.3 times forward earnings and under .4 times forward sales, while General Motors (GM) sells for 5.4 forward profits and just over .3 times forward sales.

Consumer Demand/Interest Rates:

The Fed Funds rate has now risen some 525 bps since the Federal Reserve embarked on its most aggressive bout of monetary policy since the days of Paul Volcker. Rates are now at their highest levels in 22 years. The Fed’s tightening has led to much higher interest rates for consumers, including the average 30-year mortgage rate approaching seven percent. Not surprisingly, sales of new and existing homes are down sharply from 2021, when the average mortgage rates fell below three percent.

The average rate for an auto loan in June was over 11%, and that was for individuals with excellent credit. Overall, U.S. light vehicle sales are up sharply from last year, thanks largely to pent-up demand from last year’s huge supply issues due to a stuck global supply chain. However, that pent-up demand should soon be satiated. Much higher monthly car payments, thanks to these rising auto loan interest rates, should be a considerable headwind for the foreseeable future across the industry.

The Law Of Large Numbers:

Obviously, it is much easier to build capacity and manufacturing facilities and infrastructure to build 200,000 cars a year than it is to produce two million cars annually, as Tesla is now approaching. It is harder still to get to a ten million annual run rate, which shareholders are banking on given the current valuations on the stock.

Supply chain challenges, which have been myriad across entire manufacturing space since the aftermath of the pandemic and lock-downs, multiply the larger a company gets. Electrical vehicle production also has its own unique set of challenges including development of new battery technologies, dependence on rare materials, buildout of a global charging network, etc…

As Tesla continues to ramp up production at a furious pace, these issues are likely to continue to multiply in complexity.

Declining Operating Margins:

These factors are already starting to impact Tesla’s operating margins, which have been much higher than the auto industry as a whole. It is a key reason earnings are projected to decline by a quarter this year even as the company continues to ramp up vehicle delivery at a rapid pace.

July Company Presentation

Tesla’s GAAP operating margin fell to 9.6% in the second quarter from 11.4% in the first quarter. More alarmingly, it was down substantially from 14.6% in the same period a year. This was a key reason the stock sold off nearly 10% last Thursday when second quarter numbers were posted.

Musk’s Many Distractions:

Mr. Musk had enough on his plate already managing both Tesla and SpaceX (SPACE). Then he decided to buy Twitter. While I personally applaud his efforts in the name of free speech and transparency, especially the release of the Twitter Files, the purchase has divided his attention and taken time from his other two large ventures.

Buying Twitter also put a huge target on his back as well as that of his company from various parts of the government apparatus. Mr. Musk was already infamous for his long-running feud with the Securities and Exchange Commission. Now, he and his shareholders should expect extra scrutiny on both the congressional and regulatory fronts, both at the federal and state level. Obviously, this can’t be a positive for Tesla, either for the company or his shareholders, and could be a source of future uncertainty. Some of these issues were recently highlighted by an article on Fortune.

Given the highlighted worries above, I would love to short TSLA stock. However, there are few problems for me with that approach. First, I don’t short straight equity, especially on what I consider “cult” stocks that are divorced from rational valuations. As the old John Maynard Keynes quote goes, “Markets can remain irrational longer than you can remain solvent.” This is probably one reason less than four percent of the outstanding shares in TSLA are currently held short despite the stock’s massive rally in 2023 and its stretched valuations. No one wants to get run over by a momentum-driven steamroller, after all.

I like to do out of the money bear market put spreads on overvalued stocks, but the option premiums are so large on Tesla even if I did bear market puts like the December $240/$210 put spread on TSLA it would only provide a four to five to one return if the stock declined 20% over the option duration. I can get better than a 10 to 1 return on a similar spread on the Invesco QQQ Trust ETF (QQQ), a trade I outlined the other day. Therefore, although I have a small bear put spread position in TSLA, I have a much larger one on the QQQ.

Now, if I was long the stock, selling some just out of the money call options on some of my shares could provide considerable amounts of option premium and some downside risk mitigation as well. An investor that is still bullish on TSLA after reading this article could also sell some naked puts on the stock and pick up solid premium income and/or a significantly lower entry point. Please familiarize yourself with the risk of trading options before placing any trades.

Finally, this stock has many huge reversals during Tesla’s time as a public company. The last one started in early November of 2021 and finally ended very early this year. That selloff saw the stock drop more than 70% from peak to trough. That is one last thing to consider before deciding to invest in TSLA at these levels.

All revolutions are fantasy, until they happen, then they are historical inevitabilities.”― David Mitchell.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of QQQ, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Live Chat on The Biotech Forum has been dominated by discussion of lucrative buy-write or covered call opportunities on selected biotech stocks over the past several months. To see what I and the other season biotech investors are targeting as trading ideas real-time, just join our community at The Biotech Forum by clicking HERE.