Summary:

- Tesla, Inc.’s Cybertruck production and sales are expected to generate significant revenue, with an order backlog of 1.9 million units.

- The production of semi-trailer trucks in 2024 could add another $8 billion in annual revenue.

- Tesla’s revenue growth is projected to be high due to increasing EV sales, potential cost reductions in battery technology, and expansion into new markets like autonomous vehicles and battery chargers.

Xiaolu Chu

Tesla, Inc. (NASDAQ:TSLA) is one of the market’s most controversial companies. As the leading producer of electric vehicles (“EVs”), Tesla remains ahead of the competition in many areas. Although it is highly priced on a price-to-earnings ratio basis, I feel long term it is really undervalued here because of the many things that can generate huge revenue between now and 2030.

In this article, I will provide 8 reasons why Tesla is an excellent long-term investment.

1. The Tesla Cybertruck starts production this year

The Cybertruck is scheduled to begin full production later this year, and then in 2024 is expected to produce 375,000 units. With an average unit price of $60,000, that should generate approximately $22 billion in revenue in 2024. Considering that in the fiscal year 2022 Tesla’s revenue was $81 billion, that would provide more than a 25% increase in revenue just from the Cybertruck.

Tesla

And, since the Cybertruck currently has an order backlog of 1.9 million units, we are looking at 375,000 units being produced every year at least for the next two or three years even if we include massive cancellations that may or may not be coming up.

What other company has a potential 25% annual increase in revenue locked in with a brand-new product?

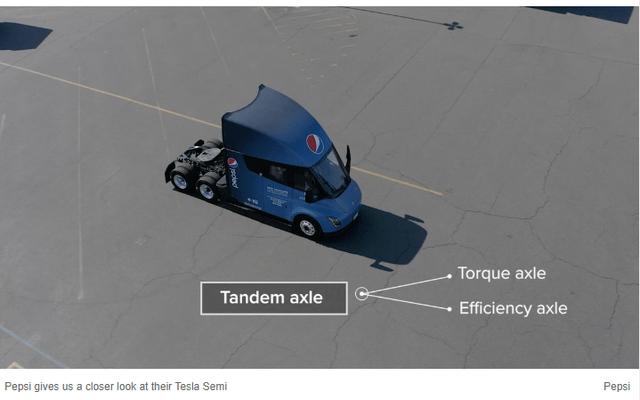

2. Semi-trailer trucks will begin production in 2024, with full production mode of 50,000 units per year in 2025

Currently, Tesla has a small production facility producing about 5 semi-trailer trucks per week. They also have an agreement with Pepsi-Cola where they’ve provided semis for PepsiCo (PEP) to use mainly in California and Pepsi really likes them.

If Tesla meets its production targets of 50,000 units per year, that would be another $8 billion a year in revenue on top of the $22 billion in revenue that they’re likely to see from the Cybertruck. Remember, these are new lines of business, not an expansion of old lines.

3. EV sales will increase by an average of 24% per year between 2023 and 2030

According to Global News Wire, EV sales will grow from $206 billion to $957 billion by 2030. With Tesla being the largest EV producer and arguably the most efficient EV producer in the world right now, obviously their revenue growth over that period will be extremely high even if greater competition cuts the growth percentage from the indicated CAGR to something less, let’s say 20% per year. At a 20% average annual growth rate, that means that Tesla’s revenue will grow to more than $300 billion, almost four times what its 2022 revenue was.

Keep in mind that this does not include any of the new projects that Tesla has coming online such as the Cybertruck, the semi-trailers, robots, and the Megapak.

4. Replacing lithium batteries should lower costs and arguably increase volumes even more

Elon Musk announced that Tesla is looking to provide a sub-$25,000 EV to the market sometime soon. My guess is that prediction has something to do with batteries being powered by sodium, i.e., salt at a fraction of the price of the current lithium batteries.

Sodium batteries do not provide as much distance per charge as lithium batteries but the fact is most people drive their cars less than 40 miles a day on average. Therefore, a battery with a range of 175 to 200 miles would be more than enough for the vast majority of car buyers especially when you can charge it at home overnight.

One way to think about this is how many times a year do you drive more than say 175 miles in a day? In my case, that would be about 12 days a year and I probably do more long-distance traveling than most people.

One of Tesla’s battery providers is the Chinese company CATL, which has recently announced that it will be producing sodium batteries before the end of 2023.

5. Tesla’s battery Chargers could be another $20 billion a year business in the next few years

As most of you know, Tesla’s chargers are increasingly being used by other companies such as EV competitors GM, Ford, and Rivian. Tesla could earn $20 billion a year just from their chargers.

Some states are requiring Tesla Chargers. Kentucky, Texas, and Washington have asked the federal government to fund charger build-outs in their states. This is another indication of Tesla’s leadership in high-tech areas other than EVs.

6. The autonomous vehicle market is predicted to grow to a $2 trillion market by 2030

Self-driving vehicles and their service revenue will arguably be one of the biggest markets for Tesla’s products, especially the software and services revenues attached to those vehicles.

How big is Tesla going to be in this market? Let’s just imagine what it’s going to be like after they purchased 10,000 H100 GPUs from Nvidia (NVDA) for a new computer they’re building. Elon Musk has said in no uncertain terms that Tesla will be a leader in this AI market. This new computer will be the 3rd fastest supercomputer in the world.

7. Megapacks could add $400 billion a year in revenue by 2030

So now we are getting to some really big numbers, backup battery systems for utilities and others as unreliable renewable energy expands and everyone will need backup at night, on cloudy days, and when the wind doesn’t blow hard enough.

Tesla

When your megapack business has grown by 62%, 152%, and 360% over the last 3 quarters, you know you have a huge growth engine.

8. Engineers want to work for Elon Musk

In a high-tech world, those who have the best engineers are the most likely to succeed.

Business Insider just did an interesting survey asking engineers who would they most like to work for once they graduated.

For example, number 20 on the list was Intel (INTC), and number 16 was Amazon (AMZN).

But number two was none other than Tesla, and number one was SpaceX – both started by Elon Musk. I think it would be safe to say there is considerable exchange of information between engineers at SpaceX and at Tesla adding to the value of both.

That’s another big win for Tesla.

Conclusion

That’s eight reasons I’ve given you to buy Tesla, and there are even more reasons that I won’t go into now.

For example, what about robotics, where of course, Tesla is a leader. Think about how robotics could work in, for example, nursing homes where they could take care of senior citizens 24 hours a day 7 days a week. They could cook, clean, talk to, play music for, do medical testing, phone relatives, do Google searches and never ask for a day off or a raise.

Another one that most people don’t know about is Tesla’s entry into the data center market. That’s a market with a current size of more than $250 billion dollars a year. What part of that $250 billion can Tesla take advantage of compared to leaders Amazon, Google, and Microsoft? I’m not sure but I would guess it would be substantial.

Obviously, I think these eight points are valid reasons for buying and holding Tesla long-term. Could Tesla have the world’s first $10 trillion market value? Looking at some of these numbers and the market size for example in Megapacks one has to wonder if that’s not true.

Could there be a downside to Tesla? Absolutely. There could be accidents, there could be controversial Elon Musk sightings, and there could be competition that we don’t know about yet. There’s also the issue of volatility. If you look at Tesla’s price over the last three years, you can see how Tesla’s price at one time was up more than 150% but currently sits at 54%, a huge downside from the dizzying heights of 2021.

I would agree that Tesla will remain extremely volatile, with violent ups and downs over the next few years, but long term I think the odds of being a very successful investment are very high, and that is why Tesla is my largest holding.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you found this article to be of value, please scroll up and click the “Follow” button next to my name.

Note: members of my Turnaround Stock Advisory service receive my articles prior to publication, plus real-time updates.