Summary:

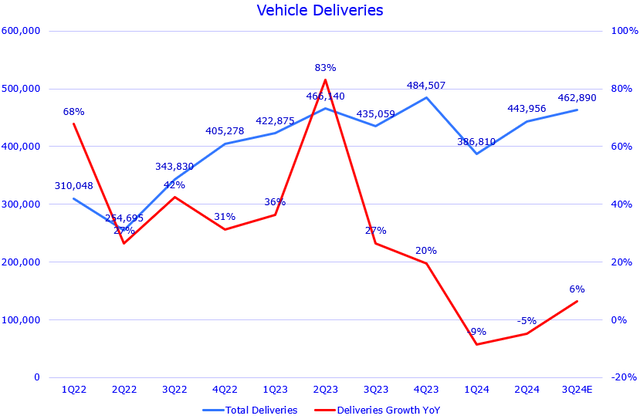

- Tesla’s 3Q FY2024 deliveries missed expectations, signaling potential muted 3Q earnings and adding pressure on revenue and EPS estimates.

- Given the optimism surrounding the Robotaxi event, the stock’s recent rally following the missing 3Q deliveries could result in a “sell the news” reaction after the event.

- Despite a large TAM, Robotaxi is unlikely to significantly boost long-term growth and will face challenges like monetization, competition, reliability of FSD technology, and regulatory hurdles, even if it materializes.

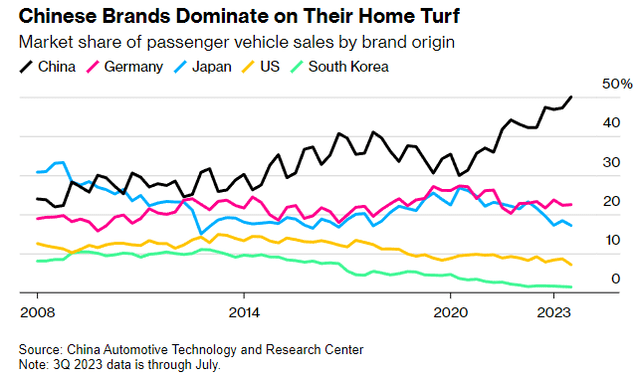

- Although China’s stimulus could boost 4Q deliveries and beyond, TSLA faces growing competition from domestic Chinese EV makers like BYD.

- The stock’s current valuation reflects an optimistic long-term growth outlook based on Elon Musk’s ambitious promises, including his target of 50% YoY growth in total deliveries.

gorodenkoff/iStock via Getty Images

What Happened

Tesla’s (NASDAQ:TSLA) stock had recently been pushing higher, driven by optimism around its 3Q FY2024 deliveries and the highly anticipated Robotaxi event next week. However, the recent delivery number missed consensus, triggering a near-term selloff, but the stock quickly bounced back on Friday. This miss may signal a relatively muted 3Q earnings report later this month, as 3Q revenue consensus suggests a similar YoY growth compared to the same period in FY2023.

Additionally, recent stimulus initiatives from China could improve the domestic EV consumption outlook. While many Chinese EV makers, including NIO (NIO), XPeng (XPEV), and BYD (OTCPK:BYDDY), saw strong rallies in their stocks, TSLA remained muted, indicating that the market does not expect a significant demand boost for the company. TSLA has been trading on long-term “what if” optimism, which has largely diverged from its current fundamental trajectory. As a result, the stock may experience a “buy the rumor, sell the news” reaction, with the recent rally already pricing in some of the positive expectations around the Robotaxi event. Therefore, I reiterate my previous strong sell rating on TSLA.

Missing 3Q FY2024 Deliveries Added Pressure in the Upcoming Earnings Report

TSLA released its 3Q FY2024 delivery results, which came in below market expectations. Although the 6% YoY growth shows gradual improvement from the previous quarter, it reflects a continued downtrend in growth momentum, significantly below TSLA’s earlier trajectory. The lower-than-expected deliveries are likely to add pressure on meeting revenue consensus for 3Q, especially as the company continues to slash vehicles prices. Additionally, TSLA has experienced gross margin compression in recent quarters, suggesting margins may decline further in 3Q due to muted volume growth, putting more pressure on beating EPS estimates. However, I expect sell-side analysts to adjust their 3Q estimates accordingly after the deliveries report.

Some investors may argue that TSLA’s value lies in its future AI technologies, which are integrated across all of its car models, and that the upcoming Robotaxi event could be a long-term growth catalyst. However, as previously mentioned, this optimism has already pushed the stock higher, and it’s possible that the stock may experience a further pullback after the event.

High Expectations for “Robotaxi Day”

The company is expected to unveil the Robotaxi on October 10th. In a previous earnings call, Elon Musk mentioned that the first Robotaxi ride will depend on the timing of achieving “unsupervised full self-driving,” which is potentially slated for CY2025. However, Elon’s history of making ambitious promises often fall short. He previously reiterated the company’s long-term goal of 50% annual growth in EV deliveries, even though the market is expecting a negative YoY growth in deliveries for FY2024.

Furthermore, Robotaxis aren’t new to the market. For example, Google’s (GOOGL) Waymo recently reached 100,000 weekly paid rides, but the project remains unprofitable. While TSLA’s Robotaxi rollout is exciting news to the market, it’s still too early to tell its monetization strategy and how it plans to build trust with riders. If their Robotaxis eventually dominate the mainstream, regulatory uncertainties regarding its autopilot and FSD technologies could also pose challenges.

Additionally, Elon is likely to unveil a lower-cost compact EV, set for release in CY2025, as the company is currently struggling to sell its existing models to maintain its previous growth trajectory. The stock’s lofty valuation is heavily based on future promises. Given the current high level of optimism surrounding this event, I believe that the elevated expectations will likely trigger a “sell the news” market reaction afterward.

Will China’s Stimulus Plan Impact Tesla? (Upside Risk)

Despite the 3Q delivery miss, some investors believe that China’s recent stimulus measures can gradually boost domestic consumption. Several of TSLA’s Chinese EV competitors have posted record deliveries in the recent quarter. While BYD’s passenger BEV sales were slightly below TSLA’s deliveries in 3Q, the gap is narrowing. In terms of NEV sales, BYD has already surpassed Tesla, and this gap continues to widen.

I acknowledge that TSLA’s upside risk lies in the potential for 4Q FY2024 deliveries to exceed estimates, driven by a strong demand recovery in China following the stimulus. Recently, the company extended its 5-year, 0% interest loan until the end of this month, and it’s possible that this program could be extended further in response to the stimulus. Since TSLA’s stock has remained mostly muted while other Chinese EV makers strongly outperformed, this could set the stage for a potential catch-up rally in 4Q FY2024.

Lastly, the European Union’s decision to impose additional tariffs on Chinese EVs in a range from 7.8% to nearly 45%. It will only face the smallest tariff of 7.8%. While this is good news for TSLA in the EU market, it’s possible that these Chinese brands will instead focus on expanding their domestic market, which could pose further competition for TSLA in the long term.

Bearish Earnings Revisions

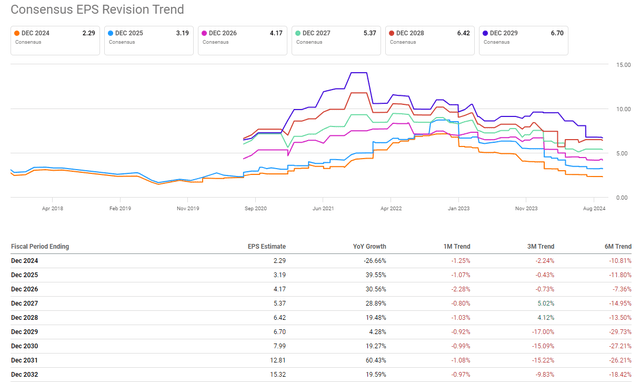

Another factor suggesting that the recent rally has already priced in near-term positive news is TSLA earnings revisions. While it’s fundamentally healthy when a company’s stock price and valuation align with positive earnings revisions, TSLA’s recent rally appears to have already absorbed much of the anticipated good news. According to Seeking Alpha, TSLA’s EPS consensus estimates have been revised downward over the past six months. Although these revisions may lag, the recent 1M trend shows earnings estimates still declining, indicating the market doesn’t expect a growth turnaround anytime soon. This is also consistent with the 3Q delivery miss.

As TSLA has been trading on near-term sentiment, more investors aggressively betting on its upside risk through OTM call options. This forces dealers selling those options to buy underlying TSLA shares to hedge against the upside risk. However, considering the FY2030 EPS estimate of $8, the stock is trading at 31.3x FY2030 P/E, which is in line with the Nasdaq 100 index’s 32x TTM P/E. The gap is nearly 7 years! While momentum traders may still profit from short-term moves in TSLA, I believe the risk-reward profile is becoming increasingly unattractive, and the stock’s further upside potential from here is limited ahead of the Robotaxi event and the next earnings release.

Conclusion

Despite the market’s beta influence, TSLA’s recent rally was driven by strong expectations for 3Q deliveries and excitement around the upcoming Robotaxi event. However, 3Q deliveries missed consensus, showing 6% YoY growth, far short of the company’s long-term target of 50% annual growth. The recent deliveries result, along with CEO Elon Musk’s history of ambitious promises, raises doubts about the company’s ability to meet its lofty goals. While the Robotaxi event adds to the hype, it could trigger a “sell the news” reaction. Moreover, I expect the 3Q FY2024 earnings results to be relatively muted, though management will likely remain optimistic about long-term growth driven by FSD, Robotaxi, and new model launches. Despite these growth narratives, the stock’s current valuation still indicates a strong sell signal.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.