Summary:

- Morgan Stanley upgraded Tesla, Inc. stock to “Overweight” and raised their price objective to $400 based on the potential of Tesla’s new Dojo system. Let’s face their valuation inputs.

- Dojo is a computer hardware and software system that aims to improve Tesla’s Autopilot and Full Self-Driving systems.

- The real impact of Dojo seems to be still uncertain, and investors should focus on Tesla’s core business and conditions before jumping on the AI bandwagon.

- I believe Morgan Stanley analysts may be rushing things by focusing on way too long-term impact rather than the nearer prospects, which are darker for the stock.

- I reiterate my previous Sell rating this time around because of the valuation and industry-specific risks for Tesla.

Nathan Howard/Getty Images News

Introduction

I have been covering Tesla, Inc. (NASDAQ:TSLA) stock here on Seeking Alpha since October 2021 and my conclusions have fluctuated between “buy” and “sell,” coming to negative conclusions the last 4 times. The data is piling up, the company is reporting its new results and corporate actions, the macro is flowing, and so I feel it necessary to share information with you that might be hard to find elsewhere.

For example, those who follow the company regularly know that analysts at Morgan Stanley (MS) recently issued a report in which Adam Jonas et al. upgraded the stock to “Overweight” and raised their price objective from $250 to $400, giving TSLA additional momentum in the market.

The main argument for the upgrade was the new Dojo system, which analysts believe should add as much as $500 billion to TSLA’s market in the foreseeable future.

Morgan Stanley [September 2023 – proprietary source]![Morgan Stanley [September 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/9/18/49513514-16950303543664148.png)

Well, I invite you to take a look with me at the premises underlying the analysts’ assumptions and decide for yourself how close they seem to be to reality.

Tesla’s Dojo And Its Impacts

First off, let’s define Dojo. It is a computer hardware and software system that is intended to process vast amounts of data and train AI algorithms quickly and efficiently, helping Tesla improve the capabilities of its Autopilot and Full Self-Driving (FSD) systems.

Morgan Stanley wrote Dojo could save Tesla around $6.5 billion by FY2024, but this is unverified because of the early stage of Dojo’s rollout, MS admits. The system could also accelerate the monetization of vehicle software, leading to higher revenues. Network Services could reach $335 billion by FY2040, representing a significant portion of Tesla’s earnings, driven by fleet licensing and increased revenue per user. The value of Dojo is also linked to Tesla Mobility robotaxis and the 3rd Party Battery Business.

In many ways, the estimates that influenced Morgan Stanley’s upgrade came from the firm’s forecasts, not from the bank’s own projections.

Morgan Stanley [September 2023 – proprietary source]![Morgan Stanley [September 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/9/18/49513514-16950318308363404.png)

The Morgan Stanley study repeatedly points out that Dojo is a relatively new technology that will take some time before we see how it works in practice. Especially when it is applied to the company’s wide-scaled operations.

In a meeting with Martin Viecha [TSLA’s VP IR], another major investment bank – Goldman Sachs – concluded that the company still has a lot of work to do to make Dojo work [proprietary source]. Moreover, “FSD on any vehicle” seems a long way off, at least for now.

Goldman Sachs, Day 3 Company-Specific Key Takeaways, September 11, 2023 [author’s notes]![Goldman Sachs, Day 3 Company-Specific Key Takeaways, September 11, 2023 [author's notes]](https://static.seekingalpha.com/uploads/2023/9/18/49513514-1695032420318668.png)

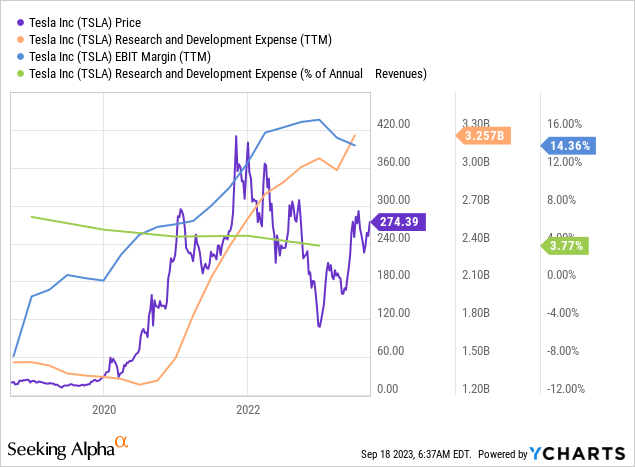

During the 2Q23 earnings call, Elon Musk mentioned that Tesla will be spending north of $1 billion on Dojo’s R&D over the next year (outlook includes all related expenses). On a TTM basis, it’s over 30% of Tesla’s overall R&D to date, which is a lot (meaning a bunch of other research projects required for a primarily manufacturing company, no matter what anyone says).

It seems to me that despite the really interesting prospects Tesla has thanks to its new Dojo, Morgan Stanley is rushing things: the real effect of the introduction of this technology is still far enough away to talk about how many billions it can add to the already high valuation of the company.

Looking at how operating margins have behaved lately, I think investors should look at Tesla’s core business and its conditions before jumping on the AI bandwagon after the MS recommendation.

Focus On The Core Business First

How have analysts changed their forecasts for the core parts of the company’s business? Well, extremely positive or neutral as far as I can see:

We made no changes to our assumptions for Tesla Energy or Tesla Insurance. The modest ($7/share) increase in the value of the core Auto business was mostly related to an increase in our exit EBITDA multiple assumption to 13x from 12x previously. Our near term (FY23/FY24) core Auto assumptions for volume and gross/operating margin were unchanged.

Core Auto: We now value Core Auto at $102/share compared to $95/share previously. Our unit and ATP forecasts remain unchanged across our forecast horizon, and we now forecast slightly higher EBITDA margins in outer years, partially offset by slightly lower Automotive Gross Profit and slightly higher capex longer term. Our FY30 EBITDA (GAAP) margin is now at 17.4% vs. 16.6% previously, Auto GP Margin is now at 17.4% vs. 17.7% previously, and Capex as a % of Sales is at 6.9% vs. 6.5% previously. Additionally, we raise our exit EV/EBITDA multiple to 13x from 12x previously. At $102/share, the automotive business trades at 15.0x our FY25e Auto EBITDA (vs. 14.1x previously).

Source: Morgan Stanley’s report, emphasis added by the author.

I don’t know about you, but to me, increasing the EBITDA margin forecast against the backdrop of a gross margin decline looks like a rather illogical activity. Adding to the instability of this forecast is an additional input of the exit EV/EBITDA multiple expansion, which I think makes MS’s conclusion even more vulnerable to any possible downsides.

Today’s reality, not a 10-year forecast into the future, is that Tesla is most actively lowering the prices of its cars, assumingly trying to a) protect their internal sales targets and b) capture more of the global market share:

Bank of America [September 15, 2023 – proprietary source]![Bank of America [September 15, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/9/18/49513514-16950349604614937.png)

But something tells me TSLA won’t stop with existing price cuts and incentives. Why?

The Manheim Used Vehicle Value Index has already begun to adjust downward due to declining inflation, making used cars increasingly affordable and taking away automakers’ share of the overall demand-side pie.

Bank of America [September 15, 2023 – proprietary source]![Bank of America [September 15, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/9/18/49513514-1695035241303248.png)

AI initiatives are great, but they won’t play a key role in protecting the demand side in the foreseeable future. I’ve written before that consumers in the U.S. and most places in the world are in a pretty deplorable situation: Prices, which have risen over the past two years, are unlikely to decline, and wage growth is constrained by the state of the business environment, which in theory should lead to continued stagnation in the economy.

The Bottom Line

I think the market is already sick of the constant narrative about how bad everything is, so it buys drawdowns in risky assets without noticing obvious things. Our brains always try to be optimistic because it’s emotionally easier. This very reason to be optimistic has been easily embraced by the masses lately [AI narrative] – which partly explains why TSLA has risen so much compared to the rest of the sector:

Bank of America [September 15, 2023 – proprietary source]![Bank of America [September 15, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/9/18/49513514-1695035863762198.png)

I don’t mean to diminish the company’s merits – the way they maintain their market share and continues to grow is amazing. But the optimistic portrayal of the company’s AI initiatives seems overstated, as there is still a long way to go before this technology is commercialized in the real world [as far as I got it]. And until that time comes, there will be months of multi-million dollar R&D and CAPEX spending that will not help the sustainability of margins with such an active approach to lowering the price of the company’s products.

Overall, I expect TSLA stock to continue its downward trajectory as the AI hype dissipates in real-time. Long-term entry targets for investors, in my opinion, are in the 25-30 times EV/EBITDA range, which is ~43% below the current multiple [in the middle of the range].

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!