Summary:

- Tesla, Inc. demonstrated notable financial and operational progress in Q3 2023, with a 9% increase in revenue driven by vehicle deliveries and expansion across business segments.

- Despite a decrease in average selling price and operating income, Tesla’s financial health remained strong, with improved liquidity and a robust balance sheet.

- Tesla’s stock shows a pronounced bullish trend, with potential for an upward trajectory in stock value, supported by falling wedge and bull flag patterns.

Xiaolu Chu

Tesla, Inc. (NASDAQ:TSLA) demonstrated notable financial and operational progress in Q3 2023, marked by an increase in revenue primarily attributed to a rise in vehicle deliveries and expansion across various business segments. However, this growth was moderated by a decrease in the average selling price. The company’s operating income experienced a decline, influenced by lower selling prices, increased operating expenses due to investments in Cybertruck and AI developments, and costs related to factory upgrades and production adjustments. Despite these challenges, Tesla’s financial health remained vigorous, improving its liquidity position, and highlighting a robust balance sheet and cash reserves.

This article extends my previous discussion by examining Tesla’s financial health in Q3 2023 and conducting a technical analysis to identify investment opportunities. The analysis indicates that Tesla has developed a pronounced bullish price trend, suggesting a potential upward trajectory in its stock value.

Revenue Growth Amidst Market Challenges

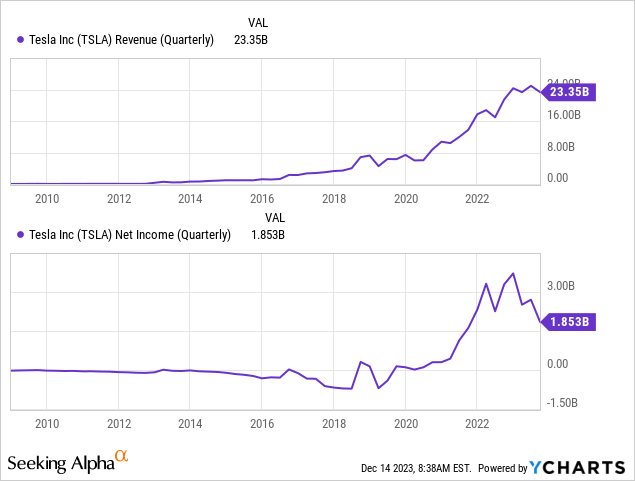

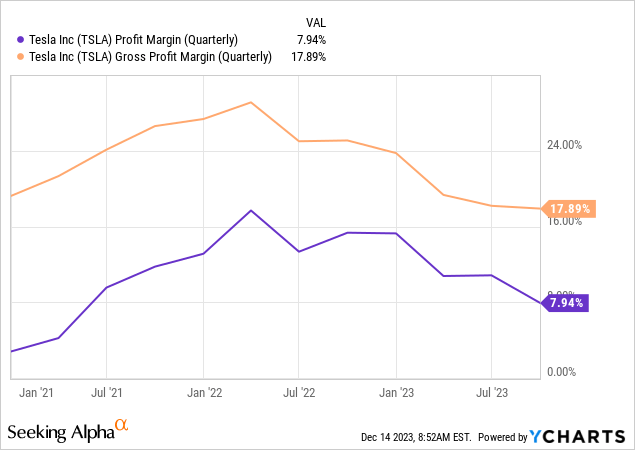

Tesla reported a solid revenue growth, with a 9% year-over-year increase, amounting to $23.35 billion. This growth was primarily fueled by increased vehicle deliveries and expansion in other segments of the company’s business. However, the revenue figures were somewhat impacted by a year-over-year reduction in the average selling price. Regarding profitability, Tesla saw a year-over-year decrease in operating income, dropping to $1.764 billion in Q3 and leading to an operating margin of 7.6%. The reduction in profitability was influenced by several factors including a decrease in average selling price, and an uptick in operating expenses driven by significant investments in Cybertruck, AI developments, and R&D initiatives. The costs associated with production ramp and idle time related to factory upgrades also contributed to this decline in profitability.

The chart below illustrates Tesla’s quarterly revenue and net income, revealing an incremental trend despite a noted decline in profitability in Q3.

Tesla has reduced the prices of its vehicles, aiming to expand its market share, in an effort to maintain its edge in the electric vehicle market. This strategy caters to consumers more concerned with monthly payments than the upfront cost, especially in the face of rising interest rates. Although this approach has fueled Tesla’s growth, with a 27% increase in deliveries in Q3, it has also reduced the gross profit margin to 17.89%.

Despite the reduction in the profit margin, Tesla’s liquidity improved in Q3, with quarter-end cash, cash equivalents, and investments increasing by $3.0 billion sequentially, totaling $26.1 billion. This was driven by financing activities that generated $2.3 billion and a healthy free cash flow of $0.8 billion, indicating a solid company balance sheet and cash position.

Additionally, Tesla substantially enhanced its manufacturing lines at several plants, leading to a momentary dip in production levels. Total production for Q3 2023 was $430.39 million compared to $479.7 million in Q2 2023. Nevertheless, the company efficiently improved its delivery pace over the quarter, noting that deliveries in September accounted for about 40% of the quarter’s total, marking a reduction from the previous year’s 65% for the same period.

In the U.S., the pilot production of the Cybertruck commenced at Tesla’s Gigafactory in Texas, with the company preparing for a steady elevation in the production rate of the Model Y. Efforts to optimize the supply chain for cost-effectiveness are in progress. The production of the dense 4680 battery cells is ongoing, with further scaling up of cathode production and lithium refining capabilities in the country.

Tesla’s energy storage sector experienced a remarkable 90% year-over-year jump in deployments, reaching an all-time high of 4.0 GWh in Q3. This surge is credited to the progressive scale-up of the Lathrop Megafactory in California, aiming for a grand capacity of 40 GWh upon completing the second expansion phase. On the other hand, the solar division faced setbacks, with deployment falling sequentially and year-over-year to 49 MW, influenced by increasing interest rates and the net metering in California.

Tesla is on track to increase production, aiming to surpass the long-term annual growth target of 50% CAGR with expectations to produce approximately 1.8 million vehicles in 2023. The company possesses substantial liquidity to support product development, capacity expansion, and other financial commitments, ensuring a resilient balance sheet.

Tesla’s resilience in the face of market challenges is evident from substantial revenue growth and strategic pricing adjustments to capture a larger share of the electric vehicle market. The company’s commitment to innovation and efficiency, particularly in manufacturing and AI, has enabled it to sustain growth and improve liquidity, despite the pressures on profitability and the average selling price. With a strong balance sheet, a focus on scaling production, and the deliveries of Cybertruck, Tesla is well-positioned to navigate the evolving automotive landscape and continue its growth trajectory.

Decoding the Bullish Price Structure

Recap

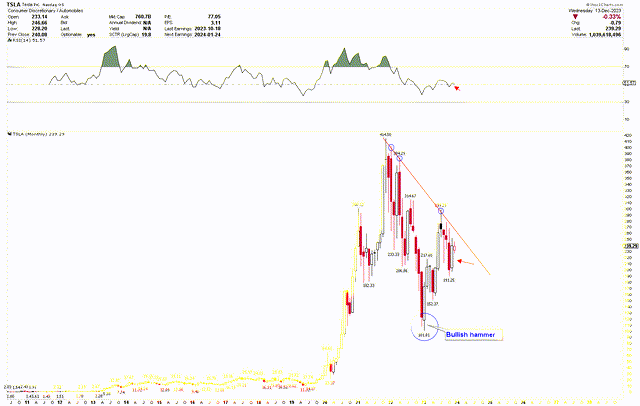

The previous article showcased the market’s significant volatility using yearly and quarterly charts. Tesla’s stock experienced a remarkable surge, escalating by 3412.17% from a 2019 low of $11.80 to a record high of $414.50 in 2021. This rapid price increase over three years indicated significant volatility, leading to a notable price correction, with the stock hitting a low of $101.81 in 2023. This price correction marked support and resulted in a robust price recovery, as seen by the bullish hammer pattern on the quarterly chart. The strong rebound from $101.81 formed a distinctive falling wedge pattern, signaling potential bullish momentum in the market. The critical support level at $215 was also the strategic entry point for long-term investors.

Tesla’s Future Trajectory

Despite ongoing market fluctuations, Tesla stock has maintained a robustly bullish trend. The monthly chart below showcases significant price moves, with the red trendline marking a critical juncture for potential future price increases. Notably, the monthly chart’s January 2023 bullish hammer candlestick signals a foundational low point and predicts a continued upward trajectory. The RSI maintaining above the 50 midpoint further reinforces this positive outlook.

TSLA Monthly Chart (StockCharts.com)

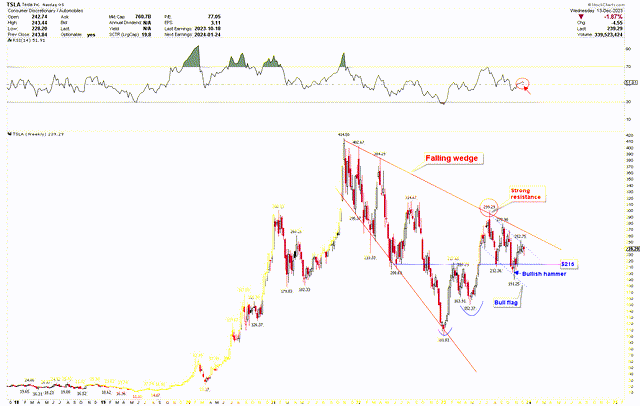

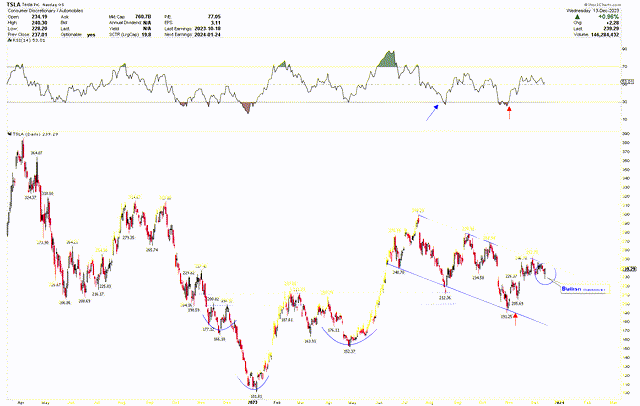

The weekly chart highlights a falling wedge pattern, reinforcing the bullish sentiment previously discussed. The stock’s consistent fluctuations within this pattern support a bullish forecast. The previously discussed key support level of $215 has shown strength, with the stock briefly dipping to $191.25 before rebounding, forming a bullish hammer on the weekly chart. This sharp decline and subsequent recovery have given rise to a bull flag pattern, another bullish signal. The existence of the bull flag within the falling wedge pattern suggests a preparation of the stock price to breach the $300 mark, triggering another substantial rally.

TSLA Weekly Chart (StockCharts.com)

This bull flag pattern is also discernible in the short-term daily chart below. It is developed following the formation of an inverted head and shoulders pattern, with the head at $101.81 and the shoulders at $166.18 and $152.37. The neckline of this pattern, situated at $215, has been decisively broken, and a recent retest of $215 consolidates the anticipation of a continued rally. Furthermore, the appearance of a bullish hammer candlestick on the daily chart amplifies the likelihood of a breakout from the bull flag pattern.

TSLA Daily Chart (StockCharts.com)

Based on the above discussion, investors can consider increasing long positions in anticipation of a significant surge following a breakthrough above the $300 mark.

Market Risk

The strategic move to reduce prices, targeting a larger share in the competitive electric vehicle market, has decreased operating income to $1.764 billion and a lower operating margin of 7.6%. This scenario, coupled with increased operating expenses from investments in Cybertruck, AI, and R&D and costs associated with factory upgrades, presents a substantial risk to Tesla’s profitability. The onset of Cybertruck production and the scaling up of 4680 battery cell production are positive steps but carry substantial financial and operational risks, including potential delays and increased costs. Additionally, challenges in the solar division, including a decrease in deployment to 49 MW, reflect broader issues in renewable energy markets.

The company’s aggressive growth target of producing approximately 1.8 million vehicles in 2023, alongside large-scale investments in product development and capacity expansion, requires careful financial management. While Tesla’s commitment to innovation and market dominance is clear, the inherent risks in these ambitious plans, coupled with external economic factors like interest rates and market competition, could impact its financial stability and stock performance in the future.

From a technical standpoint, the stock demonstrates significant volatility, evidenced by substantial price fluctuations in both directions. Should the stock close below $150 monthly, it would undermine the short-term positive trend, suggesting a potential further decline in the market.

Final Thoughts

In conclusion, Tesla showed impressive resilience and adaptability in the face of market challenges during Q3 2023. The company grew revenue, primarily driven by increased vehicle deliveries and expansion across various segments. However, this was tempered by a decrease in the average selling price and a decline in operating income, affected by investments in the Cybertruck, AI developments, and increased operational expenses.

Despite these challenges, Tesla has maintained a solid financial position with improved liquidity and robust cash reserves. The company’s strategic pricing adjustments and focus on innovation and efficiency have sustained growth and positioned it to capture a larger share of the electric vehicle market.

From a technical analysis perspective, Tesla’s stock demonstrates a pronounced bullish trend, indicating a potential upward trajectory in stock value. Tesla’s stock has consistently exhibited a strongly bullish trend despite market volatility. The falling wedge and bull flag patterns signify a solid momentum in price. If the stock surpasses the $300 mark, it will likely confirm the existing bullish price structure, potentially leading to a significant increase in price. Investors may consider taking long positions in Tesla, Inc. stock at the current levels in anticipation of a price surge.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.