Summary:

- Tesla, Inc.’s stock struggles due to overvaluation, declining margins, executive departures, and Elon Musk’s overwork and behavior, but AI and Robotaxi could drive future growth.

- Tesla regained its EV leadership in Q1 2024, surpassing BYD Company, with stabilized operating margins and record energy business revenues.

- The upcoming Robotaxi event on October 10th, 2025, is crucial for Tesla, potentially unlocking a multi-trillion dollar AI opportunity.

- Lower interest rates and the AI boom present significant upside for TSLA shares, making it a strong buy with 1.5 to 2x potential over 12 months.

Brandon Bell/Getty Images News

Tesla, Inc. (NASDAQ:TSLA) is an interesting company that features several disruptive technologies all in one: electric vehicles (“EVs”), artificial intelligence (“AI”), solar energy storage, and Bitcoin (“BTC-USD”).

In my previous Tesla article, I mentioned that Tesla was no longer the king of EVs. I saw it facing tough competition from companies such as BYD Company (OTCPK:BYDDY), NIO (NIO), Li Auto (LI), and Rivian (RIVN) as we transition from internal combustion engines (“ICE”) vehicles to sustainable energy cars.

Tesla lost its throne in Q4 2023 but regained it by Q1 2024 by delivering more EVs than BYD, its biggest competitor in the Chinese EV market.

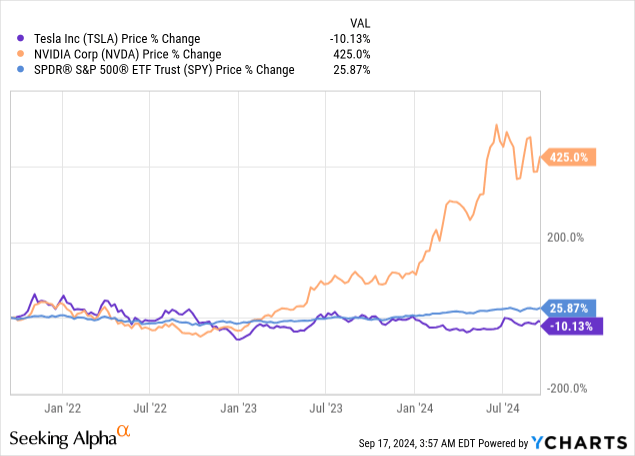

The last 3 years has been brutal for Tesla investors as we watched TSLA shares lose 10% while Nvidia (NVDA) and the S&P 500 (SPY) gained in value.

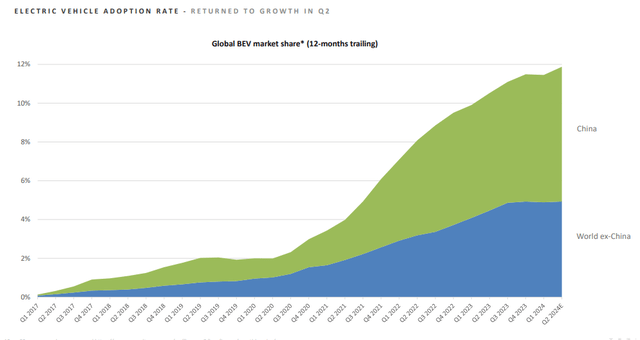

Tesla’s short-term struggles with lower operating margins and stalled EV sales growth could be a thing of the past if EV adoption and Tesla’s new AI products take off.

Global EV Adoption (tesla.com)

Why Isn’t TSLA Stock Going Up?

There are several reasons why Tesla stock is under performing its peers:

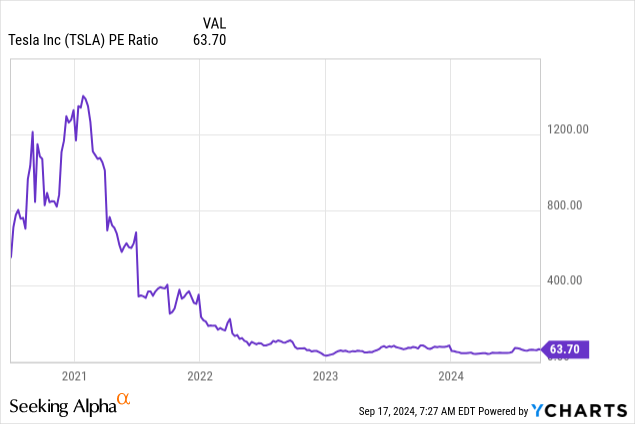

- TSLA was Overvalued with Inflated P/E Ratio: TSLA shares have traded at crazy high P/E valuations in the past due to hype and aggressive revenue growth. In Q4 2020, TSLA had a P/E ratio of 1127! Things have changed, and now TSLA shares are more reasonably priced at a P/E ratio of 63. Let’s face it: TSLA stock was too expensive for years and due for a major pullback.

- Declining Operating margins: Tesla’s operating margins are down, even though Tesla made improvements in Q2 2024 compared to Q2 2024. Increased competition plus several Tesla price cuts forced management to sacrifice short-term margins in favor of increased sales. An accelerated interest rate hike cycle increased the cost of auto loans for consumers, which means many prospective Tesla buyers can’t afford the car.

- Departure of Key Executives: Former Tesla CFO Zack Kirkhorn was one of the biggest losses to the Tesla executive team. He stepped down as Chief Financial Officer in August 2023 when TSLA shares were crashing.

- Elon Musk is Problematic: Elon Musk runs several companies, and many investors are worried that he is spreading himself too thin. At the ripe age of 53, I have no idea how much longer Elon can juggle all of his business interests and Tesla at the same time. Worried TSLA shareholders believe he may be distracted or even “burned out.”

All of this being said, I see TSLA shares at a reasonable fair value with significant upside over the coming quarters as interest rate cuts stimulate global EV sales despite Elon Musk’s questionable behavior.

Tesla Owns the Throne as King of EVs, but BYD is Still a Close 2nd

Tesla lost the throne in Q4 2023, but quickly regained the title of EV King in 2024.

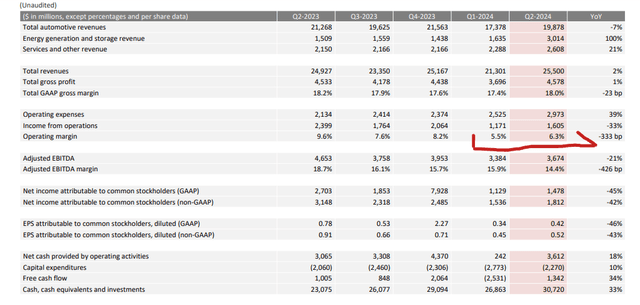

In Q2 2024, Tesla delivered 443,956 EVs in Q2 2024 (Down 5% YoY) while total revenue hit $25.5 billion (Up 2% YoY).

Q2 2024 operating margins hit 6.3% (Down 33% YoY) but a much-needed improvement from Q1 2024’s 5.5% marks. The good news is that operating margins have stabilized and could improve once the Fed starts cutting interest rates.

Tesla Q2 2024 Financials (tesla.com)

The company achieved several milestones, including hitting $30 billion in cash reserves for the first time. Plus, Tesla’s energy business continues to hit record revenues, gross profits, and total GWh deployed.

Tesla’s closest competitor, BYD Company (OTCPK:BYDDY), delivered 426,039 EVs (Up 21% YoY). However, it also makes hybrid cars as well, so it isn’t a pure EV play.

BYD is only 18,000 BEV deliveries away from passing Tesla and taking over the throne as “King of Electric Vehicles” in China. As of now, BYD has no plans to sell its BEVs in America, but that may change in the future.

Could the expected Robotaxi event be Tesla’s last chance to increase demand for its products before BYD surpasses them for good?

Your guess is as good as mine. Tesla sold 63,000 EVs in China during the month of August 2024 (Up 37% from July 2024), and could use the expected Robotaxi event as a clever marketing ploy to boost sales.

Tesla’s Q2 Earnings Call Mentioned AI 24 Times

I always make time to read or listen to Tesla’s quarterly earnings call because Elon Musk provides plenty of key insights into Tesla as well as the global economy.

In the Q2 2024 earnings call, the acronym “AI” was mentioned a whopping 25 times! Tesla needs to embrace AI to unlock the next chapter in outsized shareholder returns. Compressed operating margins will greatly benefit from Tesla’s AI Robotaxi due to removing the need of a human taxi driver.

Tesla has unveiled its new supercomputer cluster called “Cortex” powered by around 100,000 Nvidia H100 and H200 chips.

Tesla’s Cortex Supercompuer (tomshardware.com)

The company plans to use these chips for video training of Tesla’s neural networks, which is crucial for its full self-driving (“FSD”) program and Optimus Robot.

According to Yahoo!, Tesla plans to spend a whopping $10 billion on AI-related expenditures in 2024.

It’s unclear exactly how Tesla plans to monetize Robotaxi, but hopefully Elon will clear everything up during the October 10 Robotaxi event.

Don’t expect TSLA shares to soar on the day of the event because I think this is a standard “buy the rumor, sell the news” event. However, interest rate cuts and a historically bullish Q4 for stocks helps ease my concerns about buying TSLA too high.

Buy Before the Upcoming Tesla AI Boom

The expected (postponed once already) launch of Tesla’s Robotaxi product on October 10th, 2025 marks an important milestone for investors to understand that Tesla is an AI company, not just an electric car seller.

Elon Musk agreed on X that the Robotaxi “Cybercab” unveiling is the most significant moment for Tesla since the unveiling of the Model 3 in 2016.

The Cybercab is Elon Musk’s solution to the lack of autonomous ride-sharing options that’s smaller than a Model 3 and built specifically for FSD.

A Robotaxi prototype was spotted in California just weeks before the 10/10 Robotaxi event. JPMorgan warns Tesla may not turn a profit on Robotaxi for a few years, but Tesla’s major push into AI unlocks a multi-trillion dollar opportunity for the company.

Longtime Tesla bull Cathie Wood believes that Tesla’s Robotaxi is an “$8 to $10 trillion dollar global revenue opportunity” and the company could take up to 50% of the global autonomous taxi business.

This is an entirely new product, so American consumers will flock to the most affordable and safest autonomous ride-sharing option. Tesla has an opportunity to gain major market share over competitors such as Wazmo (Google).

Nvidia (NVDA) shareholders got rich thanks to the company’s AI boom, and I believe this could be a 2nd bull run for Tesla that’s similar to its 10x 2020 Pandemic run up.

Why Tesla Stock Could Short Squeeze in Q4 2024

Tesla is one of the most shorted stocks on Wall Street, with 78 million shares sold short worth $16.65 billion and a 2.57% short interest.

Lower interest rates is a big catalyst for Tesla that could send short sellers scrambling to cover their borrow shares.

TSLA stock was an absolute beast when interest rates were low because consumers could easily afford Tesla products. August CPI data showed that core inflation is down and heading towards the Fed’s long-term goal of 2%.

Several interest rate cuts are bullish for consumer sensitive stocks such as Tesla but also competitors such as Rivian (RIVN) and Lucid (LCID).

All of these EV stocks could short squeeze, but I believe Tesla is the more conservative play since the other two companies aren’t profitable yet.

Risk Factors

- Failed Robotaxi Event: Investors are approaching big tech launch events with more skepticism than previous events in the past. The Apple iPhone 16 launch was a major disaster, with some analysts predicting lower iPhone 16 global sales. Could Tesla have the same fate? A lackluster Robotaxi launch would be an epic disaster and force many disheartened investors to sell if Elon and his team cannot execute a brilliant event.

- Cybertruck Deliveries: It’s no secret that Cybertruck is Tesla’s most talked about EV right now. I believe the Cybertruck is Tesla’s big product available, but the real question is if Tesla can ramp Cybertruck to meet the enormous demand.

My Game Plan for TSLA

I sold most of my TSLA shares during 2023 and pivoted to Bitcoin and MicroStrategy (MSTR) searching for superior returns. That was when TSLA shares were trading at grossly overvalued P/E ratios.

TSLA stock is priced far more reasonably, plus should benefit from the upcoming crypto bull run in Q4 2024. Few people know that Tesla holds 9,720 Bitcoin worth $573 million at current market prices.

My goal is to buy TSLA call options and hold them until 2025. TSLA options are a leveraged way to make money from a rebound in TSLA stock without holding the underlying stock.

Here are a couple of potentially lucrative TSLA call options play:

- October 11th $250 calls: The 10/10 Robotaxi event will be widely talked about in the days leading up to the event. This looks like another “buy the rumor, sell the news” event that you can profit from buy selling calls before October 10th.

- January 17th $300 calls: These calls give you 4 months for TSLA shares to rally towards the $300 price target. TSLA shares need to gain 32% from its current $226 price point to put this option in the money.

Another alternative to buying call options is to invest in the Direxion Daily TSLA Bull 2X Shares ETF (TSLL), which gives you 2x exposure to TSLA shares.

If TSLA stock goes up 50% then theoretically TSLL shares would be up 100% minus the 0.96% expensive ratio.

I’m rating TSLA as a BUY right now, with around 1.5 to 2x upside over the next 12 months. A successful Robotaxi launch along with lower interest rates could send TSLA shares soaring to previous 2021 highs by Q4 2025.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.