Summary:

- Tesla, Inc. stock has dropped more than 25% since hitting YTD highs in July, making it an attractive buying opportunity.

- The recent dip in Tesla’s stock is mainly due to a weakening gross margin profile, but this is a temporary issue that can be resolved with scale.

- Tesla has long-term tailwinds for gross margin as it achieves economies of scale and benefits from lower lithium prices.

- Though its >50x P/E ratio may look unconventionally expensive, the company’s many growth catalysts defy traditional valuation metrics.

sarawuth702

The market has been roaring over the past few weeks with interest rate fears quelling. And while most tech and growth stocks have surged dramatically (and some, like Microsoft Corporation (MSFT), have hit new all-time highs), one major holdout from the party are electric vehicle (“EV”) stocks, and in particular, Tesla, Inc. (NASDAQ:TSLA).

Since hitting YTD highs above $290 in July, shares of Tesla have cratered more than 25%. The question many investors are asking now: is it time to buy the dip? My answer is a resounding yes.

I last wrote about Tesla toward the end of last year, issuing a bullish rating on the stock when it was trading closer to $120. My position is still sitting on some handsome gains since the start of the year: but I’m not shy to add more on this dip. I remain solidly bullish on Tesla and believe many of the current headwinds that the company faces are temporary.

The bottom line here: now is an excellent time to pick up shares of Tesla, whether adding to a current position or initiating one. For me, this is a long-term bet, and I think there are plenty of upside catalysts that can take Tesla beyond the current doldrums.

Gross margin issues are transitory and cured with scale

The large bastion of Tesla naysayers have a lot of the usual criticisms toward the company: competition with other automakers (both traditional carmakers as well as EV rivals like Rivian Automotive, Inc. (RIVN)), key-man risk in Elon Musk who is perpetually distracted by too many business ventures, and high valuation.

The crux of the recent dip on Tesla, however, is centered on the company’s latest gross margin profile, which showed a sequential weakening in the company’s recent Q3 earnings print.

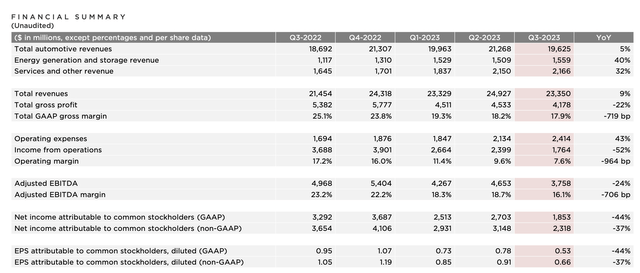

Tesla Q3 highlights (Tesla Q3 earnings deck)

Gross margin ticked down to 17.9% in Q3, down 719bps y/y and 30bps sequentially. This, of course, is a result of Tesla’s decision to cut prices on the entry-level Model 3 and Y vehicles this year in an attempt to spur demand. One could argue (and bears certainly have) that with federal tax credits open again to Tesla EVs plus the carmaker’s own price drops, there has never been a more buyer-friendly environment to splurge on a Tesla. Plus, long waiting periods are over! (during the pandemic, a potential buyer might have had to wait months to have a custom Tesla order delivered; and dealer inventory was equally low).

We can’t forget the fact, however, that soft demand is a major symptom of the macro environment. And unlike other recessions, this is also a recession that hits harder on upper and upper middle-class incomes due to broad corporate layoffs, particularly in the tech industry. Add that on top of stifling interest rates for car loans, and it’s not difficult to see why Tesla’s minor price cuts might not be moving potential buyers off the couch.

Nor will price cuts be a forever phenomenon. In China, one of Tesla’s most important markets, the company recently raised prices again after cutting them earlier this year – of course, in response to rising costs, but surely also a sign that the company feels confident enough in the region’s demand that it feels comfortable raising prices.

We also can’t forget that Tesla has long-term tailwinds for gross margin as it achieves economies of scale. Plus, lithium prices (a core component to EV batteries) have dropped sharply, and as Tesla’s technology improves, so will its cost per unit.

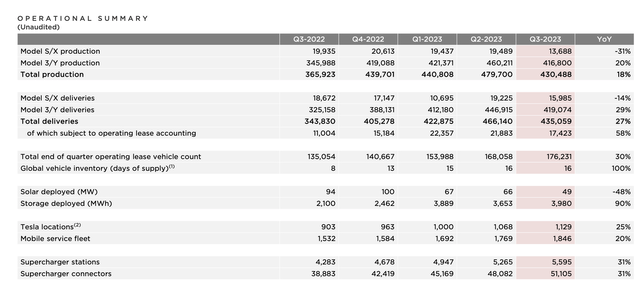

Production was up 18% y/y in the third quarter, with production of Models 3 and Y growing 20% y/y.

Tesla production ramp (Tesla Q3 earnings deck)

The ideal state for Tesla, in my view, will be to stabilize prices which consumers will get used to (there are likely a number of buyers holding out hope for Tesla to continue dropping prices). Over time, growth in production plus natural cost take-downs in battery prices should help Tesla return to 2022-level gross margins (or even better).

Look beyond the near-term auto business

Bears who bark at Tesla’s high P/E ratio amid declining gross margins are, in my view, quite short-sighted and don’t give the EV giant enough credit for its other initiatives. As most consumers know, Tesla has its hands in a number of other ventures including solar and robotics (the company’s Optimus robot gained walking and object pickup abilities this year), but one of the most promising routes to additional monetization and profitability is the buildout of its Supercharger network.

As of the end of the third quarter, the company had just about 5.6k Supercharging stations pinned throughout the United States. Investors should note as well that the company just opened this Supercharger network to non-Tesla EVs earlier this year.

A bet on Tesla isn’t just a bet on this single automaker and its ability to take on Detroit – it’s a bet on the entire EV industry, California’s pledge to eliminate gas-vehicle sales by 2030, and other states’/countries’ propensity to enact similar rules, and the general awareness of modern consumers of both the price and damage of fossil fuels.

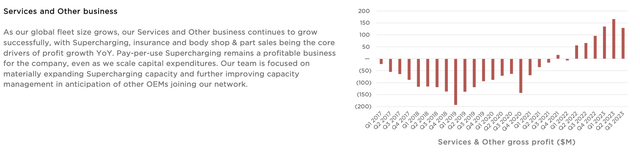

Today, the “services and other” segment at Tesla generates just under 10% of overall revenue, but grew at a startling 32% y/y – a direct correlation to the company’s decision to open this network to other EVs.

Tesla services (Tesla Q3 earnings deck)

This business, meanwhile, just started generating meaningful gross profits earlier this year, as showcased in the chart above.

New vehicle form factors are another major opportunity for Tesla. Now, among the reasons that Tesla stock diminished over the past month is Elon Musk’s own seeming bearishness on the progress of the segment. Per his remarks on the Q3 earnings call:

The Cybertruck, I know a lot of people are excited about the Cybertruck. I am too. I’ve driven the car. It’s an amazing product. I do want to emphasize that there will be enormous challenges in reaching volume production with the Cybertruck, and then in making a Cybertruck cash flow positive. This is simply normal for when you’ve got a product with a lot of new technology or any new vehicle, brand new vehicle program, but especially one that is as different and advanced as the Cybertruck, you will have problems proportionate to how many new things you’re trying to solve at scale. So, I just want to emphasize that while I think this is potentially our best product ever and I think it is our best product ever, it is going to be — require immense work to reach volume production and be cash flow positive at a price that people can afford.

Often people do not understand what is truly hard. That’s why I say prototypes are easy, production is hard. People think it’s the idea, or you make a prototype, you design a car. And as soon as they’re designing a car, it’s just that anyone can do it, it does require taste, it does require effort to design a prototype. But it’s difficult to go from a prototype to volume production, it’s like 10,000% harder to get to volume production than to make a prototype in the first place, and then it is even harder than that to reach positive cash flow. That is why there have not been new car startups that have been successful for 100 years apart from Tesla.

So, I just want to temper expectations for Cybertruck. It’s a great product, but financially it will take, I don’t know, a year to 18 months before it is a significant positive cash flow contributor. I wish there was some way for that to be different, but that’s my best guess. The demand is off the charts. We have over 1 million people who’ve reserved the car. So it’s not a demand issue, but we have to make it and we need to make it at a price that people can afford insanely difficult things.”

But again, we should look at the long term. The backlog/reservations for the truck are one indicator. Enterprise applications of heavier vehicles are another tailwind investors should consider. Difficulties in the Rivian – Amazon.com, Inc. (AMZN) partnership have surfaced over the past month, one major reason this Tesla rival’s stock has sunk. It’s not implausible to imagine Tesla taking over the retail and logistics industries with self-driving delivery vehicles, for which it already has the forefront experience and credibility in the space.

Valuation and key takeaways

The range of earnings estimates for Tesla is wide, with Wall Street analysts pointing to a low EPS of $2.27 to a high of $5.85 in FY24, per Yahoo Finance. Consensus aggregates point to EPS of $3.85 (+28% y/y versus this year’s estimate of $3.00), which wouldn’t have Tesla returning to FY22 EPS levels (its best year ever in which it generated $4.07 in EPS). Consensus is also pointing to 22% y/y revenue growth to $112.1 billion.

Against the consensus EPS estimate, Tesla trades at a 56x P/E – which many bears have pointed out as unreasonable in a 5%+ interest rate environment. In my view, however, Tesla defies conventional valuation thinking by having so many growth catalysts under its belt – economies of scale as vehicle production increases, growth in the Supercharging network, and the reliance of other EV brands on Tesla’s first-mover advantage in the space, new vehicles, and enterprise go-to-market potential, not to mention solar/energy and robotics. Though the risks of near-term profitability erosion are certainly present, I’m optimistic for the long term and am more than happy to add to my current position in the low $200s.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.