Summary:

- Wall Street has once again begun to ignore the obvious problems that have accumulated like a snowball in Tesla and the entire auto industry.

- The latest Tesla delivery data shows overproduction problems – and that’s amid losing EV market share.

- The demand side is likely to get weaker in the foreseeable future – it’s not priced in yet, in my view.

- I calculate Tesla’s P/E ratio for FY2023 at 38.4x, leading to a price target of $153.6 per share (at consensus EPS). This results in a downside of ~17.2%.

- As a result, I have decided to downgrade my previous Tesla rating from Hold to Sell.

Justin Sullivan

Introduction

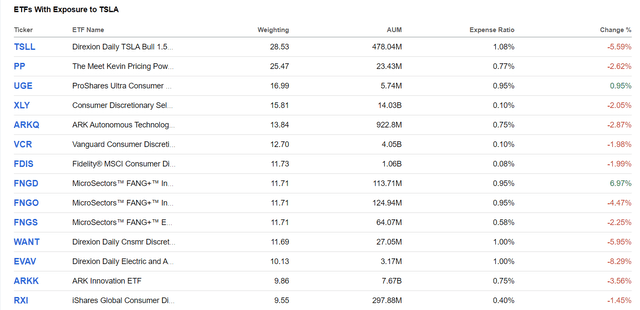

I have been pretty active in covering Tesla, Inc. (NASDAQ:TSLA) stock here on Seeking Alpha because of the ever-increasing news background for this company as well as interest from retail investors (and not just them). This stock has become a barometer of sorts for a broader market of risky assets, by which I mean not just the technology sector, but the entire equity asset class, as the number of ETFs with large exposure to this stock is growing by leaps and bounds:

Therefore, I think it is important to look at the latest corporate news and try to assess the company’s short-term prospects, as they are likely to affect the entire stock market.

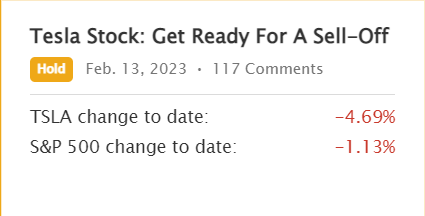

In mid-February 2023, I published an article warning investors that TSLA stock was in a relatively volatile position due to accumulated problems in the form of: a) being overbought; b) a sharp deviation of its market price from the fair value; and c) a weak macroeconomy.

Since then, my thesis has only been partially proven true – TSLA has fallen >4 times stronger than the S&P 500 Index (SP500, SPY, SPX) due to its high beta, but still not low enough to call it a buying opportunity.

Seeking Alpha (my TSLA coverage)

Since the publication of that last article on Tesla, we have had new corporate data and research papers from investment banks to analyze. I recommend you look at various data points to make specific predictions for the near future.

Tesla’s Deliveries Problems (Q1 FY2023)

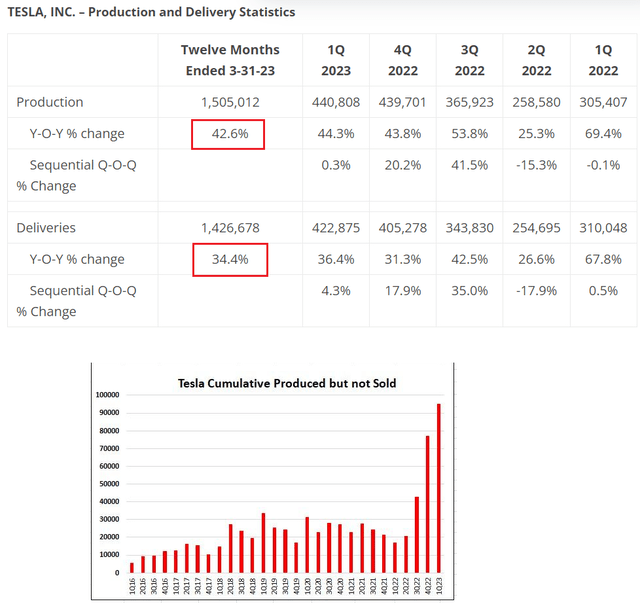

Tesla has announced that they delivered 422,875 vehicles in the 1st quarter of 2023, representing a 4% increase over the previous quarter and a 36% increase YoY. The company also produced around 441,000 vehicles during Q1. The delivery numbers were more or less consistent with Bloomberg’s projected figure of 421,000. Of the total deliveries, 412,180 were Model 3/Y vehicles, which reflects a 6% quarterly increase and a 40% YoY increase. Meanwhile, deliveries of Model S/X vehicles were 10,695, showing a decline of 38% QoQ and 27% YoY. In terms of lease mix, it accounted for 5% of deliveries in Q1 FY2023, compared to 4% in Q4 FY2022. The company also noted that they are moving towards a more balanced distribution of vehicle production across different regions, with some Model S/X vehicles in transit to EMEA and APAC.

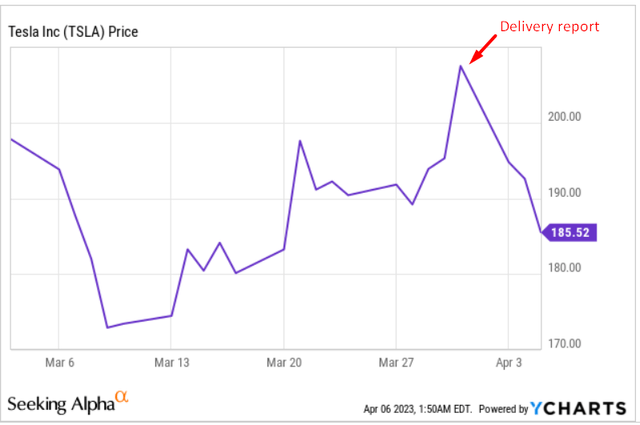

It appears that speculators have been actively building up positions in TSLA stock lately, and then, as they got the actual data, they began to actively close out their positions:

The result is an implementation of the classic trader’s adage: “Buy the rumors, sell the news.” But why did this happen?

In my opinion, the latest data has shown the market the problems of overproduction – inventories have continued to pile up, which should ultimately force Elon Musk to cut prices again at some point.

Author’s compilation (based on different sources)

As reported by the Financial Times, BYD Company Limited’s (OTCPK:BYDDF) market share for electric vehicles (“EVs”) in China rose from 34% in the same period last year to 40% in January and February. Meanwhile, Tesla’s market share slightly declined to 7.8%.

According to Seeking Alpha, in one of the fastest-growing and largest markets for electric cars, BYD is being forced to reduce working hours at its 2 assembly plants (in Xian and Shenzhen) due to slowing demand. Workers in Xian have been ordered to reduce their workweek to four 16-hour days in two 8-hour shifts, and in Shenzhen, the workweek has been reduced to two shifts per day from three previously. It’s unlikely that Tesla will experience a faster inventory turnover in the region – if the local leader (BYD) is forced to reduce work hours due to weakening demand, Tesla, being a smaller player, should be hit even harder. The solution for Tesla seems to be continuously lowering prices, although this may not necessarily result in a faster inventory turnover.

The problem is that Tesla has already slashed prices globally by as much as 20% (Reuters data), unleashing a price war after missing Wall Street delivery estimates for FY2022. As we can see from the inventory data, this was not enough.

In light of the weakening demand in the Chinese electric vehicle market, it becomes more understandable why Tesla halted production in Shanghai back in mid-February for “factory upgrades.” This reason appears to be more logical than the previously reported explanation of “coronavirus outbreaks”:

Seeking Alpha News (author’s notes)

Based on the above, I come to the interim conclusion that demand problems and not, say, temporary interruptions in component supply or “COVID outbreaks” are the reasons for the accumulation of excess inventories on the company’s balance sheet. It will most likely get worse going forward, and here’s why.

Auto Credit Data Points To Harder Times Ahead

Looking at the research paper released by Morgan Stanley in mid-March (proprietary source), it is clear how much the risk of demand disruption has increased due to recent developments in the U.S. banking sector. While the SVB Financial Group’s (OTC:SIVBQ) collapse appears to be a one-off event, its impact on the behavior of other market participants is undeniable – banks are likely to further tighten lending requirements for new borrowers. Auto and consumer credit are closely intertwined, with over 90% of cars purchased through financial instruments. At the same time, Americans are spending more on servicing their loans and leasing (for cars) today than at any time in recent years:

Morgan Stanley (03/16/2023) (author’s notes)![Morgan Stanley [03/16/2023], proprietary source](https://static.seekingalpha.com/uploads/2023/4/6/49513514-16807632801731458.png)

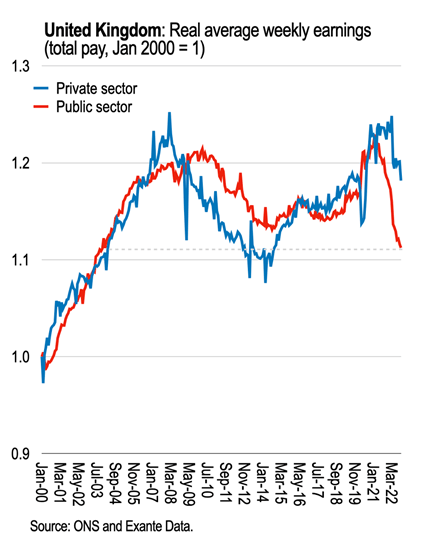

I think it is only a matter of time before the script I described above with a red arrow occurs – the credit burden on people’s incomes seems unsustainable at current levels. Accordingly, for this to happen, either demand for new auto loans must fall or monthly income must rise. I tend to believe in the first option – look at what is happening to real wages in other developed countries to make sure that the thesis about people’s income growth in the United States is null and void. For example, here’s what we are seeing now in the United Kingdom:

Chart provided by Chris Marsh

Against the backdrop of auto loan tightening, which has continued for 3 quarters in a row according to Morgan Stanley, the volume of 60+ day delinquencies is rapidly increasing, indirectly confirming my thesis about a possible disruption in auto demand rather than rising monthly incomes.

Morgan Stanley (03/16/2023) (proprietary source)![Morgan Stanley [03/16/2023], proprietary source](https://static.seekingalpha.com/uploads/2023/4/6/49513514-16807641927356222.png)

Investment Banks Are Still Bullish On Tesla Stock

Despite the company’s obvious problems, investment banks are still quite positive – at least that’s what I infer from the reports that have come into my hands.

Goldman Sachs published a TSLA report (proprietary source) immediately after the release of its delivery data. The analyst set a 12-month price target of $225 per share (+21.3% premium over the closing price on 04/05/2023). The bank forecasts a 7.6% YoY drop in EPS in FY2023, but a quick recovery in FY2024 with EPS up 49.1% YoY. At the same time, the projected P/E ratio is 61.9x for FY2023 and 41.5x for FY2024. Looking even further, we see FY2025 EPS of $6, which will be only 20.1% higher than in FY2024.

Barclays’ analysts (proprietary source) see even greater upside potential for TSLA stock – fair value today at $275 per share, based on a 25x base case EPS multiple for FY2030 (discount rate = 7%).

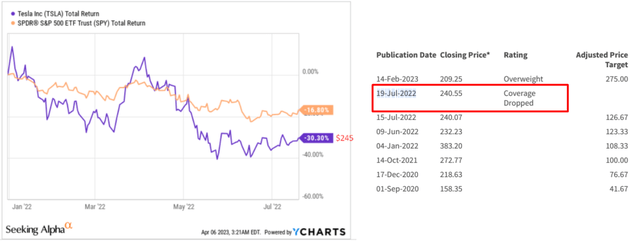

I wonder why Barclays “Dropped coverage” of Tesla on July 19, 2022 – perhaps because TSLA was down over 30% YTD at that point, and it was not clear what would happen to the stock next?

Author’s compilation (YCharts and Barclays data)

In fact, the situation is not much easier now than it was then, in the middle of last year. The demand problems could hit the company in the same way as last year’s multiple contraction. In my opinion, Wall Street’s current forecasts are overstated, especially given TSLA’s rally, which has priced in all the positive earnings revisions since the beginning of the year.

Seeking Alpha, TSLA’s Earnings Estimates (author’s notes)![Seeking Alpha, TSLA's Earnings Estimates [author's notes]](https://static.seekingalpha.com/uploads/2023/4/6/49513514-1680766273851107.png)

Tesla stock rose >71% YTD – too much for a company that will most likely have to sell its excess inventory for much less than was budgeted at the time it was peeled. Looking at quarterly EPS forecasts, the market is pricing in a “soft landing” for Tesla without major year-over-year EPS declines starting in the 2nd quarter of FY2023 – exactly when I estimate demand could be hit hard:

Seeking Alpha, TSLA’s Earnings Estimates (author’s notes)![Seeking Alpha, TSLA's Earnings Estimates [author's notes]](https://static.seekingalpha.com/uploads/2023/4/6/49513514-16807667932695243.png)

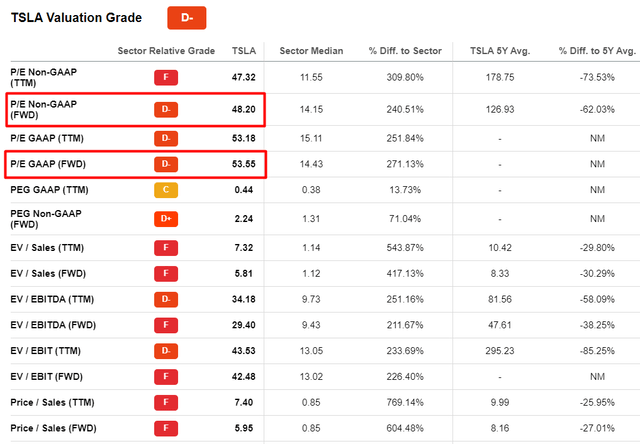

At the same time, multiple contraction is predicted to stop above 50 times the price-earnings ratio – this is what forwarding GAAP-based multiples say:

Seeking Alpha, TSLA’s Valuation (author’s notes)

Even if the analysts are correct in their estimate of $4 per share for FY2023, TSLA’s year-end multiple is not likely to be that high given the demand issues in the industry – I think it should be down at least 25% from current TTM levels. This results in a P/E ratio for FY2023 of 38.4x, leading to a price target of $153.6 per share. This results in a downside of ~17.2%.

The Verdict For TSLA

To be honest, I like Tesla, Inc. as a long-term idea – I think the company will look completely different in 10 years, with new end markets and a completely different business cycle.

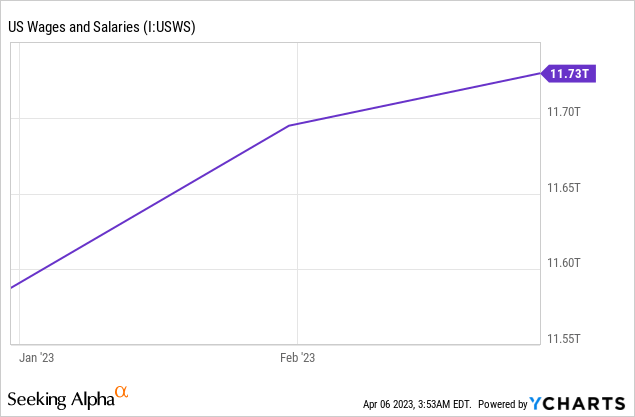

Also, I could be wrong about the state of auto demand in the U.S. – people still need new cars, and wages continue to rise.

However, I can’t look at how so many analysts have once again begun to ignore the obvious problems that have accumulated like a snowball in the company and the entire industry in particular. Based on the data analyzed in today’s article, I have to conclude that Tesla, Inc. is losing its market share and continues to accumulate inventories, which will most likely lead to further cuts in selling prices and poor YoY financial comparison to previous periods. This is not reflected in the Tesla, Inc. stock price – it has risen sharply, and the Street sees a quick solution to all problems as early as next year (FY2024).

Therefore, I have decided to downgrade my previous Tesla, Inc. rating from Hold to Sell – this is more of a tactical decision than a strategic one. I think TSLA stock needs to fall at least 17% from current levels to become interesting for consideration again.

Thank you for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to navigate the stock market environment?

Beyond the Wall Investing is about active portfolio positioning and finding investment ideas that are hidden from a broad market of investors. We don’t bury our heads in the sand when the market is down – we try to anticipate this in advance and protect ourselves from unnecessary risks accordingly.

Keep your finger on the pulse and have access to the latest and highest-quality analysis of what Wall Street is buying/selling with just one subscription to Beyond the Wall Investing! Now there is a free trial and a special discount of 10% – hurry up!