Summary:

- Tesla faces growing risks due to Elon Musk’s political alignment, impacting its primary markets and consumer perception negatively.

- Political associations influence EV ownership, with Democrats favoring EVs more than Republicans, potentially affecting the Company’s market.

- Increased competition and declining consumer interest have reduced TSLA’s market share and consideration score, threatening revenue.

- Class action lawsuits over Tesla’s FSD promises add financial risks, highlighting the company’s overvaluation and potential revenue losses.

wellesenterprises

Tesla (NASDAQ:TSLA) is one of the largest EV companies in the world, with a market capitalization of more than $700 billion. We recently discussed how the company’s fair value is less than a third of its market capitalization. However, as we’ll see throughout this article, the company faces risks from a number of avenues including slowing growth, weak FSD, and the association with its founder, Elon Musk, who’s vocally aligned himself with the Republican Party.

That could have a substantial impact on the company’s future growth.

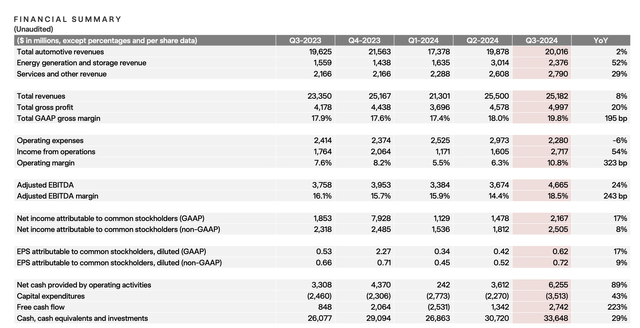

Tesla Earnings

Tesla saw its share price go up after hours, by double-digits, after announcing respectably strong earnings in a market expecting doom.

The company also predicted 20% vehicle growth next year; however, we’d like to highlight that this is from the company seeing ~6% YoY growth, and predicted 50% annualized growth last year. We’ll believe it when we see it, but we’re not optimistic. The company’s total revenues increased only 8% YoY supported by services and energy generation and storage.

Tesla has continued to hype up autonomy, but as we discussed here, the company is well behind. The company’s profit went up, and we will concede that FCF for the company was strong, not surprising given margins in energy generation and storage. However YoY the company’s growth in cash and cash equivalents was ~$7.5 billion, not enough to justify its valuation.

Given the slowdown in automotive revenues which indicates a shift towards lower margin vehicles, the company’s after-hours strength represents a better selling opportunity to us.

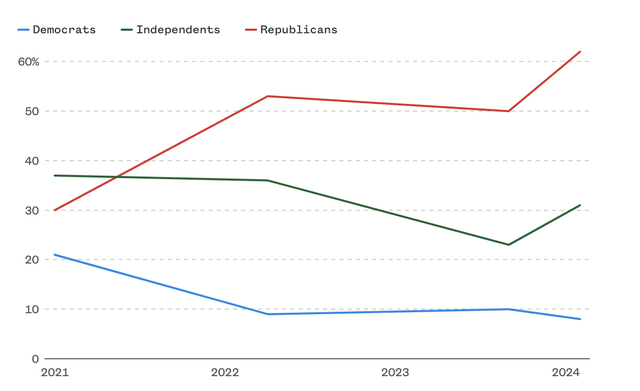

EVs versus Political Association

Given the different stances the parties have taken on climate change, there’s a strong political association to EV ownership.

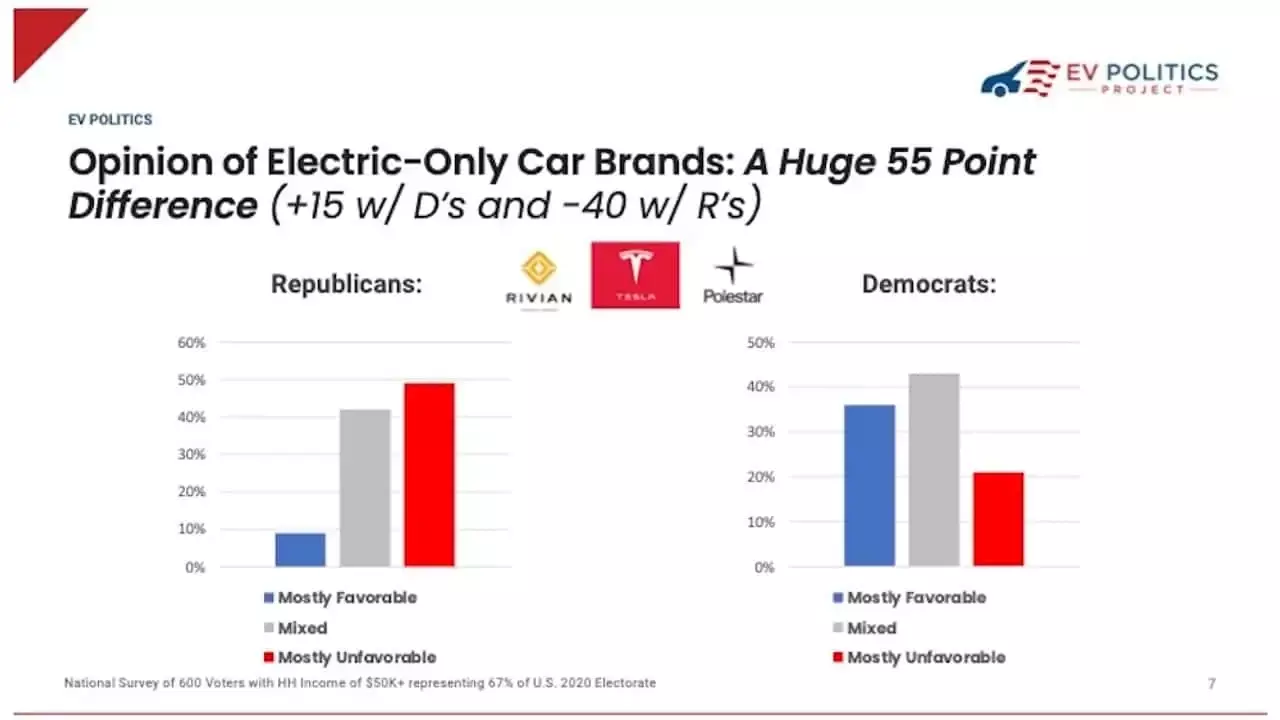

EV Politics

Tesla itself is known for its largest market being California, where it was founded, the quintessential “blue” state. The above chart highlights how by major political party views on EVs vary dramatically. Among Republicans, almost 50% have a mostly unfavorable view on electric-only car brands while only 10% have a mostly favorable view.

Among Democrats, the mostly favorable percentage is almost 40% while the mostly unfavorable is only 20%.

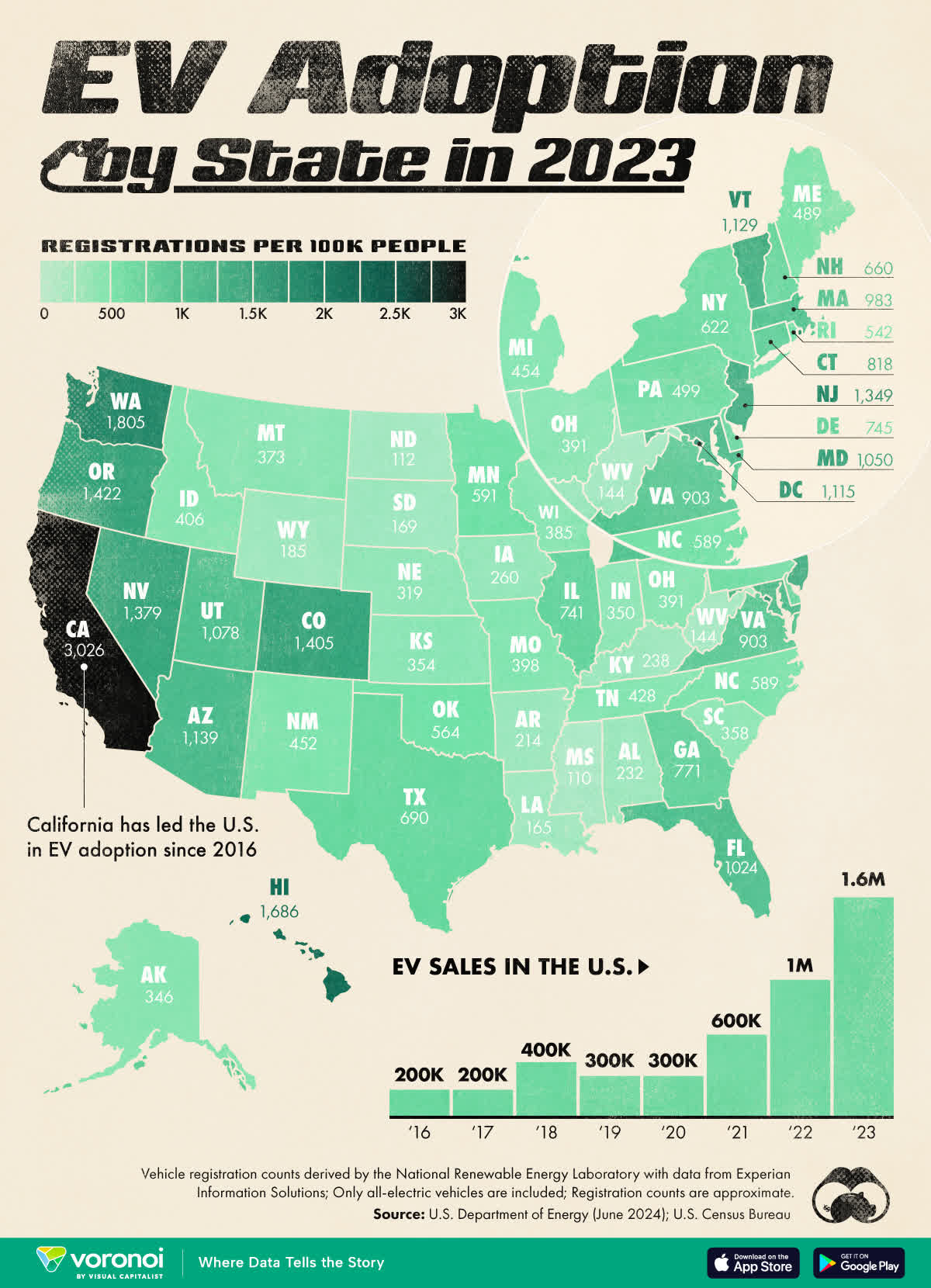

EV Adoption

This is also partially visible in EV ownership registrations per 100K by state. While there are some associations (i.e. blue states tend to have more concentrated / higher populations that could lend themselves well to EV ownership) it’s visible that EV ownership varies partially by party association of the step.

For example, Colorado has 1.4% EV adoption, while Wyoming next door has <0.2%. Wisconsin has 0.4% while Iowa has 0.25%. This variance helps reaffirm what we stated above, through polls, which is that Democrats are dramatically more likely to own an electric vehicle than Republicans.

Elon Musk versus Target Buyers

In our view, that association presents a substantial risk given that Elon Musk has aligned himself with the Republican Party’s candidate, Donald Trump.

The impact of this alignment can be clearly seen in polls asking people of their opinion on Elon Musk. Democrats have an approval rating of 6% which has plummeted from more than 20% while at the same time approval about Republicans has more than doubled from 30% a few years ago to more than 60%.

Now you might say you don’t care about political opinions on the CEOs of the companies you shop at. That’s valid. However, we’d argue that Elon Musk as a persona is much more associated with Tesla, with 83% of Americans doing so. That means that a negative view of Elon Musk could have an impact on Tesla’s primary markets.

The net result of this all, regardless of how reasonable anyone thinks it is, is that there’s a substantial risk to Tesla.

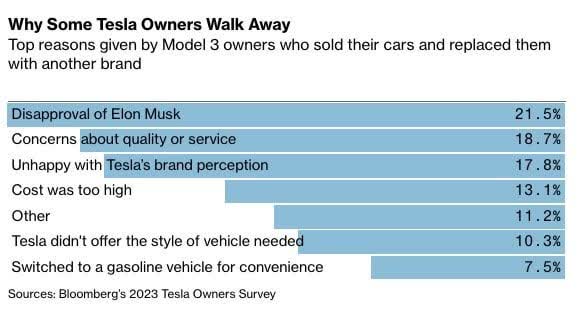

Bloomberg Tesla Owners

According to Bloomberg’s 2023 Tesla Owners survey disapproval is a top reason why Tesla owners are walking away, with more than 20% saying yes. Now it’s tough to quantify exact risks. However, in the same survey above, 13% of Model 3 owners were planning to leave at all, which means that ~3% of Tesla owners today are considering walking away.

However, in Tesla’s world, at 2 million vehicles per year, that’s 60K vehicles less of Model 3 demand, which is billions of dollars of lost revenue. More importantly, this is coming at the same time as competition is increasing, and EV sales are slowing.

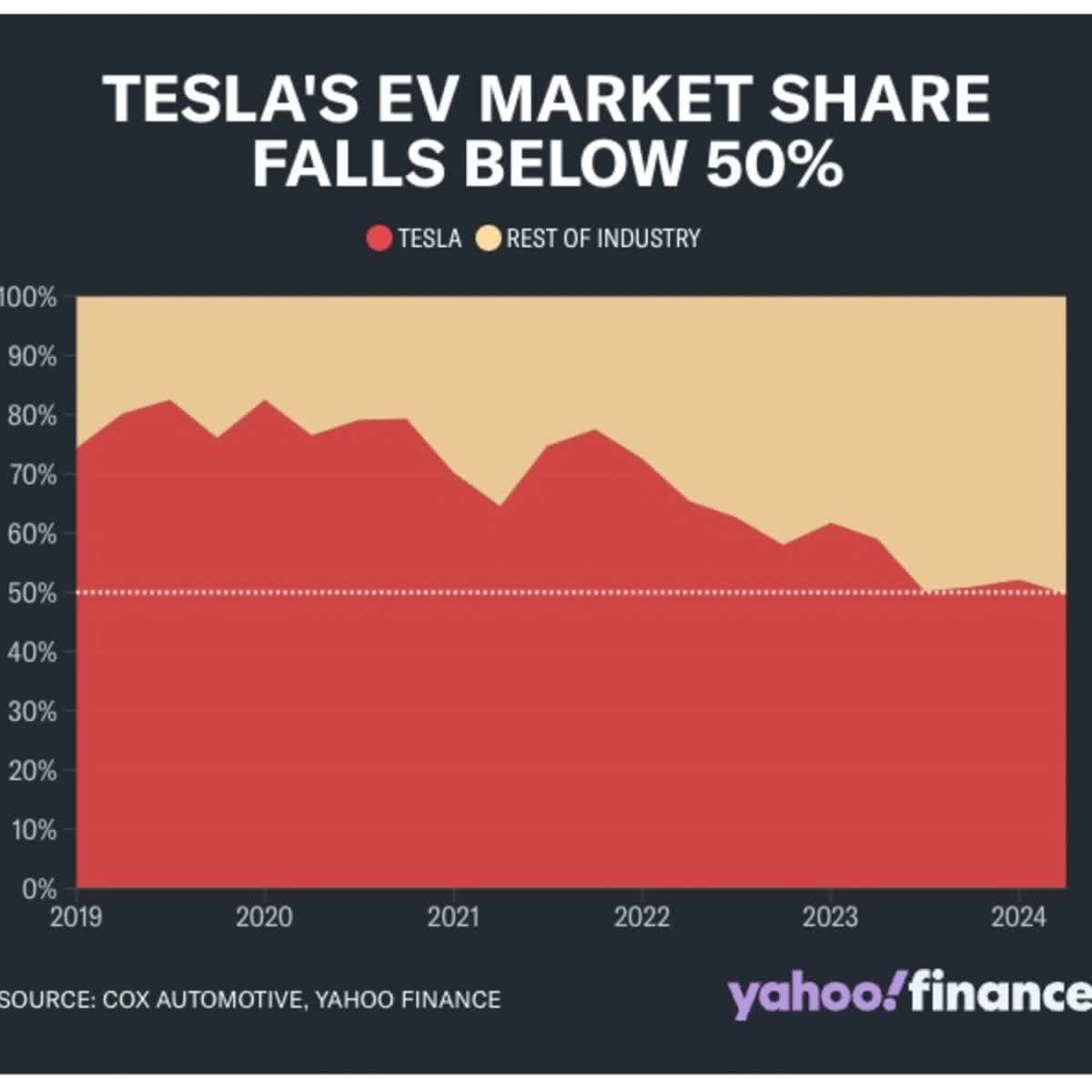

Cox Automotive

Tesla has continued to face additional competition which has pushed down its market share to below 50%. From a global market share perspective, the company is still struggling to compete for its crown, with cheap EVs in China and Europe putting substantial pressure on the company. The company competes with BYD for the crown of the top global EV maker.

Overall new competition has pushed down Tesla’s consideration score:

Survey data reported by Reuters found that Tesla’s “consideration score” – a metric used by Caliber to track consumer interest in brands, based on how they respond to the prompt “I would buy, or continue buying, products and services from Tesla, if given the chance” – has fallen to 31 percent from its 70 percent high in November 2021, tumbling by 8 percent alone this January. Caliber’s consideration scores for rival EV-producing manufacturers Audi, BMW, and Mercedes, meanwhile, increased slightly during the same period, reaching between 44-47 percent.

In Europe, one of the largest retail chains, Rossmann, has halted plans to purchase EVs as a result of Donald Trump directly. This is a quantifiable risk that could cost the company billions at a time when sales are already flat lining.

Tesla FSD Hardware Class Action

At the same time, after Tesla’s lackluster self-driving event, we expect class actions over the company’s FSD to ramp up. That’s been a major source of the company’s profits recently, and the company is already facing some class action lawsuits.

It’s well known that Tesla FSD has been promised as being around the corner for almost a decade now. Tesla owners with the “HW3” package spent more than $10K on this package with the promise of full-self driving. Tesla has continued to make this promise despite releasing “HW4” and not offering an upgrade to “HW3” owners, saying it would be too expensive.

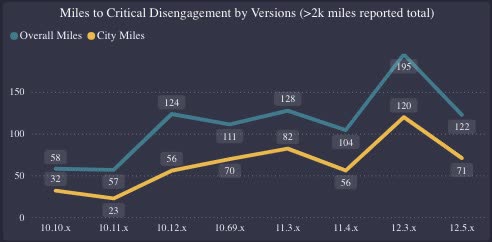

Bloomberg Disengagement

Tesla’s miles to disengagement has barely doubled over the last several years. For perspective, Waymo is at roughly 100x that, and conventional wisdom is that there’s much further to go. Think about how often your car would need to go before “failure” for you to buy a FSD car with no steering wheel or controls. Tesla is far, far away.

Tesla appears to understand the risk with HW3, saying “let’s not get nuanced” at the event asking the company to confirm, while updating the language on its website. Recent FSD releases indicate that Tesla is hitting the limits of what’s possible with HW3, with recent releases coming out on HW4 first instead of HW3.

More importantly, HW3 releases now use both computers, which makes it impossible to achieve Level 5 FSD given a requirement for redundant computers.

Thesis Risk

The largest risk to our thesis is that the company’s newfound allegiances might change some of the statistics above and make a new group of people more open to EVs. That could help replace lost customers and support Tesla’s sales and returns.

Conclusion

Tesla, as we discussed in our prior article, is already trading well above fair value. Now, with recent developments around the election along with the company’s FSD event, we see risks increasing. That could potentially cost the company billions in revenue as it’s struggling.

This adds on to the company’s liability with FSD, as the company has made promises that it’s now seeing class action lawsuits with. These sales were a massive source of profits for the company and margins, so having to refund them could be massively expensive.

As a result, this helps to highlight how overvalued Tesla is and why it’s a poor investment at this time. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.