Summary:

- Tesla’s stock is likely to remain range-bound, facing strong resistance at $260 and significant support in the low $200s.

- Tesla’s revenue growth is expected to be modest in 2024 but could accelerate in 2025 and 2026 with increased production capacity.

- Potential catalysts include the development of FSD, Cybertruck production, and new lower-priced EV models, but these are not immediate.

- Competitive pressures and possible secondary offerings pose risks, making it prudent to sell shares near $260 and wait for stronger catalysts.

Sven Piper

Tesla, Inc. (NASDAQ:TSLA) has failed to maintain its recent momentum and break out of its midterm range, despite recently completing both a cup and handle pattern, as well as a reverse head and shoulders pattern. This recent move back into the meat of its 2024 trading range indicates TSLA stock is unlikely to move higher in the near term, and may even test support in the low $200s on poorly received earnings, among other potential updates that may come to market between now and the end of the year.

In late September and early October, technical analysis appeared to support the argument that Tesla had the momentum to break out and into the high $200s. Tesla shares were range-bound for most of the summer, but made sharp moves to the mid-$200s in July and again recently. As was the case in July, Tesla promptly bounced off of apparent upside resistance in the low $260s. This created a clear double top, and shares have since returned to their prior trading range. Now, shares appear likely to remain range-bound, and potentially test downside support in the near term.

Tesla’s double top (Finviz.com)

The double top tesla recently established also coincides with Tesla’s share price at the end of 2023, and this continuing resistance indicates a low probability of Tesla moving above such a valuation without a significant fundamental catalyst. It should also be noted that Tesla contended with the low $260s for a longer period of time in July, as opposed to the quicker rejection that just occurred. This appears to indicate that this resistance is considerable, and that a great many existing shareholders are willing to sell at such pricing, and potentially breaking even when doing so.

As the above chart shows, $260 has been resistance and a high mark for TSLA shares since the start of the year. Tesla made a strong move towards breaking out of this resistance in July, only to fail and fall below $200. Now, they are again approaching this level, and it seems exceedingly likely that they will either quickly reverse or continue to move higher.

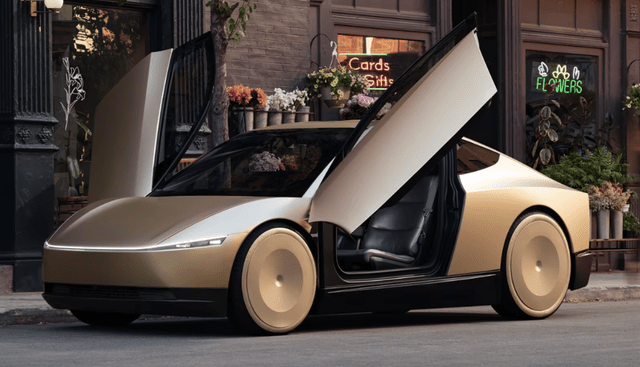

Tesla’s position in FSD may develop the capacity for a ride-hailing application that could either compete with existing systems, or be utilized by them. Tesla also just provided a new update to its “Robotaxi” capacity. On October 10, Tesla held its “We, Robot” event where CEO Elon Musk unveiled a Cybercab prototype that drove around the Warner Bros. movie studio in Burbank, California. The Cybercab prototype had no steering wheel or pedals, and its two doors opened upwards and towards the front.

Tesla Cybercab prototype (Tesla.com)

The Cybercab is still far from street ready, and Musk’s comments included that production is anticipated to begin in 2026. Musk also added that he anticipates full unsupervised autonomous driving in Texas and California for the Model 3 and Model Y starting in 2025. Tesla also displayed a new version of its Optimus humanoid robot, including that the estimated cost of Optimus will be between $25,000 and $30,000.

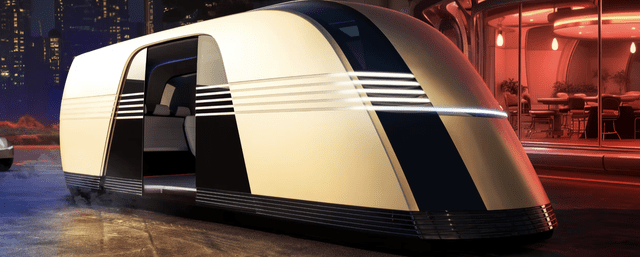

In addition to the Cybercab and Optimus, Tesla also revealed an autonomous Robovan prototype with the capacity to transport up to twenty people. I think the Robovan was reminiscent of the USR transport vehicles in the 2004 film I, Robot.

Tesla Robovan prototype (Tesla.com)

It appears the reaction to Tesla’s recent “We Robot” event was largely disappointment, given that shares are trading down following it. One considerable issue is that none of the products displayed are available, or likely to be available next year, and that they are instead mere prototypes where production appears likely to begin in 2026 at the soonest. This also likely means that their earliest availability would occur in 2027, and that may be an optimistic outlook.

Tesla’s revenue is expected to increase in the low single digits for full-year 2024. This is low for the Tesla. Tesla’s continued development of factories in Texas (Austin) and Germany (Berlin), should substantially increase the company’s global production capacity in coming quarters, and potentially through 2026. If this proves to be the case, and Tesla is capable of selling a presumed increasing production rate of EVs, its revenue should accelerate throughout 2025 and 2026.

Tesla’s revenue growth over the next two years appears likely to exist even if Tesla cuts prices on its EVs. I believe Tesla’s revenue is likely to increase between ten percent and twenty percent in each of the next two years. The precise level of revenue growth shall depend upon factors including the rate of production increases, the efficiencies realized at Tesla’s new factories, the level of any price cuts Tesla enacts, if any, and the strength of competitive offerings made by other manufacturers.

Other factors include whether Tesla will release a new lower priced model in 2025, as well as the rate of production and delivery of its Cybertruck. Tesla has been slow to manufacture and deliver Cybertrucks. Despite this low level of fulfillment, Cybertruck demand remains strong, with the vehicle having a remaining reservation count of over two million units. The Cybertruck should become a highly meaningful producer of revenue in 2025 and 2026 so long as Tesla ramps its capacity to fulfill these reservations and deliver a growing number of units over the coming months and quarters.

Tesla is still the domestic market leader in electric vehicles (“EVs”) and seems likely to maintain this position for the foreseeable future. Tesla also appears capable of competing in the Europe and Asia, as well as other international markets. Further, in 2022, Tesla opened the two above-mentioned factories, and they should facilitate the company’s continued production capacity growth. Beyond increased production numbers, Tesla may also achieve some operational advantages through realized efficiencies, as compared to most of its domestic competitors that still cannot profitably manufacture EVs at scale.

Tesla’s business model is mostly the selling of EVs, but also extends to related add-ons, such as insurance, batteries & charging systems, and autonomous driving software subscriptions. Tesla’s business model also includes selling solar panels and related energy storage batteries and systems for both residential and commercial uses. Tesla’s competency within power generation and storage in markets outside of automotive has the potential to grow considerably in the future, but this capacity and the margins it may realize are difficult to quantify.

Tesla’s maintains considerable operational advantages when compared to its domestic EV competitors. None of the traditional domestic auto manufacturers has yet proven itself capable of producing at scale a model of EV that is a competitive threat. Moreover, most of the EVs these competitors produce are unprofitable and being supported by existing internal combustion engine vehicle sales, as well as government subsidization. Meanwhile, Tesla has consistently reduced its unit production costs and frequently cut the retail price of its EVs.

Tesla continues to have a significant potential benefit from full self-driving (“FSD”) software subscriptions. Tesla already sells its existing FSD service as a monthly subscription, and this subscription revenue may substantially increase as the technology improves, and the fleet of Tesla EVs on the road grows. It is also possible that competing auto manufacturers might license Tesla’s FSD technology, much like how several have adopted Tesla’s Superchargers. This is unlikely in the near term and should require significant continued improvements to the technology, as well as proven real-world applications, before others adopt it.

Similarly, Tesla is at a tremendous advantage versus its peers at the manufacturing of its own batteries, as well as the software used to enhance their efficiency that utilizes and charges them. As tesla scales its production of EV batteries, some competing auto manufacturers may end up acquiring batteries from Tesla, or licensing their proprietary technology in order to more efficiently use their own or otherwise procured batteries.

While Tesla is far from being an undervalued equity, the company has a history of growing its business far beyond market expectations and average analyst estimates. Further, Tesla is incubating various possible new revenue streams, including from AI computing, as well as the development of humanoid robots. Similarly, Tesla’s battery technology could eventually become a product for competing auto manufacturers, and also get broad adoption for use within the electric utility marketplace. Tesla’s solar power panels may also experience growth if the cost of electricity were to considerably increase along with existing demand growth for electricity.

I continue to expect Tesla to have adjusted earnings per share of about $2.40 in 2024, and for it to realize EPS of $3.50 or greater in full-year 2025. Tesla also has a balance sheet commensurate with a mega-cap tech company, with a cash position of over $30 billion, and has maintained low levels of debt. If Tesla can increase its cash position over the next year, it may be in a position to initiate a share repurchase plan.

Without a near term catalyst, Tesla appears likely to remain rangebound and incapable of breaching upside resistance at in the low $260s. As such, I believe it makes sense to sell shares at or near such pricing, including selling covered calls with strike prices at or slightly above $260. I do not believe Tesla is likely to substantially decline from current levels, as shares appear to have significant support in the low $200s, as well as at around $200 and the low $180s.

Risks

Tesla is an opportunistic issuer of secondary offerings of shares in order to raise capital. While it has not issued a secondary offering recently, the company may choose to do so to fund its development plans in robotics and AI, as well as to ramp production of the Cybertruck and a new lower priced EV. The probability of such a secondary should increase along with any sustained share price appreciation above resistance in the low $260s.

Risks to Tesla include competitive pressure from traditional automakers, as well as newer Chinese manufacturers of EVs. Competitors are making significant investments in developing their EV manufacturing capacity, and Chinese manufacturers offer lower priced EVs that should take growing market share in most international markets. This could result in lower-than-expected revenue, operating margins, and earnings estimates for Tesla.

Tesla could also face pricing competition in the form of lost subsidies, and this could depend upon where certain a model’s batteries are made. For example, Tesla’s Model 3 contains a Chinese battery that would likely disqualify it from eligibility for U.S. subsidies. Imported Chinese EVs are likely to be partially constrained, if not stifled, by political restrictions such as tariffs and subsidy exclusions, but they may still affect pricing and margins.

Conclusion

Tesla underperformed and remained range-bound in the first half of 2024. In both July and earlier this October, tesla shares made strong moves in an attempt to break the low $260s, but were rejected both times. This level also acted as resistance in late 2023. Tesla’s recent failure to break through this level and its rapid rejection and repricing lower indicate that Tesla lacks the momentum or investor demand to push the share price higher in the near term.

Moreover, Tesla remains an expensive equity that lacks the fundamentals to support a sustained move higher without a meaningful catalyst. This week’s robotaxi event is being viewed as a sell the news occurrence, and as a result, shares lack sufficient conviction to move higher. Therefore, I believe the proper course of action is to wait for Tesla shares to test their support in the low $200s here, and to potentially wait for shares to prove they can move through the $260s before adding significant exposure.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, TSLL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.