Summary:

- Tesla’s self-driving technology faces a critical 12-18 month period due to the rapid scale up of the company’s training infrastructure and access to data.

- If meaningful progress is not demonstrated in the next few years, Tesla’s approach to autonomy will begin to look like a dead end.

- Tesla’s vertical integration and scale could give it an advantage, but the timeline for a general self-driving solution remains uncertain.

- While the pursuit of a dedicated robotaxi has renewed investor optimism, Tesla is years away from genuine self-driving capabilities and the Cybercab event was a reminder of this.

- This should be a downside risk, but Tesla’s share price is often divorced from the fundamentals of the business.

Hiroshi Watanabe

Tesla’s (NASDAQ:TSLA) (NEOE:TSLA:CA) business faces a critical 12-18 month period, as its investments in self-driving technology are reaching a point where significant progress will be needed for the company to maintain its valuation premium. This is a risky setup, as it is largely unknown, how self-driving performance will improve with access to more data, but the results aren’t particularly encouraging so far.

Despite this, the difficulty of the problem is the primary reason to think that Tesla is best positioned to develop a general self-driving solution. Companies will likely need to be prepared to invest tens, if not hundreds of billions of dollars in training infrastructure. A relatively general solution could also still be something like a decade away, requiring deep pockets and enormous patience. Google (GOOG) is probably the only other company positioned to make this type of commitment, although I think they will be happy to spend significantly less and focus on a specialized solution that functions in the main ride hailing markets.

Even if Tesla is successful, a lot of pieces will need to fall into place to create significant returns for shareholders from current prices, particularly if training costs stretch into the hundreds of billions of dollars and the technology isn’t mature until the 2030s.

Market

While ADAS sales and robotaxi revenue are currently fairly small, the autonomous vehicle market is expected to rapidly expand in coming decades, driven by technological advancements. For example, an Intel (INTC) study estimated the self-driving market would provide 800 billion USD revenue in 2035, growing to 7 trillion USD by 2050. This projection appears optimistic though, with more realistic estimates for 2035 in the 300-400 billion USD range.

Tesla has so far chosen to capitalize on this opportunity by selling the technology to Tesla owners, providing both a direct monetization opportunity and increasing the appeal of Tesla’s vehicles. This is potentially important as survey data indicates that 60% of respondents in China, Europe and the US would switch automotive brands to access a vehicle with improved autonomy features.

Customers appear hesitant to purchase vehicles that do not allow the driver to take control of the vehicle, though, indicating that trust in the technology is still low. The primary appeal of the technology appears to be its ability to handle traffic jams and highway driving, as customers view these as pain points. Customers have also indicated that AVs would be more useful if they allowed the driver to sleep, work, read, shop, or watch movies. This indicates that most of the value for consumers will be created at Level 3+ self-driving capability.

McKinsey has suggested that Level 2 advanced features will cost around 1,000-2,000 USD, with Level 3 systems costing upwards of 5,000 USD. The price for customers would likely be significantly higher than this though, so that OEMs can recover development costs. By 2030, McKinsey expects 64% of vehicles to have some level of autonomous driving capability, with most of these vehicles having Level 2 capabilities.

All of this points towards a large opportunity, but it suggests that a step change in technological capabilities is still needed for the opportunity to be realized.

Tesla Self-Driving History

Tesla initially discussed self-driving technology with Google in 2013, but the companies differed in their approach to developing the technology. Google reportedly rejected Tesla’s approach on safety grounds, presumably referring to deploying a system that was still under development. At the time, Musk suggested that Tesla had technical discussions with Google regarding lidar, but he felt their approach was going to be too expensive. Even at that point, Tesla was leaning towards a camera-based system.

Tesla released Autopilot to 60,000 vehicles in 2015, providing customers with partial automation that was more akin to a safety feature. By November 2016, Autopilot had accumulated approximately 300 million miles of data. Tesla’s initial solution was based on cameras and a perception system from Mobileye (MBLY), although the companies parted ways in the middle of 2016 after a safety incident involving Autopilot. Mobileye stated that it was ending the relationship because Tesla was using its technology in an inappropriate manner. Tesla refuted this, suggesting that Mobileye ended their partnership after discovering Tesla was developing its own perception system. After this incident, Tesla planned on upgrading Autopilot by adding radar as a secondary sensing system.

Tesla launched its Full Self-Driving Beta program in October 2020, enabling a limited number of customers to test Tesla’s self-driving software on public roads. Access was widened in September 2021, with more customers allowed to use the software, provided they had achieved a high enough “safety score” (based on metrics like aggressiveness of braking and turning). In November 2022, FSD Beta was made available to anyone in North America.

Tesla Self-Driving Technology

Tesla’s approach to self-driving has evolved significantly over time, but none of its moves have been particularly surprising, given the company’s approach in areas like EVs and energy storage. In particular, Tesla is pursuing vertical integration and scale as means to improve its capabilities and reduce costs.

Tesla initially utilized a combination of cameras, forward-facing radar, ultrasonic proximity sensors and Mobileye EyeQ 3 hardware. This setup was referred to as Hardware 1.

Hardware 2 was introduced in 2016, replacing Mobileye’s hardware with the NVIDIA (NVDA) Drive PX 2. Hardware 2 also utilized an increased number of cameras (8 versus 1).

In 2019, Tesla shifted to its internally developed FSD chip, with the new system referred to as Hardware 3. The FSD chip featured ARM CPUs, two neural network arrays and a Mali GPU. Each neural network array is capable of 36 TOPs.

Radar sensors were dropped, starting in 2021, followed by the elimination of ultrasonic sensors in 2022. While Tesla has promoted the merits of a vision only approach, the decision to only utilize cameras was likely an economic rather than an engineering decision. Tesla couldn’t afford to put lidar/radar and the necessary computing hardware in all vehicles, so it implemented a low-cost tech stack in the hope that data would eventually enable this approach to work.

Hardware 4 began shipping in early 2023 and was Tesla’s first vision only system. Hardware 4 features twice the RAM and four times the storage of Hardware 3. It also reportedly offers 3-8 times the computational capabilities. In addition, Hardware 4’s cameras have 4-5x better resolution and fidelity than Hardware 3.

Hardware 5 (subsequently renamed AI5) was announced in the middle of 2024 and is scheduled for release in early 2026. Musk has suggested that AI5 will offer a 10x improvement over Hardware 4, with 50x the inference power. It will also reportedly use up to 800 watts, versus 300 watts for Hardware 3 and Hardware 4.

Despite rejecting the use of alternative sensors, Tesla purchased over 2 million USD worth of lidar sensors from Luminar (LAZR) earlier in the year. Tesla was Luminar’s largest lidar customer in Q1, comprising more than 10% of the company’s revenue. Given that individual lidar sensors are likely to cost around 1,000 USD, this implies Tesla purchased several thousand sensors, presumably enough for at least something like 500 vehicles. Tesla has previously experimented with lidar, but little is known about what the company is doing, beside commentary that alternative sensors are a crutch.

While Tesla has stated that alternative sensors are not necessary, that does not mean that they are not useful. I think it is highly likely that Tesla’s decision to pursue a camera only architecture was driven by the cost of deploying lidar in millions of vehicles. Given that Tesla is now more serious about a dedicated robotaxi, it would not be surprising if the company chooses to utilize lidar due to the relatively small volumes involved and the much greater performance requirements.

Tesla initially used a large number of hand coded rules to provide much of its self-driving functionality but has gradually been making greater use of AI. The company is now using a vision only architecture with end-to-end neural networks trained on billions of miles of real-world data, meaning all capabilities are inferred from the data by the model, rather than hand coded. With version 12 of FSD, Tesla replaced more than 300,000 lines of human-crafted code and introduced a single system capable of both city and country driving. Tesla is now focused on reducing the frequency of interventions and improving driving comfort.

In terms of software, limited information has been given, but unsurprisingly, Tesla continues to introduce new models with substantially more parameters. In 2022 Tesla referenced utilizing a neural network with 1 billion parameters. Parameter count was increased 5x with the new FSD model in 2024. Musk has stated that the 5x increase in parameter count would be difficult to achieve without upgrading the vehicle inference computer, suggesting that older hardware versions may not be able to run newer models.

Training Infrastructure

Given that Tesla is pursuing a camera only architecture utilizing end-to-end neural networks, the company’s approach is likely to be data and compute intensive. While Tesla is aggressively investing in this area, it really is unknown how much data and training infrastructure will realistically be needed to produce a competent general self-driving solution.

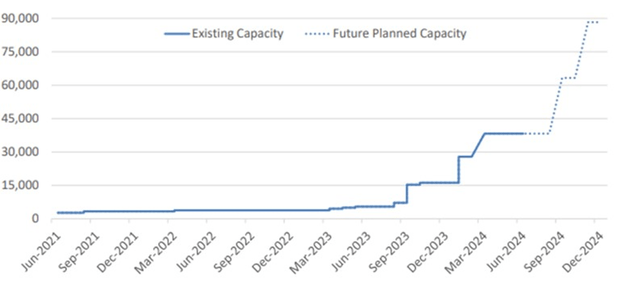

Tesla currently has around 35,000 H100 equivalent GPUs installed and commissioned and expects to have around 85,000 by the end of 2024, with further increases expected down the road.

The company is currently planning for around 130 MW of power and cooling for its training facility this year, which is expected to increase to over 500 MW over the next 18 months. Tesla’s hardware will reportedly constitute around 50% of the AI supercluster with Nvidia/other hardware making up the rest. This presumably means something like 500,000 H100 equivalent GPUs and something like 10-20 billion USD CapEx, just on GPUs.

Figure 1: Tesla Training Capacity – H100 Equivalent GPUs (source: Tesla)

In line with its vertical integration strategy, Tesla has invested in customized silicon to train its FSD software, developing chips with large amounts of memory and ultra-high bandwidth between cores for training neural networks using video data. While it is questionable whether Tesla can compete with a company like Nvidia more generally, there is potentially value in developing specialized hardware to handle its unique needs.

In early 2023, Musk suggested that Dojo had the potential to reduce training costs by an order of magnitude and that it could also eventually become a commercial service. This would likely require the development of more general-purpose hardware/software.

Dojo was first mentioned in early 2019 and the D1 chip was introduced in the middle of 2021. Dojo is a supercomputer used to train Tesla’s self-driving software and is made up of D1/D2 chips. 25 D1 chips are connected on a tile, functioning as a single system, with each tile offering 9 petaflops of compute power and 36 terabytes per second of bandwidth. D2 places an entire tile onto a single silicon wafer, rather than connecting 25 chips.

Tesla unsurprisingly had teething issues during its semiconductor development efforts, but now appears to be reaping the rewards, with Dojo already being used for training in 2023. Dojo 1 is expected to have the equivalent of 8,000 H100 GPUs by the end of 2024.

Solving the Data Problem

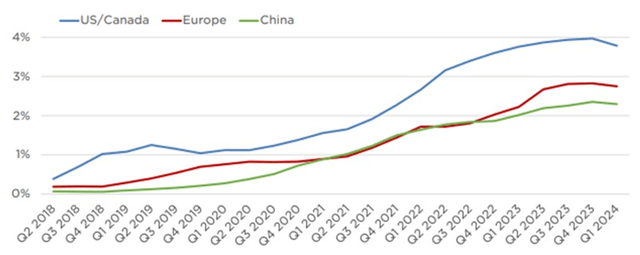

Tesla believes that scaled autonomy is only achievable with data from millions of vehicles, and its switch to an end-to-end model in early 2024 represents a doubling down on its data intensive approach to developing a generalized self-driving solution. In many ways, this makes sense given that AI projects in a range of areas have demonstrated that with sufficient model complexity, and access to large datasets, a high level of performance can be achieved. If this is the case, it makes Tesla one of the few companies with a genuine shot at solving autonomy, due to both the company’s sizeable fleet of vehicles on the road and the presence of FSD hardware/software on all of these vehicles.

Figure 2: Tesla Market Share by Region (source: Tesla)

It is this access to data which differentiates Tesla’s approach compared to companies like Waymo and Cruise, both of whom have fleets measured in the hundreds of vehicles. In May 2017, Waymo reported collecting a total of 3 million miles of data, with its fleet registering around 140,000 miles per month. Waymo has now likely driven something like 50 million miles, a figure dwarfed by Tesla’s more than 1.6 billion cumulative FSD miles. Waymo also makes extensive use of simulation, performing a total of over 1 billion miles of simulated driving by 2017. While simulation is likely useful, and cost-effective, it isn’t a replacement for real-world miles.

While Tesla will likely always have a large data advantage, this could narrow in coming years as companies like Waymo commercialize and scale their operations. Waymo recently announced that it was providing 100,000 autonomous rides each week. Similarly, Baidu’s autonomous ride-hailing platform averaged 75,000 rides per week in the second quarter of 2024. While these figures are still relatively low, it is not hard to envision companies like Waymo providing millions of rides per week in the next few years.

Tesla would still have an enormous advantage in terms of miles driven, and particularly in the diversity of data acquired. Consideration also needs to be given to data density (Waymo utilizes far more sensors) and to what extent data is actually utilized. For example, if the majority of miles occur on highways with no incidents, they are of little value.

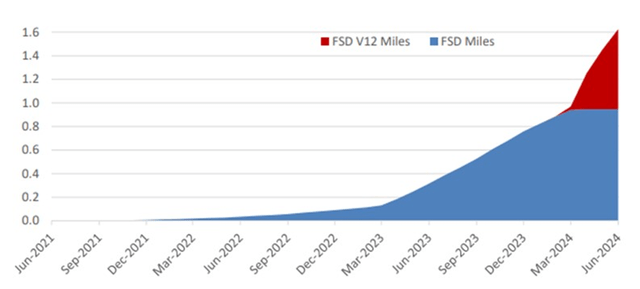

Figure 3: Cumulative Miles Driven with FSD – billions (source: Tesla)

It is not enough to just be generating data at scale, though. Companies must be able to handle this data and extract value from it. Current estimates suggest an L5 autonomous automobile generates 1-20 terabytes per hour. If nothing else, it is not really feasible from a cost perspective to try and utilize all of this data. As a result, Tesla has made significant investments in technology and processes to identify and label useful data, including:

- Using a classifier score to trigger the transmission of sensor data for use in training

- Auto-labeling AI to annotate data

- Human labelers to assess video and identify cases of exemplary driving

Self-Driving Performance

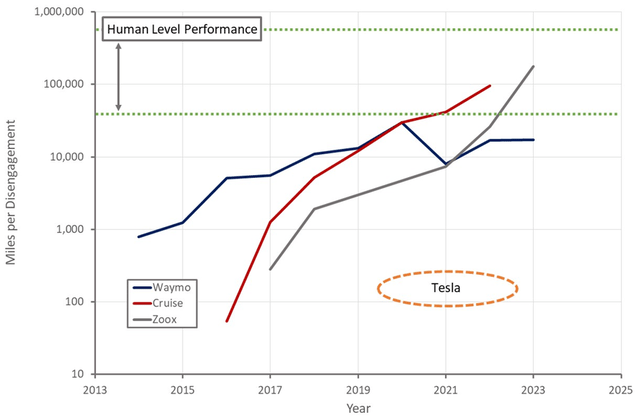

Assessing the performance of self-driving technology, both in relative and absolute terms, is a difficult task using publicly available information. While there is a growing body of safety and disengagement data, miles driven are not necessarily comparable (time of day, weather conditions, highway versus urban, traffic conditions). Disengagement data is also dependent on what is considered a safety event.

Disengagement data suggests that Tesla isn’t competitive, but I tend to think this is somewhat misleading. Given that Tesla’s FSD is driven under far more diverse conditions and many drivers are likely probing the system for weaknesses, Tesla’s performance probably looks worse than it actually is.

It is also difficult to reconcile reported disengagement data with information about how robotaxi fleets are currently being operated. Prior to halting operations, Cruise was utilizing roughly one remote agent for every 15-20 vehicles. While these human assistants are generally providing wayfinding intel rather than actually driving the vehicles, they reportedly need to intervene around every 5 miles. This suggests that while a number of companies now have self-driving vehicles that can operate fairly safely, these vehicles are still regularly confused by traffic conditions.

In any case, it should be obvious that no company is remotely close to developing a general self-driving solution. If any of these vehicles were allowed on the road completely unsupervised, they would regularly be involved in crashes or become stranded.

Figure 4: AV Company Miles per Safety Disengagement (source: Created by author using data from the California DMV)

Full Self-Driving

Tesla is currently commercializing its autonomous vehicle technology through its FSD service, which is sold as an optional add-on. FSD has a 99 USD per month subscription price and an 8,000 USD purchase price, although this was recently lowered to try and increase accessibility. While FSD is often considered a self-driving solution, it is regulated as a Level 2 Advanced Driver Assistance System, meaning the driver must supervise the vehicle at all times and be ready to take over. Fully autonomous FSD is expected to be available in Texas and California next year, although there appears to be little reason to actually believe this timeline.

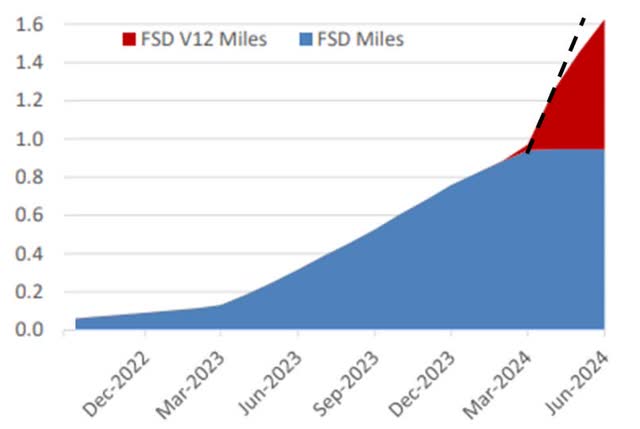

All Tesla vehicles manufactured since April 2019 have contained the necessary hardware to support FSD. In the first quarter of 2022 there were over 100,000 people in the Tesla FSD beta program, although this figure was artificially constrained by Tesla. Tesla recently provided a 30-day free FSD trial for eligible cars in the US and Canada to try and accelerate adoption. FSD Version 12 was rolled out to around 1.8 million vehicles in early 2024, with around half reportedly using it. A 2% adoption rate has been suggested, but Elon Musk has refuted this, without providing an alternative figure. Given the cost, and the fact that FSD requires supervision, it is not surprising that the product has limited appeal so far.

Tesla’s own data suggests that the pace at which FSD miles are being accrued has declined recently. While this could be the result of owners driving less miles, it most likely suggests that after the free 30-day trial, many users elected not to continue with the service. The slope of this curve needs to be monitored in coming months, assuming the data continues to be provided.

Figure 5: Cumulative Miles Driven with FSD – billions (source: Tesla)

Tesla has also reportedly had conversations with a major automaker regarding licensing FSD. While this would provide a source of high margin revenue, it would be an interesting move given the strategic importance of a superior ADAS solution. If Tesla ends up with significantly more advanced AV capabilities than other OEMs, FSD could provide sales with a meaningful boost. FSD will not be a make-or-break factor in the purchase decision for many customers though, and many brands are not really in direct competition with Tesla.

Robotaxi

In addition to its FSD service, Tesla plans on introducing a robotaxi service. Tesla had previously suggested that the service would utilize customer vehicles, providing owners with up to 30,000 USD profit annually. The introduction of a dedicated robotaxi that has been optimized for autonomy appears to be a step away from this vision, though. Some of this is likely driven by the fact that hardware requirements are much higher than initially expected, and it could indicate a need for additional sensors.

Tesla will be operating the fleet and has indicated that it will be introducing its own app. This is another point of differentiation for Tesla, as Waymo and Cruise are working with Uber (UBER), despite have their own apps. While this will enable Tesla to keep far more of the revenue it generates, there are questions around things like the scalability and elasticity of supply.

More light was shed on the Cybercab at Tesla’s robotaxi event on the 10th of October, although details were conspicuously absent. The Cybercab is a two-seat robotaxi that lacks a steering wheel or pedals. While this makes sense given the vehicle’s purpose, it could be an issue from a regulatory perspective. The Teamsters union called on the NHTSA to deny GM’s request for an exemption from Federal Motor Vehicle Safety Standards for the Cruise Origin, which also lacked manual controls. Cruise recently abandoned the Origin, with GM’s CEO citing regulatory uncertainty as the reason.

The Cybercab will also feature inductive charging, simplifying robotaxi operations. I don’t think this feature is particularly important, though. There are questions about the efficiency of inductive charging, and it shouldn’t be very difficult to develop an automatic charging setup with a cable. Tesla also unveiled a 20-person Robovan at the event, which is probably more of a distraction than anything else at this point in time.

The Cybercab has tentatively been penciled in for a 2026 release with a 30,000 USD target price tag. Tesla also suggested a 0.2 USD per mile operating cost, which is low but not unreasonable based on the other information given. The vehicle will be available for purchase by the public, and individuals will be able to manage their own robotaxi fleets. This will presumably be through Tesla’s app, though, with the company taking a healthy cut. The decision to make the Cybercab available for purchase at a very low price is an interesting one, given that Tesla could choose to own and operate the entire robotaxi fleet. It could actually make sense from a financial perspective though, dependent on a range of variables (Cybercab margins, ridehailing margins, take rate for third-party vehicles on Tesla’s platform). As much as anything, it would avoid the need to have a large amount of capital tied up in vehicles.

In terms of actually commercializing a robotaxi service, Tesla has significant work to do beside just developing a specialized vehicle. Remote operators will be required for the foreseeable future and fleet management (cleaning vehicles, maintenance, recharging) will be required. The Cybercab will also need a system that can detect collisions and complies with government reporting requirements. There are also considerations related to Tesla’s lack of detailed mapping, like determining where to pick up and drop off passengers while avoiding restricted areas, like bus stops.

Tesla will also need a license to operate a commercial service. There are a handful of states that already have adopted autonomous vehicle laws, and Tesla hopes that the data currently being generated will pave the way for a broad-based regulatory approval in the US. Companies like Waymo and Cruise are also doing a lot of the necessary leg work at the moment. While regulations could hamper the pace at which the technology is deployed, it is unlikely to be a barrier once the technology is shown to be safe.

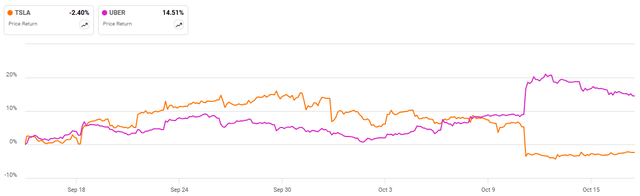

Perhaps the most interesting aspect of the Cybercab event was the market reaction to it. While Tesla has impressive self-driving / ADAS technology, it should be obvious at this point that there is still a large amount of work needed to launch a service comparable to Waymo’s. Prior to the event, many investors obviously felt that a Tesla robotaxi service was imminent though, and that it would be large enough to have a material impact on Uber.

Figure 6: Tesla and Uber Share Price Response to the Cybercab Event (source: Seeking Alpha)

Valuation

Tesla is difficult to compare to other auto OEMs due to the diversity of its activities, but the company’s market capitalization seemingly embeds several hundred billion dollars related to autonomy.

Value can be attached to each of Tesla’s potential autonomy revenue streams (FSD sales, Robotaxi, Licensing) by making assumptions regarding adoption rates, pricing, margins, etc. Uncertainty is extremely high for a number of reasons, though:

- A genuine self-driving solution could still be decades away

- Competition could realistically be fierce or negligible

- Consumer demand is still poorly understood

- Tesla’s FSD investments are now closely tied to its robotics business

- Technology like Dojo could eventually be commercialized

It is not hard to develop estimates which attribute most, if not all, of Tesla’s current value to its self-driving business. This, of course, assumes significant progress in the underlying technology. If capabilities stall near current levels, Tesla’s ADAS is probably likely to be worth something more like 25-50 billion USD.

On the robotaxi front, I am particularly skeptical of Tesla’s ability to capture value in the near term. While Waymo’s technological approach can be criticized, the company has a viable commercial solution that is rapidly scaling. Given that the vast majority of robotaxi market value will be in a handful of large cities, I believe Waymo is positioned to capture a significant portion of this value before Tesla has a viable service.

Looking at the value of other leaders in the space, investors appear to be fairly skeptical of self-driving’s near-term prospects. Waymo raised at a 30 billion USD valuation in 2020, although estimates have been as high as 175 billion USD. Cruise’s valuation peaked at 30 billion USD in 2021, but a third-party estimate prepared for General Motors in early 2024 put that figure at closer to 12 billion USD.

Conclusion

It is conceivable that by the end of 2025 Tesla has two orders of magnitude more training compute power versus early 2023. A larger fleet of vehicles, along with broader adoption of FSD, also means Tesla has access to far more data. Given the performance improvements offered by data and compute on other AI problems, this should be highly positive. It also creates a fairly narrow time window for Tesla to demonstrate meaningful FSD progress, or its approach to autonomy will begin to look like a dead end.

An end-to-end system using vision could be the right approach to developing a universal self-driving solution long-term. This approach will likely be far slower to achieve a minimum viable product, though. Tesla’s future is complicated by the fact that it is difficult to know how long it will take to scale using this approach. This is because Tesla must collect enough data for FSD to be able to handle essentially all possible edge cases. If the data distribution is highly leptokurtic, the end-to-end approach could be impossible on a reasonable timescale. I am not this pessimistic, though, as driving on public roads is a bounded problem where the vehicle essentially just has to avoid collisions and obey the road rules.

I think a general self-driving solution will take longer to develop than many expect though and will require far more capital than has been invested so far. As a result, I tend to think that developing a constrained solution that works reasonably well in the key robotaxi markets is a better approach from a commercial perspective. Tesla’s market capitalization will likely prove excessive if a significant improvement in FSD is not achieved over the next few years, although it is probably futile to look at Tesla’s share price from a fundamental perspective.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MBLY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.