Summary:

- Tesla, Inc. stock has lost 33% of its year-to-date value and keeps correcting sharply. Is it time to buy the fear finally? I don’t think so – Read on.

- Tesla’s Q1 2024 delivery and production numbers fell short of estimates, indicating a decline in demand and market share.

- The ongoing supply-demand issues are forcing further price cuts or the maintenance of moderate pricing, which could likely keep the margins under pressure.

- Tesla maintains a high FWD P/E ratio of ~64x, nearly 4 times that of its Consumer Discretionary sector peers, while its EBITDA forward growth rate surpasses the sector by just 24 basis points.

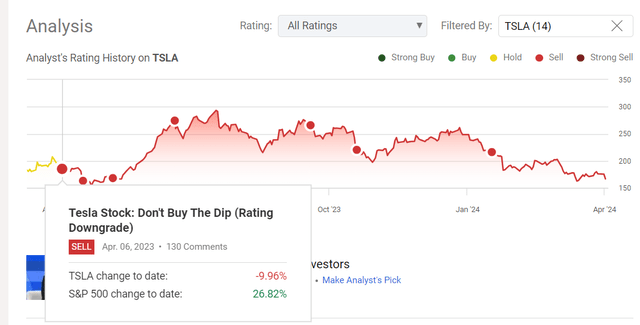

- I maintain my cautious view of Tesla’s prospects, reiterating the “Sell” rating. I’d recommend being ready for new local lows ahead.

Slaven Vlasic

Intro & Thesis

Almost exactly one year ago, on April 6, 2023, I downgraded Tesla, Inc. (NASDAQ:TSLA) stock and strongly recommended investors not to buy the stock when it was on the dip. For several months, I maintained my bearish view on the stock, which rallied tens of percent. But market logic took its toll, and Tesla stock became the brightest underdog among the mega-caps last year and went into a sharp correction in 2024, already losing 33% YTD.

Seeking Alpha, the author’s coverage of TSLA stock

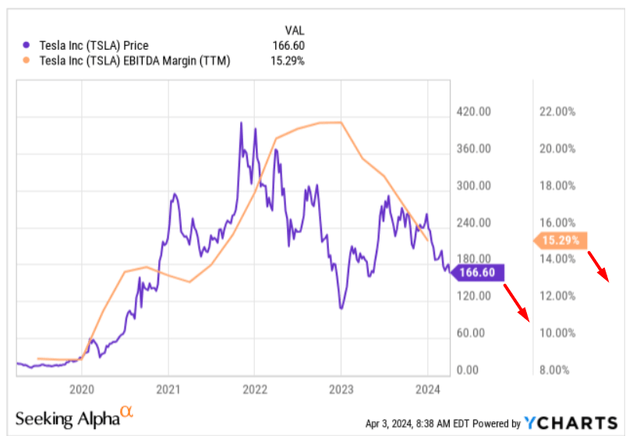

Today, I still hold the same opinion as 3 months ago when I last updated my thesis on Tesla: It’s getting harder and harder for the company to compete for its electric vehicle (“EV”) market share, which remains the most important factor for the firm’s success. This should inevitably lead to a decline in margins and thus a decline in the valuation premium – and that is exactly what is happening today. In my opinion, we should witness new lows ahead – it’s too early to buy this dip, again.

Why Do I Think So?

As I’m writing these lines (on Tuesday), Tesla has announced its Q1 2024 delivery and production numbers, with deliveries totaling 386,810 vehicles and production reaching 433,371 vehicles. Both figures fell short of consensus estimates, leading to a logical price action for TSLA stock:

Seeking Alpha, TSLA

According to the press release, difficulties in ramping up production of the upgraded Model 3 at the Fremont plant, along with plant closures due to the detour of ships because of the conflict in the Red Sea and an arson attack at the Gigafactory Berlin, are responsible for this miss. But I assume that organic factors played a more important role here than one-off events like the crisis at the Red Sea.

By organic factors, I mean the competition in the EV market, which the company started to lose. I propose to divide this statement into answers to 2 logical companion questions:

- What does it mean to be “winning the market competition”?

- What is the manifestation of “losing the competition”?

The answer to the 1st question is quite simple: winning the competition means maintaining the leading market position (or gaining it if the basis of comparison is low) and at the same time having good pricing power to keep the key financial margins as high as possible and maximize profits by taking them from competitors, so to speak.

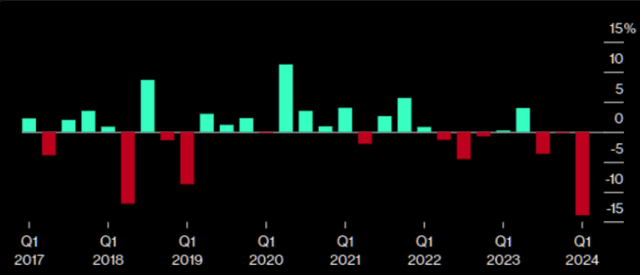

What does it mean then to lose the competition – it means losing market share and pricing power, which squeezes profit margins. Perhaps many will disagree with me on this interpretation, but it seems logical to me. So Tesla is now in a losing position. As I’ve already mentioned above, TSLA’s EV sales experienced a notable decline in Q1 – they dropped by 9% compared to the same period last year, marking the sharpest sales decrease in 4 years. Deliveries have fallen more sharply than ever before in history (even below the most conservative analyst estimates), according to Bloomberg:

TME newsletter, Bloomberg data

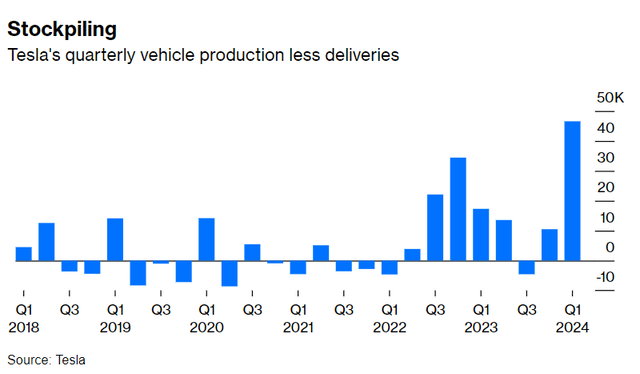

The number of cars produced exceeded the number delivered and reached a size that no one had ever seen before:

It is reasonable to assume that such a stark discrepancy between these metrics speaks volumes about the state of demand for Tesla vehicles, in my opinion. These fears are confirmed by the latest data on used Tesla vehicle prices shared by Charlie Bilello:

Charlie Bilello [on X: @charliebilello]![Charlie Bilello [on X: @charliebilello]](https://static.seekingalpha.com/uploads/2024/4/3/49513514-171214650011762.png)

Many people are taking note of the recent news we saw on April 1 (it wasn’t a joke) – after a series of price cuts, Tesla has decided to raise prices in China. Here my opinion will not be original: The threat of imminent price hikes is likely aimed at boosting some last-minute sales in the region. I assume that this measure will ultimately not have a significant impact on earnings and that the company’s profitability will continue to fall, because one price increase does not cancel out a series of earlier decreases, and the growing inventories in the warehouse will have to be sold sooner or later anyway. So it would be wise to assume the upcoming financial report, scheduled for release on April 24, may reveal an even more pronounced deterioration for Tesla’s EV business. I expect further margin contraction in the coming quarters.

Moreover, competition has not disappeared. Keep an eye on Xiaomi’s (OTCPK:XIACF) efforts to penetrate the electric car market in China with its debut EV – the SU7 – sparking significant interest with 88,898 pre-orders within 24 hours of its launch, and driving a 16% surge in its Hong Kong-listed shares, the Seeking Alpha News team reported recently:

With a base price of just ~$30,000, SU7 (looking like a legit Porsche car) should intensify the already fierce competition in China’s crowded EV market, further threatening Tesla’s sales and margins there. Considering Xiaomi’s global reach and the operational strength of its consumer electronics segment, due to which the company should theoretically have more pricing power (it plans to sell the SU7 at a loss for some time), Xiaomi can be considered not just another competitor to Tesla, but a worthy competitor. Therein lies the big difference.

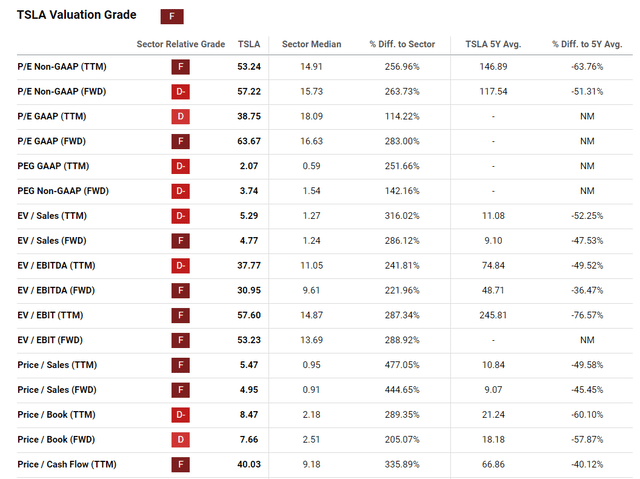

Despite all this negativity, Tesla remains a relatively expensive company with a price-to-earnings ratio (GAAP) of ~64x, nearly four times that of the Consumer Discretionary sector, of which Tesla is a part. In addition, the company’s growth rate, as measured by EBITDA forwarding growth rate, outpaces the same sector by just 24 basis points (TSLA’s 3.94% vs. the sector’s 3.70%). In my opinion, the stock is still well above its fair value.

Seeking Alpha, TSLA’s Valuation grades

The problem here is that no one can say exactly where Tesla’s fair value lies. The largest Western car manufacturers operate with a net profit margin of 6-8%, and the shares trade at P/E ratios of 5-7x. So, based on Tesla’s current sales volume of ~$97 billion per year, this gives an estimated capitalization in the range of $30-50 billion, i.e., several times less than the company’s current market cap.

But it’s worth considering the development of the company’s ecosystem – the software it owns, the brand it markets, etc. Tesla should get a bonus for having Elon Musk at the helm (only a bit of a joke here). In my opinion, it will all depend on what new products Tesla introduces in the future. The Cybertruck has proven to be a blockbuster, but apparently, it did not become a necessary “game changer.”

Where Can I Be Wrong?

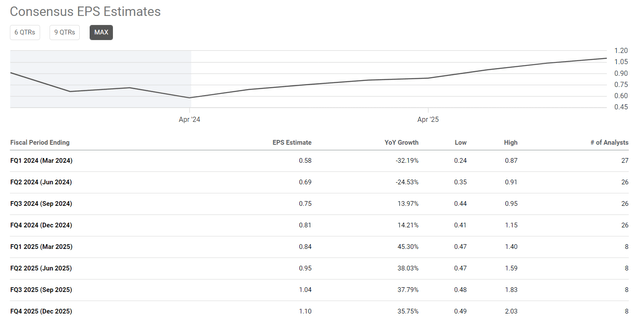

In fact, I’m taking a big risk by rating Tesla “Sell” again today. Perhaps much of the company’s downturn is already priced in – it operates in a cyclical sector and, therefore, what we see today in its margins may be irrelevant tomorrow. In any case, Wall Street is already anticipating a decline in earnings per share for the next two quarters.

That means an unexpected decline may not materialize, and the next earnings announcement may radically change the situation if Elon Musk and his colleagues find something positive to present to analysts.

Furthermore, “the long term” could win out – by this, I mean the company’s efforts to diversify its business and develop its ecosystem, which could make my current pessimistic view of Tesla’s growth potential seem unfounded.

Final Thoughts

The company has found both ardent supporters and critics among investors, and for the past few months, the critics are winning. While many bears have rejoiced at TSLA stock’s falling price, the company has had a difficult time in recent months, proving to be an unexpected (for many investors) underdog among mega-cap companies.

Unfortunately, this trend looks set to continue.

I disagree with the view of some radical bears claiming that the company’s valuation should hover around $50 billion, which seems significantly undervalued given Tesla’s brand prestige and its central role in the global effort to electrify cars (and not only). Furthermore, its ventures into diversifying its energy business and stepping into other sectors underline its importance.

However, there is little to be happy about in terms of the company’s margins going forward. The ongoing supply-demand issues are forcing further price cuts or the maintenance of moderate pricing, which could likely keep the margins under pressure. Therefore, I maintain my cautious view of Tesla’s prospects, reiterating the “Sell” rating. I’d recommend being ready for new local lows ahead.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!