Summary:

- TSLA stock declined 29% to $138 since my last coverage before it rebounded, which was still within my support zone.

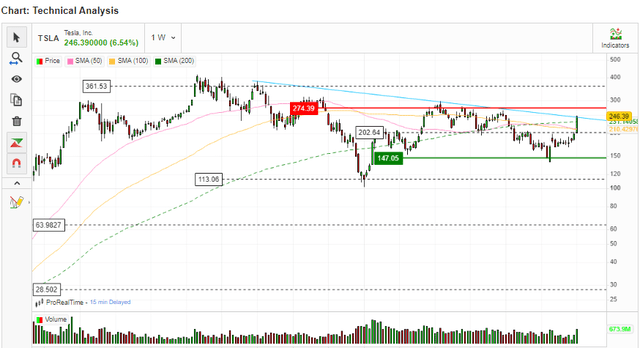

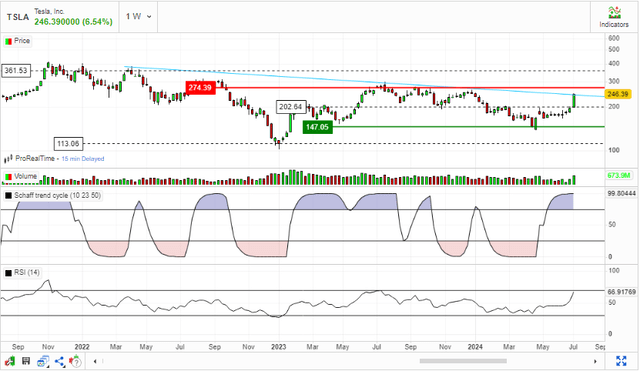

- Technical analysis shows a short-term bullish trend, potential resistance at $281.

- Production and delivery challenges, competition from BYD, caution advised for long-term investment.

baileystock

Investment Thesis

In my previous coverage of Tesla, Inc. (NASDAQ:TSLA) I reiterated my hold rating because the stock was in a bearish trend and was trending towards my support zone of about $117. Since my coverage, the stock declined about 29% from $195.33 to about approximately $138 which still falls around the support zone as will be illustrated later, and rebounded where I had recommended short positions within the $117 and $281 price range.

While the recent bounce on the support zone and the upward trajectory on the stock could mark the onset of a long-term bullish trend, I still hold some reservations about opening a long-term position here because, from a technical point of view, the long-term outlook is neutral. In addition, the company is still facing some headwinds especially its production and delivery woes, which unless they subsidize don’t support a long-term upward trend. The major long-term bullish catalyst that I am monitoring closely is its diversity beyond the EV market through the introduction of autonomous vehicles and the launch of the robotaxi business.

According to estimates, the robotaxi would yield an annual revenue of $700 billion and Optimus would yield an annual revenue of $1 trillion. The combined revenue contribution would see a triple effect on Tesla’s current revenue, which would be a massive growth. Looking at these optimistic estimates alongside the projected CAGR of 80.8% for robotaxi between 2022 and 2030, as well as the projected 52.8% CAGR of the global humanoid robot market size between 2023-2030, it is indisputable that these are major long-term growth levers if implemented effectively.

While I recommend close monitoring of the developments in these projects, I have several data points and insights that I believe we can look forward to gathering from the robotaxi unveiling event in August which include:

- Design of the new robotaxi

- Autonomous technology such as details on whether it will use a camera-only sensor suit or incorporate other technologies.

- Information on how the company plans to navigate the state and local regulations for autonomous vehicles, which are essential for the deployment

These among other common insights such as potential production and release dates should form the scope of our evaluation of the developments of this company’s long-term growth projects. Until these projects are fully operationalized and prove their potential in revenue contribution, I believe TSLA is a hold.

Technical Take

TSLA bounced on the upper side of the support zone, and it is currently in what I see as a short-term to midterm bullish trend which could reverse when it hits the $281 price mark which is a potential resistance zone. However, should there be a strong catalyst, the price could break above this range and that could mark the onset of a long-term upward trajectory with a price target of about $400 as shown below.

With these defined target zones, let’s dive deeper and assess the potential price action based on technical indicators. First off, the price has gone above the 50-day and 100-day MAs a sign that the stock is currently bullish in the short and midterm horizons. However, the two MAs are currently at the same level where a golden cross is possible, which will be a confirmation that this current bullish momentum is sustainable. In addition, the 200-day is currently at par with the price, a sign of a neutral long-term outlook. Above all, the 200 MA recently crossed above the 100-day and 50-day MAs which is a death cross and that could usher in a potential bearish trend. With this mixed outlook, I believe a hold decision is justified as we look for a clear direction from the MAs.

To support my hold decision, the RSI is currently at 66.9 slightly below the overbought region of 70 where a trend reversal is likely. Above all, the Schaff trend cycle shows that the currently bullish momentum is peaking and it is likely reversing. To me, this implies that the stock could reverse at the $281 mark which is a short-term pivot point, and most likely retest the support zone before a long-term bullish trend.

In summary, TSLA is exhibiting a mixed technical signal which warrants a hold decision. Most importantly, the long-term outlook is neutral and my buying decision will only be informed by major catalysts such as the launch of the robotaxi business or the unveiling of the autonomous vehicles. Otherwise, the mixed signal and the current woes leave me cautious.

Current Woes: Why I am Cautious

Tesla has been experiencing production and delivery challenges as competition intensified (For a detailed analysis of the competitive landscape refer to my previous analysis). To put it in perspective, the company reported its second quarter of YoY production and delivery decline. It reported producing 410,831 vehicles for the three months ending in June 2024, a 14% decrease from the corresponding number of 479,700 vehicles in Q2 of 2023. Deliveries decreased 4.7% from 466,140 in 2023 to 443,956 in Q2 2024. The annual decrease carries over the pattern that began in Q1, when deliveries dropped to 386,810, an 8% year-over-year dip, as the market for electric vehicles slowed down globally. The corporation made a roughly 10% staff reduction as a result of this, which in my view shows the extent of its current headwinds.

While the decline can be partly attributed to the slowdown in the global market, intensifying competition in my view is a major concern. My concern is that, despite Tesla’s declining production and delivery trajectory, which indicates a decline in consumer demand for its goods, rival BYD announced second-quarter battery EV sales that increased by almost 21% year over year to 426,039 units, as reported by CNBC.

In my view, the growing competitor’s output while Tesla’s is shrinking implies that it could be seizing its market share to its competitors, a reason I believe is fueled by BYD offering cheap options to Tesla’s products. It is even worse to see that EV sales are projected to decline from 60% in 2022 and 31% in 2023 to 21% in 2024 and 19% in 2025. This declining adoption of EVs points out a bleak market outlook at a time when Tesla appears to be losing the race to its competitors, something which forced them to cut prices to match the competition. The declining deliveries are a testament that the strategy hasn’t paid off. Consequently, I foresee a scenario where its financial performance could keep declining due to lower prices and lower sales volumes. This will translate to lower margins and eventually lower stock prices unless the scenarios improve.

While Tesla opted to price cut to catch up with BYD, the latter has adopted a price war in response which implies that the competition ought to go beyond just price wars because it is apparent that BYD is winning here and this proves to be detrimental to TSLA as shown by the declining sales compared to BYD. To demonstrate how BYD is winning the price battle, it debuted its first “medium-sized urban smart electric SUV,” the Sea Lion 07, in May. BYD’s new electric SUV undercuts Tesla’s best-selling Model Y, which starts at 249,900 Yuan ($34,550) in China, with a starting price of 189,800 Yuan ($26,250).

In summary, I expect the recent woes to persist because it will be almost impossible to curb BYD’s growing threat, which I believe could soon see it surpassing Tesla sales in the EV market and become the next EV giant if it keeps innovating affordable products. Above all, I believe Tesla’s underwhelming production and delivery output against BYD’s will lead to reduced investor confidence, which could turn to bearish sentiments.

One More Thing: My Expectations for Q2 2024

Tesla is expected to release its Q2 2024 earnings reports on 23rd July 2024. In my view, this upcoming quarterly report will exhibit a mixed performance given that the company has seen its vehicle deliveries and production levels decline YoY as discussed above which implies that its revenue may experience a hit following these low deliveries and its price-cutting strategies. However, I expect the effects of this low output in the automotive segment to be partially offset by the energy generation and storage segment which has reported the highest quarterly storage of 9.5 Gwh in Q2. Given these dynamics, I expect a negative net effect both on the revenues and profits where revenue will be in the region of $90 billion compared to $94 billion in Q2 2023 and EPS will be in the region of $1.49 compared to $1.52 billion in Q2 2023. This will reflect the effects of the price cuts and low deliveries reported this quarter.

My Final Thoughts

In conclusion, Tesla is still plagued by production and delivery headwinds, which reflect the weakening demand for its products. This happens amidst its competitor’s overwhelming performance on this front, which implies that it could be losing the market to its competitor, especially BYD. Despite its attempt to cut prices to match competition, BYD has adopted a price war in response and it appears that Tesla is losing this war. Given this intensifying competition and bleak market outlook, I am cautious to invest here until TSLA fully implements its robotaxi and Optimus projects, which could liberate it from its recent struggles. For these reasons and the mixed technical outlook, I recommend patience here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.