Summary:

- Obviously, I was wrong about Tesla, Inc., as the stock went up significantly since that bearish call, and I must admit that.

- However, my prediction regarding the response of Chinese consumers’ demand in the past few weeks was accurate.

- It seems to me that the supply/demand balance in China looks pretty unfavorable for Tesla’s 22% of consolidated sales volume attributable to that region.

- I was also right about weakening auto demand in the U.S., as the light vehicle incentives rose unusually sharply in May.

- Therefore, I reiterate my Sell rating on Tesla, highlighting the relative resilience of the business, but not seeing enough upside potential.

jetcityimage

Since the beginning of this year, conservative analysts covering Tesla, Inc. (NASDAQ:TSLA) stock, as I do, have fallen into the trap of looking only at fundamentals. For example, in my last article, I analyzed demand data and various surveys from major investment banks that served as a sort of weather vane for where car consumers are headed and what they expect to do in the foreseeable future. Based on this analysis of mine, I concluded that the propensity to buy for the auto industry as a whole is declining rather rapidly and that TSLA stock, which is first and foremost an automotive company – with all the “buts” – must be one of the first to fall in price under the weight of its market capitalization. Obviously, I was wrong, as the stock went up significantly since that bearish call, and I must admit that.

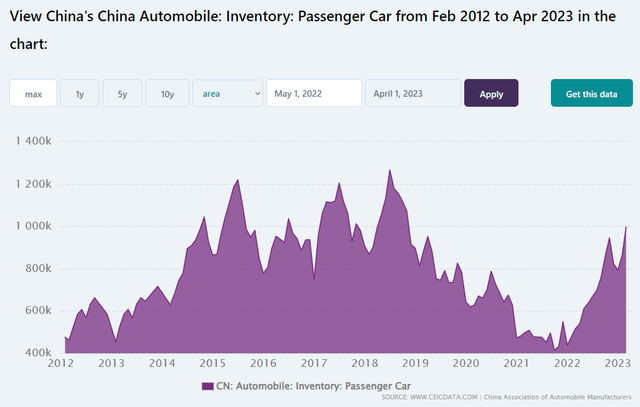

However, my prediction regarding the response of Chinese consumers’ demand in the past few weeks was accurate. As you may recall, I referred to a Credit Suisse survey conducted by analysts in the bank’s China office. They surveyed individuals from various regions in China to gauge their intentions to purchase different products. Specifically, the survey revealed a notable decline in the momentum for car purchases, which is consistent with the latest data we have observed [Goldman Sachs’ proprietary source]:

Wind, Goldman Sachs Global Investment Research [June 19, 2023 – proprietary source], author’s notes![Wind, Goldman Sachs Global Investment Research [June 19, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/20/49513514-16872417290785255.png)

Also, as was reported by Reuters, Tesla’s expansion plans in China are now facing challenges due to sector overcapacity. The CEO of Automobility has stated that China currently has an excessive auto production capacity, estimated at around 10 million vehicles per year. To put it into perspective, this figure is roughly 2/3 of the entire North American output in 2022.

It’s worth noting that Elon Musk previously discussed intentions to increase Tesla’s annual capacity by 450,000 vehicles at the new Shanghai site, located approximately 1.9 miles away from the existing plant. However, considering the current weakening demand in China, the timeline for implementing these plans looks uncertain, in my view.

Overall, it seems to me that the supply/demand balance in China looks pretty unfavorable for Tesla’s 22% of consolidated sales volume attributable to that region.

A somewhat different picture is emerging for the North American region. Compared to the previous year, total light vehicle sales showed a significant increase of about 23% in May, with car sales up by approximately 18%, pickup truck sales up by around 17%, and SUV sales up by approximately 27%. Sequentially, sales volume grew by about 1%, according to the Goldman Sachs Equity Research team [June 1, 2023 – proprietary source].

Against this backdrop, Tesla and General Motors (GM) have continued to take market share from Ford Motor Company (F):

Goldman Sachs Equity Research team [June 1, 2023 – proprietary source]![Goldman Sachs Equity Research team [June 1, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/20/49513514-16872595893225946.png)

But then again: I was right about weakening auto demand in the U.S., as the light vehicle incentives rose unusually sharply in May [+65% YoY and +14% QoQ]:

Goldman Sachs Equity Research team [June 1, 2023 – proprietary source]![Goldman Sachs Equity Research team [June 1, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/20/49513514-16872598914210818.png)

The above graph implies that automakers and dealers may be offering more attractive deals, discounts, or promotions to incentivize vehicle purchases. It may also indicate that consumer demand is not as strong as hoped, leading automakers to offer additional incentives to entice potential buyers. As a result, the automakers’ prospective margins are at a greater risk now than they were, say, a few quarters ago, in my view.

But there are 2 crucial points I need to mention here to be fair.

First, supply is still limited, which allows automakers not to cut prices too much and maintain profitability:

Goldman Sachs Equity Research team [June 1, 2023 – proprietary source]![Goldman Sachs Equity Research team [June 1, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/20/49513514-16872602844682121.png)

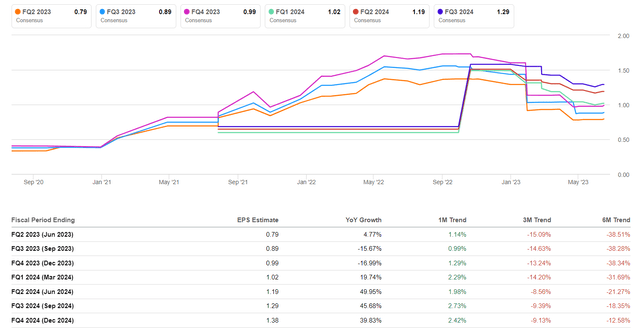

Second, as for Tesla, the greater weakness in demand may already be priced into consensus EPS estimates, as most quarterly numbers have been revised downward by 20-30% in the last 6 months:

Since I touched on earnings revisions, investors need to understand how important they generally are to a potential increase in the stock price. Analysts at Morgan Stanley, who have been among the most furious TSLA bulls for many months, believe that positive EPS revisions play a big role [proprietary data]. But after TSLA’s recent near-exponential recovery rally, even they are now cautious.

Despite recent developments, we do not anticipate significant upward revisions in earnings for Tesla, as per the consensus forecast. We still believe that the prevailing pattern of events indicates continued price deflation driven by intensifying competition with Chinese EV players and a slowdown in auto consumer demand. It seems the market is either looking through the potential revisions or assuming a less severe earnings downturn than previously expected.

Source: Morgan Stanley [June 13, 2023].

It’s apparent that Tesla is not just an automaker, and its non-automotive segments deserve a big premium in the company’s valuation. But I just don’t see a logical upside for TSLA stock at its current price levels, because even if we look at Morgan Stanley’s SOTP valuation model, we see that the total on relatively optimistic entries is only $200 per share, which is 23% below the last closing price:

Morgan Stanley [June 13, 2023]![Morgan Stanley [June 13, 2023]](https://static.seekingalpha.com/uploads/2023/6/20/49513514-16872617436155696.png)

Argus Research – another strong bull – saw significant opportunities for share price appreciation after the first quarter, supported by strong brand awareness among customers, production efficiencies, new vehicle launches, and efforts to diversify the business [proprietary source]. But even their 12-month price target was $220 [-15% lower than what I see on my screen today].

I am well aware that it is wrong to value a fast-growing company by P/E ratios or P/B ratios, but everything has its limits – especially when there are so many fundamental headwinds around.

TSLA stock was up for 13 straight days in June. A similar upward move has happened before, but over the next 1-3 months, the stock reacted differently depending on the market:

Morgan Stanley [June 13, 2023]![Morgan Stanley [June 13, 2023]](https://static.seekingalpha.com/uploads/2023/6/20/49513514-16872623633205044.png)

This time, I think TSLA has higher odds of repeating the 2022 and 2023 post-streak movements. Therefore, I reiterate my Sell rating, highlighting the relative resilience of the business, but not seeing enough upside potential.

The main risk of my updated thesis is a faster growth of the Tesla anon-automotive businesses and a prolonged bull euphoria, the duration of which is very difficult to predict.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!