Summary:

- Tesla, Inc.’s share price is poised for a trend reversal, driven by optimism surrounding upcoming events like the October Robotaxi announcement and long-term growth prospects.

- Key catalysts include the introduction of a new, affordable model and advancements in FSD, potentially disrupting companies like Uber.

- Tesla’s technological edge, including the Dojo supercomputer and AI capabilities, positions it ahead of competitors, with potential shifts towards autonomous driving and robotics.

4X-image

Investment Thesis

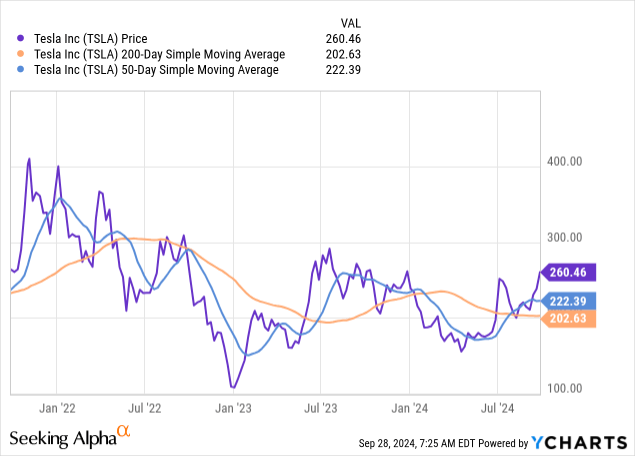

In recent weeks, Tesla, Inc.’s (NASDAQ:TSLA) share price has moved upwards again ahead of the October event and is on the verge of a trend reversal; it has already surpassed the 200-day moving average. The new optimism could pave the way for even higher prices in the medium term.

Of course, in the short term, there can always be setbacks in the direction of the trend line. However, I tend to be optimistic due to the long-term outlook and the many opportunities in the coming years. In this article, I would like to explain why several positive factors are currently coming together that could drive the share price to new highs.

Overall, this article will focus more on future developments and less on figures from recent years. However, these have already been mentioned in many articles. Tesla is one of the stocks covered the most on Seeking Alpha.

My opinion has changed somewhat since my last Tesla article, when the stock was similarly expensive, but I called it overvalued. After further research, I am more able to put the various future potentials into a broader context. Additionally, I have done a lot of research on competitor companies and the market in general, and this has made me realize the difficult situation that legacy automakers are in. I have written about Ford, for example. Over the coming weeks, I will publish more articles and plan an article about the likely cost development of EVs compared to ICE cars. The decisive factor in which technology prevails in the long term will be the price, a combination of acquisition and running costs.

Many potential catalysts

I believe several things are coming together at Tesla at the moment. The Robotaxi event on October 10 is likely to include significant announcements.

Robotaxis & FSD

As the name suggests, a business concept for a cab fleet is likely to be presented here. Tesla and Elon Musk are not humble regarding announcements. The event has already been postponed once, suggesting the company wants to present something significant.

“We, Robot” says the tagline of the Tesla Robotaxi unveiling event invite email graphic. The title is a reference to Will Smith’s iconic I, Robot movie. Replacing the ‘I’ with a ‘We’ hints that it’s even bigger than what was shown in the motion picture. “This will be one for the history books,” Elon Musk posted on X with the Tesla Robotaxi event invite email’s screenshot

Three massive things are coming together: Firstly, all this is only possible because full self-driving (“FSD”) is now ready to be used safely on a large scale after years of development. Tesla has often been criticized for FSD coming years later than originally announced. While this is true, it is also an incredible technical challenge requiring extreme computing power. In my opinion, Elon Musk is frequently criticized unfairly at this point – his promises come late, but they do come, and overall, everything he does is incredibly innovative.

Since the introduction of FSD 12 in early 2024, BofA says Tesla vehicles have driven over 600 million miles using the software, with interventions required only once every 10,000 miles.

Secondly, although it is not yet one hundred percent certain, there are some indications that this will not happen with an existing model but that a new one will be introduced that is probably smaller and cheaper. Elon Musk has been talking for some time about cheaper models for around $25k and that a next-gen platform will “hopefully launch in 2025.”

My guess is that, on the one hand, a platform will be introduced where you can call autonomous cars and pay per mile without owning the vehicle, similar to what is already possible with Waymo. On the other hand, I believe this cheaper model will also be sold to people who still want to own a car. As I said, this is just my guess, but I think that combining these two options makes the most sense. The traditional, straightforward selling of cars is a time-tested business model, and the change to robotaxis will happen slowly. Tesla will probably not make a hard switch too suddenly.

Disrupting Uber?

In other words, this business is potential competition for Uber (UBER) and Lyft (LYFT) but will likely be cheaper. Whatever gets people from A to B more affordable will prevail in the long term. Uber does not have the technology to offer FSD but could, at most, lease the technology from other companies (but from whom?). In addition, Uber is not a car manufacturer, which means that Tesla should have a cost advantage in all areas and thus be able to offer autonomous rides much cheaper than Uber ever could. This is obviously a massive market.

But Musk’s ambitions go further. What better car would there be for the job of ferrying passengers back and forth than one built strictly for that purpose? It wouldn’t even need a steering wheel or pedals. That’s the kind of visionary concept he will likely be presenting on Oct. 10.

Such a car could economically compete with an Uber without the hassle and cost of paying the driver.

Optimus

The linking of the Optimus robot with all the things already mentioned is interesting. Firstly, the robot can be used in production facilities, making future production cheaper (or Tesla’s margins higher). Secondly, the robot is only possible thanks to the existing technology enabling FSD. Tesla has been collecting camera data from its fleet for years and has used that data to train its neural networks to see and understand the world as humans do. This year-long process was necessary to enable FSD; now, it only makes sense to use this ability for other purposes, such as producing productive robots.

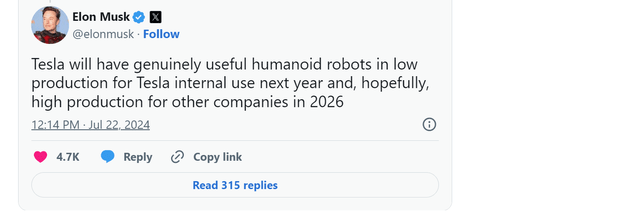

Finally, there is also the possibility of selling the robot itself as a product, for example, in private households, to do all kinds of jobs. I imagine that in the future, everyone will have a robot at home that does everything for them that they don’t want to do themselves. It should be clear that there will be massive demand for this. Elon Musk has already announced that the robot will also be offered to other companies.

Dojo & AI

All of these points above are only possible because Tesla has laid a strong foundation in neural networks, chips, and its Dojo supercomputer, which offers enormous computing power. Dojo is designed to process the vast amounts of video data generated by Tesla’s vehicles. This supercomputer is already up and running and is constantly being expanded.

Tesla CFO Vaibhav Taneja said that despite a dip in Q2 capex, the company still expected capital expenditures to pass $10 billion. “As we increase our spend to bring a 50,000 GPU cluster online, this new cluster will immensely increase our capabilities to scale [full-scale driving] FSD and other AI initiatives.”

Musk said that the company had “been working 24/7 to complete the South extension on the Tesla Giga factory in Texas. That South extension is what will house 50,000 H100s

Tesla is miles ahead

I’m not a Tesla fanboy, and I don’t drive a Tesla. But if you look at all the facts, you can only conclude that Tesla is thinking and acting bigger and more visionary than the competition.

I have already analyzed numerous car manufacturers, and there is not even the slightest mention of anything that goes in the direction of what Tesla is doing. Given these developments, I understand why people say they’re much more than a car manufacturer. Of course, they still make most of their money selling vehicles. Still, it’s important to look a few years ahead. It may well be that the business focus will shift significantly to Robotaxis and robots in the upcoming years.

Many traditional car manufacturers struggle with EVs and sell them at a loss. Tesla’s offering of a cheaper model and autonomous cabs will put even more pressure on the competition. Additionally, a robot fleet would reduce the overall demand for car purchases, as more people will probably decide not to own a car themselves.

The present: Valuation & current developments

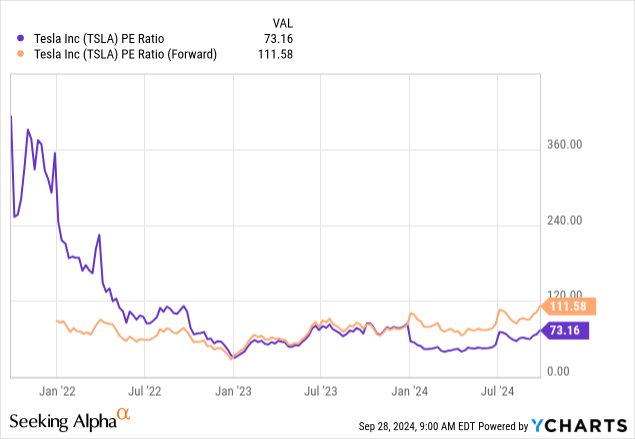

The company’s enterprise value is $815B, market cap is about $832B, so its net cash position is about $17B. As far as the valuation is concerned, the company is currently valued as expensive on a forward P/E basis as it was last in August 2022.

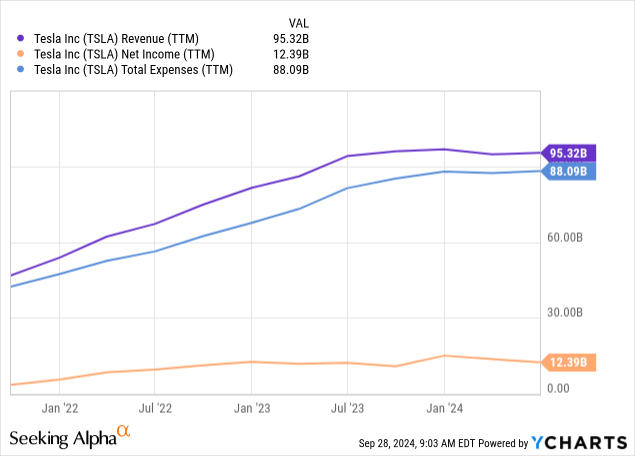

This is also because sales are stagnating year-on-year, and EPS are expected to be 25% lower this year.

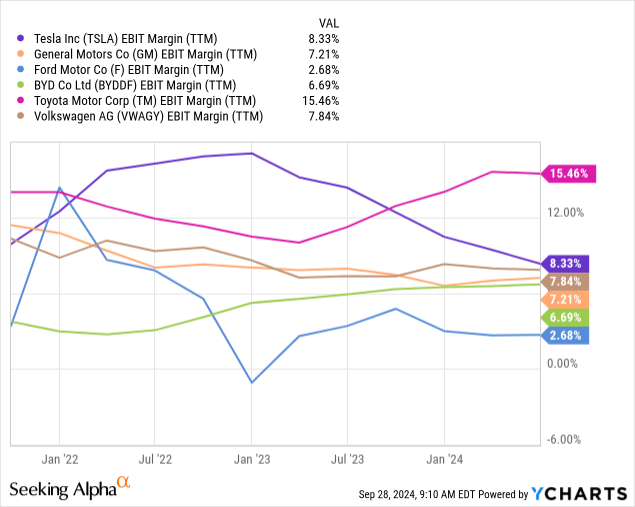

This is also because, among other things, margins have fallen significantly compared to previous times as a result of competition, particularly in China. Here is a comparison with the competition in terms of EBIT margins.

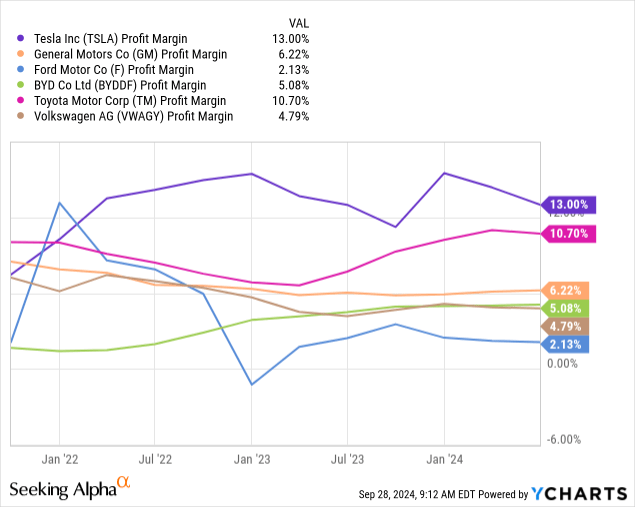

However, the profit margin is the most crucial, and Tesla is still the leader in this area. The challenges of switching to, or at least adding, EVs and everything that goes with them (setting up production facilities, selling vehicles at a loss) can be seen in the margin development of some competition-except for Toyota, which has so far almost completely stayed out of the pure electric car business.

Overall, Tesla has considerable advantages over the competition, and not only for the technological reasons mentioned above. Here is an excerpt from my last article about Tesla.

Tesla has already built up and optimized production capacities for EVs, which other manufacturers have to build up first. Therefore, Tesla can start lowering its prices earlier and thus make the electric car sales business a loss-making business for other manufacturers. If, simultaneously, the combustion business for these manufacturers is more and more shrinking, they are in a difficult position to remain competitive in the long run. In addition, manufacturers such as Volkswagen, Ford, and General Motors are already in enormous debt, while Tesla has no debt at all.

– “Why Tesla’s Margin-To-Volume Shift Is A Win.”

Risks

Of course, there are also several risks to the share’s success story, and these risks are not insignificant. Particularly given the high valuation, the realization of risks potentially means high volatility on the downside.

Firstly, there is a general slowdown in the electric car market. Financial incentives, such as purchase subsidies, have been reduced or eliminated in many countries. A second reason is the higher inflation recently, which has led to a considerable loss of purchasing power among broad sections of the population. This, combined with the continuing economic uncertainty (and in Europe, even quite a lot of pessimism), means that consumers tend to be reluctant to make major purchases.

EVs must overcome the next hurdle and penetrate the broad mass market. This will only succeed if the purchase costs, with the running costs, are significantly lower than for ICE cars.

China

In the past few years, Tesla’s business in China has been a significant success story, which may continue, but it could also turn into a risk. As far as electric cars are concerned, Tesla is the only company that still plays a significant role in China-all other manufacturers only sell minimal quantities of EVs and continue to focus their sales on combustion cars.

We have to see this in the context of the economic war. Chinese consumers are proud to have their Chinese car companies for the first time and want to support them. The country wants to become independent in all critical areas to realize its long-term goal of replacing the USA as the world’s number one power. I have already written two very detailed analyses about the general development in China, the last one in June with the title “Power Shift Part 2: Western Brands In China’s EV Market.”

I recommend reading this article to anyone interested in investing in car manufacturers. Although it has become more mainstream that Chinese cars represent a significant challenge for Western companies, I think too many people still underestimate them. China is entering the car market with tremendous momentum and offers high-quality products at a low price. This competitive pressure has already forced Tesla in China to cut prices and is unlikely to increase margins in the coming years.

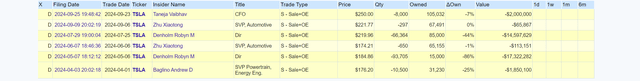

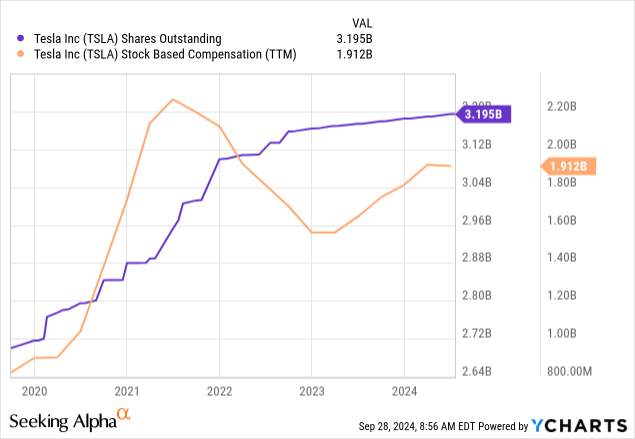

Share dilution, insider trades & SBCs

These three things are standard checks I make in every article, as excessive stock dilution and stock-based compensation (“SBC”) can disadvantage shareholders. In addition, insider trades sometimes contain valuable information about management’s confidence. Overall, things look excellent in this area. The SBCs are not excessively high, and the outstanding shares are only being increased minimally.

These are all insider trades of the last six months. There has not been much activity, which is a good thing.

Conclusion

Tesla is currently experiencing a phase of stagnation, but I believe this will only be temporary-the car market, in general, will have to be reorganized over the coming years. Many manufacturers exist, as many new ones have been added following the rise of EVs. In the upcoming years, some will leave the market, and I can imagine that a few traditional companies will also be among them.

Compared to the competition, Tesla focuses much more on the technological side of self-driving vehicles, robots, and supercomputers that handle all this. Given the general technologization of the world, I think this will be the future, whether we like it or not. Efficiency prevails, and so it will be in the automotive sector. If renting a vehicle for a few hours and having it driven around is cheaper and more efficient than owning a vehicle yourself, then it will prevail in the long term.

|

Investor’s Checklist |

Check |

Description |

|

Rising revenues? |

No |

Increasing over longer periods |

|

Improving margins? |

No |

Possible competitive edge |

|

PEG ratio below one? |

No |

PEG ratio below one may suggest undervaluation |

|

Sufficient cash reserves? |

Yes |

Vital for the survival & growth, especially of unprofitable companies |

|

Rewards shareholders? |

No |

Returning capital to shareholders |

|

Shareholder negatives? |

No |

Actions that disadvantage shareholders |

|

Stock in an uptrend? |

Yes |

Trading above its 200-day moving average? |

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.