Summary:

- Tesla, Inc. stock is not good value for money despite its recent share price drop.

- Tesla’s fundamentals are deteriorating. The net profit is dropping, whilst the company is having a price war with its rivals.

- Tesla’s strongest division in the long term is its energy storage business.

- But a recession appears to be around the corner.

- I recommend selling Tesla stock before it’s too late.

jetcityimage

Many analysts predict we are near a full-scale recession. Indeed, some banks are failing, while the Fed is raising interest rates. The question here is what stocks depreciate the most when there is an economic crisis. I would say that overvalued companies with deteriorating fundamentals depreciate the most. Tesla, Inc. (NASDAQ:TSLA), in my view, is such a stock. Yes, Tesla with its outstanding technologies, leadership positions in the EV market, and Elon Musk, its charismatic CEO. Let me explain my thesis.

Tesla’s recent news

The company’s earnings results disappointed investors. The profit and revenue figures have not reached the analysts’ estimates. It is very clear why. Tesla’s management has lowered its electric vehicle (“EV”) prices several times this year alone. In 2013 Elon Musk said (emphasis added): “I think the most important thing is to make cars that people can afford.“

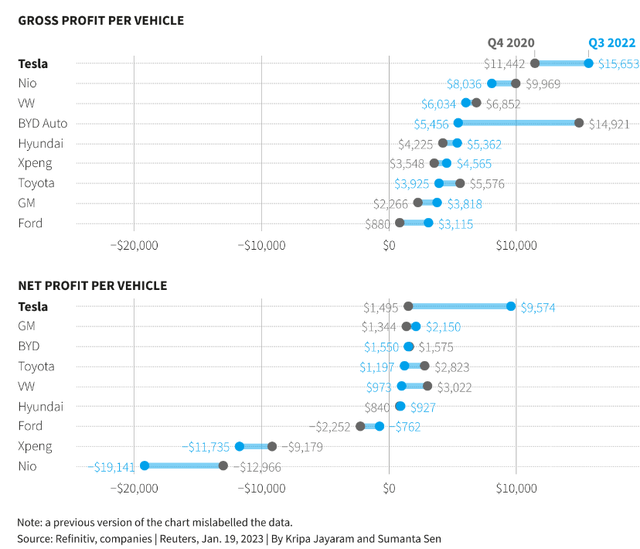

However, many analysts believe that the main target of Tesla does not only amount to making EVs mass market products. Many of them believe the company’s management is trying to force its competitors out of business. So, Tesla is having a price war. It can afford to do so in the near future because it has very high gross profit and net profit margins compared to other EV makers.

But price wars are quite risky and mean losses even for quite big and profitable companies.

Moreover, in my view, Tesla would have done much better by highlighting its electric vehicles’ exclusivity and focusing more on the niche market of environmentally concerned higher-income consumers. Like this, its margins would have been better.

EV companies have ended up having too much production capacity. After all, the green energy trend is popular in many countries, and the number of consumers willing to buy EVs is rising. But still, the extra production facilities cannot be justified. According to the EV sector forecaster Warren Browne, North American EV demand will hit a level of about 2.8 million vehicles a year. But North American EV factories will assemble more than 4.5 million vehicles. So, the overall capacity will be just under 60%. That means that EV companies will not be able to earn high margins on their production.

Tesla’s recent earnings results

Whilst a lot of good articles have already been written about Tesla’s earnings results, I would like to focus on the key points.

Earnings per share: 85 cents adjusted vs 85 cents expected by analysts

Revenue: $23.33 billion vs $23.21 billion expected by analysts

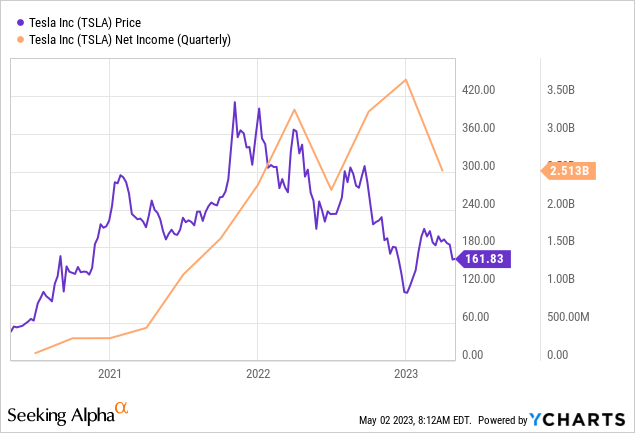

Tesla’s net income decreased by 24% to $2.51 billion, or 73 cents per share, compared to $3.32 billion, or 95 cents per share, a year ago.

Tesla’s case clearly illustrates that the “underutilization of new factories” is bad for profit margins. This is likely to continue in the future. Higher raw materials, higher logistics and warranty expenses as well as lower revenue from environmental credits, all contributed to the fall in earnings compared to last year.

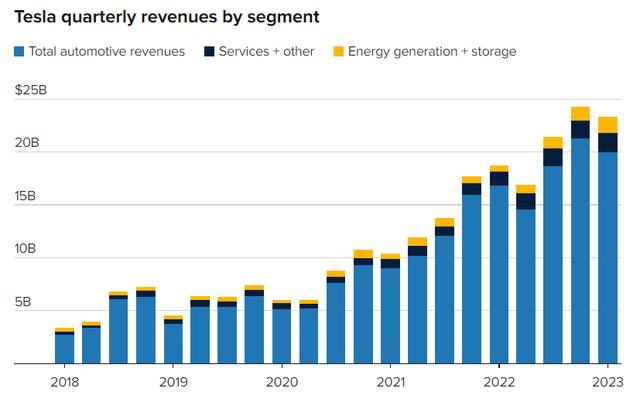

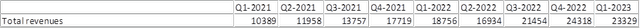

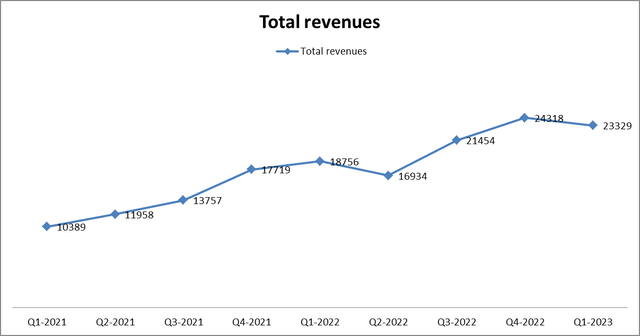

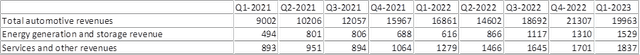

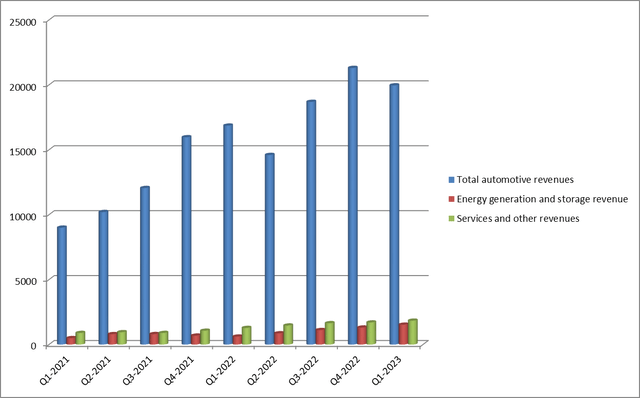

For the sake of objectivity, Tesla’s automotive revenue, the company’s core segment, totaled $19.96 billion in the past quarter, an increase of 18% compared to last year. Total revenue surged by 24%. But sales from automotive regulatory credits for 1Q-2023 totaled $521 million, a decrease from $679 million for 1Q-2022. This can be well illustrated by the diagram below.

Overall, Tesla’s sales seem to be rising. Yet, the total revenue for 1Q-2023 was somewhat lower compared to 4Q-2022.

Moreover, the net profits have not been rising in the last several quarters. Just the opposite is true. The net income reached its peak in the first half of 2022. In my view, Tesla would have been far better off focusing on its product exclusivity.

Outlook for Tesla

According to Bernstein, Tesla’s decision to recently lower prices means that “volume ambitions were far too aggressive.” The demand is simply not here.

Toni Sacconaghi, an equity analyst, mentioned that “the company still appears to be struggling to generate sufficient demand, and the impact from price cuts has been short-lived.”

In short, Tesla’s plans to deliver large volumes of Model 3 and Y EVs were far too ambitious. Earlier on, the management planned to deliver 3 to 4 million units per year – almost 50% of the total EV supplies. In Sacconaghi’s view, this is highly unrealistic because the global car market is highly fragmented. Moreover, a large share of potential buyers are skeptical of electric vehicles and will be unwilling to switch from traditional petrol-powered cars to EVs in the near future.

That is why Tesla was forced to decrease the prices to somehow stimulate demand to reach these ambitious goals. It is, therefore, likely the company would keep decreasing the prices for its EVs.

Some analysts argue Tesla is about to mass produce its fully autonomous vehicles. But investors have been hearing this for almost 10 years now since Elon Musk first mentioned this lofty target. So, the management’s expectations should always be taken with a grain of salt, in my view.

Tesla’s best-performing business

With all that being said, I believe there is a very good part of Tesla’s business that could really make its future shine in the very long term. I am talking about the energy storage division. We all know that solar energy is an important component of the modern energy mix. However, this energy source is too dependent on the weather conditions. In other words, you get energy when the weather is sunny but you end up with nothing when there is no sunlight. Storing that energy during fair weather and using it when it is cold and cloudy is a major challenge. True, there are already some ways to store this energy, including thermal storage systems, electrical storage systems, and chemical storage systems. But there is still no mass production of large solar energy storage systems. In other words, there are plenty of growth opportunities in this field.

Tesla is taking advantage of this long-term opportunity. Its energy storage division is doing extremely well, especially compared to its overall business.

If we see the table and the diagram below, we will see that in the past two years, Tesla’s total revenue growth was rather even and not very rapid.

(The data are given in $millions.)

(The data are given in $millions.)

The same can be said about the company’s automotive sales, the most important source of revenue for Tesla. The revenues from selling electric vehicles are growing fast, but nowhere near as well as the energy generation and storage sales. This can clearly be seen from the table and the graph below. In 1Q-2021 the energy generation and storage revenue was $494 million, whilst in Q1-2023 it was $1,529 million, more than 3 times higher. The growth totaled 200%, just over the 2-year period. As concerns Tesla’s automotive revenue, its growth was somewhat above 100% over the same period. This is very good on its own but nowhere near the storage business performance.

(The data are given in $millions.)

(The data are given in $millions.)

However, the energy generation and storage business did not grow very evenly. Q4-2021 and Q1-2022 were not very good in terms of growth. This area of the company is not something that produces consistent benefits yet.

But still, Tesla’s energy storage seems to be the long-term bright spot of its business. On that aspect, I fully agree with my fellow Seeking Alpha contributor Vlad Deshkovich. However, it might still take the company ages for energy storage revenues and profits to total a substantial part of its total sales and income. Right now, that business division only accounts for 6.55% of Tesla’s revenue. Such things are very hard to predict, but it will definitely take many years for Tesla’s energy storage sales to exceed its automotive revenues, but it is promising. Yet, a major recession seems to be around the corner, given the Fed’s rather hawkish stance and the failing banks. So, I still would not recommend buying TSLA stock now for the short to medium term just because of the growing energy storage.

Valuations

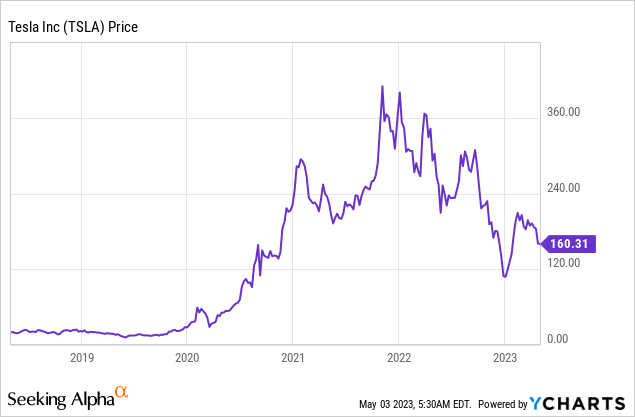

If we have a quick look at TSLA stock, we might say that it is trading far below its all-time highs. Yes, this is true. But the stock is not undervalued if we use the traditional valuation ratios.

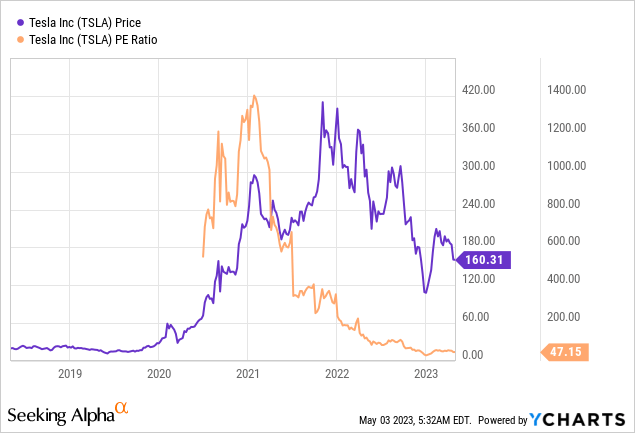

The company’s price-to-earnings (P/E) ratio is near its all-time low. It is good on its own. However, a P/E ratio of 47 is still not particularly good value for money, given the company’s falling net profits and the likely recession around the corner.

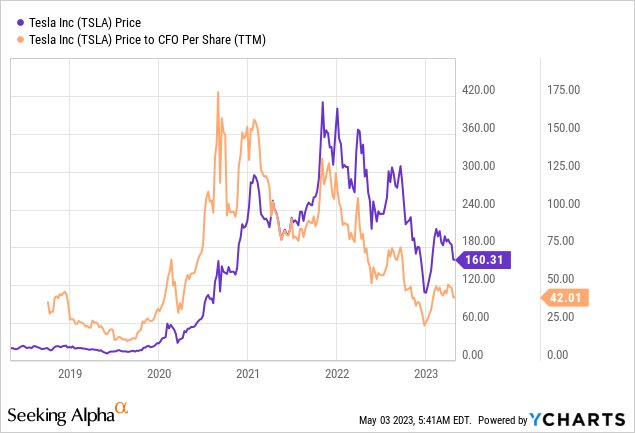

Absolutely the same thing can be said about Tesla’s price-to-cash flow per share.

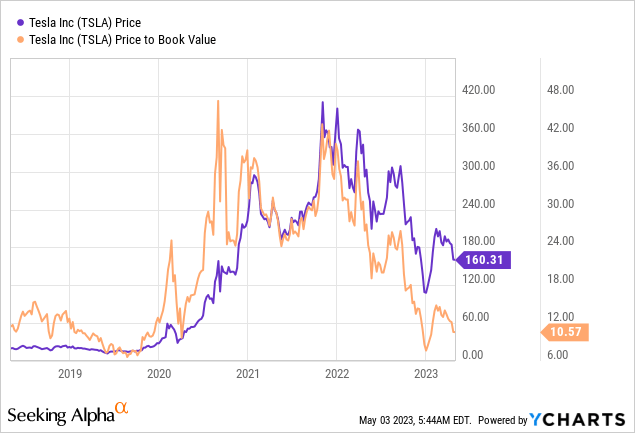

Tesla’s price-to-book (P/B) ratio is lingering near its all-time lows. Yet, a P/B of almost 11 is quite high, given the deteriorating economic outlook.

Given the fact Tesla has always been unbelievably high, TSLA stock seems to be moderately valued. But I do not think it is good value for money given the company’s deteriorating fundamentals.

Risks

Based on the above bearish assessment, you might think I am suggesting that you sell Tesla stock short. Short-selling a stock is a big risk by definition. Even if you just sell your own stock that has been bought by you for your portfolio to hedge your position, you might miss out on the gains, should the stock increase in value. But in addition to that, if you go the next step and short-sell, you might have to deal with a much larger loss since the gains are limited, whilst the potential losses are unlimited.

In the case of Tesla, it looks obvious to me the shares are overvalued, whilst the fundamentals are deteriorating. The situation might worsen if we face a real recession. However, Tesla certainly is not headed for bankruptcy in the near term. Not to mention it is considered the EV leader and remains extremely popular amongst investors. So, there is a risk some investors rush to buy TSLA too soon after the next stock market correction.

Last but not least, there is a risk no recession will come. That would mean that stock market valuations remain high, whilst bears would be the ones to lose.

Conclusion

Even though Tesla, Inc. certainly is not headed for bankruptcy and is enjoying good margins compared to other pure electric vehicle companies, I believe its stock is overvalued and is not going to do well in the near future. That is not only due to the recession we are highly likely to see soon, but is also because of the falling net profits and the price war Tesla has gotten itself into. If you are a high-risk investor and understand the risks and implications, you might wish to buy a put option or even short-sell Tesla stock. If you are more conservative Tesla shareholder, it might be more reasonable for you to just take profits.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.