Summary:

- Tesla’s stock surged post-earnings and Trump’s election, but the company continues to face significant challenges that can undermine its growth strategy.

- Despite cost efficiencies and new affordable vehicle plans, geopolitical risks and rising competition could hinder Tesla’s future performance and expansion.

- Tesla’s heavy reliance on non-core income and potential elimination of tax incentives pose significant risks to its profit margins and pricing strategy.

- Tesla is significantly overvalued, with a forward P/E of ~160x, making the margin of safety non-existent at the current price.

baileystock

Tesla’s (NASDAQ:TSLA)(NEOE:TSLA:CA) shares have been on a great run since the release of the company’s earnings results in October. The stock has also got an additional boost after the Presidential elections in the United States due to Elon Musk’s close connection with President-elect Donald Trump. While this is a good thing for Tesla’s investors, the company faces a mounting number of challenges, ranging from the negative impact on margins from the EV price war to the extensive reliance on regulatory credits to boost profits, which can undermine the growth story over time.

Tesla Surprises The Market

For most of 2024, Tesla’s stock has been underperforming YTD as the ongoing price war within the EV industry has been affecting the company’s bottom-line performance. However, the release of the company’s successful earnings report in October and the election of Donald Trump as the next President of the United States last month made Tesla’s stock rally. Currently, the stock is up ~70% YTD and up ~115% since the publication of my latest article on the company in August.

The latest earnings report has been positively accepted by the market as Tesla managed to increase its profit margins in Q3. The revenues were also up by 7.8% Y/Y to $25.18 billion. Going forward, Tesla has several growth catalysts that can help the company continue to grow its sales and potentially retain the growth momentum of its stock.

One of the biggest advantages of Tesla is its ability to efficiently decrease the costs of its vehicles in comparison to the competitors. In Q3, the COGS per car was one of the lowest in its history at ~$35,100. There’s a possibility that the costs will decrease even further, which could prompt more customers to prefer Tesla’s cars over its competitors.

We already know from the latest earnings call that the company is planning to launch a new affordable vehicle in 2025 and aims to price it at under $30,000. Some recent reports suggest that the new vehicle will be called Model Q, it’s expected to be launched in the first half of 2025, and its price with the government incentives will range between $25,000 and $30,000. If that’s the case, then there’s a possibility that Tesla will be able to boost its overall sales in 2025 even more and generate new record revenues.

At the same time, the macro environment is also on Tesla’s side. The Federal Reserve is expected to further cut interest rates this month, which should lower auto loan rates and make the company’s cars more attractive to purchase. There’s also a possibility that despite all the geopolitical risks, the American and the global economy will continue to grow in 2025, which is another positive development for Tesla.

Finally, Elon Musk’s close relationship with President-elect Trump could also benefit Tesla over the long run. There’s a consensus on the street right now that it’s going to be much easier to receive federal approvals on autonomous vehicles under the Trump administration. This is a good thing for Tesla, given that it has ambitious autonomy projects that it wants to implement in the foreseeable future.

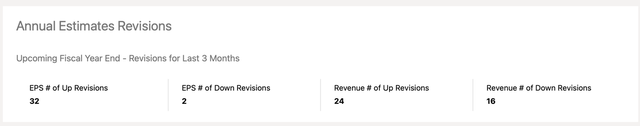

Thanks to all of those developments, Tesla has already received dozens of upward revenue and earnings revisions in recent months.

Tesla’s Street Revisions (Seeking Alpha)

At the same time, the street is far more optimistic about Tesla’s ability to boost its sales in 2025 and 2026 in comparison to 2024.

Tesla’s Revenues Consensus (Seeking Alpha)

Risks Continue To Increase

While investors are celebrating this reverse of fortune after months of underperformance, major risks continue to mount. There’s a risk that Tesla’s bottom-line performance will suffer in the foreseeable future.

In Q3, Tesla managed to improve its earnings, largely thanks to the boost from regulatory credits. Out of $2.2 billion in GAAP net income in Q3,$739 million, or ~34% of its net income, was generated by carbon credits. Such a relatively high reliance on non-core income streams to generate earnings could be considered a downside in the current environment.

Recently, Elon Musk, who also leads DOGE, publicly called for the elimination of all credits, which might include not only regulatory credits but also tax incentives that were implemented under the Biden administration and from which Tesla has been greatly benefitting in recent years. If those credits and tax incentives are eliminated, then Tesla’s profit margins could take a hit, and it’s hard to imagine how it would price its newest affordable vehicles under $30,000 without the help from the government.

The geopolitical risks also continue to rise and could undermine Tesla’s expansion in the future. Earlier this year, Tesla already announced that it had paused the construction of its factory in Mexico due to the tariff uncertainties. Currently, Tesla’s share of content produced in Mexico accounts from 15% to 25% depending on the model of the car. Given that President-elect Trump already threatened to impose new tariffs on Mexico, it’s hard to see how Tesla will benefit from another trade war.

Finally, the competition within the EV industry continues to rise and affect Tesla. The company’s share within the overall EV market is gradually declining, its margins are still below the levels achieved in late 2021 – early 2022, and its business in China appears to be underperforming as its shipments there are declining.

There’s also an indication that the price war within the Chinese EV industry is about to intensify, which could also create a new set of challenges for Tesla. Add to all of that the fact that FSD appears to not be ready for a wide scale robotaxi deployment, while Cybertruck faces demand issues, and it becomes obvious that Tesla’s downside is significant at this stage.

The Margin Of Safety Is Non-Existent

Tesla’s current valuation is another area of concern. The company trades at a forward P/E of ~170x and forward P/S of ~14x. For comparison, the sector’s median forward P/E and forward P/S are ~18x and ~1x, respectively. Considering those multiples, it’s safe to assume that Tesla is greatly overvalued at the current price. My valuation model from the previous article showed that Tesla’s fair value is $119.46 per share. This also indicates that the margin of safety at the current price for investors is non-existent.

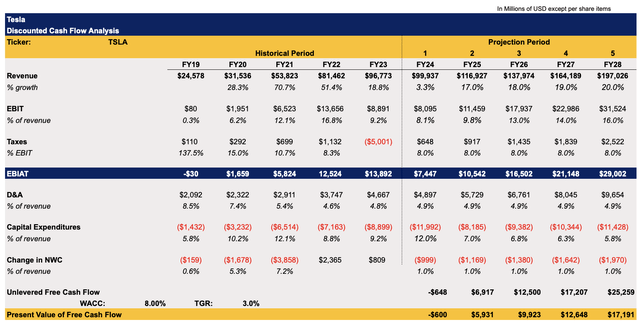

Since Tesla released the Q3 results and the street revised some of their expectations recently, I decided to also update my valuation model, which can be seen below. The revenue growth rate assumption for FY24 was increased primarily thanks to the better-than-expected performance last quarter and is n ow in-line with the latest expectations. For the following years, I expect Tesla to grow its revenues at a double-digit rate since the release of a new car next year should boost overall sales.

The EBIT growth is slightly decreased in FY24 and FY25 from the previous model due to the potential negative impact of various developments described above on the bottom-line performance. This closely correlates with the overall assumptions as well.

The effective tax rate remains in single digits as well, since the potential implementation of Trump’s new tax policy could have a favorable effect on the company in the long run. The CapEx for FY24 increased to over $11 billion and is now in-line with the management’s expectations. The assumptions for other metrics mostly remained the same and are closely correlating with Tesla’s historical performance.

Tesla’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author )

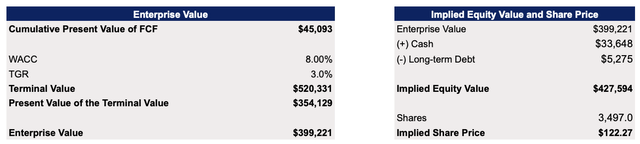

While some of the assumptions in this updated model could be fairly optimistic, especially if most of the risks described in this article materialize, the calculations show that Tesla’s fair value based on those expectations is $122.27 per share. This is above the fair value from the previous model, but still greatly below the current market price.

Tesla’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author )

Considering this, it’s safe to say that Tesla remains an overvalued company and the company’s potential utilization of various growth opportunities is unlikely to justify the current market price of its stock. Seeking Alpha’s Quant system also gives Tesla a rating of ‘F’ for valuation, while the consensus on the street is that the company’s stock represents a fairly significant downside at the current price.

The Bottom Line

Tesla’s stock had a good run in the last two months, but a further upside is not guaranteed. The major challenges that the company faces haven’t disappeared, while the recent appreciation of its stock is mostly due to speculative reasons.

In the past, I gave Tesla a rating of HOLD simply because the company’s stock constantly traded at excessive multiples as the market was ignoring some major risks, and there was always a possibility of further appreciation. Now I’m changing the rating to SELL since after the recent run of its share price it’s hard to justify the current market price.

Currently, Tesla faces many rising challenges that can undermine its performance. The end of the price war within the EV industry is nowhere near in sight, while the competition continues to rise. This makes it hard to justify Tesla’s current valuation as the margin of safety is non-existent at the current price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.