Summary:

- Self-driving is a lucrative market with potential for trillions in profits in the US alone.

- Waymo and Tesla are leading the race to self-driving with different approaches.

- Waymo is far ahead of Tesla in the self-driving race, which puts a major dent in the Tesla bull case.

hapabapa

Self-driving technology is currently the holy grail of AI applications. The pure profit potential of self-driving could result in trillions of dollars in the US alone, especially when factoring in current ride-sharing economics. This potential has led to a race among numerous automotive and technology giants to achieve reliable self-driving technology. Alphabet’s (GOOGL) Waymo and Tesla (NASDAQ:TSLA) (NEOE:TSLA:CA) are currently leading this race, though they are utilizing vastly different approaches.

While Tesla is ramping up its self-driving efforts, it is becoming increasingly clear that Waymo will likely capture most of the profits in the self-driving market. This is great news for Alphabet shareholders and terrible news for Tesla shareholders, especially considering how much of Tesla’s valuation hinges on the company’s self-driving efforts. This article will delve into why Waymo is likely to win the self-driving race and why Tesla may be overvalued as a result.

Much of Tesla’s value depends on the success of full self-driving. The company’s current market capitalization is inflated, as many view the company as a call option for this high-potential technology.

Fundamentally Different Approaches

At the core of the self-driving debate are two fundamentally different approaches. Tesla relies primarily on what it claims to be end-to-end neural networks and cameras, while Waymo employs a more comprehensive sensor suite consisting of LiDAR, radar, and cameras. While Waymo’s multi-modal approach is more expensive, it allows for greater redundancy and a more complete picture of the environment.

Furthermore, Tesla is implementing a pure-vision approach, whereas Waymo is using a map-based approach. Again, while Waymo’s approach is far more expensive—requiring the mapping of entire geo-fenced areas—it provides a greater baseline understanding of the environment, including permanent obstacles, road layouts, and traffic signals. While Tesla’s pure-vision approach could theoretically work, it requires the system to interpret and respond to every aspect of its environment in real time, a monumentally complex task with today’s technology.

Why Tesla Will Lose the Trillion Dollar War

While Tesla’s approach to self-driving is more scalable in theory, the technology required for a pure-vision approach is simply not there yet. The two major improvements that Tesla has made to its self-driving technology over the past two years have given many Tesla bulls a false impression of the technology’s readiness. Although Tesla has massively improved its system’s interventions through crowdsourced data, there are key reasons why Tesla’s approach is likely to fail.

First, the two major self-driving improvements that Tesla has made recently cannot be easily replicated in the future. The first major improvement came from an architectural shift to an end-to-end neural network system. The second major improvement came from dramatically increasing the parameter count of its self-driving technology. However, there are only so many architectural breakthroughs that Tesla can make.

Scaling laws indicate that a system becomes smarter as it scales its parameter count and data. While research supports this, the scaling laws are quadratic in nature. This means that a tenfold improvement in parameter count requires a 100-fold increase in compute capacity. Given that Tesla needs to fit the self-driving hardware in the car, it cannot scale its systems to the same degree as companies running frontier multi-modal models.

Even if Tesla somehow overcomes this technical hurdle, the company will need to scale its self-driving data concurrently. This could also become problematic, as there is no way to predict exactly how much data would be needed. Some AI experts, like Yann LeCun, believe that the amount of data Tesla will need to gather may not be feasible due to the numerous corner cases that automobiles encounter.

Tesla’s Self-Driving Intervention Data is Dismal

While Tesla does not officially release intervention data, there are crowdsourced efforts that provide a rough picture of Tesla’s progress. Teslafsdtracker reports that for Tesla’s latest FSD version 12.5, customers report a critical intervention every 216 miles for overall miles and every 132 miles for city miles. This is many orders of magnitude worse than Waymo’s disengagement rate and safety statistics, which indicates intervention rates in be in the tens of thousands.

Tesla’s crowdsourced intervention data clearly shows that the company’s self-driving technology is not even in the same league as Waymo’s when it comes to real-world safety. To make matters worse, the only two times that Tesla has noticeably improved its intervention data were the aforementioned architecture change and parameter increase. For 2-3 years prior to the architecture change, Tesla’s intervention data was more or less stagnant, which contrasts sharply with Elon Musk’s promise of exponential improvements.

Waymo’s Approach Works

Waymo’s more cautious and risk-averse approach has allowed the company to leapfrog the competition. The company’s use of a highly redundant system, which comes from its integration of data from LiDAR, radar, high-resolution cameras, and pre-mapping, has enabled it to operate robotaxis on a small scale in cities like Los Angeles and Phoenix. While Waymo was initially criticized for being too conservative in its approach, such caution is clearly paying off, as Waymo is the only company operating robotaxis at any meaningful scale.

Recently, Waymo reported that it is experiencing roughly 100,000 paid rides a week, which represents a doubling over the past few months and a 10x increase from a year ago. This exponential growth is likely to continue as the company gathers more data from its growing fleet. This will help Waymo close the data gap that Tesla currently holds.

Waymo Using Capital as a Weapon

In addition to its technological advantages over competitors like Tesla and GM’s (GM) Cruise, Waymo also has unparalleled resources at its disposal thanks to its parent company Alphabet. Alphabet will be able to use its capital as a weapon, especially given how resource-intensive it is to build and operate robotaxis. Zoox may have a chance to compete on the capital front given its backing from Amazon. However, the company is far behind Waymo in terms of technological capabilities and scale. Even still, it is hard to imagine that Amazon will be willing to plow tens of billions of dollars into Zoox just to keep up with Waymo, especially considering how capital intensive Amazon’s core businesses of retail and cloud are.

As Waymo continues to scale up its operations, the company should experience dramatically lower costs due to economies of scale—from manufacturing to increased concentration of robotaxis, which should allow for shorter wait times and thus more efficient use of its vehicles. This will enable Waymo to further decrease its prices and put even more pressure on competitors. Among the current players in the self-driving market, it is hard to see which competitor will be able to keep up with Waymo purely on the economic front, let alone the technological front.

Tesla Clearly Overvalued if it Loses the Self-Driving War

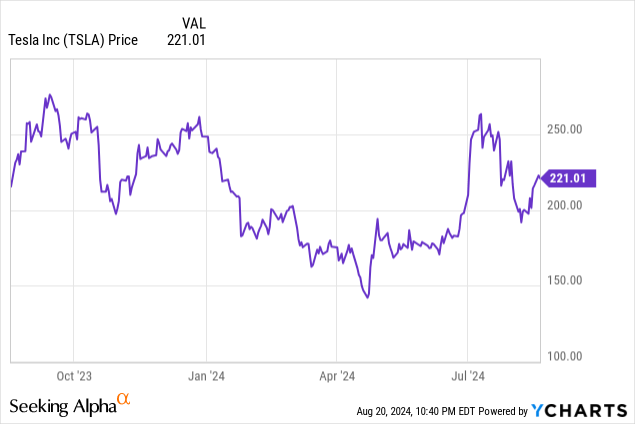

Tesla currently boasts a market capitalization of $693 billion, which translates to a forward P/E ratio of 62. This contrasts sharply with the valuations of traditional automakers, which usually hover around 10. While a higher-than-average P/E ratio can be somewhat justified given Tesla’s first-mover advantage in EVs, even this advantage may not hold up given the influx of highly competitive Chinese EVs.

Analysts largely agree that Tesla’s inflated P/E ratio is mainly a result of the company’s ambitions in AI, namely full self-driving. Elon Musk has even stated that the majority of Tesla’s value lies in its ability to achieve full self-driving. While the economics of full self-driving are indeed mind-blowing, especially if it can be achieved purely using Tesla’s vision approach, Tesla’s approach is clearly not paying off.

To make matters worse, in the increasingly likely event that Tesla is unable to achieve full self-driving in the foreseeable future, the company will have likely burned through tens of billions of dollars on a product that does not work, while Waymo will likely be scaling up in all the major cities. Even if Tesla does eventually achieve FSD many years down the line, the plethora of competitors in the space will likely push down margins to a point where self-driving becomes a commodity.

In such a scenario, Tesla’s sunk costs will be enormous, as it will have invested billions of dollars into developing a self-driving technology that is simply inferior to that of Waymo’s is terms of safety and reliability. Moreover, the opportunity cost from investing so much time and resources into self-driving technology will also be massive, as Tesla has many other major markets that it could be investing in.

Every dollar that gets invested into developing self-driving is a dollar that could have been spent on its core EV and battery pack manufacturing businesses. Elon Musk has stated that “investment in training compute, gigantic data pipelines and vast video storage will be well over $10B cumulatively this year” when discussing its self-driving efforts. Tesla is clearly staking the company’s future on self-driving.

If self-driving is mass adopted, overall demand for automobiles will likely decline. After all, many consumers may forego personal vehicle ownership in favor of a cheap self-driving alternative. Given that personal vehicles are incredibly underutilized, overall demand for vehicles will almost certainly decline even if overall miles driven remain the same. If Tesla is unable to truly capitalize on self-driving, it will see demand for its EVs drop as a result of self-driving adoption.

Growing Number of Serious Competitors

Given the enticing economics of self-driving, a growing number of smaller competitors are investing serious amounts of resources into the technology. Companies like Mobileye (MBLY), Cruise, Zoox, Apollo, and Pony.ai are all making serious inroads in advancing their own self-driving technologies. What’s more, many of these companies also have large backers. For instance, Zoox has the backing of Amazon (AMZN) and Apollo has the backing of Baidu (BIDU).

Chinese players like Apollo and Pony.AI may find strong footholds in China, but are unlikely to make major inroads in Waymo and Tesla’s markets as a result of geopolitical tensions. Western governments are unlikely to allow millions of Chinese robotaxis to operate in their countries’ streets, which could result in security risks as a result of unauthorized data collection. As such, domestic players like Waymo and Tesla have little to worry about from the major Chinese players.

Cruise, which is backed by General Motors (GM), appeared to be leading the self-driving race at one point. However, the company’s reckless approach has led to numerous incidents that have set the company back in terms of public perception and regulatory approval. Rehabilitating its image and gaining the approval of regulators once more will be incredibly difficult.

Amazon’s Zoox may have the biggest chance to legitimately compete with the likes of Waymo, especially given the resources that Amazon can throw at Zoox. Although Zoox is focused more on niche markets like self-driving delivery, the company has the means to take serious market share in the self-driving market. However, Zoox is still far behind Waymo, as it is still largely in the testing stage of its products.

Conclusion

Elon Musk has staked much of Tesla’s future success on the outcome of its full self-driving software. The company plans to invest tens of billions of dollars in compute and training in the coming years, which means that Tesla will essentially be burning cash if the technology does not work out. So far, the technology appears to be far from ready.

Waymo is the only company with a real robotaxi business that is actually growing at an exponential pace. By the time Tesla has a workable self-driving product, Waymo will likely have saturated all the major markets. As a result, Tesla should be valued similarly to most other companies. Even if we assign a relatively generous P/E ratio of 20, this puts Tesla’s valuation at around $230 billion, which is a far cry from its current valuation. Investors should definitely avoid Tesla at its current valuation given all the risks associated with the company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.