Summary:

- When I last covered Tesla, Inc., I provided fairly bearish commentary, on the grounds that the company’s margins were likely to shrink due to increased competition.

- Since then, the company’s margins have shrunk, but it has made progress on “full self-driving, or FSD.

- FSD is unlike any of the other autonomous car projects currently underway: it aims to make Tesla EVs completely autonomous even in novel environments.

- If FSD can achieve mass release, then it will give Tesla a major differentiator and possibly ramp up its growth.

- In this article, I explain why I believe those shorting Tesla today are taking a bigger risk than longs are.

Tesla Shanghai Gigafactory Xiaolu Chu

Tesla, Inc. (NASDAQ:TSLA) is the rare big tech stock that hasn’t yet retaken its COVID-era highs. Peaking at $407 in 2021, it has underperformed the broader indexes. For those who bought at the top, the return has been -57%. This is really remarkable because the S&P 500 Index (SP500) – of which TSLA is a part – is up 10.5% during the same period of time. The tech-heavy NASDAQ (COMP.IND), of which Tesla is also a part, is up 9.9% during that time period.

I don’t mean to congratulate myself too heavily, but I saw this coming. In June of 2022, when Tesla’s bear market was just starting to get underway, I rated the stock a sell – a rating that proved quite prescient. Tesla continued selling off after I issued it. As the bear market went deeper, I upgraded my rating to hold – albeit a weak hold with bearish commentary. As you can see in this article, I thought that TSLA’s discounted cash flows (“DCF”) in a no-growth scenario did not justify the stock price, but I rated it Hold nonetheless. My reasons for doing this were twofold: one, the stock had fallen in price from the level at which I previously covered it; two, I didn’t want to encourage people to short the stock. Although I felt Tesla overvalued, I didn’t see the problems as being severe enough to guarantee an abrupt selloff.

It has now been more than a quarter since I last covered Tesla. Consistent with my most recent article on the stock, I no longer consider it a clear sell, as I did when I first started covering it. Although TSLA trades at fairly high multiples, it’s not the most expensive big tech stock anymore. It actually has lower trailing multiples than Nvidia (NVDA) does–though, of course, that stock has shown much better growth.

Despite selling off by nearly 60% from the highs, Tesla has made considerable progress on some of its most promising projects. The energy business has been improving for years, and unlike the core automotives segment, continues to grow. The services segment is growing at 27%. Finally, much progress has been made on full self-driving (“FSD”)–to the point that impartial experts (e.g., PhD physicists) are saying that the latest FSD beta test performs better than human drivers. That last factor wasn’t part of the equation when I last covered Tesla. It demands that I revisit the stock.

Today, I still consider Tesla stock a “hold,” although with more potential upside than downside risk. This is a reversal of my previous opinion, which is that the risk to longs was greater than the risk to shorts. My previous article contained a discounted cash flow model that assumed 0% growth and valued TSLA at around $100. I maintained a hold rating despite this price being 37% lower than the price at the time, because I maintained that Tesla’s technological innovations could plausibly re-ignite growth again. Today, the plausibility of that happening is higher than it was when I wrote my previous article.

For this reason, I maintain my Hold rating, and my opinion that the stock is best avoided; but now I counsel against short positions in Tesla more insistently than long positions. In the ensuing paragraphs I will explain this change to my opinion on Tesla, and what it means for investors.

Tesla’s Growth Catalysts

A key contributor to my change in opinion on Tesla is the company’s progress on key growth initiatives. When I last wrote about Tesla, the company’s growth was slowing while its margins compressed. The company was cutting prices in an attempt to get revenue growth up; despite the efforts, automotive sales grew just 1% in Q4, while margins declined. It all looked pretty dire.

Indeed, CEO Elon Musk himself seemed to have considered it pretty dire, as shortly before the Q4 earnings release came out, he said that Chinese EV makers would “demolish” the competition if countries didn’t erect trade barriers. He didn’t specifically count Tesla among the EV companies that would be “demolished,” but being the world’s biggest non-Chinese EV company, Tesla was implicitly included in that category.

Indeed, if Tesla were simply a car manufacturer, it would be in trouble. Competition in EVs is heating up, and if EVs start to look like internal combustion engine (“ICE”) cars, then there won’t be much room for margins or growth. Below you can see a table of three of the top legacy automakers, along with their trailing 12 month (“TTM”) margins and growth rates as reported by Seeking Alpha Quant:

|

Volkswagen (OTCPK:VWAGY) |

GM (GM) |

Ford (F) |

|

|

Net margin |

5.15% |

5.9% |

2.5% |

|

Revenue growth |

15.5% |

9.6% |

11.4% |

|

EPS growth |

7.6% |

19.4% |

N/A (negative in base period) |

As you can see, not a whole lot of growth here, and pretty low margins. Tesla meanwhile has a 15.6% net margin–if it trends in the direction of the traditional auto-makers, then it will become less profitable.

Nevertheless, there are several catalysts that could lead to a ramp up in growth at Tesla, and help it lock in high margins.

The biggest one is the impressive progress that’s been made on full self driving. One of the reasons why FSD remains in perpetual beta test mode is because it needs to achieve a very high safety standard to be approved for mass release. The project is ambitious: it’s the only self-driving AI that aims to be so thoroughly trained that it can handle novel environments: other “robo taxis” you may have read about were trained in specific areas and can only handle those environments. If FSD becomes what it’s intended to become, then it will be the best self driving AI in the world.

Unfortunately, until now, it has not become what it was intended to be: it has been mired by safety concerns that have held back a wide release. Debate has raged over whether FSD is safer than an average human driver: there have been passionate cases made for the affirmative and the negative.

What’s undeniably true is that there’s a growing chorus of experts saying the latest version of FSD is or will be safer than human drivers. AI expert James Douma says that if FSD beta 12.X achieves a 1% of the human interventions that FSD 11 needed, which would mean one intervention every three months to one year. Physicist Paul Pallaghy called FSD 11.3 “really impressive,” and also touted a point that I mentioned in past articles: that it’s attempting to drive anywhere without pre-mapping its routes. This meaningfully distinguishes FSD from Waymo and Cruise and demonstrates that if FSD can leave beta testing and go mass-market, it will have a differentiator. That argues for the possibility of TSLA continuing to outperform its competitors’ stocks.

Updated Discounted Cash Flow Model for Tesla

To explain why I now think there is more risk to those shorting Tesla than those going long the stock, I have to look at the stock under several scenarios. In a past article, I put Tesla’s fair value in a no growth scenario at between $75 and $110. If Tesla never grows again, then it is indeed worth somewhere in that range, going by discounted cash flows.

However, as I showed in the preceding paragraphs, several experts believe Tesla’s FSD is nearly ready for prime time. If they’re right about that, then TSLA will have a major edge over its competitors. Additionally, FSD 12 is becoming “less hesitant” and more human-like in its driving, which shows that its developers are increasingly confident in the technology. Were FSD to achieve wide release and truly eliminate the need for passengers to drive their cars, it would be a game-changer. Teslas would have technology that no other company possesses–sales acceleration would be likely. So, I need to model a scenario in which Tesla continues to grow.

Tesla’s five year CAGR revenue growth rate is 35%. The company has achieved such scale that it is not likely to get back there even with FSD in full release. However, as I showed in previous paragraphs, even legacy automakers can achieve growth rates around 16%.

I will model Tesla’s revenue growth at 20%–slight acceleration from the TTM growth rate of 18%. I will further assume that COGS grows at the same rate. Using Seeking Alpha Quant’s historical income statements, I calculated a 15.3% CAGR growth rate in operating expenses for Tesla. I will use that as my estimate for operating expenses.

I model interest expense/income at $0 for the next five years, as it has averaged near-zero over the previous five. Finally, I’ll use 10% as the tax rate, as it was close to that in 2022, while 2023’s deeply negative tax rate would be over-optimistic if used in a forecast. These numbers produce the model below:

|

BASE PERIOD |

YEAR 1 |

YEAR 2 |

YEAR 3 |

YEAR 4 |

YEAR 5 |

|

|

Revenue |

$96.8B |

116.2B |

$139.3B |

$167.4B |

$200B |

$241B |

|

COGS |

$79.1B |

$92.9B |

$113.9B |

$136.7B |

$164B |

$196.8B |

|

Operating expenses |

$8.77B |

$10.1B |

$11.65B |

$13.44B |

$15.5B |

$17.87B |

|

EBIT/EBT |

$9.9B |

$13.2B |

$13.75B |

$17.26B |

$20.5B |

$26.33B |

|

Tax rate |

-50.5% |

10% |

10% |

10% |

10% |

10% |

|

Net income |

$14.9B |

$11.9B |

$12.375B |

$15.5B |

$18.45B |

$23.7B |

|

Shares outstanding |

3.174B |

3.174B |

3.174B |

3.174B |

3.174B |

3.174B |

|

EPS |

$4.72 |

$3.74 |

$3.89 |

$4.88 |

$5.8 |

$7.46 |

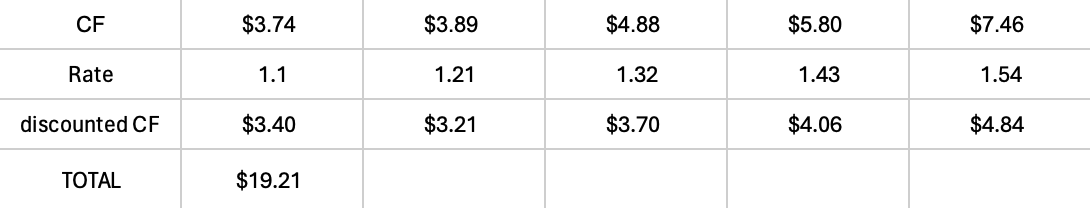

We have a 9.5% CAGR growth rate in EPS. Discounted at 10%, these cash flows are worth $19.21 (see table below).

Discrete forecast math (The author)

Now, as for terminal value, we can safely assume that Tesla will grow by at least 9% if FSD is achieved, as there are legacy automakers doing such a rate already, with no such differentiators. We’ll use that as our estimate. So we end up with a final cash flow of $5.08 and a terminal value of $508. Finally, the present value of the terminal value is derived by discounting $508 at the last discount rate shown in the table above, times 1.1. That gives us a discount rate of 1.69 and a $300 present value of terminal value.

Now, in the article I alluded to in the paragraphs above, I said that TSLA’s fair value in a no-growth scenario was between $75 and $111. For the sake of conservatism, I’ll go with the lower of these in estimating the weighted average of my two scenario-based estimates. Weighting each Tesla, Inc. scenario at 50%, we get a fair value estimate of $187.5. That’s approximately 6.6% upside to today’s price.

It’s for this reason that I rate Tesla a hold. 6.6% isn’t an amount of upside worth chasing: the S&P 500 (SP500) beats that in a typical year. However, note that when you average my two estimates, you do get upside–there’s not only upside in the best case scenario, there is upside in the average of two extremes. This implies that there is more risk in shorting Tesla now, than in buying the stock.

So, while I maintain my rating, I revise my opinion slightly: although Tesla stock appears likely to underwhelm, shorts are taking more risks than longs on the stock today.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.