Summary:

- Tesla, Inc.’s recent performance has been disappointing, with stalled growth in EV deliveries and declining net income despite numerous price cuts.

- The much-anticipated robotaxi event failed to impress investors, leading to a nearly 9% drop in Tesla’s stock price.

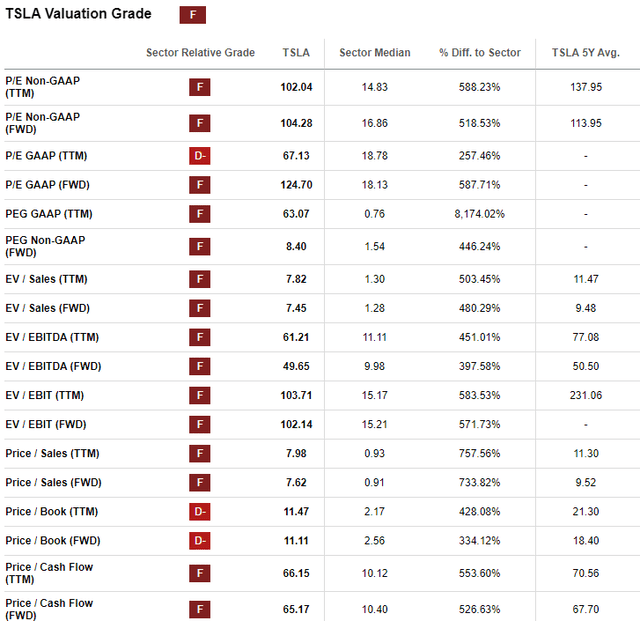

- Tesla’s stock remains highly overvalued compared to its competitors, with P/E ratios significantly higher than industry medians.

Brandon Woyshnis/iStock Editorial via Getty Images

A lot has happened since my last Tesla, Inc. (NASDAQ:TSLA) stock coverage. Yet again, the company produced a rather disappointing deliveries report, published on 2 October. Furthermore, Tesla’s June 2024 earnings results were quite poor. The company is due to post its third-quarter results on 23 October 2024, which I do not expect to be brilliant. Even the much-expected robotaxi event disappointed Tesla’s investors. But let me go into more detail.

My previous article on Tesla

In my previous analysis of Tesla, I wrote that the corporation’s latest earnings showed deteriorating fundamentals, with a 9% drop in sales and a 55% decrease in net profit margin.

At the time, EV deliveries were also down, while operating expenses surged. Despite Tesla’s rather deteriorating performance, the stock price was very high compared to the corporation’s rivals.

I also mentioned key risks to my rather pessimistic thesis, including the company’s potential innovations, market share growth in China, and strong global EV sales.

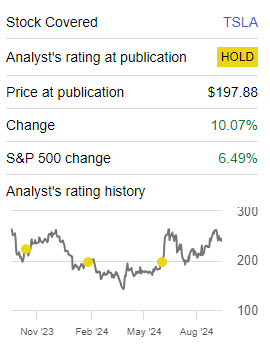

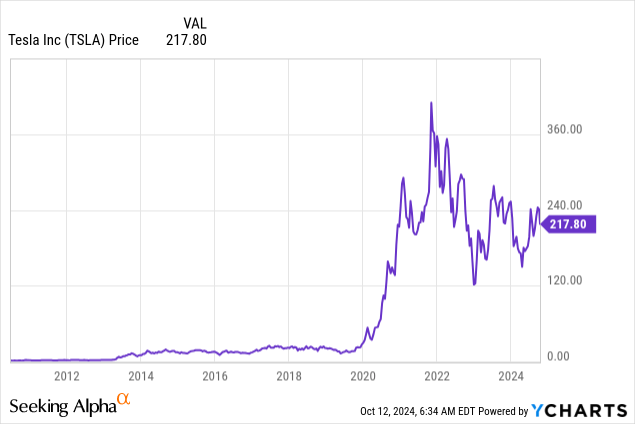

Since my coverage of TSLA stock, it has gained almost 10%, versus the S&P 500’s (SP500) gain of about 6% as of the time of writing.

Seeking Alpha

In my view, this was due to the stock market’s expectations of Tesla’s robotaxi event. There were no other real reasons behind the positive change because the last earnings and deliveries reports were both rather mediocre. However, even the robotaxi event disappointed investors.

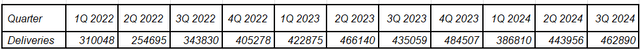

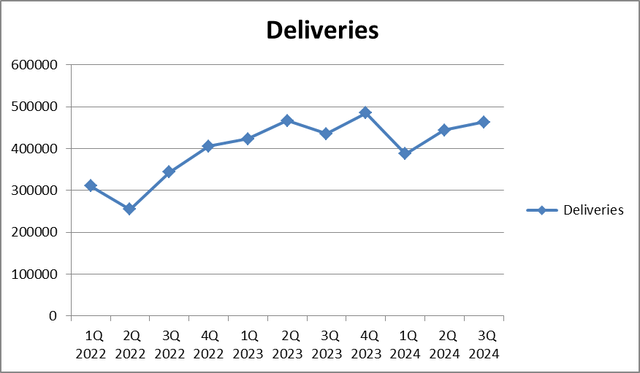

Tesla’s deliveries and results

In the last several quarters, I would say that Tesla has not justified its reputation as a high-growth company, to say the least. The growth rate has stalled between the years 2022 and 2023. Even though the last reported figure of 462,890 EVs delivered in 3Q 2024 was described as excellent by many market observers, it was roughly in line with the numbers reported for 2Q 2023, 4Q 2023, and 2Q 2024.

Tesla’s deliveries history

Prepared by the author based on Tesla’s data

Prepared by the author based on Tesla’s data

As can be seen from the diagram above, the last successful quarter in terms of deliveries was arguably 4Q 2022. Thereafter, the growth rate has stalled.

Now let me take a look at the company’s quarterly earnings updates.

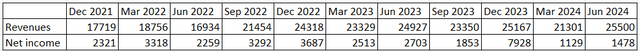

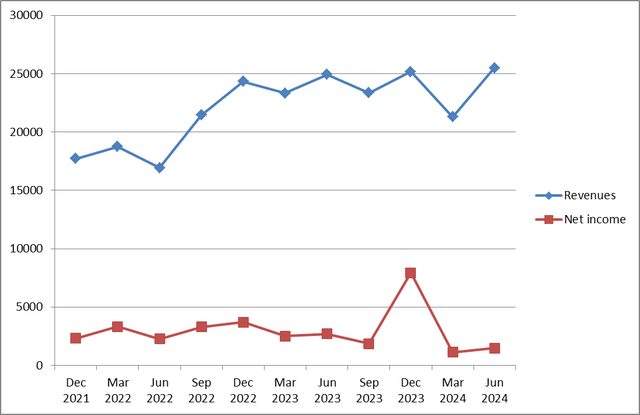

In terms of net profits, the June 2024 quarter was only slightly better than a relatively unsuccessful March 2024 period. The 2Q sales were somewhat better, but not by much than the ones reported for the December 2023 and June 2023 quarters. Moreover, the fair sales figures and very poor net income numbers suggest the company’s inefficiency. As I have mentioned many times before, this situation is due to Tesla’s EV price cuts. Despite the numerous price cuts, the sales are not growing as much.

Tesla’s revenue and net income figures (the data are given in $ millions)

From the diagram below, it also seems that the sales growth has stalled after 2022.

Tesla’s revenue and net income figures (the data are given in $ millions)

Prepared by the author based on Seeking Alpha’s data

So, while sales growth has stalled, net income numbers seem to be on the decline.

Robotaxi event

On 10 October, there was a much-expected robotaxi event where Tesla presented its key innovations. Elon Musk presented a two-seat Robotaxi prototype and said that a total of 50 fully autonomous cars were available.

Musk seems highly optimistic about robotaxis. According to Tesla’s CEO, their safety level is high, while their operating expenses on a per-mile basis are quite low. Mr. Musk described a situation where an Uber (UBER) or Lyft (LYFT) driver could manage a fleet of autonomous vehicles. As concerns Musk’s expectations of fully autonomous self-driving, he expects to launch it in Texas and California in 2025 for the firm’s Model 3 and Model Y versions. According to Musk, production is likely to begin in 2026 and is expected to cost below $30,000 per unit.

Another surprise of the event was an autonomous robovan prototype that can transport up to 20 passengers or a considerable load of goods. Mr. Musk also presents this development as useful in decreasing transportation expenses. He argues the cost of travel can go down to $0.05 or $0.10 per mile.

Another Tesla prototype was the Optimus humanoid robot that can help with household or business tasks such as bartending. Tesla’s CEO expects it to cost between $25,000 and $30,000. Musk expects the product to be a great success due to the high demand for it from most people.

Even though these inventions and innovations might seem impressive, I would say that there is plenty of uncertainty on how these will be monetized. To start with, Elon Musk’s estimates on the possible launch dates as well as the potential costs are highly approximate. As I have mentioned many times before in my other articles, Tesla’s management tends to be far too optimistic when it comes to forecasting innovations and demand for Tesla’s products. Even if we assume these expectations are very accurate, no specific details were given on how much profit and when these innovations would generate.

Surprisingly to me, the market reacted negatively to this event. Normally, Tesla’s investors tend to react very positively to any of the management’s announcements and positive expectations. However, just like me, the market was skeptical of the achievements and forecasts announced during the event. The stock opened down by almost 9% during the 11 October trading session. In my view, this was due to the fact the management was very vague and did not explain how exactly and how much the company can profit from its inventions.

Tesla’s Q3 earnings expectations

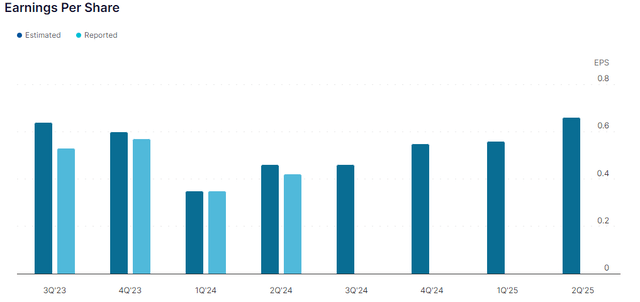

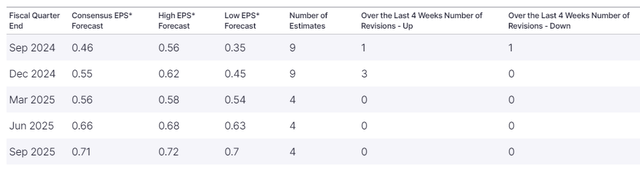

After having discussed Tesla’s news, I would like to discuss the 3Q earnings results that the company is set to post on 23 October 2024. Here is what analysts expect:

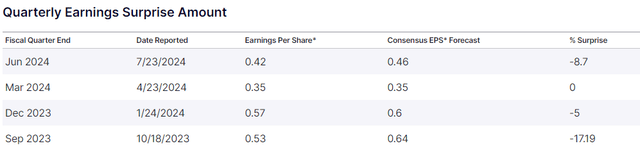

The average EPS expectations for 3Q 2024 are $0.46, somewhat higher than the actual figure of $0.42 reported for the previous quarter.

As can be seen from the table above, in the recent several quarters, Tesla has been reporting somewhat lower earnings figures compared to analysts’ average expectations. It is quite likely the same will happen during the 23 October earnings call.

Even though numbers always matter, I would look even more carefully for any updates on the company’s innovations, including its exposure to AI. Most analysts carefully watch any EV updates, especially Tesla’s sales in China. This is very understandable because a large majority of Tesla’s revenues come from selling EVs.

But this is not the company’s highest-growth division. I would also look for any updates in Tesla’s energy generation and storage segment. It accounts for 6.2% of Tesla’s total revenue and includes the design, manufacture, installation, sales, and leasing of solar energy generation and energy storage products, as well as sales of solar energy systems incentives. This division is not as large as Tesla’s EV business. But it is much more successful. At the end of 2023, Tesla’s energy storage deployments reached 14.7 GWh. Total installations for 2023 were more than double than in 2022, a surge of 125%. The division’s profit nearly quadrupled. It would therefore be interesting for me to see this segment’s progress. I would also listen to the management’s earnings call and the CEO’s outlook on Tesla’s accounting and sales fundamentals. However, it is worth treating this information with some skepticism because every so often the management’s optimism is not justified.

Upside factors

The upside risks are significant. First and foremost is Tesla’s market share. Not only is the company the US leader, but it also has a substantial market share in overseas EV markets. Despite tough competition in China, it is still growing its sales in this country. Add to that the fact that it invests heavily in innovations, including AI. I do not believe Tesla’s management’s great expectations are always justified. However, there is a risk that the corporation can announce substantial progress in one or more fields. Therefore, the stock price can soar, thus making TSLA short sellers record considerable losses, given the stock’s popularity among investors.

Downside risks

The downside risks are clear as well. First, Tesla’s stock is highly overvalued, while its sales and profit growth rates have substantially slowed down. Then, the company relies heavily on selling EVs. Its other divisions do not expand at a fast pace and are not accountable for a substantial share of Tesla’s earnings or revenues, while Tesla’s EV sales growth rate is down. The stock’s valuations significantly rely on the market’s assumptions that Tesla would come up with outstanding innovations.

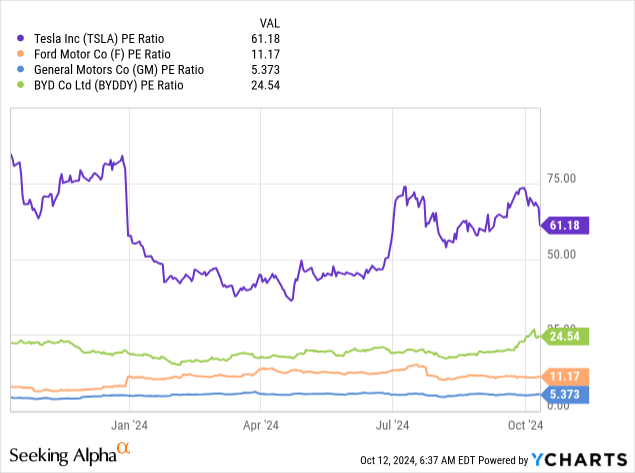

TSLA stock valuations

On the surface, it does seem that Tesla’s stock is not trading at its all-time highs. In other words, TSLA stock price used to linger near the $360 mark. It is now selling for about $220 per share, substantially above the $120 low reached between 2022 and 2023. However, it is still highly overvalued compared to the whole auto sector and its close competitors.

So, if we look at the table below, we will see that Tesla’s P/E ratios are about 7 times higher than the sector’s medians. Tesla’s 5-year averages, however, are somewhat higher. The same is true of almost all the company’s valuation ratios, including EV/Sales, PEG GAAP, and Price/Cash flow. At the same time, TSLA’s average valuations were somewhat lower than they currently are. In other words, TSLA stock has always been ridiculously overvalued according to the classical valuation ratios analysis.

But let me compare Tesla’s valuations to those of its close competitors, namely Ford (F), General Motors (GM), and BYD Company Ltd. (OTCPK:BYDDY). The diagram below shows how these leading automakers, also producing EVs, compare to TSLA in terms of their P/E ratios.

TSLA’s P/E ratio of about 62 is more than 2 times higher than its close competitor BYD’s, the leading EV-maker of China, about 6 times higher than Ford’s and more than 10 times greater than that of General Motors.

This means that Tesla, Inc. stock is highly overvalued.

Conclusion

During the robotaxi event, several interesting innovations were presented by Tesla. However, no detailed information was given on how profitable these new products would be for the corporation. The market, therefore, reacted rather negatively to the event. Since my last article on TSLA, no substantial positive changes have taken place despite the stock price rise since then. I am still neutral on TSLA stock because of its popularity among investors and due to the possibility of positive changes.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.