Summary:

- Tesla stock has surged despite declining automotive sales revenue and market share, leading to a ‘strong sell’ rating.

- Increased competition in the electric vehicle market, coupled with Elon Musk’s questionable actions, poses significant risks to the company.

- Unless something changes, the picture for the business will likely only worsen.

wellesenterprises

I don’t know about you, but to me, one of the most interesting things about the market is watching scenarios where share prices significantly diverge from fundamentals. As a long-oriented value investor, I love finding opportunities where a company is trading at a significant discount to its intrinsic value. But there is also a certain morbid fascination that I have with seeing the opposite, which would be a case where a company is drastically overpriced.

One such example of this can be seen by looking at electric vehicle manufacturer Tesla (NASDAQ:TSLA). And the situation regarding the company has become even more severe over the last few months. You see, since I last rated the company a ‘sell’ back in April of this year, shares have skyrocketed by 35.6%. This is well above the 7% increase seen by the S&P 500 over the same window of time. However, it is worth mentioning that since I initially rated it a ‘sell’ in June of 2023, the stock is still down 9.3% while the S&P 500 has soared by 23.9%.

The recent upswing seen by shares might be viewed by investors as a sign that the picture for the business is turning around. But based on my own observations, the opposite is true. The market is getting overly excited about a company that is not only struggling, but that will likely continue to struggle even more moving forward. In addition to this, significant concerns over the quality and incentives of Elon Musk should stoke in investors even more fears. In light of all of this, I have decided to take and even more aggressive step myself by downgrading the stock from a ‘sell’ to a ‘strong sell’. This is a designation that I assigned stocks that either have significant fundamental or legal issues, or that are trading at massive premiums compared to what you would expect.

The picture is worsening

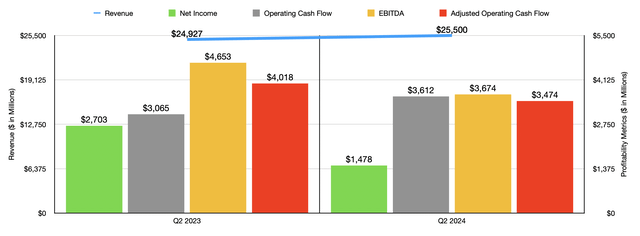

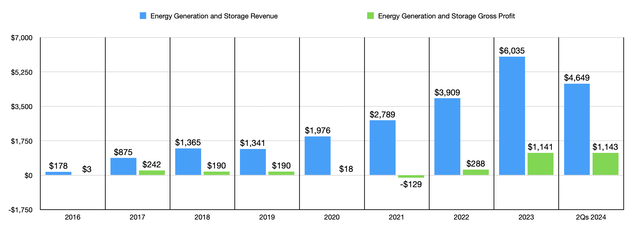

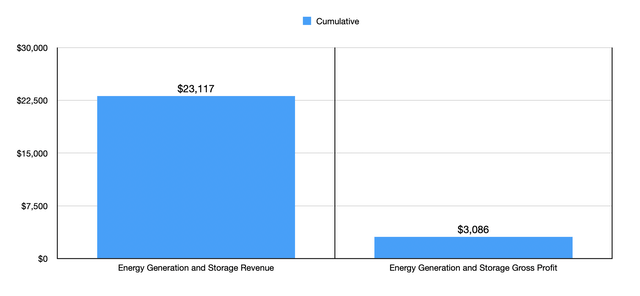

Fundamentally speaking, things are not going well for Tesla. At a high level, we need only to look at financial performance seen this year compared to last year. In the latest quarter, which would be the second quarter of the 2024 fiscal year, the company reported revenue of $25.50 billion. This does represent a 2.3% increase over the $24.93 billion generated one year earlier. But this is really only because of certain non-core operations like the automotive regulatory credits that saw sales grow from $282 million to $890 million, its Energy Generation and Storage segment that reported a surge in revenue from $1.51 billion to $3.01 billion, and its services and other operations that reported a rise from $2.15 billion to $2.61 billion.

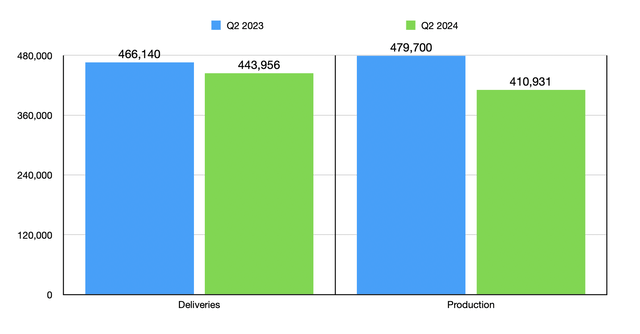

All of these improvements are great to see. And management should be lauded for them. However, the core of the business, which would be its automotive sales category, reported a drop in sales from $20.42 billion to $18.53 billion. That’s a 9.3% drop year over year. This was driven in part by a decline in the number of vehicles delivered from 466,140 in the second quarter of 2023 to 443,956 the same time this year. To management’s credit, they did attribute around 13,000 of this decline to the early phase of the production ramp of the company’s updated Model 3 at its Fremont factory. But considering that total deliveries during this time fell by 22,184, it’s clear that there are other issues at play. This matter is made worse by the fact that this larger decline factors in around 4,000 additional deliveries involving the Model S, Model X, and Cybertruck, with most of that increase driven by the Cybertruck. The company also suffered from a drop in pricing. Management did not say by how much pricing changes impacted revenue. But they did say that it was the primary reason for the decline.

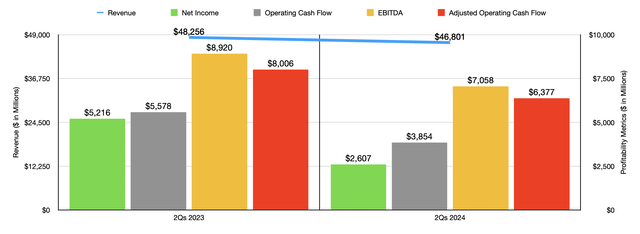

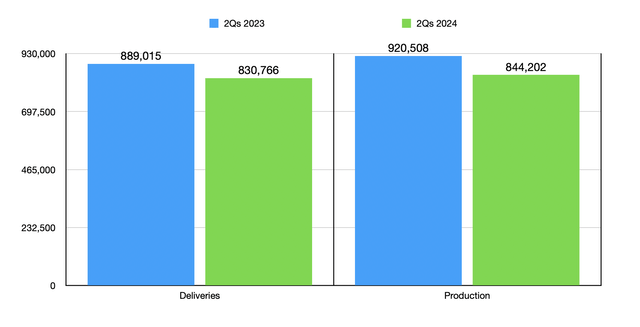

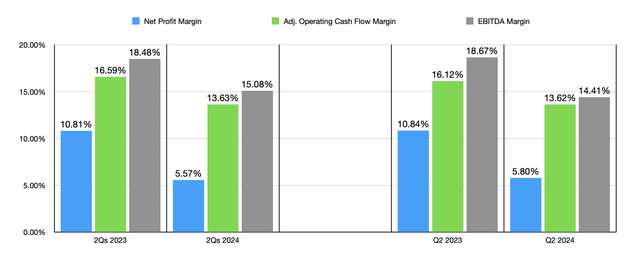

As you can see in the chart below, financial performance for the first half of 2024 compared to the first half of 2023 is very similar to what we saw in the second quarter of this year relative to the same time last year. Even though the company is seeing growth in some parts of its operations, earnings and cash flows are plummeting as vehicle pricing drops and as the number of deliveries declines substantially. In fact, earlier, I stated that automotive sales revenue for the second quarter of this year was down 9.3% compared to the same time last year. But for the first half of this year as a whole, it was down a whopping 11%.

This strikes that one of multiple problems that Tesla has on its hands right now. And that is the fact that the electric vehicle market is becoming increasingly competitive. As I detailed in an article regarding rival Rivian Automotive (RIVN) back in April, electric vehicle prices are quickly approaching parity with gas powered ones. According to one estimate, it’s believed that by 2027, electric vehicle prices would be even lower than the prices of gas-powered ones. Regardless of your feelings regarding Elon Musk and the job that he is doing, he accurately pointed out in January of this year that the Chinese electric vehicle market poses a substantial risk to American vehicles.

This is true not only in the Chinese market, but also here in the US. To compete with this, all electric vehicle manufacturers are going to start coming under pricing pressure. In fact, an article in Bloomberg from June of this year pointed out that there are now three electric vehicle producers with operations in the US that now sell their electric vehicles at a price that’s lower than the average new vehicle. Specifically, this should be long-range electric vehicles (those with at least 300 miles of range on a single charge). One of these happens to be Tesla. But the other two are Hyundai-Kia and General Motors (GM).

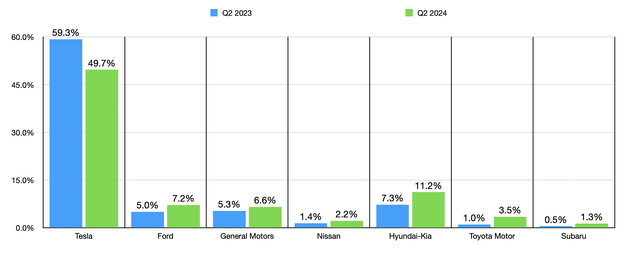

Contrary to some rhetoric that has developed over the past several months, the number of electric vehicles sold in the US is not declining. In the second quarter of 2024, there were 330,463 electric vehicles sold in this country. That marked an increase of 11.9% compared to the 295,355 sold the same time last year. But during this time, Tesla reported a drop of 6.3% in the number of electric vehicles sold throughout the country. In fact, the company’s market share continues declining. In the second quarter, it was 49.7%. That was down from 52.1% in the first quarter and down from 59.3% in the second quarter of 2023. Other companies are doing considerably better. Hyundai-Kia reported a rise in market share from 7.3% in the second quarter of 2023 to 11.2% at the same time this year. General Motors saw a rise from 5.3% to 6.6%. And Ford (F) grew its market share from 5% to 7.2%. Even marginal players in the electric vehicle space are performing well. In the chart above, you can see the year-over-year improvement in market share for the second quarter for some of these firms.

It probably doesn’t help that Tesla is no longer viewed as the golden standard of the electric vehicle space. Car and Driver recently reported that only one of the company’s models, the Model 3, ranked in its list of the top 9 best electric vehicles in the country. It came in at number 4. However, Edmunds did say that the Model 3 remains the second-best electric vehicle in the luxury category. So it would not be accurate to say that Tesla is down for the count. As far as the quality of electric vehicles goes, and the price at which it sells some of them, it is still the big player.

In the past, Tesla was able to generate strong margins from its dominant, market leader position. But those days are likely gone. In the chart above, you can see the net profit margin for the company, as well as its operating cash flow margin, its adjusted operating cash flow margin, and its EBITDA margin, for the most recent quarter compared to the same time last year, and for the first half of this year compared to the first half of 2023. The fact that we are in the early days of increased competition in this space is disconcerting since further margin contraction caused by price reductions, not to mention the decline in production and deliveries, is almost certainly to occur moving forward.

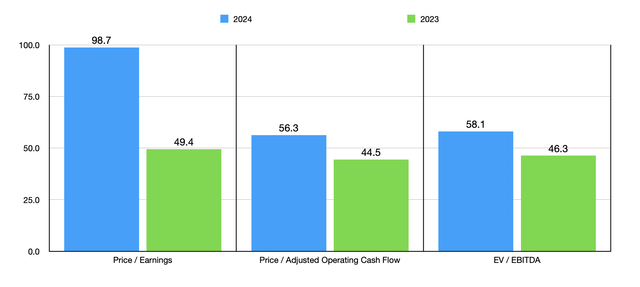

If shares of the business were trading on the cheap, I think I would be more open minded to the picture. But in the chart above, you can see how shares of the business are priced relative to earnings and adjusted operating cash flow. I also include the EV to EBITDA multiple. This chart includes historical results for 2023 and estimates for 2024. Since management does not provide any guidance for what earnings or cash flows might be for this year, the 2024 estimates were calculated by assuming that the rest of this year will look like the first half of this year relative to the same time of 2023. But even if we were to assume that fundamentals would end up reverting back to what they were last year, the stock is still incredibly pricey, especially considering the market dynamics that I already mentioned.

There are other issues as well

To compound problems, Tesla’s woes include non-fundamental factors as well. Some of the actions taken by Elon Musk can only be construed as reckless at best, or downright harmful to the company at worst. The first is the company’s decision to award him a pay package of $55.8 billion. This plan originally dates back to 2018. Earlier this year, the Delaware Court of Chancery issued an opinion that stated that the award should be rescinded. Long story short, at the company’s Annual Meeting of Stockholders, shareholders who were considered ‘disinterested’ ruled in favor of a pay package that would significantly increase Musk’s ownership in the company. However, the next hearing on the matter to see if this will ultimately go through is set for August 2nd of this year.

The dilution that investors would see from this would be significant. It would boost his ownership from 13% to roughly 25% if all goes according to plan. Unfortunately, he had to basically threaten the company into this position by saying that he was ‘uncomfortable’ growing the company by using AI and robotics if he did not have such a large ownership stake. Even stated that he would ‘prefer to build products outside of Tesla’ if it came to that. Although I am no attorney, this certainly feels like a breach of fiduciary duty to me.

Another recent issue involves Musk’s ownership over xAI, which is a company centered around the development of large language models and AI that is being developed to compete with other players like OpenAI and its ChatGPT technology. If this were just another side project like SpaceX, that would be one thing. However, he has been actively diverting AI chips from Tesla to go to xAI and Twitter, and hiring away employees from Tesla to work on the technology. This is in spite of the fact that xAI is not a subsidiary of Tesla. Add on top of this his decision to approach Tesla’s Board of Directors with a proposal to have Tesla invest $5 billion into this project at a time when even he acknowledges the electric vehicle space is facing serious competition, and investors have every right to be worried.

It’s also worth pointing out that this kind of self-dealing has not exactly been all that profitable for the company in the past. Back in 2016, Musk had Tesla buy up another one of his companies, SolarCity, in a deal valued at the time at $2.15 billion. This was an all-stock transaction. But by the time you account for the current share price of Tesla and factor in the two different stock splits the company has seen, that transaction today equates to a value of $38.74 billion. For an enterprise that, since that time, has generated only $3.09 billion worth of gross profit for Tesla shareholders, it’s clear that the deal has so far been harmful to the company. Admittedly, the Energy Generation and Storage segment this now falls under is finally starting to do really well. So the picture could ultimately change. But even allocating that capital to almost anything else would have been more profitable.

The one saving grace that the firm may have at its disposal would be to get into the robotaxi space. This is a market that Musk himself has lauded. Furthermore, I have talked about it in prior articles, including in my article from April. But there are also significant risks and costs associated with a move in this direction.

Takeaway

Fundamentally speaking, Tesla is facing some issues. The company also has other problems, mostly as a result of Elon Musk and rising competitive pressures. Add on top of this the fact that we are likely in the early days of this increased level of competition, and factor in how expensive shares are, and I absolutely think that Tesla warrants a ‘strong sell’ rating at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!