Summary:

- Tesla’s energy storage business is showing significant growth and improved margins, potentially becoming a major earnings driver.

- The company’s automotive segment is facing increased competition, resulting in declining market share and margins.

- Tesla’s partnership with CATL gives it an advantage in the energy storage market, especially in North America and Europe.

- Tesla’s Full Self-Driving (FSD) and Robotaxi services currently have low margins, but there’s potential for a strategy shift towards licensing technology.

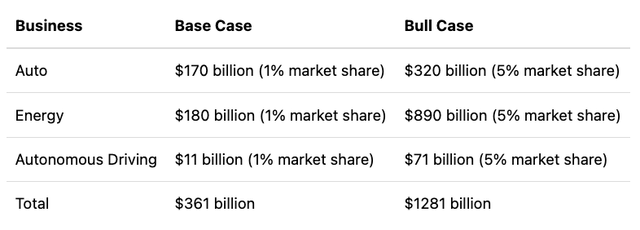

- The valuation analysis indicates a wide range of potential values for Tesla, depending on its future market share in various segments.

JaCZhou

Introduction

Last year, we were bullish on Tesla (NASDAQ:TSLA) due to the significant growth potential we saw in its energy storage business. Today, it appears that this business is performing as Elon Musk predicted and is on track to become a major earnings driver.

Tesla’s total gross margin has declined by 600 basis points since its 2022 peak, mainly due to intense competition in its automotive segment. Although many investors see Robotaxi as a potential lifeline, its service margin in Q2 2024 was only 6.4%. On the other hand, Tesla’s energy business margin improved significantly, rising from a 4% loss in 2021 to 24.5% in Q2 2024.

Gross margin by segment (From Tesla and edited by LEL)

With that in mind, we will first discuss our outlook on Tesla’s energy business before diving into a few key catalysts for its service and automotive segments.

Historical Context and Policy Impact

Let’s review the timeline leading to the current situation. In 2018, Trump imposed tariffs on certain EV parts. When Biden took office in 2021, his administration introduced tax benefits for U.S.-made EVs and key minerals imported from select U.S.-friendly countries. By 2023, Biden increased tariffs on Chinese EVs and proposed a ban on the import of Chinese-related software and hardware into the U.S.

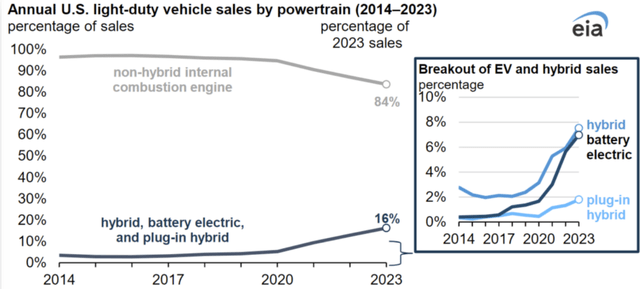

These measures significantly disrupted the plans of many automakers. Major players like Ford (F) announced delays in their EV projects, and Apple reportedly abandoned its secret Apple Car (AAPL) initiative. The U.S. EV industry has faced strong headwinds due to these ongoing policies. Tesla has also been affected, as EV penetration in the U.S. remained as low as 6% in 2023 (see chart below).

New energy vehicle penetration (EIA)

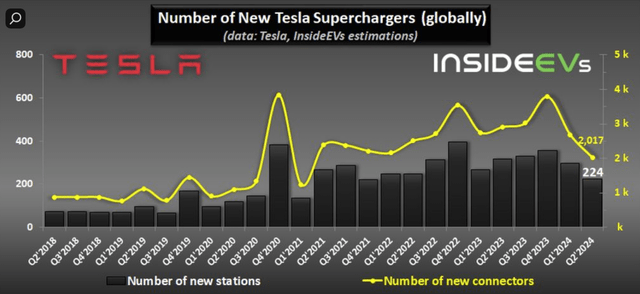

A 6% EV penetration rate is relatively low, likely reflecting demand primarily from those purchasing EVs as second vehicles or for recreational use. The lack of collaboration among major automakers has further slowed the expansion of EV charging infrastructure. Tesla contributed to this issue by laying off its Supercharging team in April, although they were quickly rehired. This misstep led to the lowest number of Supercharger deployments in Q2 since 2021. (See the below chart) In our view, the slower-than-expected rollout of charging stations is a major barrier preventing widespread adoption among mainstream consumers.

Number of EV charging stations of Tesla (InsideEV)

Why would the government take such actions? It wouldn’t be surprising if both Biden and Trump were willing to sacrifice parts of the U.S. EV industry to slow down the growth of China’s EV sector.

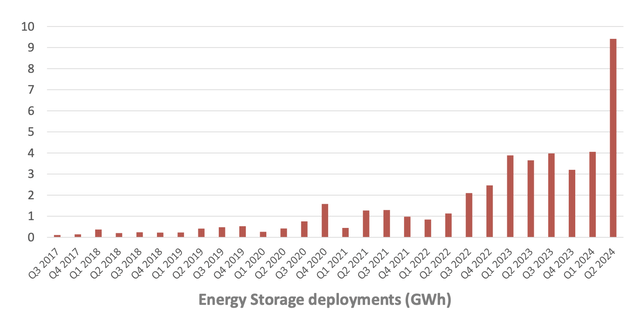

However, this strategy could also create opportunities for Tesla to thrive and adapt. The US energy storage market is thriving in this environment, much like Tesla’s energy storage business is. Due to several restrictions on foreign suppliers, Tesla faced minimal competition in the US and quickly shifted its emphasis and battery technology to this industry. Tesla quickly expanded this business by utilizing its advanced machine-learning software and battery production capabilities to gain shares.

Tesla’s energy storage deployment (TSLA)

Tesla’s Energy Storage Business

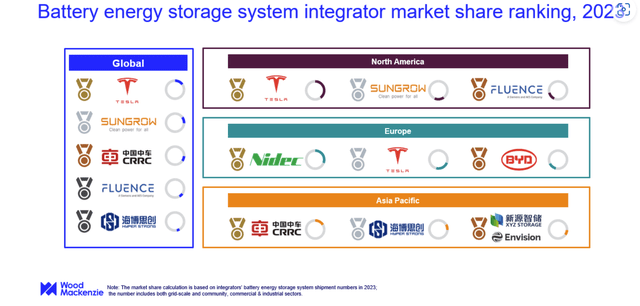

In fact, in terms of battery energy storage systems, Tesla is now ranked first in North America and second in Europe.

Battery energy storage system market position (Wood Mackenzie)

Partnership with CATL

This advantage is largely due to CATL, the world’s largest battery manufacturer. CATL signed a technology transfer and licensing deal with Tesla this year. Through this partnership, Tesla is expected to gain technical and data support for building its battery factory, which does not directly violate the administration’s rulings against Chinese EVs. While CATL is in talks with other automakers, Tesla remains the only non-Chinese manufacturer producing energy storage systems. As a result, CATL may enhance the EV manufacturing capabilities of other automakers, but only Tesla has the potential to expand in the energy storage sector.

Meanwhile, BYD, Tesla’s peer in both EVs and energy storage, is facing greater scrutiny entering the European market. Additionally, BYD’s EU market share in both EVs and energy storage remains lower than Tesla’s. As a result, Tesla is likely to maintain its lead over BYD in Europe and leverage its CATL partnership to capture more of the energy storage market, especially as existing players like Nidec and Siemens lack strong battery production capacity and similar technology partnerships.

The DOE currently offers favorable terms for new energy project loans, including long-term tenors at relatively low interest rates. Additionally, investment tax credits under the Inflation Reduction Act are available for clean energy projects. However, if Trump wins the 2024 election, there is uncertainty about whether these policies will continue. Investors should be aware of this potential risk of another administration’s intervention.

That said, Tesla’s energy business now boasts a 24.5% gross margin and saw 158% growth in Q2 2024, accounting for 16% of Tesla’s total gross margin—up significantly from 6% a year ago. This demonstrates strong momentum. While Chinese battery storage companies are formidable competitors, most Western buyers are utilities with a long-term focus and are less likely to risk purchasing from Chinese manufacturers. We believe Tesla is well-positioned to capitalize on this tailwind and further grow its energy storage business.

Full Self-Driving (FSD) and Robotaxi

There’s a lot of excitement surrounding the upcoming Robotaxi launch in October 2024. However, the reality is that Tesla’s services segment currently has a gross margin of just 6%, which doesn’t seem like a profitable venture to us.

Gross margin by segment (TSLA)

Even though Waymo entered the Robotaxi market first, it nevertheless lost $2 billion annually. Baidu has also operated its Robotaxi at a loss. As a result, a lot of doubters wonder how Tesla’s FSD technology will be profitable.

Potential Strategy Shift

We were initially among those skeptics about Tesla’s potential, but that changed with Huawei’s entrance into the market. In H1 2024, Huawei’s automotive business saw its revenue double and achieved a 21% margin. Unlike Tesla and Waymo, Huawei doesn’t sell cars or operate a Robotaxi fleet. Instead, it licenses its autonomous technology to other car manufacturers, earning royalty fees. We wouldn’t be surprised if Tesla adopts a similar strategy in its upcoming Robotaxi announcement.

Huawei’s CEO recently acknowledged that selling cars priced under 300,000 RMB (approximately $42,000) is not profitable. This indicates that the higher R&D costs make it difficult to bundle autonomous technology with lower-priced vehicles. As a result, Tesla likely sees minimal profits on its lower-priced models, like the Model 3. In the U.S., Tesla’s biggest competitor, Waymo, has chosen to partner with Uber in the ride-sharing sector and with Mercedes for semi-trucks.

While Huawei’s strategy may not be the only way to monetize autonomous technology, it has proven to be the most profitable so far. Therefore, Tesla must catch up with Waymo in the licensing space.

Automotive Segment

Global Competition

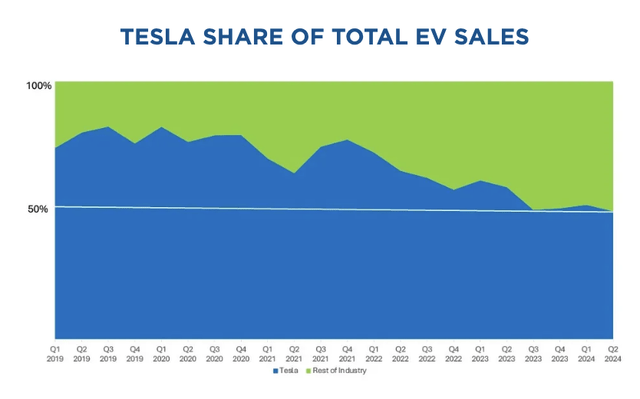

In addition to seeing a decline in gross margin, Tesla’s auto division has seen a loss of market share worldwide. For the first time, Tesla’s market share in the US has fallen below 50% as it loses ground to other US and Korean peers. (See the chart below)

Gross margin by segments (TSLA)

Tesla US EV market share (Cox)

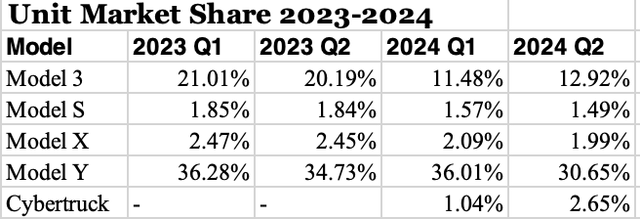

Tesla has lost market share in the lower-priced Model 3 segment (see the chart below), while its higher-priced models have maintained their market share relatively well. This is likely due to the slow deployment of charging stations, which restricts further penetration into the mass market.

Telsa US market share by models (KBB)

At the high end, Tesla’s Cybertruck has captured market share from competitors like Rivian (RIVN) and Ford. It ramped up production aggressively, surpassing Rivian in 2024, and notably accelerated its sales in July, selling 5,175 units while the entire EV pickup segment sold only 5,546 during the same period.

While we recognize Tesla’s strength in the premium EV market due to its strong brand, we believe this alone won’t be enough to sustain the Cybertruck’s success, as it remains less competitive in terms of towing capacity and price. It can tow less than 100 miles while costing more than the Ram diesel truck, which offers three times the range for the same towing capacity, according to a test we reviewed on YouTube. Consequently, the Cybertruck is likely to remain in a niche market and cannot compensate for the market share loss of the Model 3.

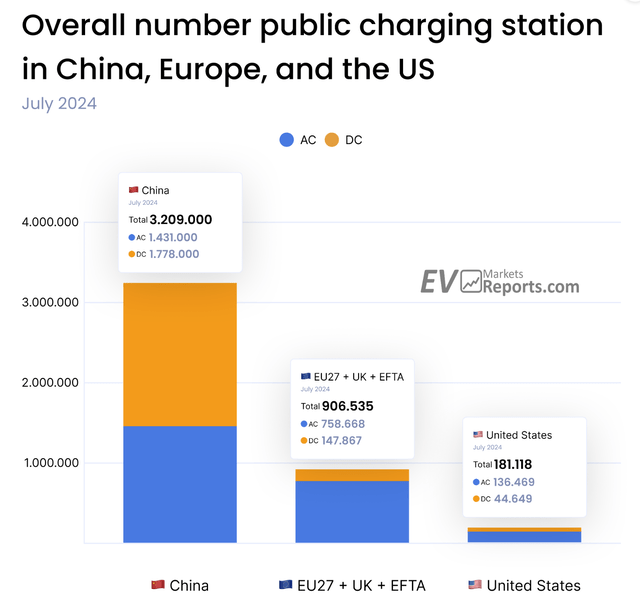

In the U.S., Tesla needs to install enough charging stations to increase EV penetration in the mass market. However, the significant gap between the U.S. and markets like the EU and China makes this a challenging task that won’t change overnight. (see the chart below) Therefore, we foresee Tesla’s Model 3 reaching a plateau in the near term in the U.S. market.

Number of charging stations by regions (EVmarketsReport)

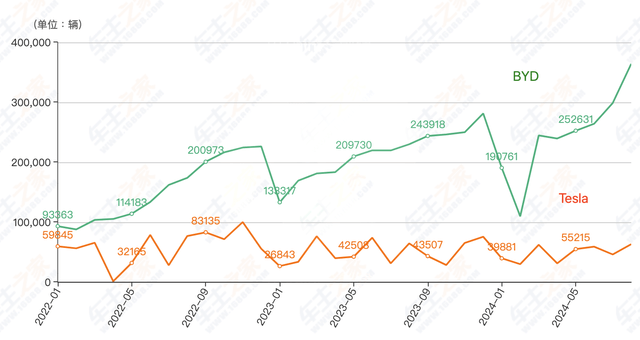

Tesla was up against fierce competition in China and Europe as well. Given that BYD and BMW have surpassed Tesla in this market (see the charts below), it is evident that Tesla lacks a strong competitive advantage.

EV EU leading board (Jato Dynamics)

China unit sale (Auto home)

We believe that for this segment to contribute significantly to Tesla’s valuation, the company must demonstrate its ability to differentiate itself from competitors and achieve meaningful market share gains. However, we currently do not see a differentiated strategy in Tesla’s product innovation efforts. Consequently, it is difficult to assert that Tesla has a strong competitive moat.

Valuation and Conclusion

We laid out our sum-of-the-parts valuation analysis in our earlier article and based on various long-term market share projections for different categories, we concluded that its valuation range can be between $360 billion and $1.2 trillion.

Sum of the part valuation (LEL)

While we acknowledge that Tesla appears to have a strong lead in the energy storage segment, which, we believe, has significant potential due to its market size, we also recognize that this business is built on the success of its automotive segment, making its foundation less secure. Rising competition from global automakers and the autonomous vehicle space puts Tesla’s premium valuation at risk. In our opinion, Tesla is currently benefiting from favorable geopolitical sentiment towards non-Chinese EV manufacturers, maintaining its position through both resilience and a bit of luck. As a result, we do not find the current price particularly attractive and maintain our Hold rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.