Summary:

- Post its 2023 annual shareholder meeting, Tesla, Inc. stock is rallying higher, with investors seemingly buying the dip on Musk’s advice.

- Traditionally, such events have served as boosters for Tesla’s hype engine, and the latest shareholder meeting was no different.

- While Musk acknowledged the challenging macroeconomic environment, he reiterated a bullish long-term outlook for Tesla, citing exciting developments such as FSD [generalized AI], Cybertruck, Optimus Humanoid Bot, and more.

- The technical setup for Tesla continues to look precarious, and the stock is looking slightly overvalued after baking in Q1 results into the model.

- Hence, I continue to rate Tesla stock “Neutral/Hold” at $188.

Win McNamee

Introduction

A new wave of investor optimism seems to be pushing Tesla, Inc. (NASDAQ:TSLA) stock higher in the aftermath of its shareholder meeting (held on 16th May 2023), wherein CEO Elon Musk highlighted Tesla’s long-term business prospects in emerging areas such as autonomous driving [FSD] and robotics [Optimus].

In late-2022/early-2023, I was incredibly bullish on Tesla in the mid to low $100s, at a time when Mr. Market was selling it off like a drunken psycho on a daily basis. After having accumulated Tesla for several months in the mid to low $100s, we sold half of our Tesla position at ~$194 a few weeks ago as the wild rally in TSLA took a pause at a key technical level at ~$200-215.

While market participants are clearly getting excited about Tesla once again, I am sticking to a “Neutral” rating for TSLA after having shifted my stance in light of Tesla’s Q1 earnings back in April. If you have been following my work on Tesla, you know that my rationale for the downgrade was based on greater macroeconomic uncertainties, dangers of Tesla’s recession playbook [making it a binary bet on FSD], and ominous technical setup. Find a more detailed explanation here:

- Tesla Stock: The Good, The Bad, And The Ugly

- Tesla Stock: Mr. Musk Is Betting The Farm On FSD, And Mr. Market Is Clearly Not Happy About It.

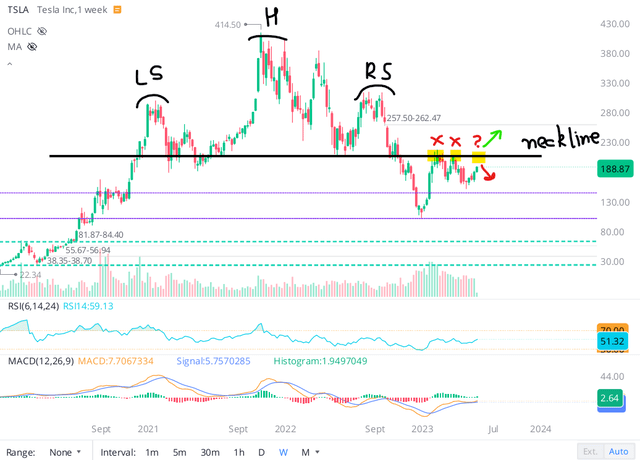

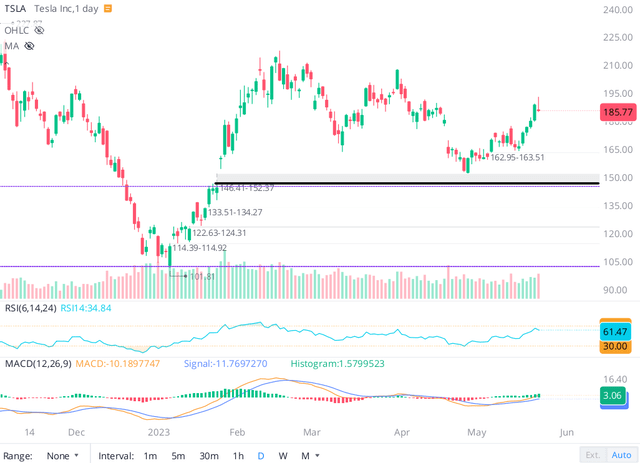

Despite Elon Musk’s dire warnings on the economy, investors have been piling into TSLA stock, which apparently looks set to re-test the neckline of its head and shoulders pattern. As you can observe in the chart below, Tesla’s stock has already been rejected twice at this key technical level. If Tesla fails to break past this area of resistance, technically, the stock could be headed back down to the mid $100s [and even to the low $100s] in a continuation of the reverse gamma squeeze we saw in late-2022.

In this note, we will discuss major takeaways from Tesla’s Annual Shareholder Meeting. And then check up on TSLA’s ominous-looking technical chart.

Highlights Of Tesla 2023 Shareholder Meeting

Keeping in tradition with past investor events, Tesla’s 2023 Annual Shareholder Meeting and Musk’s subsequent CNBC interview (with David Faber) were filled with lots of hyperbolic statements such as “FSD could be the ChatGPT moment for Tesla” and “Demand for Tesla’s Optimus Humanoid Bot could be 10 billion units.”

Here’s a list of noteworthy announcements from the meeting:

- Elon Musk is staying on as CEO of Tesla for the foreseeable future and is planning to refocus his efforts on the EV giant’s AI products (FSD and Optimus) after handing over the reins at Twitter to Linda Yaccarino.

- The macroeconomic environment is likely to remain tough for the next 12 months, and Tesla is not immune to global economic conditions.

- Tesla will try traditional advertising to spur additional demand for its electric vehicles (“EVs”).

- Tesla is set to start deliveries for Cybertruck in 2023, targeting production of 250-500K units per year (at scale).

- Tesla is working on two new EV models that can result in additional production of 5M units per year. (Potentially a compact car and a van.)

- Tesla FSD is close to reaching full autonomy, and reaching this feat could lead to the greatest increase in asset value of all time, as Tesla FSD can boost the value of Tesla’s fleet by 4-5x. Tesla EV gross margins could shoot up to ~80% (from ~20%) when FSD reaches full autonomy.

- Optimus bot will use the same generalized AI being created for FSD. And demand for Optimus could be ~10B or ~20B units because every human will want one or two. (The video shared during the meeting showed that Optimus had come a long way from where it was at the last reveal, but I would take that demand figure with a pinch of salt.)

- Musk strongly believes “Optimus will be the majority of Tesla’s value over the long-term.”

- Tesla’s energy business is scaling well, and the margins here are likely to remain in the 20-30% range.

The above list covers all the key developments from Tesla’s annual shareholder meeting, and since this event has been widely covered, we will not go deeper into it in this note. If you are interested in learning more, I suggest you watch the presentation at Tesla.com or read this detailed SA note.

Now, let’s discuss Tesla’s business outlook in light of its shareholder meeting.

What Is The Long-Term Business Outlook?

While Musk stoked the hype engine quite a bit with positive commentary on ambitious projects such as FSD, Cybertruck, Optimus humanoid bot, and two new EV vehicle models (likely a compact car and a Van), none of these are likely to move the needle for Tesla in the near-term.

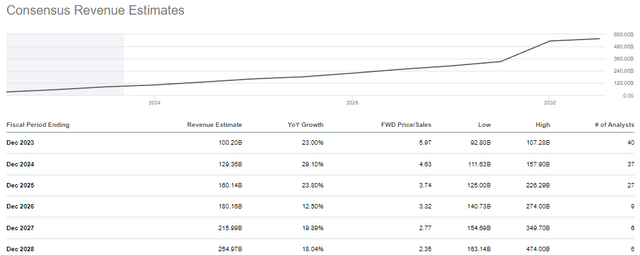

That said, Tesla’s recession playbook is still expected to result in volume growth during 2023. According to consensus street estimates (and Musk), Tesla is likely to do $100B in revenue this year.

Going forward, consensus analyst estimates peg CAGR sales growth to be in the low-to-mid-20s, which is a far cry from where Tesla’s growth has been over the past decade. Given Tesla’s scale, I think a slowdown is natural; however, a growth slowdown raises question marks over TSLA’s valuation premium. Now, bulls like to value Tesla as a high-margin software company, whereas bears prefer a valuation more in line with other automakers.

Personally, I think the reality is somewhere in between. As I said in my previous note, Tesla is turning into a binary bet on FSD. According to Musk, FSD could boost Tesla’s gross margins to ~80%. While I am skeptical about that figure, I think that if FSD achieves full autonomy, Tesla can deliver software-like margins. In this scenario, Tesla would deserve a multiple similar to an Apple Inc. (AAPL) (~25-30x earnings) and not a Ford Motor Company (F) (~5-10x earnings).

Will Tesla FSD reach full autonomy in 2023 or 2024? I don’t know. While the likes of Cathie Wood (and many Tesla bulls) think it could happen this year, the jury is still out there. As an investor, I prefer to wait for evidence before trying to model something like FSD into my valuation estimate for the company. And so, I am not altering my model based on Musk’s positive FSD commentary from the annual shareholder meeting.

TQI’s Valuation Model For Tesla

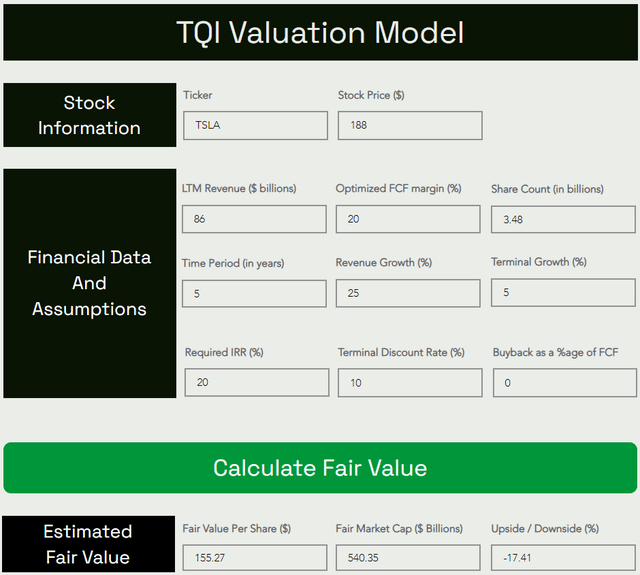

With Q1 results coming (more or less) in line with expectations, I am sticking to most of my pre-earnings assumptions for Tesla. However, in order to factor in the added risk of Tesla turning into a binary bet on FSD due to Musk’s recession playbook, I raised our model’s “Required IRR” from 15% to 20%.

Also, Tesla’s recession playbook is killing its free cash flow (“FCF”) generation, and in the interest of improving the margin of safety in our model, I reduced the “Buyback as a % of FCF” (capital return program) assumption from 25% to 0%.

Here’s my updated valuation for Tesla:

TQI Valuation Model (TQIG.org)

According to these results, Tesla’s fair value is ~$155 per share. With the stock trading at $188 per share, it is currently overvalued by ~17.5%. Now, I am happy to pay a premium for a high-quality company like Tesla; however, is the risk/reward attractive enough to justify an investment at current levels?

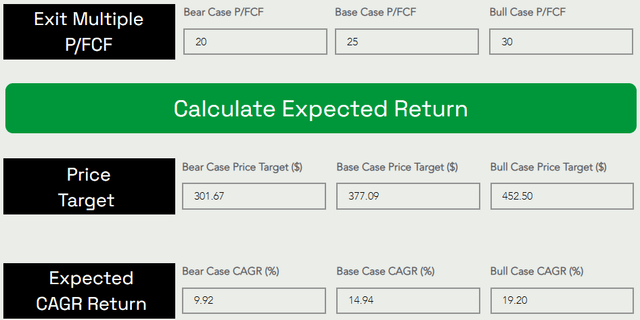

TQI Valuation Model (TQIG.org)

Assuming a base case P/FCF exit multiple of 25x, I see Tesla hitting $377 per share by 2027. As can be seen below, Tesla is projected to deliver CAGR returns of 14.94% for the next five years, which more or less meets my investment hurdle rate of 15%.

However, the valuation is not exciting enough to justify a long position by itself, as was the case in late-2022 when Tesla was trading in the low $100s. Since then, macroeconomic conditions have worsened, with multiple bank failures threatening a credit crunch for the economy and a demand crunch for Tesla. In response to flagging demand, Tesla’s management has instituted multiple price cuts this year, and this move is causing margin pressures. The longer Musk and Co. execute this aggressive playbook, Tesla’s margins are likely to remain under pressure. While we are modeling Tesla using long-term steady-state margins, Mr. Market is a far short-sighted person, and he could sell TSLA off during lean economic times.

And Musk warned about this during the annual shareholder meeting (emphasis added):

This is going to be a challenging 12 months, I sort of want to be realistic about it that Tesla is not immune to the global economic environment. I expect things to be just at a macroeconomic level difficult for at least the next 12 months. Like, Tesla will get through it, and we’ll do well and I think we’ll see a lot of companies go bankrupt.

The economy moves in cycles, and we’ve had a very long period of upcycle, and next twelve months will be [I think] difficult for everyone. During Berkshire Hathaway’s annual meeting, Warren and Charlie actually said this year Berkshire companies are going to make less money. These are very well run organizations and that is generally true for the economy. It’s important to remember that there are good times, and there are dark times, which are followed by good times. So my advice would be –

Don’t look at the market for the next 12 months. If there’s a dip, buy the dip, and you’ll not be sorry. My guess is tough times for a year and then Tesla will emerge stronger than ever. Net present value of future cash flows will be incredibly high in my opinion.

The long-term future for Tesla remains bright; however, near-term price action is likely to be volatile, and the technical chart does look ominous.

Final Thoughts: Tesla’s Ominous-Looking Tryst With Technicals

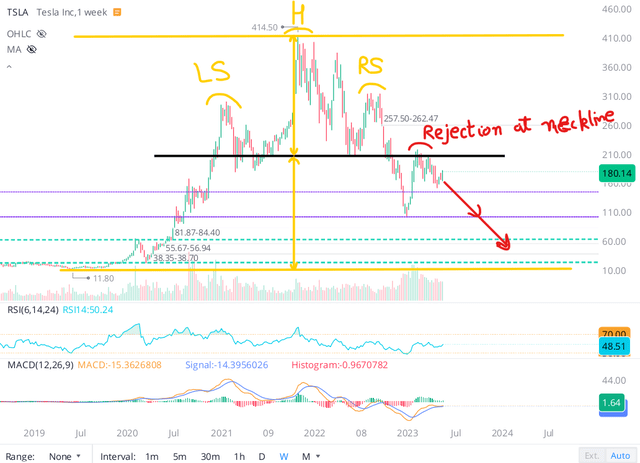

Earlier in this note, we looked at the H&S pattern on Tesla’s chart, and in my view, another rejection from the neckline would be extremely bearish for the stock. From a technical perspective, a breakdown of an H&S formation could result in a downward move equivalent to the gap between the head and the neckline. In Tesla’s case, that level falls in the range of $40-60 (based on how you draw the neckline [horizontal or slanted]).

Now, I am not saying Tesla, Inc. stock is headed down to the mid-double digits; however, technicals suggest that this is a possible outcome. From a valuation perspective, Tesla can trade at such levels if it loses growth in a dire economy and the stock gets priced like a traditional automaker (~5-10x earnings). Hence, it is not unrealistic.

While I don’t think Tesla should be valued like a traditional automaker, I wouldn’t rule it out, as Mr. Market can do crazy things. That said, I would view such a sharp selloff as a massive buying opportunity. Now, such a move is very unlikely to materialize until and unless we end up in a deep recession, which is certainly not my base case right now.

In the short term, I think a move down to $145 is very much on the table, given we still haven’t filled the gap there. And if Tesla fails to hold that level, I can even see a re-test of recent lows, i.e., the low $100s.

In a nutshell, Tesla’s technical chart is looking ominous. A breakout of the neckline at $215 would make me change my view here. However, for the time being, I think investors can afford to remain patient with Tesla, Inc. stock and wait for a better entry point. If Tesla gets down to the mid-$100s, I will resume accumulation via a DCA plan.

Key Takeaway: I continue to rate Tesla, Inc. stock “Neutral” at ~$188 per share.

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below or DM me.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

We have recently reduced our subscription prices to make our community more accessible. TQI’s annual membership now costs only $480 (or $50 per month) for a limited period only.