Summary:

- Tesla’s Q4 earnings slightly missed expectations, but the company reported higher GAAP earnings and strong growth in vehicle production and deliveries.

- The long-term outlook for Tesla is positive, with the development of autonomous technologies and the potential for higher margins from its autonomous taxi service.

- The company’s balance sheet is well structured, providing a strong foundation for future development in AI and energy storage.

- I consider this to be a good time to purchase Tesla shares as an investor with a long-term outlook, and my analyst rating for the stock is a Buy.

Xiaolu Chu

Tesla (NASDAQ:TSLA) reported its Q4 earnings, and most analysts are less than happy about the results. However, I think the current ratings for the firm are far too short-sighted. As an investor with a 10+ year investment horizon, here’s my take on why I think the shares remain a Buy.

Q4 Earnings Results & Margin Considerations

While the company slightly missed its EPS expectations, it only missed by $0.02. For non-GAAP EPS, the consensus was $0.73, and Tesla reported $0.71. However, GAAP earnings were a higher $2.27 per share; this was the result of a one-off non-cash tax benefit of $5.9 billion in Q4. $25.167 billion in revenue was reported, and its gross margin decreased to 17.6% from 17.9%.

The firm produced around 495,000 and delivered over 484,000 vehicles. Production increased by 35% for the entire year, up to 1.85 million. Vehicle deliveries grew by 38% for the entire year, up to 1.81 million. This is particularly important to note for strong growth in the firm despite the margin contraction.

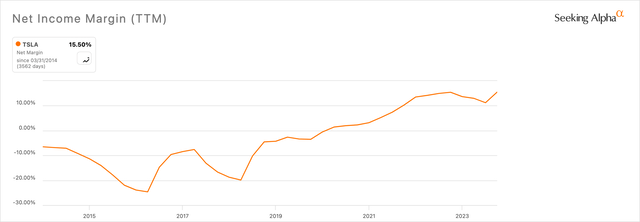

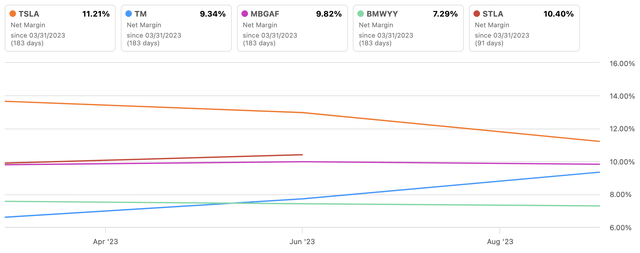

The main issue investors are concerned with at the moment is Tesla’s margins. While its net income margin is in a long-term uptrend, the recent Q4 earnings results indicate slower margin growth ahead for the immediate future. I think this should be expected, but it doesn’t fully detract from the long-term potential of FSD and artificial intelligence initiatives in contributing to long-term margin expansion.

BYD (OTCPK:BYDDF) has grown its presence in the EV market, and there is concern about whether BYD could overtake Tesla as the global market share leader in the industry. BYD currently has 70.88% YoY revenue growth, compared to Tesla’s 18.80%. BYD registered 40,400 EVs produced in a single week in January 2024, and Tesla registered 11,700 EVs in the same period.

Tesla’s pricing power is likely to continue to be challenged by the competition from BYD and other less established auto firms. Tesla has already made price adjustments and faced production challenges, including a temporary halt at its German factory due to component shortages. Tesla has cut the Model Y price by as much as 26.5% in the US in the last year.

There are also going to be effects on the company’s margins in the near term based on its Cybertruck production ramp-up. I discussed some of these issues in my recent article on the project in December last year. However, with strong demand, the short-term margin contraction as a result of the increased operational costs should be short-lived. In 2025, the Cybertruck could start to be cash flow positive and begin to bolster the firm’s profitability.

My long-term thesis and Buy sentiment for Tesla stock are largely supported by the company’s Full Self-Driving initiatives moving forward and further integrations of artificial intelligence that may help to improve the company’s margins. While Tesla has already integrated a suite of different intelligent technologies into its driving experience, these additions are not unique to Tesla, and its competitors implement many. The largest contributor to Tesla’s margin recovery and increased growth rates over the long term would be related to autonomous taxi services, something already in the legal documentation for car sales and ready to begin operating with regulatory approval. As such, the firm’s margins could move from that of an automotive company to that of an automotive-software hybrid.

Long-Term Outlook for Tesla

ARK Investment Management has been influential in my perspective of Tesla’s long-term potential. Particularly, ARK has a long-term view of the growth of advanced technology. Although I do not take such a specialized approach to investing in my own portfolio, preferring breadth and diversification amongst industries, the consideration of growing trends in intelligent automation, as one of the most relevant examples, shows awareness of a potential cultural shift underway. For Tesla, ARK has mentioned that further development of autonomous technologies, including AI-as-a-service and energy storage solutions, could be instrumental in developing stronger margins long term. In addition, Tesla’s autonomous taxi service could be a large contributor to higher margins by 2027.

ARK estimates that by 2027, Tesla’s autonomous taxi business could contribute 58% to its enterprise value and 45% of EBITDA. ARK has a price target for Tesla in 2026 at $4,600 per share; while I consider this too high, I think the sentiment that the firm can expect high growth potential over the long term is justified.

During the earnings call for Q4, there were discussions surrounding Tesla’s FSD and its integration of AI. Working with Nvidia (NVDA), Tesla hopes to address present challenges with FSD.

Tesla has been working on a next-generation chip to further enhance its capabilities in autonomics, acknowledging that 144 trillion operations per second from its previous computer will be insufficient to support the full potential of FSD.

I think it is particularly important for investors at this time to consider what type of economy we are evolving into and to picture where Tesla may be in such an economy in the next thirty years. Understanding the significant and aggressive adoption of artificial intelligence and autonomous technologies is paramount in understanding the long-term value of an investment in Tesla today. The current skepticism about the share price may be a perfect buying opportunity if investors have the patience to hold for multiple decades.

Further Long-Term Financial Considerations

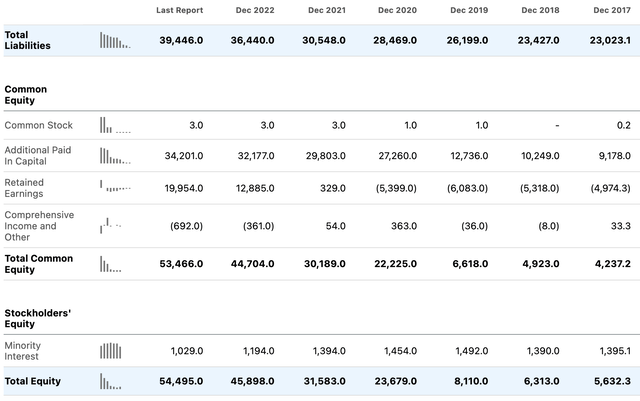

The company’s balance sheet is notably well structured, with more equity than liabilities at this time, which was not the case historically. As such, a lower margin period at the moment is absolutely fine, in my opinion. The balance sheet represents a strong overall financial health, which the company can take with it into its development of FSD and more advanced AI in driving and energy storage:

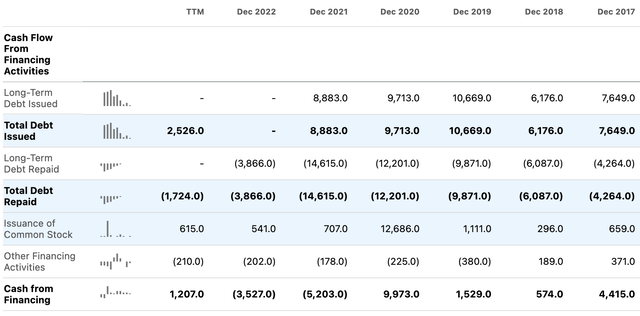

The company has been issuing debt consistently but also repaying it at a stable rate. In addition, it tends to issue a considerable amount of common stock every year, slightly diluting shareholder value. However, this is offset by the firm’s strong growth.

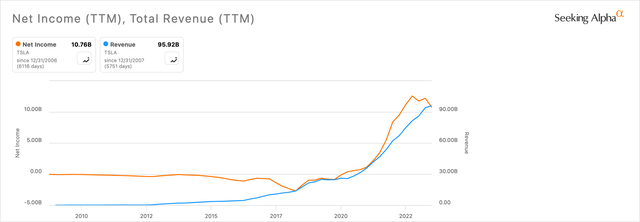

Looking at the full picture of the company’s revenue and net income historically, the performance of Tesla is very strong. I think the current concerns regarding the momentary decreases in net income and slowdown in revenue growth are much too short-sighted. The company also has leading profitability amongst most of its major autoindustry peers.

Author, Using Seeking Alpha Seeking Alpha

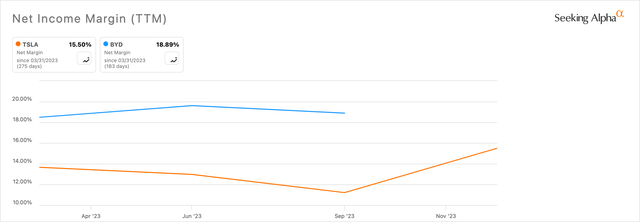

Notably, however, BYD does have a higher net margin than Tesla at the moment:

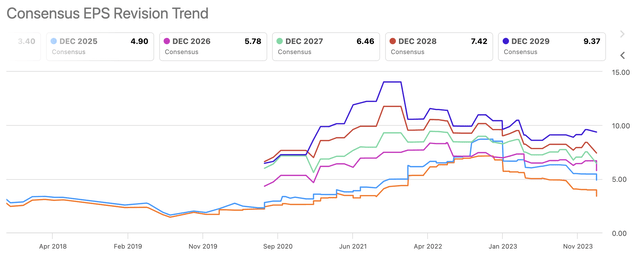

A relatively short-sighted consensus around Tesla is fair to expect, as the firm is now one of the largest companies in the world. Wall Street can be very focused on earnings results and how these tie in with medium-term returns, as opposed to how the results fit into the wider picture of a company in many decades to come. As such, I think the current stock price drop signifies an opportunity to be contrarian with a long-term perspective in mind.

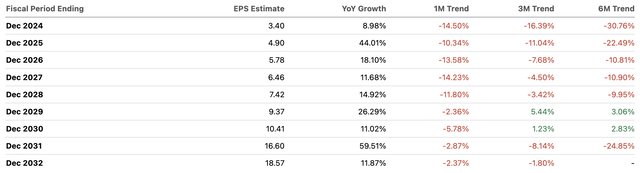

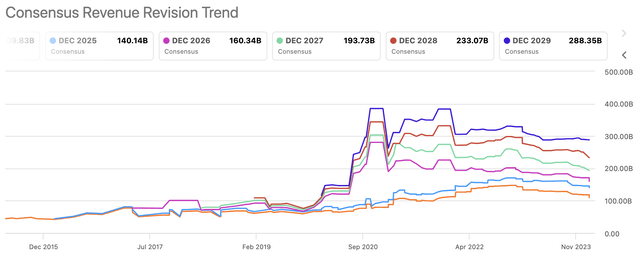

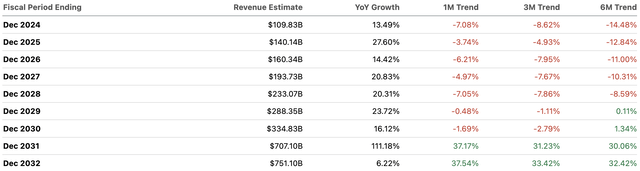

A cautious outlook here would be to understand that consensus estimates for the firm have been revised in a downtrend for both EPS and revenues, meaning the company could face a significant slowdown in the next few years. My allocation to Tesla, however, takes into consideration its potential outsized success following this potentially lower-growth period. Additionally, I think the market has priced in these slower growth expectations into the stock already, meaning it is favorable to buy at this time because the growth estimates, while lower, are still strong.

Seeking Alpha Seeking Alpha Seeking Alpha Seeking Alpha

My outlook on Tesla is very positive based on its long-term past performance and initiatives in advanced technology integration. These integrations could arguably still be in the early stages when related to FSD and artificial intelligence and the full benefits these developments could introduce in operational and financial efficiency.

Valuation Risk

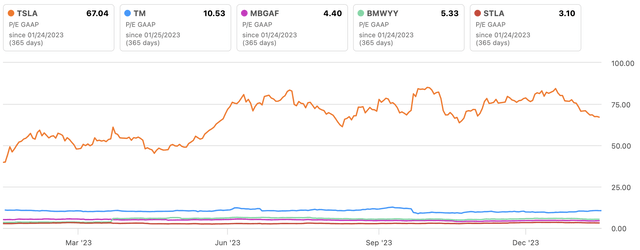

Tesla’s valuation is notably unappealing and needs to be considered as one of the major risks when investing in Tesla stock at this time:

Looking at its P/E ratio historically, however, we can see that this high valuation has not deterred investors from buying the shares. The chart also shows that ironically, compared to historically, Tesla stock is cheap:

Compared to peers, however, we can see just how highly valued the firm is. Tesla’s valuation is in a league all of its own:

While the valuation of Tesla stock right now is a major concern, this has not stopped investors from purchasing the shares in the past. Due to a simple reversion to the mean in consensus estimates, does that counteract all of the firm’s future growth prospects related to its operational advantages? I don’t think so, and because the historical valuation of Tesla is in a league of its own, I would say that based on analysis of the firm as it stands, it is fairly valued at this time. Considerable skepticism, downward revisions, and notable risks are already priced in. What might not be fully priced in is that Tesla could just be beginning to fully evolve as an advanced technology and intelligent automobile company. As such, the potential for large long-term returns is present here.

Further Risks

Current geopolitical risks surrounding Taiwan and TSMC (TSM) could put pressure on Tesla’s share price if international relations worsen between China and the US. This is a time of sincere uncertainty in the world, and many of us are hopeful that peaceful cooperation will be the path forward. Others like Ray Dalio are less sure and see some inevitability to global conflict if the US cannot severely fix its overleveraged economy. I agree with Dalio’s defensive approach whilst also remaining optimistic that present economic tensions globally may not result in large-scale hot wars. I have decided to diversify my portfolio away from too heavy an exposure to technology stocks in the United States as a precaution at this time. I’m not allocating aggressively to Tesla shares as a result.

There is also a considerable chance that Tesla’s FSD operations and autonomous taxi plans will not execute as planned. While I do have faith in the management of the business and the executive strategy, it is not guaranteed that these high-margin opportunities based on AI and autonomics will definitely pay off. One of the largest hurdles the organization will continue to face is regulatory scrutiny, a force I think will simply slow down growth in its autonomic segments rather than inhibit it.

Conclusion

Tesla is being rated a Sell and a Strong Sell by some analysts based on Q4 earnings results, but I think this is unwarranted. The long-term outlook for the firm remains positive based on my analysis of the company. At this time, a cautious rating could be a Hold, but because of the potential large returns from FSD and autonomics over the long term, my analyst rating for Tesla stock is a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, NVDA, TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.