Summary:

- Tesla, Inc. recently announced its Q2 earnings, beating on both the top and bottom lines with revenue at $24.9 billion and GAAP EPS of $0.78, with record vehicle production and deliveries.

- The company is on a bit of a tear, stacking several small wins in recent weeks.

- Despite these wins, Tesla’s stock fell over 10% in the days following earnings due to narrowing margins.

Robert Way

New Developments

Tesla, Inc. (NASDAQ:TSLA), the electric vehicle (“EV”) maker–and technology company, according to bulls–helmed by Elon Musk, announced its second quarter earnings yesterday. The company beat on both the top and bottom line, with revenue at $24.9 billion and GAAP EPS of $0.78.

On the Q2 conference call, Musk stated that Tesla:

“achieved record vehicle production and deliveries, and record revenue of about $25 billion in a single quarter. And Model Y became the bestselling vehicle of any kind globally in Q1, surpassing the likes of [the Toyota] Corolla and [Volkswagen] Golf.”

The earnings release was just the tip of proverbial iceberg for Tesla this week, however. The company announced that it had completed manufacture of its first Cybertruck. The long-awaited vehicle has been so on the minds of Tesla bulls and bears alike that one can be forgiven for wondering if the company were ever going to release it. Of course, the building of release candidates isn’t a full production rollout, but it demonstrates actual progress on a front that investors had speculated endlessly about for years.

Perhaps even more important than the Cybertruck, however, was the announcement that the company was beginning production of the Dojo supercomputer, which is expected to train and evaluate the company’s autonomous driving platform. We say that this is arguably more important than the Cybertruck, because Tesla has made bold claims about its vehicles’ full self-driving (“FSD”) capabilities in the past, and, well… the technology has had a lot of issues. The production (which, to temper expectations is not a deployment of the computer) seems to be a least a step in the right direction for the success of the self-driving platform.

Further adding to the company’s wins, the wider automotive industry has adopted Tesla’s charging framework. Ford Motor Company (F), General Motors (GM), and several other legacy internal combustion engine (“ICE”) manufacturers have decided that, in the case of electric charging infrastructure, it’s better to play along with Tesla’s tech than propose a new one.

Now, we add that the adoption of charging standards isn’t quite the win that it may seem at first glance. At best, it means that auto makers have decided that they would rather not spend time, money, and labor on developing their own charging model, or have decided that the juice isn’t worth the squeeze on continuing with their own framework. While it’s a bit of a PR victory for Tesla (and stock bulls), it is a victory that likely won’t have much meaning in the long term as charging stations will likely commodify over time in the same way gas stations have for ICE vehicles.

Lastly, while we cannot quantify what the exact results will be, it does seem that the most distracted phase of Elon Musk’s ownership of Twitter may be over (we nervously write this sentence, as we cannot be sure of what will happen regarding Musk’s engagement with Twitter by, say, tomorrow). It seems that Musk’s appointment of Linda Yaccarino to be CEO of the social media platform may be freeing up his time to focus once again on Tesla.

The attention Musk has paid to Tesla since his pricey acquisition of Twitter has been a subject of intense scrutiny, bringing even high-level investors to issue rare public rebukes to the CEO over his ever-increasing workload between multiple companies.

Results & Valuation

Investors may have been surprised to see that Tesla dipped as much as it did in the session following the earnings announcement. As of this writing, the stock has fallen a little over 10% since the record second quarter results were published. The slide in price has largely to do with narrowing margin–historically one of Tesla’s strengths.

All that being said, management has shown itself willing to do what needs to be done in the form of price cuts to maintain the delivery rate of vehicles. In 2022 Tesla delivered 1.3 million vehicles to customers, and in the Q4 2022 call, Elon Musk gave guidance to investors that 1.8 to 2 million vehicle deliveries in 2023 was the company’s goal.

We have to acknowledge, then, that the company has maintained this goal, with Musk reiterating the guidance of 1.8 million vehicle deliveries in 2023 on the Q2 conference call.

This, we note, is a bit of a change of pace for a company that bears have often accused of shifting the goal posts. Three consecutive quarters of maintaining a consistent target and of taking action to meet those goals (through cost reductions or other means), is applaudable. Despite the company’s falling margin, we believe that the focus on execution is the larger, more unsung story among investors, and a better one to tell.

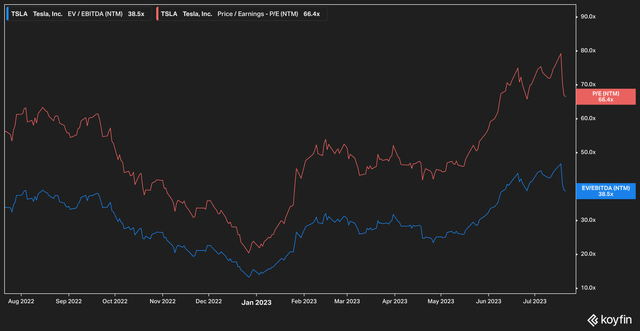

On the valuation front, Tesla still remains at heights that seem to defy logic. With a forward earnings multiple of 64x, and a EV/EBITDA multiple of 38x, we still believe that Tesla’s stock–despite its apparent progress–remains richly valued, to put it lightly.

The Bottom Line

Tesla is a stock that has divided investors for years, and will likely continue to do so in the future. While we still have concerns about the company, such as vehicle safety, the number of consumer complaints Tesla’s vehicles generate, and the subsequent warranty risk the company may be exposed to in the future (which we wrote about here), we acknowledge that Tesla, Inc. has executed well against its targets even at the expense of its prized margin.

Further, given Tesla’s standing as a polarizing stock, we acknowledge that fundamentals often matter less for true-believers than they would for companies that inspire a bit less loyalty, for lack of a better word. In this sense, Tesla seems to us a bit like a wave–one can fight it, or one can ride it.

This analogy only goes so far, of course. We adjust our Tesla, Inc. rating to Hold from Sell because we still believe that there are serious concerns within the company that need to be addressed. Recent execution, however, combined with Musk’s renewed focus at the company, forces us to consider Hold as the best option and to see if the good news for Tesla continues.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information contained herein is opinion and for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. The opinion of the author may change at any time and the author is under no obligation to disclose said change. Nothing in this article should be construed as personalized or tailored investment advice. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.