Summary:

- The Tesla, Inc. Robotaxi catalyst doesn’t look sufficient to me. In my opinion, the market is significantly overestimating the prospects for a recovery of Tesla’s business, at least in the near term.

- Despite showcasing new technologies like Robotaxi and Optimus robot, the event failed to provide concrete growth catalysts, leading to continued stock underperformance.

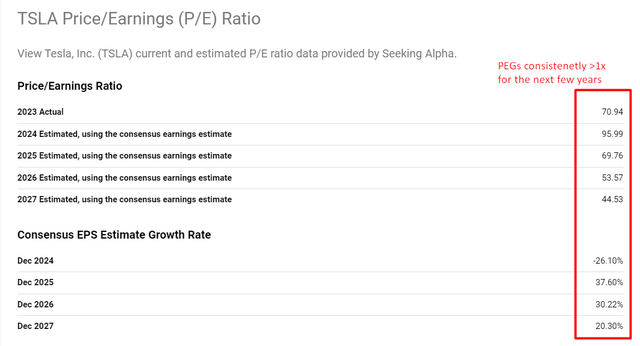

- Tesla’s valuation remains extremely high, with PEG ratios above 1x even in 2027, suggesting the stock is significantly overvalued.

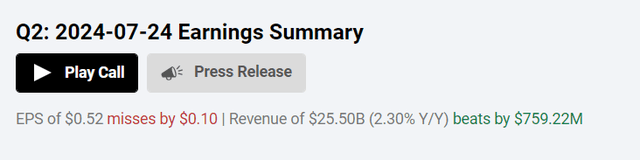

- Tesla’s Q2 2024 results showed a significant decline in profitability, with EPS dropping to $0.52, well below estimates, due to lower ASPs and higher expenses.

- I maintain a “Sell” rating on Tesla, as the market overestimates its recovery prospects, and fundamental data indicates continued pressure on the stock price.

PhonlamaiPhoto/iStock via Getty Images

Intro & Thesis

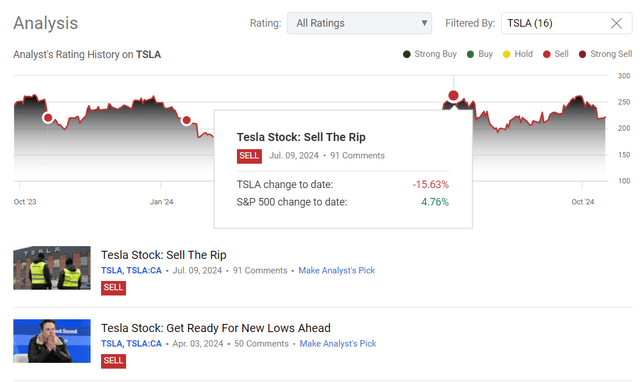

My first article about Tesla, Inc. (NASDAQ:TSLA) was published in October 2021 with a “Buy” rating, which I changed to “Hold” in October 2022, and eventually to “Sell” in April 2023. Since then, I have maintained my bearish rating on TSLA. Since April 2023, the stock has increased by only 20%, experiencing insanely high volatility, while the S&P 500 index (SP500, SPX) has grown more than twice as much, by 43% over the same period. My last Sell-rated article, titled “Tesla Stock: Sell the Rise,” was published in July 2024. Since then, the stock has declined by ~15.6%, whereas the S&P 500 index has risen by about 4.8%, so Tesla’s underperformance stayed in place:

Seeking Alpha, the author’s coverage of TSLA

After the recent event showcasing Tesla’s Robotaxi to a wide audience, the stock has experienced a slight correction. I believe the catalyst every bull hoped for was actually insufficient to rekindle market hopes for a swift recovery of the stock. Therefore, I don’t see any reason to be overly optimistic about Tesla, at least in the medium term — hence my “Sell” rating reiteration this time around.

Why Do I Think So?

Tesla’s second-quarter 2024 results, based on the adjusted net profit of $1.812 billion ($0.52 per diluted share), represented a bleak success from the $3.148 billion ($0.91/share) a year ago. That EPS loss was considerably lower than both the internal estimates and consensus $0.64 and $0.61, respectively. The decline in profitability resulted primarily from “lower vehicle ASP, a poor mix of vehicles, higher operating expenses related to Cybertruck, AI and other R&D investments, and lower vehicle deliveries.” On the other hand, Tesla managed to top revenue consensus expectations, which is a bright spot in the report:

As you can see, Tesla’s total revenue jumped 2.3% to $25.5 billion. Yet, the car business, another key revenue source, fell 7% YoY to $19.878 billion. The revenue from Services and Other was offset by a 21% rise in Services and others, rising to $2.608 billion. Overall, Tesla’s Energy Generation and Storage business doubled in revenue to $3.014 billion, on higher demand for its Powerwall and Megapack offerings with a 9.4 GWh deployment.

Anyway, the quarter’s gross margin was 18.0%, slightly below the year-end of 18.2% due to, again, lower ASPs and additional expenses from new product ramps and R&D. Furthermore, I see no positives in the auto-deliveries data as we saw 443,956 vehicles for the quarter, a 5% drop from last year (these included 21,551 Model S and Model X vehicles and 422,405 Model 3 and Model Y vehicles). Deliveries deteriorated in part because of lower production rates during past quarters, but the Shanghai plant is back up to full capacity.

The realization of Tesla’s ambitious plan to grow business at a 50% CAGR became a problematic target yet for another year, as the EV market is experiencing slowed growth and is transitioning from major growth stages.

So investors were largely hoping that Tesla would independently drive growth by announcing its FSD technology, robots, robotaxi, and stuff like that in October 2024. However, in my opinion, there was nothing particularly outstanding demonstrated to suggest that growth rates would return to their one-day elevated levels.

I wasn’t at the event myself, but I found guys whose take I consider quite valuable — Goldman Sachs analysts. They attended Tesla’s “We, Robot” event to view its Cybercab and Robovan as well as updates to the Optimus humanoid robot; thereafter, they described their thoughts in a specialized research report (proprietary source, October 2024), which I’d like to cite here in my article.

Even though they were intrigued by the developments of the Optimus robot and its realistic interactions, they also complained that little information exists on Tesla’s FSD performance or robotaxi business model — still. I think that having no lower-cost consumer-van unveiling also appeared to disappoint investors, with Tesla’s stock set declining after an upward push earlier.

Goldman Sachs expects Optimus to play a larger role in investor discussion and anticipates long-term Tesla opportunities in ADAS and AVs, though widespread Level 4 autonomy may be a while off. I agree with their perspective because without concrete details — which the company did not provide — it is challenging to predict the future. Given that previous projects have experienced delays, I anticipate a similar outcome this time.

What we know today is that Tesla plans to introduce unsupervised FSD robotaxi operations into Texas and California next year on existing models, and expects to begin production of the Cybercab in FY2026. Autonomous vehicles can be 5-10x more used, the company estimates, with Cybercab operating at roughly $0.20 per mile and pricing at $0.30-$0.40 per mile. It’s estimated that the Cybercab will be available for $30,000 or less, according to Tesla. However, I have some doubts because we recall the initial expected price for a Cybertruck and how it ultimately turned out to be different.

Cybercab is expected to incorporate an AI 5 computer for distributed inference computation and inductive charging with a self-cleaning system. However, the absence of incremental FSD performance data means the debate about Tesla’s proximity to unsupervised FSD hasn’t been settled, GS analysts added.

Goldman Sachs anticipates robotaxis to offer significant long-term revenue but admits that small-scale pilot installations might bring only modest revenues. The cost advantage Tesla would have by building robotaxis for $30K versus competitors’$50K-$75K cars could also lead to lower per-mile depreciation. The Cybercab will be a blind or unradared vehicle, based on vision and AI, and there are uncertainties about how it’ll function in different weather and lighting.

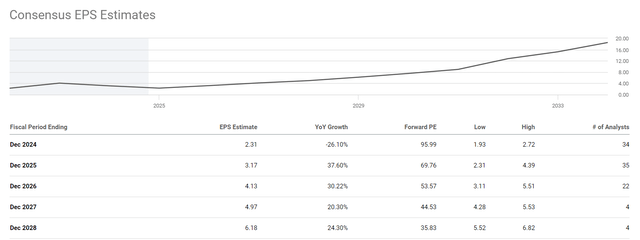

I’m a non-believer in Tesla stock in the medium term, as competition and price pressure in EVs have affected the auto business, restricting EPS growth over the near to intermediate term. Contrary to my expectations, Wall Street continues to believe that this year will mark the bottom of the company’s EPS decline. By FY2025, it’s anticipated that TSLA’s EPS will grow to $3.17. This represents a 37.6% YoY increase, while the projected CAGR over the next 5 years is set to be almost 22%. This is quite significant, in my opinion, for a company whose operations are still heavily tied to the highly competitive automotive industry.

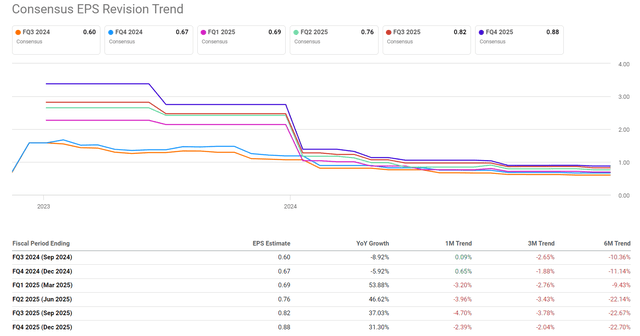

I anticipate that the reality for Tesla will be much harsher, as we’ve already observed. For example, EPS forecasts have been reduced over the past 6 months, with some being cut by nearly a quarter from their original values:

As I have stated in my previous articles, Tesla’s valuation is extremely overvalued today, even if we assume that current estimates of Tesla’s net profit growth for the next few years are correct. The implied PEG ratios are still expected to remain above 1x even in 2027, suggesting that the rate of decline in the multiple (i.e., multiple contraction) is too low to be attractive today. In my view, Tesla should trade at no more than 30 times net earnings by the end of FY2027. This means that the current valuation is almost twice as high as the maximum fair value.

Seeking Alpha, TSLA, notes added

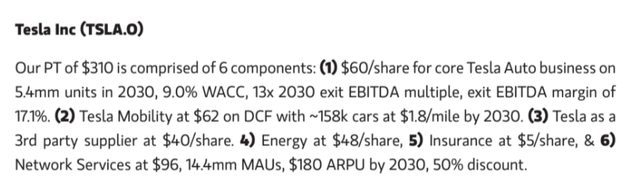

However, my colleagues at Goldman Sachs disagree with me: They have a neutral rating on Tesla, but their forecast proposes a target price of around $230/share, which is already higher than the current price.

I’m more conservative here. Despite the growing and promising share of non-automotive revenue in Tesla’s business structure, I believe the catalyst many anticipated in October wasn’t as significant as the bulls expected. So moving forward, we’ll need to focus on the actual fundamentals, which, based on preliminary indirect signs, may not be as optimistic as Wall Street expects today. This is how I currently view the situation, and it’s why I’m maintaining my “Sell” rating unchanged. We’ll learn more after Tesla reports its earnings on Wednesday, October 23rd.

Where Can I Be Wrong?

First, I concede that I may have underestimated the significance of the recent event. Maybe I’m not thinking very far out about the eventual long-term positive value in what the company introduced a few days ago. Most sell-side analysts almost unanimously believe the long-term growth prospects for the company are strong. In this respect, I might get caught up in short-termism, in which I focus only on the current problems and fail to take the full positive view that can push the stock higher down the line.

Secondly, one more risk lies in how I view the company’s valuation. While I would prefer to see a much faster decline in valuation multiples over the coming years, there are factors to consider. For example, Tesla could potentially increase its EPS much faster than currently forecast if it addresses its margin issues soon. Perhaps the multiples won’t fall as quickly as I would like. According to an analysis from Morgan Stanley, breaking Tesla’s business into several parts and evaluating them separately suggests that the company may actually be undervalued. A significant portion of its current valuation is actually attributed to services, not the auto business:

Morgan Stanley (proprietary source, October 2024)

The Bottom Line

Despite the risks to my thesis, I continue to believe that Tesla’s current challenges in reviving its previous growth rates are not as short-term as the market perceives. The catalyst we saw recently doesn’t look sufficient to me.

The market has an enormous overstatement, in my view, when it comes to a recovery of Tesla’s business, at least in the near-term. Meanwhile, Tesla’s stock remains among the most expensive ones among mega-cap firms. Estimating the company’s fair value today is difficult, as traditional methods point to a significant overvaluation. Nevertheless, I believe that the fair value should be significantly below the current stock price — I expect continued pressure on TSLA’s price as more fundamental data becomes available for analysis. For all these reasons, I am leaving my “Sell” rating unchanged.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!

![GS [proprietary source]](https://static.seekingalpha.com/uploads/2024/10/17/49513514-17291557235236375.png)

![GS [proprietary source]](https://static.seekingalpha.com/uploads/2024/10/17/49513514-17291565273293886.png)