Summary:

- Tesla Inc.’s U.S.-based target audience is planning to spend less on autos [in the next 6 months] than AlphaWise’s analysts found just a few weeks ago.

- Based on CQi’s updated survey findings, the desire of the solvent Chinese population to make a “big-ticket” purchase in the foreseeable future is quite weak.

- Judging by what’s happening right now, CEO Elon Musk has absolutely no plans to sacrifice margins for growth – otherwise, he wouldn’t be raising prices against the backdrop of competitors’ price cuts.

- SLOOS survey shows a negative outlook for growth as bank credit growth has peaked and credit impulse is declining rapidly, which will impact activity in H2 2023.

- Despite all the upside risks to my thesis, I confirm my previously given target of ~$114 per share, which should lead to a selloff of up to 30-35%.

jetcityimage/iStock Editorial via Getty Images

Intro & Thesis

Tesla, Inc. (NASDAQ:TSLA) is one of the most popular tickers in the stock market, but in addition to it, the company also operates in one of the most widely-covered industries – automotive. Data appears literally hourly in this sector – one just has to have time to analyze it. Moreover, thanks to its once-high growth rates and equally breathtaking valuation multiples, Tesla remains the subject of heated debate and controversy for many, which only adds to the interest of retail investors on platforms like Seeking Alpha.

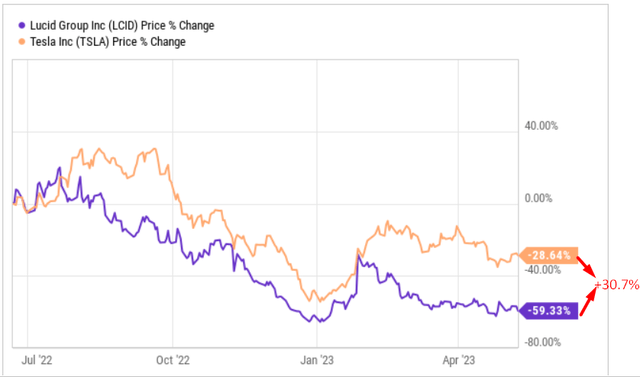

Since 2021, my thesis on Tesla has changed from bullish to bearish, and the conclusions of my thesis have been different. It’s nice to know that my idea to short Lucid Group, Inc. (LCID) and buy Tesla shares for the same dollar amount is still working very well after almost a year:

However, a positive spread between Tesla and its “poorer-quality” competitors doesn’t make Tesla a “Buy” – I still think Tesla stock is a clear “Sell” despite its growing market share among global automakers. This is because currently, the stagnation in demand from the upper middle class or higher income population is becoming more and more apparent.

Why Do I Think So?

Business Research Methodology suggests that Tesla’s target audience consists primarily of individuals who are in senior positions, such as upper-middle or higher-income employees, professionals such as doctors, lawyers, business owners, and senior executives. This is partly due to the high cost of purchasing the Model X and Model S, which are the best-selling models.

In my investment community [Beyond the Wall Investing], I recently published a newsletter with an analysis of the latest data from Morgan Stanley’s AlphaWise [proprietary source – May 8, 2023] survey of various categories of the U.S. population. About 2,000 U.S. consumers were surveyed from April 28 to May 1 to measure their consumer behavior, attitudes, and outlook.

So, according to the latest survey, Tesla’s U.S.-based target audience is planning to spend less on autos [in the next 6 months] than AlphaWise’s analysts found just a few weeks ago:

Morgan Stanley’s AlphaWise report as of May 8, 2023 [proprietary source], author’s notes![Morgan Stanley's AlphaWise report as of May 8, 2023 [proprietary source], author's notes](https://static.seekingalpha.com/uploads/2023/5/10/49513514-16837049245141454.png)

I bold the words “planning to spend” for a reason, because it’s precisely such data that form the forecasts that differ from the consensus and give investors an edge. In the first quarter of fiscal 2023, Tesla’s net income fell 24% due to price cuts across its model line-up, resulting in lower profit per vehicle sold, even as sales rose 36% to a record 422,875 vehicles worldwide. Tesla’s operating profit margin also fell from 19.2% in Q1 2021 to 11.4% in Q1 2022, and the company produced nearly 18,000 more vehicles than it sold in that quarter, indicating slowing demand at the time. As we recall, the stock reacted with a steep drop of more than 9% on the day the results were announced. It was a classic “sell on facts” – those investors who were able to predict the first TSLA’s earnings miss in the last 9 quarters could make good money or lose less by reducing their exposure in advance. So as I wrote in more detail in my last article on the S&P 500 Index (SPY), the market looks at the future, not the past – we have to look ahead and make “out-of-consensus” assumptions if we really want to get the desired alpha.

So if we go back to demand, we see that consumers from the company’s target group are planning to lower their car costs. How has Tesla responded to this trend? To put it mildly, non-trivially – the company raised prices in key markets:

Tesla has increased prices by up to $290 on its top-selling electric vehicles (“EVs”) in Canada, China, Japan, and the United States after slashing prices since the beginning of 2022. But as we can recall, despite offering discounts to encourage demand, the company’s Q1 deliveries only increased by 4% to 422,875 units. The recent price increase could negatively impact Q2-Q4 FY2023 sales growth rates, especially in the already challenging Chinese market.

Tesla’s deliveries in China fell by 15% in April, from 89,000 to 76,000 vehicles. In comparison, the local Chinese competitor BYD sold 1.6% more vehicles than in March. On May 4th, the automaker increased the price of the Model S and Model X by ¥19,000 [~ $2,750]. The price increase in China may further reduce demand. I see this corporate decision as an attempt to contain margins, but I’m questioning the hoped-for sales growth in China.

A few hours ago, Credit Suisse’s team of analysts in China, who regularly conduct CQi surveys, which I mentioned earlier, published an update. This survey examines the desire of the solvent Chinese population to make a “big-ticket” purchase in the foreseeable future [in the next 6 months].

Credit Suisse [9 May 2023], proprietary source![Credit Suisse [9 May 2023]](https://static.seekingalpha.com/uploads/2023/5/10/49513514-16837070187138903.png)

As you can see from the survey results, the number of people who want to buy a new car among the Chinese is still at a relatively low level – demand for cars is returning relatively weakly despite all the claims of a post-Covid recovery.

Returning to the AlphaWise report, Morgan Stanley’s research team has also noted a decline in Chinese consumers’ demand for luxury products [autos are a constituent of this category]:

Morgan Stanley’s AlphaWise report as of May 8, 2023 [proprietary source]![Morgan Stanley's AlphaWise report as of May 8, 2023 [proprietary source]](https://static.seekingalpha.com/uploads/2023/5/10/49513514-1683710593677349.png)

However, in the same SA News report dedicated to the recent price increases, Tesla CEO Elon Musk stated that the company is ready to sacrifice margin for increased sales volume while also raising pricing where it can to keep up with production and delivery.

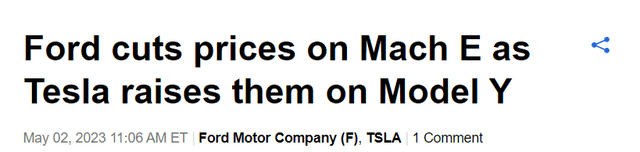

But judging by what’s happening right now, Musk has absolutely no plans to sacrifice Tesla’s margins – otherwise, he wouldn’t be raising prices against the backdrop of competitors’ price cuts:

As the Seeking Alpha News team reports, Ford cut the starting prices of its Mustang Mach E electric SUV in the U.S., making many versions cheaper than the Tesla Model Y, its main competitor. The standard range base versions of the Mach E saw $3,000 price cuts, with the rear-wheel-drive version dropping to $42,995 and the all-wheel-drive model going to $45,995. Tesla, on the other hand, has raised prices by $250 on the Model Y SUV and Model 3 small sedan, while its Model Y dual motor now starts at $47,240. However, the Mach E is only eligible for a $3,750 U.S. federal tax credit this year, while the two top-selling Tesla models are eligible for $7,500. Ford also said it is reopening the order bank for the Mach E after upgrading a factory in Mexico to increase output.

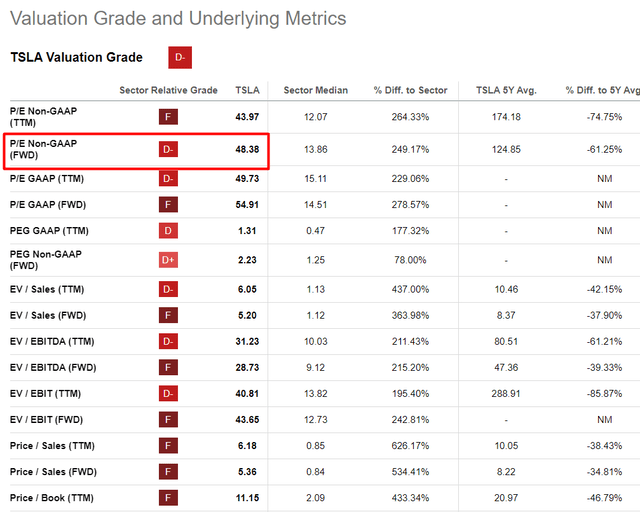

From all of the above, I can only conclude that Q2-Q3 will be a test of Tesla’s pricing power – the company’s shareholders’ satisfaction will depend on how TSLA’s growth rates behave, for which investors are paying 48.38 times forwarding net income today.

Seeking Alpha, TSLA’s Valuation, author’s notes

Departing from the non-standard Tesla’s corporate decision to raise prices against the backdrop of other competitors, I’d like to look at the sector’s demand side again, but from a slightly different angle.

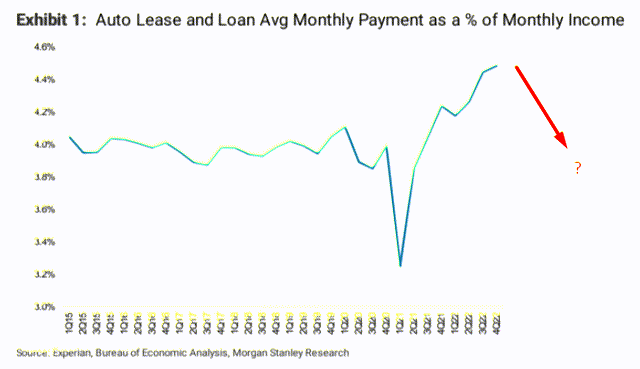

In one of my previous articles, I cited infographics from another Morgan Stanley study [published in mid-March, proprietary source] that clearly shows the dependence of car sales in the United States on borrowed funds:

Morgan Stanley (03/16/2023) (author’s notes)

Americans are spending more on loan servicing and leasing for cars today than in recent years, exacerbating the potential impact of tighter lending requirements. While the collapse of SVB Financial Group (OTC:SIVBQ) et al. seems to be isolated, it has affected the behavior of other market participants, causing banks to tighten lending requirements for new borrowers. This is a cause for concern as auto and consumer credit are closely connected, with over 90% of cars purchased through financial instruments.

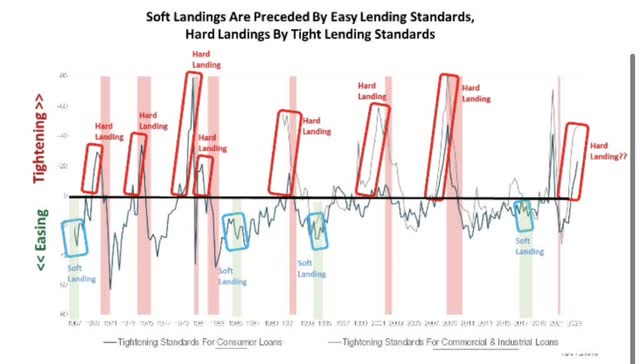

Goldman made a nice review of the latest Senior Loan Officer Opinion Survey report [8 May 2023, proprietary source], mentioning weaker demand for C&I and CRE loans in Q1.

And as one trader I follow closely noted, the recent SLOOS survey showed that banks tightened lending standards for all types of loans, but the rate of change was not as bad as during the financial crisis. The survey results were slightly better than what most investors were expecting. However, the demand for commercial and industrial loans, real estate loans, and consumer loans was very weak. So this data release is a net negative for growth as total bank credit growth has already peaked, and the credit impulse is dropping sharply, which should start weighing on activity in the second half of the year.

Also, Michael Kantro, the Chief Investment Strategist at Piper Sandler, showed graphically that today’s lending standards data portends an ugly outcome for the stock market going forward:

The Verdict For Tesla Stock

What conclusion can be drawn from all this specifically for Tesla, Inc. stock? I think there’s enough data to conclude that auto demand is weakening in both the U.S. and China [and the world in general] and that Elon Musk’s decision to raise vehicle prices is counterintuitive and unlikely to spur the growth Musk has prioritized lately. Without adequate growth, and even in the context of the relative stability of margins at current levels [or even slightly higher], multiples will be too high for Tesla to keep the stock stable. As production increases, Tesla gradually becomes a value stock [more stable margins, less growth], and as a value stock, the valuation doesn’t stand up to scrutiny.

Of course, there are a number of risks to my thesis that I cannot rule out. First, Tesla is far from being just an automaker stock, and the latest quarterly report clearly showed that. Non-automotive revenue growth continues to pick up and the regulatory environment suits the company well to continue to expand and diversify away from just vehicle sales. Therefore, any bearish thesis runs the risk of collapse, as it did for many years prior to 2022 – especially if there’s a soft landing going forward.

Second, many negative expectations are already priced in by the market. Third, I look at demand dynamics based on forward-looking studies of indirect indicators – just because someone didn’t tell AlphaWise analysts about their plans to buy a new car in the next six months doesn’t mean that person won’t end up buying. Moreover, the AlphaWise sample consisted of only 2,000 respondents.

But despite all the upside risks to my thesis, I confirm my previously given target of ~$114 per share, which should lead to a selloff of up to 30-35%:

TrendSpider Software, TSLA, author’s notes

Author’s note: the timeframe for the TSLA stock’s fall depicted in the chart is for illustrative purposes only. I am not making any predictions that the price will reach the projected price level of ~$114 exactly in 29 weeks.

So, I reiterate my previous Sell rating on Tesla, Inc. stock.

Thank you for reading! Please, let me know what you think in the comment section below!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to navigate the stock market environment?

Keep your finger on the pulse and have access to the latest and highest-quality analysis of what Wall Street is buying/selling with just one subscription to Beyond the Wall Investing! Now there is a free trial and a special discount of 10% – hurry up!