Summary:

- Since my previous assessment, Tesla stock has rallied from $160 to $250 per share within three months.

- Tesla’s Q2 delivery outperformance, Elon Musk’s victory on his compensation package vote, and robotaxi hype have catalyzed a wild earnings multiple expansion in the EV giant’s stock.

- However, rubber is about to meet the road as Tesla reports Q2 2024 numbers in today’s after-hours session.

- The article discusses what to expect from Tesla’s Q2 2024 report, including quarterly estimates and revision trends. Also, we will re-evaluate Tesla’s long-term risk/reward.

Sean Gallup/Getty Images News

Introduction

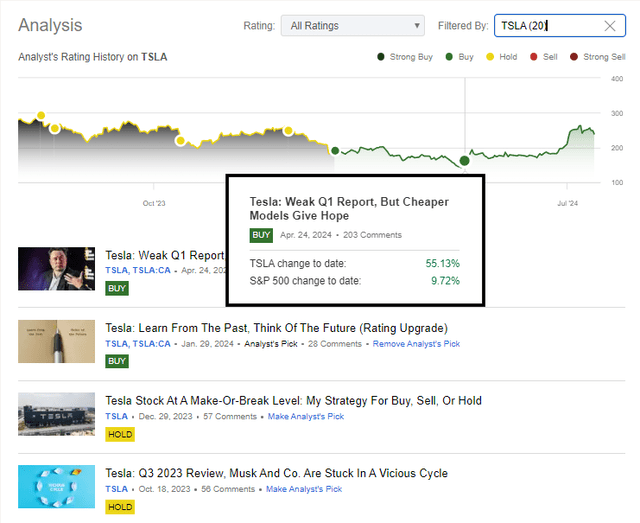

In light of its Q1 2024 report, I reiterated Tesla Inc. (NASDAQ:TSLA) as a “Buy” at $160 per share, citing its future growth prospects and compelling long-term risk/reward [5-year expected CAGR return of 15%+]:

Based on fundamentals and technicals, I view Tesla’s near-term risk/reward as skewed to the downside. In my view, investors with a 1-2 year investment horizon should continue to avoid Tesla. On the other hand, I like the idea of restarting accumulation for investors willing to look beyond a couple of years due to Tesla’s favorable long-term risk/reward. At my investing group, we like to operate with a 5+ year time horizon, which is why we will restart slow, staggered accumulation in TSLA stock at our next bi-weekly deployment. To be clear, we understand that Tesla could drop more than 50% from current levels in the event of a hard landing. The plan is to dollar-cost average for the next couple of years even if Tesla keeps spiraling lower during this low-growth period for the EV giant.

Key Takeaway: I rate Tesla a modest “Buy” at ~$160 per share, with a strong preference for slow, staggered buying over the next 12-24 months.

Since then, Tesla’s stock has rallied up by ~55% in just about three months!

Two big catalysts that have powered this move in TSLA are –

1) Elon Musk winning the shareholder vote on his $56B compensation package, i.e., removal of risk associated with Musk moving AI/robotics away from Tesla; and

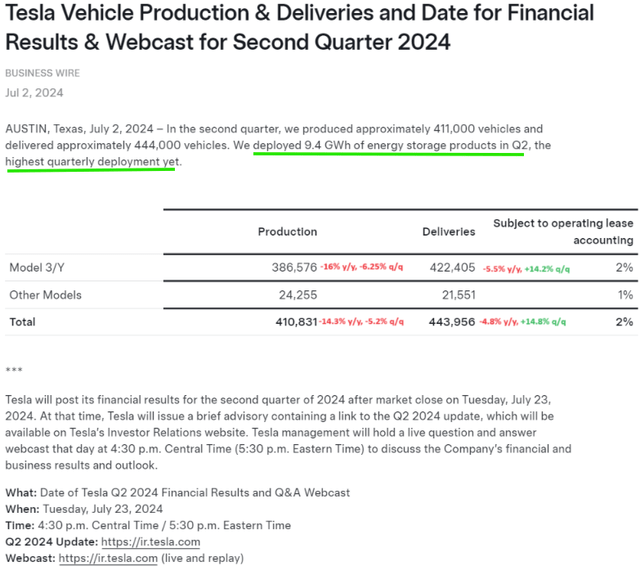

2) Tesla recording better-than-feared delivery numbers for Q2 2024 [plus announcing a record high quarterly deployment of energy storage products: 9.4GWh]

Author, Tesla Investor Relations

While Tesla’s delivery volumes fell ~5% y/y in Q2, the EV giant experienced a significant jump in deliveries on a sequential basis (+14.8% q/q). With deliveries outpacing production by ~33K, Tesla seems to have reversed some of the recent inventory buildup, as projected by Tesla’s leadership last quarter. As I see it, the inventory reduction will help propel Tesla’s FCF generation back into positive territory.

Now, Tesla is all set to report its Q2 numbers in after-hours on July 23; however, after going up from $160 to $250 per share in a flash, is TSLA stock still a “Buy”? Let’s find out!

Tesla’s Updated Risk/Reward

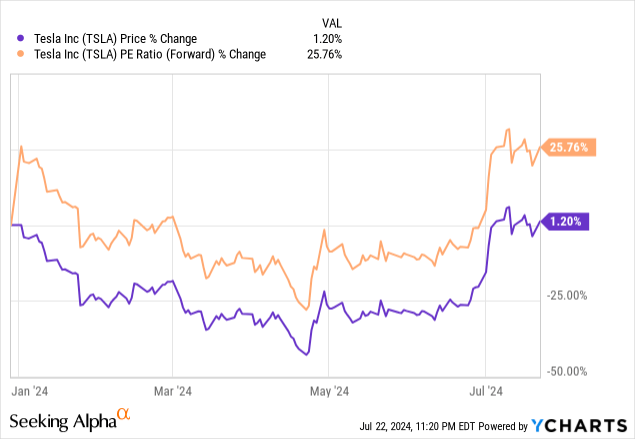

While Tesla’s stock has completely reversed a 40% YTD loss in a matter of weeks, the entire rally in TSLA has been driven by trading multiple expansion, with very little improvement in consensus earnings estimates over the past three months.

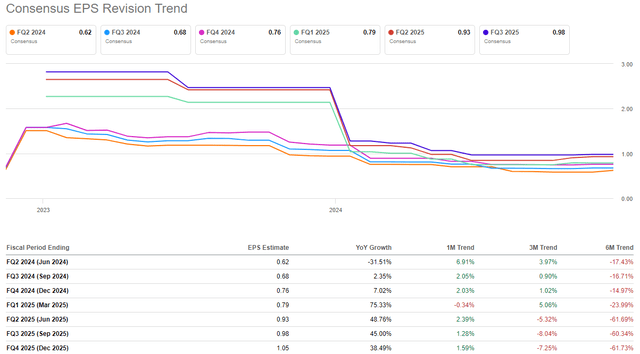

SeekingAlpha

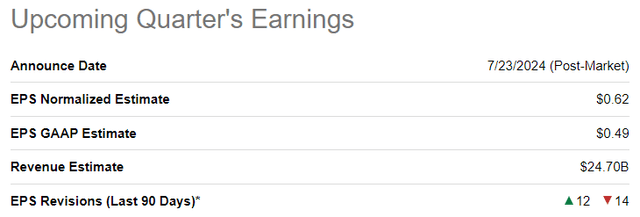

Given Tesla’s delivery numbers for Q2 beat consensus estimates, one would expect to see a rebound in Tesla’s EPS estimates. While Tesla hasn’t been cutting prices recently, the EV maker has been incentivizing consumers with discounted rates [e.g., 0.99% APR offer on Model-Y] to boost sales volumes. This is probably why Tesla’s EPS estimates have failed to move up by much in light of its Q2 delivery beat.

For Q2, Tesla is projected to generate $24.70B and $0.62 in revenue and normalized earnings per share, respectively.

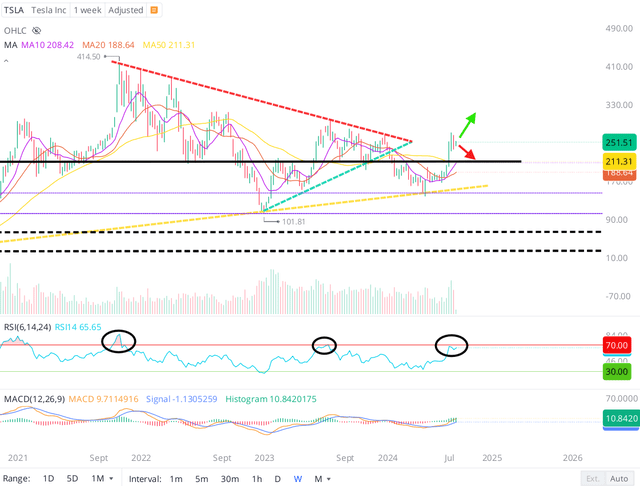

On the back of its vertical run-up from the mid-$100s to mid-$200s, Tesla’s weekly RSI has raced up from ~30 [“oversold”] to ~70 [“overbought”]. Clearly, the sentiment around TSLA stock heading into the quarterly print is bullish. While a positive earnings surprise and/or (more) robotaxi hype can trigger an upside breakout, Tesla’s stock appears primed for another technical correction, with the Q2 report likely to be a “sell the news” event.

Tesla stock chart (WeBull Desktop)

As we have discussed previously, Tesla is set to experience slower growth and continued margin pressures for the next couple of years:

Our company is currently between two major growth waves: the first one began with the global expansion of the Model 3/Y platform and the next one we believe will be initiated by the global expansion of the next-generation vehicle platform. In 2024, our vehicle volume growth rate may be notably lower than the growth rate achieved in 2023, as our teams work on the launch of the next-generation vehicle at Gigafactory Texas.

Source: Elon Musk, Tesla’s Q4 2023 Earnings Deck

Not much has changed on the fundamental/economic side, so I do not expect any explosive surprises in Tesla’s Q2 report. The hype around the Tesla robotaxi has boosted sentiment around TSLA stock; however, with the robotaxi launch event already confirmed to have been pushed out to later in the year, momentum can unwind rapidly if Q2 earnings fail to justify lofty expectations.

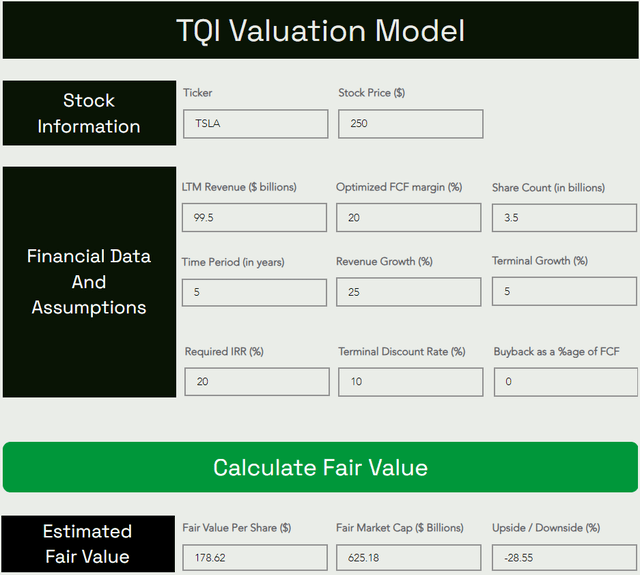

Based on our long-term growth [25% CAGR growth for the next 5 years] and steady-state FCF margin [20%] assumptions for Tesla, the rally from $160 to $250 per share has rendered TSLA stock a “Hold” due to a significant deterioration in its long-term risk/reward.

Here’s my updated valuation for Tesla:

TQI Valuation Model (Free to use at TQIG.org) TQI Valuation Model (Free to use at TQIG.org)

At our previous assessment ($160 per share), Tesla’s stock was undervalued by ~5%; however, at current levels ($250 per share), TSLA stock is overvalued by ~30%, and this is despite an increase in our fair value estimate for Tesla, which is up from $170 to $179 per share.

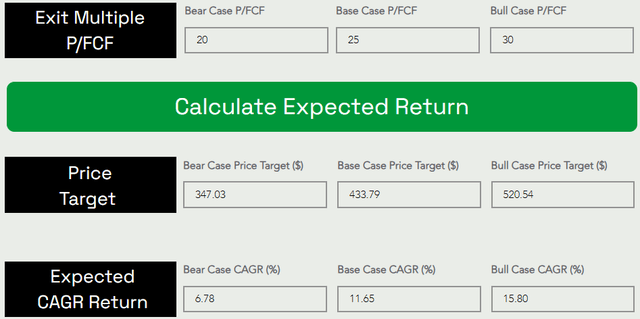

Assuming a base case exit multiple of ~25x P/FCF, I now see Tesla stock going from ~$250 to ~$433 per share over the next five years at a ~11.6% CAGR.

Since Tesla’s 5-year expected CAGR return has dropped from ~21% to ~11.6% [well under our investment hurdle rate of 15%], I am downgrading Tesla stock to a “Hold” rating.

In light of its recent run-up, Tesla’s long-term risk/reward has deteriorated significantly. Considering its recent financial performance and uncertain business outlook, I view Tesla’s near-term risk/reward as skewed to the downside. At TQI, we have paused the accumulation of Tesla shares ahead of its Q2 report, and I have no plans to get off the sidelines until TSLA’s 5-year expected CAGR rises above 15%.

Key Takeaway: I rate Tesla a “Hold” at ~$250 per share.

Thanks for reading, and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We Are In An Asset Bubble, And TQI Can Help You Navigate It Profitably!

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.