Summary:

- Tesla, Inc.’s stagnant performance stands in stark contrast to the rapid growth of the S&P 500 over the past few quarters.

- I believe that we’re now looking at a great buying point in Tesla stock amid an abundance of bullish catalysts around it.

- The continuation of the systematic shift to the less cyclical non-automotive segment should, in my opinion, and the margin contraction lead to systematic growth in the long term.

- Tesla has never been this cheap from a historical perspective – look at EV/EBITDA (both TTM and FWD) and compare the current position with recent years to see that.

- Returning control to CEO Elon Musk was a must – I now expect AI to become a cornerstone for the company’s growth. I reiterate my previous “Buy” rating today.

baileystock

My Thesis

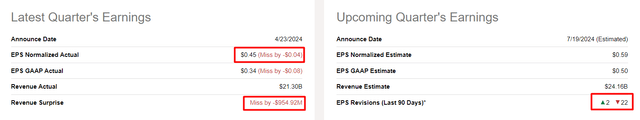

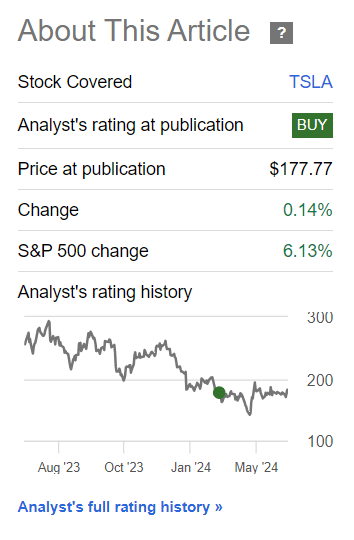

In March 2024, I initiated coverage of Tesla, Inc. (NASDAQ:TSLA) stock, suggesting that it was in the buy zone and investors should consider a long-term position. My analysis at the time was based on the findings that the company’s margins were showing early signs of a potential turnaround shortly; in addition, Tesla’s long-term prospects and its leadership position in EV production and clean energy were adding significant growth potential. However, despite my findings, Tesla stock’s price remained flat in the quarter following the publication of my article. This stagnant performance stands in stark contrast to the rapid growth of the S&P 500 (SP500, SPX) over the same period:

Seeking Alpha, Oakoff’s coverage of TSLA stock

Despite this underperformance, I believe that we’re now looking at a great buying point in Tesla stock amid an abundance of bullish catalysts around it. Therefore, I have decided to reiterate my buy recommendation today.

My Reasoning

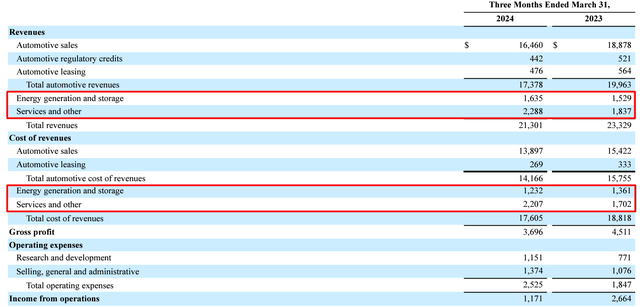

Tesla reported Q1 2024 numbers on April 23, posting an adjusted net profit of $1.536 billion ($0.45 per diluted share), which was a decline from $2.931 billion ($0.85/share) in the same period last year. This earnings figure fell short of the consensus estimate of $0.49. In addition, Tesla also missed on the top line, reporting ~$955 million less than expected, which logically led to plenty of negative earnings revisions for the next few quarters ahead:

Overall revenue declined by 9% to $21.301 billion, with the automotive division’s revenue falling 13% to $17.378 billion. Non-automotive sales went up from $3.4 billion to $3.9 billion (+16.57% YoY) with revenue from “Services and Other” increasing by 25% to $2.288 billion. Overall, the share of non-automotive revenue in the sales structure rose by almost 400 basis points YoY in Q1. That is, this happened in just one year, which leads me to believe that Tesla will be approaching 25% of its revenue from non-automotive in the foreseeable future. This move should reinvigorate the growth rate the company used to boast. In addition to that, margins in the non-automotive segment should be less cyclical and generally higher. The non-automotive segment’s gross profit margin has risen from 9% to 12.34% in just one year, against the backdrop of a fairly difficult period in terms of competition and pricing.

Although the company’s overall gross profit margin has fallen from 19.33% to 17.35%, the continuation of the systematic shift to the less cyclical non-automotive segment should, in my opinion, end the margin contraction and lead to systematic growth in the long term.

What should also boost profitability in the medium term are the 10% layoffs, which have apparently not yet been completed – if the staff cuts go ahead, the gross profit margin should pick up.

As was noted in the press release, the decrease in earnings was attributed to a “lower ASP for vehicles, an unfavorable vehicle mix, increased operating expenses due to investments in Cybertruck and AI projects, and costs related to factory upgrades.” But here it’s important to understand that these investments are a fact of the past. That is, the company’s margins have already suffered from them, leading to a decline in earnings and negative surprises vs. consensus estimates (and also subsequent estimates downgrades). The company now faces a period in which it should reap the rewards of these investments, which in turn should theoretically boost revenue growth and restore margins. Now that Tesla reached a production record of 1,300 Cybertrucks per week, targeting a production increase of 2,500 Cybertruck units per week by the end of 2024, I think Tesla will take a significant share from Ford (F), General Motors (GM), and other major pickup trucks makers shortly.

Tesla is currently still the world’s largest EV seller globally, holding ~51% of the U.S. electric vehicle market by the end of 2023. Although the Q1 results were weaker than expected due to weaker deliveries, price discounts, and high investments in R&D, and AI infrastructure (plus additional production capacity), we shouldn’t ignore another particularly encouraging piece of news back from January: Tesla plans to begin production of a new low-cost EV model in late 2024 or early 2025, priced between $25,000 and $30,000. I see this development as a positive move that could help Tesla maintain and possibly even expand its EV market. As the plans for the production launch fall right in the last months of 2024 and early 2025, I suspect that the approach of these dates could provide the market a good incentive to change the sentiment around TSLA and make the current stock price seem too low.

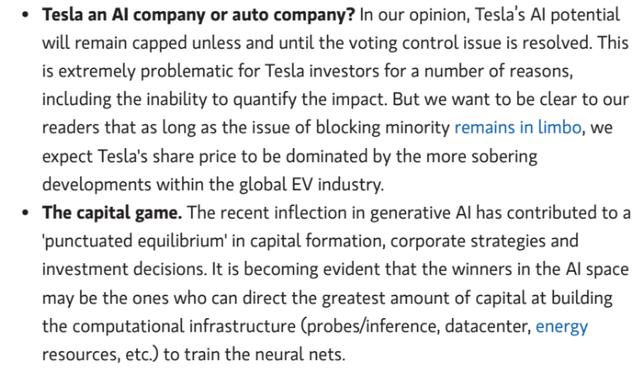

When we talk about future growth prospects, we can’t ignore the development of the autonomous transport market. According to Statista, Level 4 autonomous vehicles are expected to generate revenues of around $42 billion by 2030; autonomous vehicles are predicted to hit the market in a big way. According to a study by IMARC, the market for autonomous vehicles in the USA will grow at a CAGR of 28.6% between 2024 and 2032. Crucial to Tesla’s development in this direction is its focus on AI, which according to Morgan Stanley analysts (proprietary source) was a major problem until recently due to Musk’s difficulties in obtaining blocking minorities.

Morgan Stanley (proprietary source)

But now the way is clear for development in this direction: Elon Musk has finally received his paycheck approval, and I expect the company to be more active in trying to develop its AI potential.

I believe that the combination of all the above catalysts – margin expansion due to a shift in revenue structure amid layoffs, new affordable model, FSD, and AI focus after Musk finally took control – is precisely what explains the current, still very high valuation of TSLA stock.

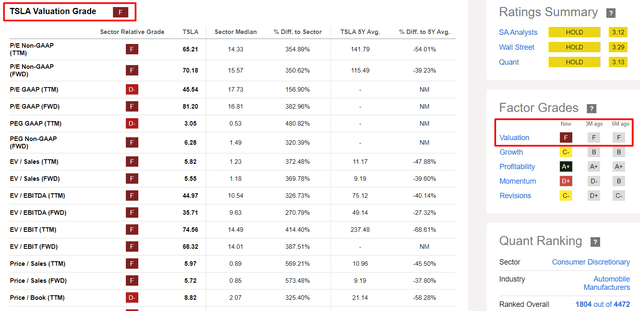

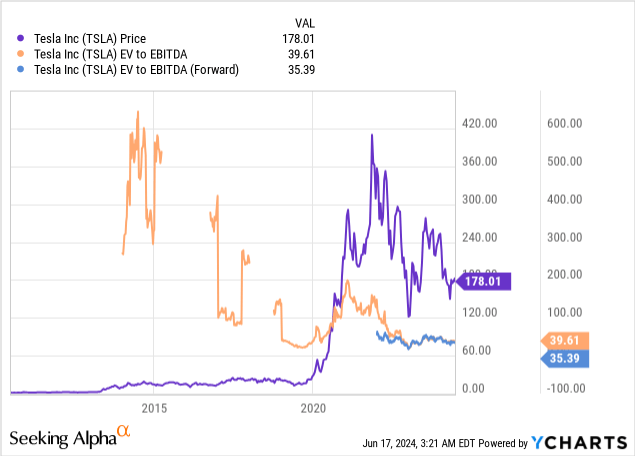

SA, TSLA’s Valuation, Oakoff’s notes

Here, however, I must also note that Tesla has never been this cheap from a historical perspective – look at EV/EBITDA (both TTM and FWD) and compare the current position with recent years to see that.

Yes, 30x+ in EV/EBITDA is still a lot. But if we imagine that the catalysts I mentioned above materialize and current valuation multiples continue to fall at least as much as the market is predicting today (the difference between FWD and TTM), then I think Tesla stock has every chance to grow significantly against the backdrop of potentially higher EBITDA figures (and not only) than currently expected.

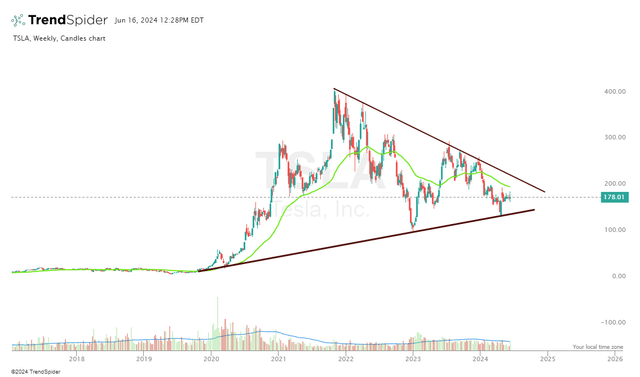

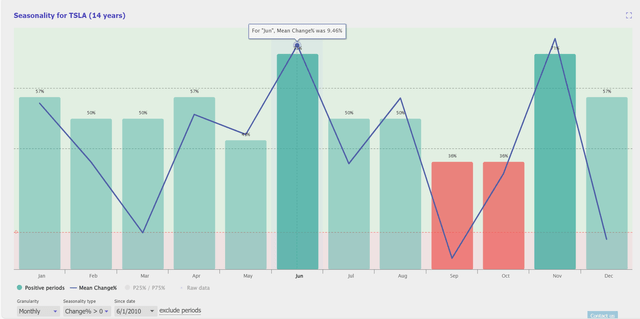

Currently, I see a very long consolidation in Tesla’s stock price, technically speaking. TSLA is closing within a triangle formation on the weekly chart, testing the exponential moving average either from below or above, as the market cannot yet determine the direction of the following move. Given all that I have described above, I expect a breakout of this formation to the upside once the catalysts I have described come into play. From a seasonality perspective, June and the next 2 months strongly suggest that we probably won’t be waiting long. So today’s price is a great buying point, in my opinion.

TrendSpider, TSLA weekly, Oakoff’s notes TrendSpider, TSLA’s seasonality, Oakoff’s notes

Risks To My Thesis

Tesla operates in a very complex manufacturing business, which is very dependent on regulation. On May 14, the Biden administration proposed raising tariffs under Section 301 on China-made EVs and imported lithium-ion batteries for EVs and battery parts, set to take effect in 2024. Additionally, the European Union announced a substantial tariff increase on EVs imported from China, starting July 5, 2024. These tariff hikes could pressure Tesla’s margins, particularly since Tesla relies on Chinese-made LFP batteries for its Standard Range Model 3 in the US and for its Megapack. Goldman Sachs (proprietary source) estimates that these increased tariffs could negatively impact Tesla’s non-GAAP automotive gross margins by about 75 to 100 basis points, contradicting my finding today that GP may improve going forward. This is a pretty big risk to my entire thesis that I can’t ignore.

Another important risk for your consideration: Tesla, similar to its rivals, faces challenges due to weak global economic conditions and changes in consumer preferences and spending patterns. The company also contends with increasing costs for components and raw materials, as well as potential manufacturing disruptions. Moreover, as a newer player in a well-established, high-volume industry, Tesla must deal with the complexities and intense competition typical of this market, which many bulls forget.

Furthermore, TSLA stock remains one of the most overvalued companies of its size, both in terms of absolute metrics and considering recent declines in growth rates (plus profitability). If I’m wrong about the company’s long-term growth prospects, the stock is likely to continue moving lower for the foreseeable future – the triangle formation in the chart above could “break out” to the downside rather than the upside, as I expect.

Your Takeaway

Despite the numerous risks surrounding the company, I believe Tesla is at a great buying point right now because, despite some recent setbacks, such as a decline in vehicle deliveries and increased costs, the company’s long-term prospects remain bright. The upcoming production of a new low-cost EV model should increase Tesla’s market share, and continued investment in AI and production capacity underlines the company’s commitment to innovation and growth.

Returning control to Elon Musk was a must – I now expect AI to become a cornerstone for the company’s growth, while previous investments and the scaling of Cybertruck will provide impetus for the recovery of the business with potentially increasing margins. I reiterate my previous “Buy” rating today.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSLA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.