Summary:

- Tesla’s Robotaxi event was underwhelming, with no verifiable evidence that timelines for FSD or new products are achievable.

- Despite Tesla’s technological advantages, the company faces increasing competition in the EV market, and its market share is shrinking.

- Tesla’s reliance on AI and cameras for self-driving tech may face regulatory hurdles, and the company’s cash burn could necessitate raising funds.

- Investor confidence hinges on Tesla delivering tangible products and meeting deadlines; otherwise, the stock may face significant setbacks.

Yagi Studio

Thesis Summary

Tesla, Inc. (NASDAQ:TSLA) (NEOE:TSLA:CA) revealed its new Cybercab at its We, Robot event. The company also unveiled a Cybervan and an updated Optimus robot.

The timeline for FSD and these innovations is the same as always; sometime next year.

Elon Musk cannot be faulted for his enthusiasm and perseverance, but investors are growing impatient.

While Tesla works on its new AI initiatives, it must battle to maintain market share in an increasingly competitive EV market.

The clock is ticking.

I outlined in my last article that Tesla’s lead in FSD was tenuous, though I had hoped it could leverage its superior technology. However, this event has not reassured me at all.

I am giving Tesla one more year to produce something tangible, or I will be out of the stock. I am downgrading to a neutral rating, as I believe the odds of success for Tesla diminish every passing day.

Robotaxi Event

Tesla’s much anticipated Robotaxi day has come and gone, and here’s what we learned from the event.

Musk unveiled a $30,000 Cybercab, projected to hit the market before 2027. On top of that, Musk unveiled the Robovan, a similar concept but with seating for up to 20 people.

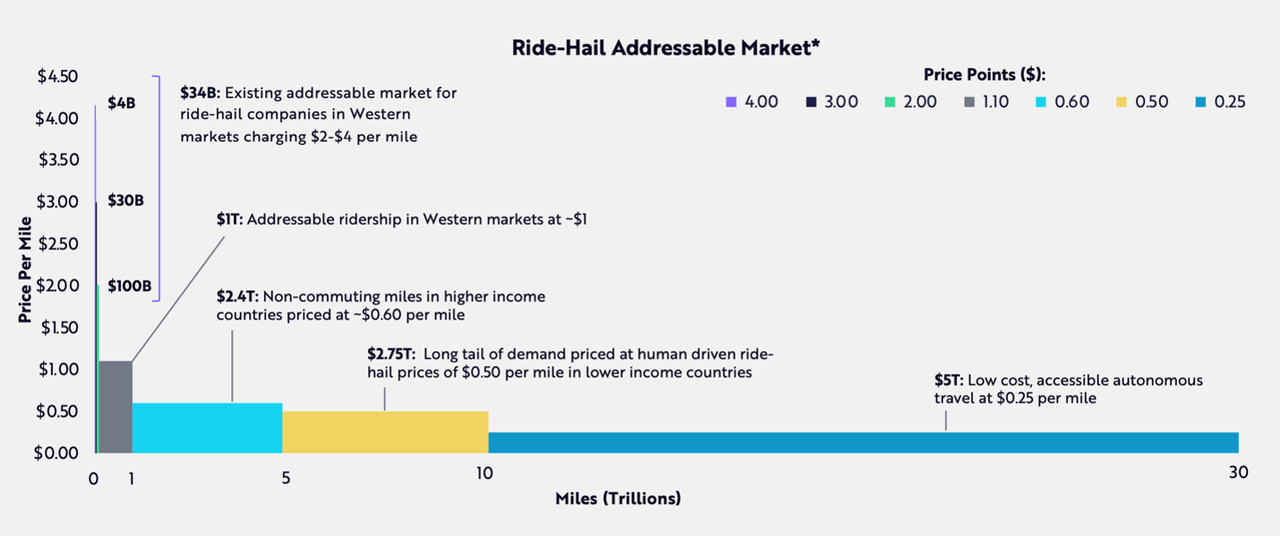

According to Musk, self-driving technology will be 10-20x safer than human driving and could cost as little as $0.20 per mile, making it even cheaper than buses.

“I think the cost of autonomous transport will be so low that you can think of it like individualised mass transit,”

Source: Elon Musk

Finally, we got to see a lineup of Optimus robots perform a choreographed dance, with Musk reiterating that this was perhaps the largest market opportunity for Tesla. He also mentioned the humanoid robot would be available for under $30,000 at scale.

That pretty much concluded the 30-minute presentation.

My 2 cents

When all is said and done, I found the robotaxi event was underwhelming, and looking at the pre-market action right now, I don’t seem to be the only one.

While we got to see the vision, there was no “verifiable evidence” as Jeffries analysts put it, that any of these timelines presented were achievable, or that Tesla’s FSD had made any meaningful progress in the last few months.

Musk has repeatedly overestimated his company’s ability to deliver products. It’s the kind of optimism and belief that is essential to any successful entrepreneurial venture, but perhaps not appropriate when dealing with a board of directors and public investors.

And even if Tesla can pull it off, it may take years for government agencies to approve completely self-driving cars, especially given that Tesla’s technology relies on AI and cameras, rather than Lidar.

But let’s get back to our previous question.

Can Tesla Pull It Off?

I’m not going to argue that driverless technology will be revolutionary. No doubt, there will be resistance to it, but we are talking about saving countless hours of labour, not to mention lives.

The ride-hailing market alone will potentially be huge, as shown by Ark research:

And though I have been harsh on Tesla so far, we can’t deny it does have some advantages over its competitors.

For starters, FSD has driven way more miles than any of its competitors, although FSD does require a driver to still be at the wheel. I do believe the technology is there. Otherwise, what was the point of buying all those NVIDIA (NVDA) chips?

The other thing Tesla does have going for it is its vertically integrated supply chain. Tesla has the production capacity to quickly scale this service, not to mention its spare inventory and the many Teslas in existence that could be added to a fleet of robotaxis.

But Musk is his own worst enemy. Investors would be able to forgive Tesla for not reaching full autonomy if Musk hadn’t always been so optimistic with his timelines. In my opinion, this is now working against the company, and explains, at least in part, why the stock sold off after the event.

The Clock Is Ticking

The problem with trying to rebrand Tesla as an AI business is that it still takes in 82% of its revenues from EV sales. But Tesla’s lead in this department is quickly shrinking.

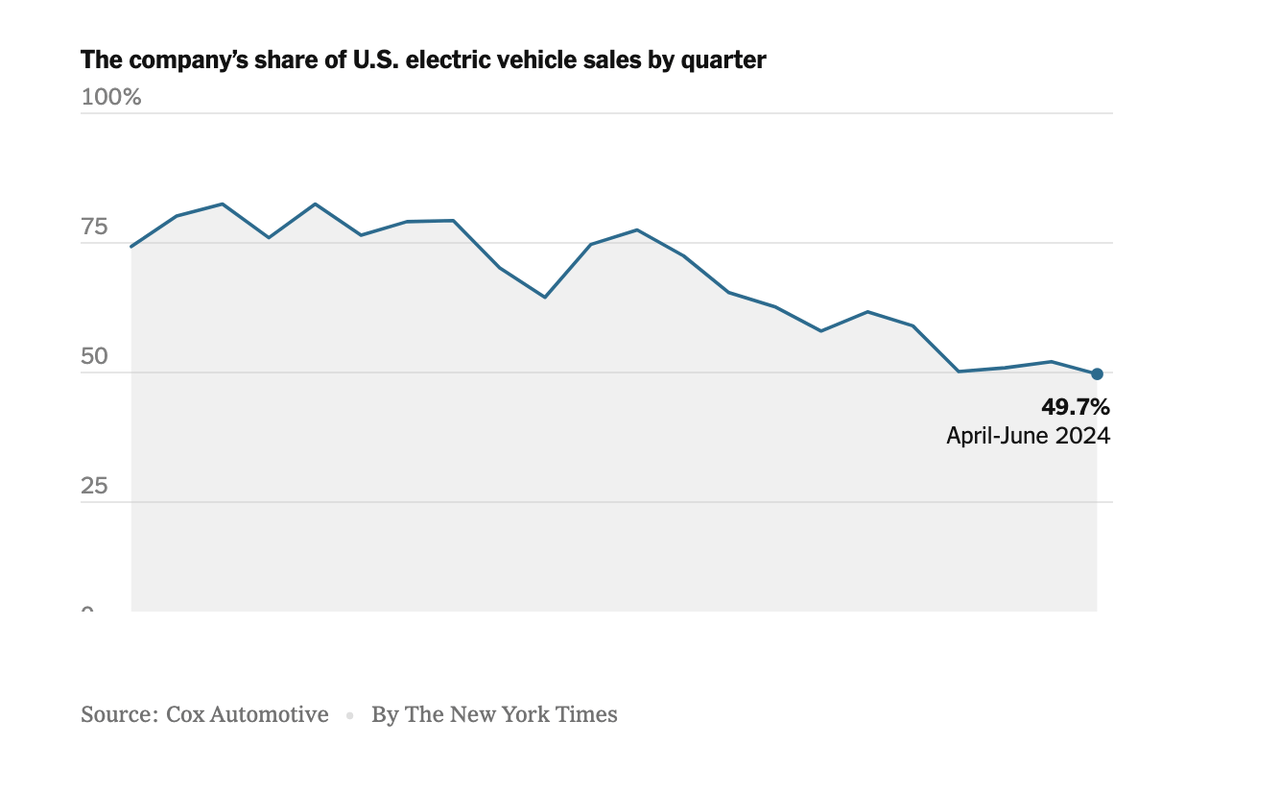

Share of US electric vehicles (Cox Automotive)

The company’s share has fallen below 50% and things may get worse. While the Cybertruck seems to be selling well, production is still limited. Furthermore, the lack of any talk in the recent event of the Model 2, just reinforces this idea.

Tesla still has a strong presence in the US market, but it is not growing like before, and it hasn’t put as much effort as its competitors to gain market share, since it is not bringing out many new models.

This adds extra pressure on Tesla to deliver something new.

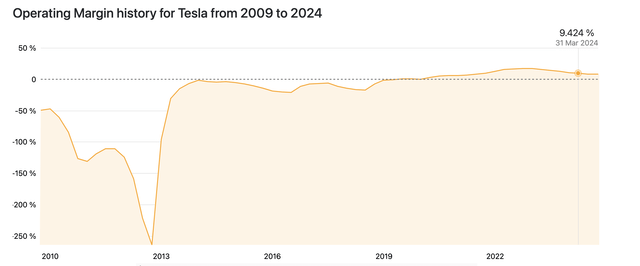

Tesla Operating Margin (Companiesmarketcap.com)

Meanwhile, although Tesla does have a positive operating margin, it is still quite narrow, and there’s a risk that all the investment in AI technology could drive margins back into negative territory. Tesla still has enough cash to keep things going for a while, but investors will need to see some payoff to all these investments sooner, rather than later.

Final Thoughts

All in all, the presentation was underwhelming, and it’s not enough for Musk to say stuff or show us prototypes anymore. We need to see an actual product hit the market, and the latest deadlines have to be met. Not doing so will be incredibly detrimental to investor confidence.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is a high-risk/high-reward opportunity, which is exactly what I look for in my YOLO portfolio.

Joint the Pragmatic Investor today to get insight into stocks with high return potential.

You will also get:

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video