Summary:

- Tesla’s Robotaxi event disappointed investors, leading to a 9% stock drop and failing to present substantial autonomous driving progress or new income paths.

- Tesla’s 3Q24 deliveries missed expectations, with 462,890 units delivered, marking the first quarter of positive growth after two declining quarters.

- Tesla’s operating margins are under pressure, with 2Q24 margins falling to 6.3% due to discounts and incentives; 3Q24 earnings may disappoint.

- Tesla’s stock is technically weak, falling below the 50-day moving average; further downside risk exists if it breaks the 200-day moving average at $202.34.

jetcityimage

The market was less than impressed with the Robotaxi presentation of Tesla, Inc. (NASDAQ:TSLA) (NEOE:TSLA:CA) a few days ago and, as a matter of fact, it disappointed investors to such an extent that the electric-vehicle company’s stock price decreased 9%.

Tesla’s stock has gotten clobbered in the last year as well as electric-vehicle demand slowed, and the Robotaxi event did not particularly help in changing investors’ mood about Tesla.

While the electric-vehicle company did reveal a driverless Cybercab, expectations widely fell short of expectations, in no small part because Tesla did not make substantial progress on presenting autonomous driving capabilities.

I think that Tesla is a ‘Hold’ after the stock broke through a critical support level, but investors should watch the downside.

Robotaxi Event Is A Dud

Elon Musk’s Tesla revealed a self-driving taxi, a fully autonomous transport vehicle, the Robovan, for up to 20 persons and the company announced that it made some progress in terms of its robot development.

However, the event, which was both delayed and much-hyped, failed to produce any near-term catalysts or showed investors a new income path that could have helped the stock to power higher.

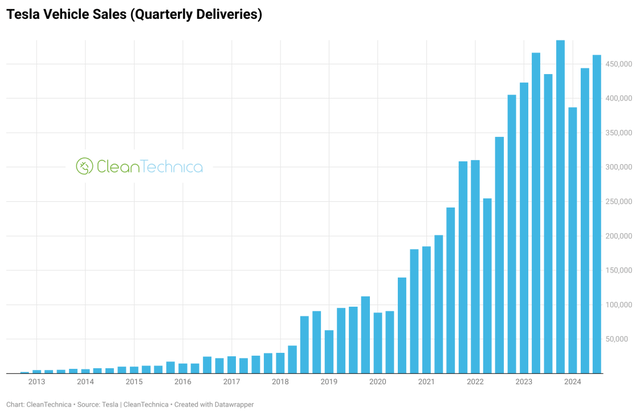

Just days earlier, Tesla released delivery figures for 3Q24, which fell short of consensus expectations. Tesla delivered 462,890 electric-vehicles in the third quarter and though the delivery figure was up more than 6% compared to the year ago period, Tesla missed expectations of 469,828 deliveries.

With that said, though, it was the first quarter of positive growth as both previous two quarters saw declining volumes on a YoY basis.

Tesla Quarterly Vehicle Sales (Cleantechnica)

Tesla Has Probably Seen More Operating Margin Pressure in 3Q24

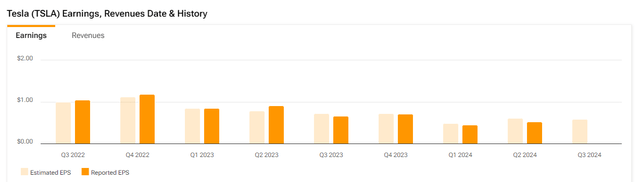

In the last quarter, growing pressure on deliveries and a cool-down of the market led to pressure on Tesla’s operating margins. In 2Q24, Tesla’s operating margins fell to 6.3%, reflecting a decrease of 333 bps YoY amid heavily discounted car deals and other incentives that weighed on profitability.

In the third quarter, China’s growth came back, but also primarily based on deal availability. This implies that Tesla is probably going to see ongoing margin contraction, which could lead to a lackluster earnings release next week.

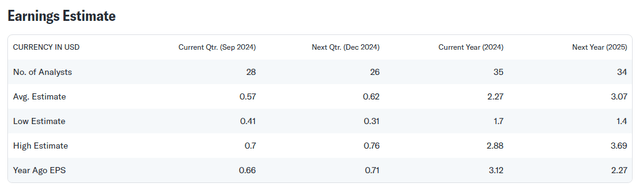

The market presently models $0.59 per share in profits for Tesla’s most recent quarter, which compares against $0.66 per share in profits last year. Tesla also missed profit estimates for four straight quarters, with the last quarter of a profit beat dating back to 2Q23.

With no real catalysts in the business and deliveries coming in below expectations, I think Tesla’s stock is likely to remain in a side-ways movement moving forward.

Earnings And Revenues (Yahoo Finance)

Approaching A Key Level, The 200-Day Moving Average Line

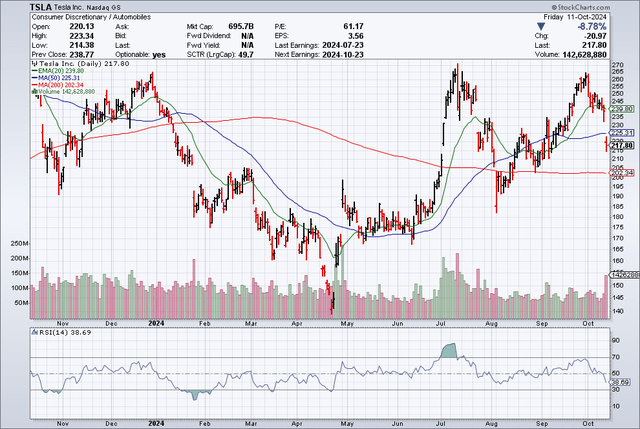

The technical situation of Tesla’s stock can be described critical, as the stock price after the Robotaxi event fell below the 50-day moving average line, which presently runs at $225.31.

Based on the Relative Strength Index, Tesla is trending toward oversold territory, but as of yet the stock is not technically oversold. If Tesla drops toward and below the 200-day moving average line, the technical setup greatly deteriorates. The 200-day moving average trendline currently runs at $202.34 which is also where the stock has robust support as well. If the $202 level breaks, Tesla’s stock could be in real trouble and have much more short-term downside.

The next event that could lead to a retest of the 200-day moving average trend is the earnings release for the third quarter, results of which are expected on October 23, 2024.

Relative Strength Index (StockCharts.com)

Tesla Is Rather Expensive

The market models $3.07 per share in profits for Tesla in 2025, reflecting back to us an anticipated profit jump of 35% YoY. With a stock presently selling at $218, the electric-vehicle company has a profit multiple, on a leading basis, of 71x. To put it mildly, Tesla is not a steal here and investors still seem to have kind of high expectations for Elon Musk’s electric-vehicle company, expectations that might not be justified based on Tesla’s Robotaxi event and delivery growth in 3Q24.

Presently, neither the robot nor autonomous driving businesses appear to offer any products of near-term marketability, and many years may pass before we actually see a market-ready product such as a Cybercab or Robovan.

In the meantime, companies like Waymo are eating Tesla’s lunch and Google’s Self-Driving Car Project just days ago hired the head of Tesla’s vehicle programs. Waymo has level 4 autonomy, meaning it doesn’t need a driver to be fully operational. Tesla, however, is only at level 2 autonomy, which means a driver needs to be alert and be ready to intervene at the wheel at any time. With Waymo leading Tesla in terms of self-driving tech, I think that the investment outlook for Tesla in the short term is not particularly compelling.

Earnings Estimate (Yahoo Finance)

Why The Investment Thesis May Be Faulty

Tesla is obviously not moving toward a near-term catalyst event that could drive a substantial upsurge in net sales. Since the market has also experienced slowing demand for electric-vehicles and new product introductions are years away, I am not convinced I like the catalyst situation for Tesla, particularly in the context of the disappointing Robotaxi event.

With that said, I could definitely be wrong and Tesla’s sales in the electric-vehicle business could soar on recovering EV demand or other reasons. Tesla dominates the EV industry and, in the long run, has sufficiently scaled production and deliveries to justify a high valuation multiple.

My Conclusion

Clearly, as the market’s reaction last week showed us, the Robotaxi event was a dud and did not rise to meet the high expectations that investors had prior to the event. It is quite obvious that it will take years for any of Tesla’s self-driving cars to drive on American roads, and I think that Tesla’s stock rightfully got socked after the Robotaxi event.

Tesla’s 3Q24 deliveries were also lower-than-expected, and I just don’t see a new wave of sales momentum, particularly with Tesla’s vehicle fleet aging and self-driving tech stuck at level 2 autonomy.

Tesla also is very highly valued, based on profits, and the technical chart picture is not particularly compelling: with the stock dropping through the 50-day moving average trendline, I think that the stock has more short-term correction potential, particularly if the company’s 3Q24 earnings disappoint.

Since Tesla has not really been good for major positive surprises as of late, I think the best way to handle Tesla is as a ‘Hold’.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.