Summary:

- Tesla is getting ready for its robotaxi event in a few days, but the company faces an increase in headwinds.

- The next few quarters will be particularly challenging for the company as it faces a difficult competitive environment in international regions due to a stagnant product lineup.

- Google’s Waymo has set a very high bar in terms of safety and customer satisfaction, which has allowed the company to increase rides to over 100,000 trips a week.

- Tesla will likely face a massive revenue and margin headwind in 2025, which would hurt the sentiment towards the stock, despite any positive effect of the robotaxi progress.

- The recent price surge should allow investors to cash out and wait for better entry position in the future.

baileystock

Tesla (NASDAQ:TSLA) (NEOE:TSLA:CA) is showing new challenges as the company prepares for an eventful October. The product lineup of the company appears to be quite stale as competitors continue to launch new products at a staggering pace. This is particularly true in international regions where Tesla is facing competition from Chinese automakers. In the recent quarter of Q2 2024, Tesla reported 20% YoY decline in revenue in China to $4.6 billion while its competitor BYD had over 20% revenue growth with revenue of $24.7 billion in Q2 2024. In a previous article, I had a Buy rating for Tesla which has now changed to a Sell due to new headwinds.

Tesla’s optimism rests on a good ramp up in robotaxis. However, Google’s (GOOG) Waymo has set a very high bar in terms of safety and service. Recently, Google announced another big $5 billion investment in the Waymo project, and it is rapidly expanding the services to new regions. The weekly paid trips have doubled to 100,000 in the last few months. GM (GM) has already shown the pitfalls in launching the service and if Tesla does not live up to expectations, it could face a backlash from regulators and investors.

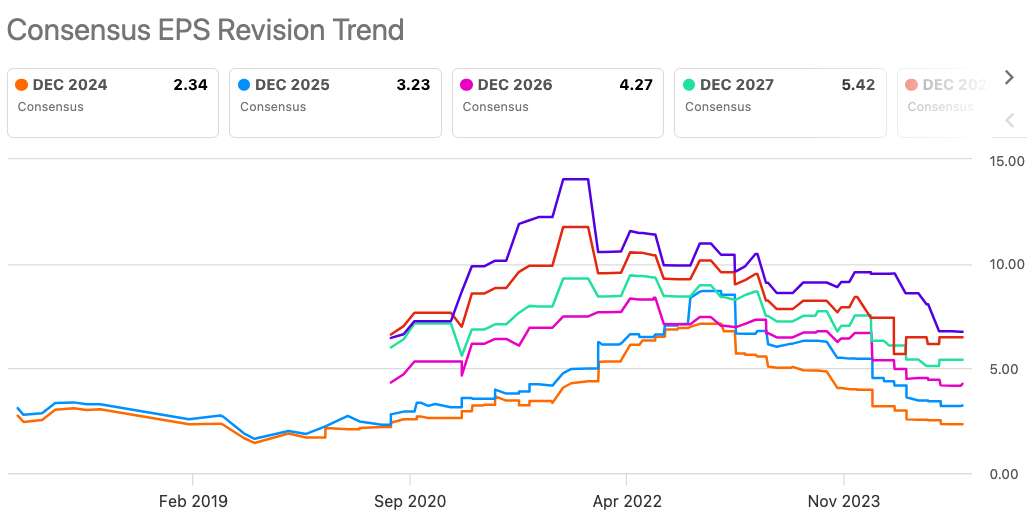

The consensus EPS estimate for Tesla is $4.27 for fiscal year ending Dec 2026 which gives the stock forward PE ratio of 60.2. Tesla stock has always been expensive but the recent increase in competitive challenges and rapid growth of Waymo would be another big headwind for the sentiment. I believe the forward EPS growth could be on the lower side as the company is forced to give price discounts. Investors already invested in Tesla stock can consider cashing out at the current price and wait for better entry point at a later date or look for other EV options.

Change in competitive story

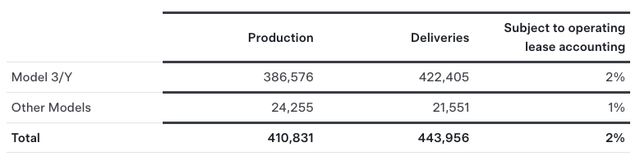

The competitive environment is changing rapidly for Tesla. The product lineup of Tesla is also looking stale as competitors continue to launch new models with better tech. More than 95% of Tesla sales are still coming from Model 3/Y. Even Rivian’s CEO has mentioned that Tesla might be close to saturating the addressable market with Model 3/Y.

Figure: Tesla’s delivery numbers in the recent quarter. Source: Tesla Filings

Cybertruck is showing good demand, but it is still a very small fraction of the overall deliveries. The affordable car project is showing delays, and it might be too late for Tesla to enter this space. On the other hand, BYD continues to ramp up its deliveries through new products.

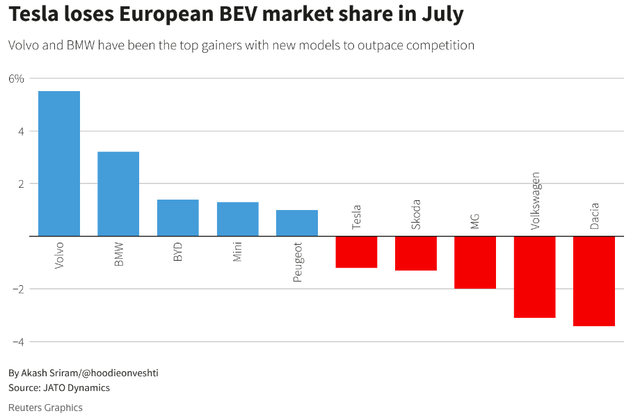

Figure: Tesla is losing market share in Europe. Source: JATO Dynamics, Reuters

According to a recent report in Reuters, Tesla is losing market share in Europe as traditional automakers like BMW deliver better numbers. Even BYD is increasing its market share in Europe despite the rhetoric around tariffs.

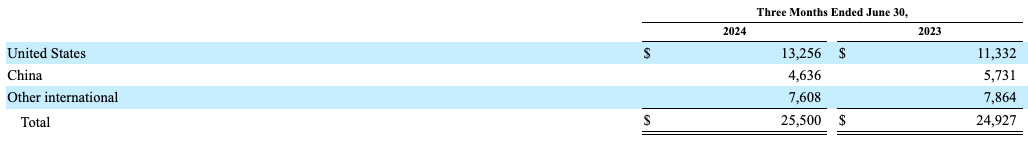

In the recent quarter, Tesla made close to 50% of its revenue from outside the domestic US market.

Tesla Filings

Figure: Tesla revenue in different regions. Source: Tesla Filings

The difficult competitive picture can be gauged by the recent news of massive plant closures announced by VW in Germany. Despite the backing of the German government, VW is finding it difficult to effectively compete against Chinese competition. Other automakers are also facing similar challenges. This change in direction would be impossible to guess even a few quarters back. However, the overall landscape is changing rapidly and Tesla is not showing any good answer. Tesla continues to sell high number of model 3/Y, but international sales will continue to be under pressure as new models are launched by other competitors.

Change in robotaxi growth model

It is highly likely that the autonomous driving industry will be consolidated by Big Three players which include Google’s Waymo, Amazon’s (AMZN) Zoox and Tesla. However, the recent growth in Google’s Waymo should sound an alarm bell for Tesla investors. Google has set a very high bar in terms of safety. It is also able to work efficiently with regulators and iron out any issues. The weekly paid trips in Waymo have increased to 100,000 as the company expands beyond the Sun Belt. The weekly paid trips have doubled from the last report in May. At the current expansion pace, Waymo could report over a million weekly paid trips in the second half of 2025. This would put the revenue base of this service to over $1 billion.

Waymo will also be getting another $5 billion from Alphabet and the company has enough resources to meet any challenges in terms of tech or pricing. Tesla has delayed its robotaxi event a number of times and has been developing this service for close to a decade. I am still optimistic about the rollout of the robotaxi service. However, Tesla will have to compete against the full might of Google. There is more downside potential for Tesla if the hype does not meet reality.

The robotaxi service requires massive investment, and it requires rapid scaling up of commercial operation to distribute the cost. If Waymo corners a big chunk of autonomous driving market share, Tesla could face a challenge in justifying the massive investments in this service.

Risks associated with Musk

Investors will also need to price in the fact that Musk is becoming increasingly distracted with other ventures. In the pre-pandemic era, Musk was highly focused on making sure that new Tesla products were launched at a rapid pace. This helped the company gain a good reputation among customers for innovation and EV efforts. However, lately, the product lineup does not look very appealing, and we do not know about any big product that can change the dynamic in this industry.

Musk is also involved in X, and he is facing increasing challenges from regulators in different countries including UK, Brazil as well as EU. It is possible that the sentiment towards Tesla turns negative if Musk spreads himself too thin. In the near term, there is hype around robotaxi service. However, over the longer term, Tesla would need to deliver new products to effectively compete in different regions. This requires a strong focus from Musk and improvement in the product lineup.

EPS trajectory can underperform expectations

The consensus EPS estimate for Tesla is $4.27 for fiscal year ending Dec 2026. This would give the stock a forward PE ratio of 60. We could see strong downward revision to these estimates if the company continues to face challenges in the international regions. The robotaxi service can boost sentiment, but it will be a net negative for EPS for at least the next few quarters. Massive investments are required for this service, while mass commercialization is still a few quarters away.

Seeking Alpha

Figure: EPS estimates for Tesla. Source: Seeking Alpha

Over the last few quarters, Tesla stock has continued to see downward EPS revisions, which has hurt the sentiment towards the stock. These downward revisions might continue for a few more quarters as the company tries to restart its next growth model. Most of the upside from the robotaxi service seems to be baked in while we could see Waymo run away with a majority market share.

Seeking Alpha

Figure: Downward revisions in Tesla stock in last few quarters. Source: Seeking Alpha

Investors could use the recent bull run to cash out of Tesla and wait for the situation to become clearer over the next few quarters.

Investor Takeaway

Tesla is facing massive challenges in China and other international regions. For Q2 2024, Tesla reported a 20% YoY dip in revenue in China, while its main competitor BYD reported over 20% YoY growth in Q2 2024. This trend could continue in the near term as Chinese automakers launch new products. Other international regions are also showing a dip in revenue. Tesla will be forced to do price cuts in order to maintain its delivery number, which can hurt the operating margins in the next few quarters.

Google’s Waymo has set a high bar with its taxi service, and Tesla would need to effectively work with regulators to launch this service. Musk is already having a tussle with regulators in several regions including Brazil, UK, EU, and others. This will certainly have a negative impact on the long-term potential of Tesla to launch new products and services. The stock is trading at over 60 times the EPS estimate for fiscal year ending Dec 2026. We could see a few more downward EPS revisions if the margins are squeezed, which should hurt the returns potential of Tesla in the near term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.