Summary:

- The thesis is to explain why I believe the current Tesla stock price has reached a near-term peak.

- And as such, I am seeing more downside risks than upside potential for new buyers in the short term.

- My main concerns include technical signals and the market’s overenthusiasm surrounding the recent supercharging station’s announcements.

- Insider trading activities, which are completely dominated by selling recently, are also worth noting.

SimonSkafar

Thesis

Readers following my writing know that I have been a long-term bull for Tesla, Inc. (NASDAQ:TSLA). However, over the past month or so, I have become concerned that its prices have risen ahead of its fundamentals. Since my last bullish article on it about 1 month ago, the stock price has rallied by more than 44% (see the chart below), while the S&P 500 (SP500) rose by 5.19%. Under the background, the thesis of this article is to argue for a downgrade from “buy” to “hold.” I see the stock prices currently at a near-term peak. And new buyers would face much more downside risks than upside potential. The risk calculus for existing holders to sell is a bit different if you have capital gain taxes to consider.

In the remainder of this article, I will detail my concerns, and they fall into the following 3 buckets:

- On the technical front, the stock is very overbought, and the current rally is not supported by large volumes.

- A large reason for the recent rally is catalyzed by Ford (F) and General Motors’ (GM) announcement surrounding the supercharging stations, in my mind. And I will argue why the market reaction is overly optimistic.

- Finally, its insider trading activities have been dominated by selling recently. And I will explain why I interpret these activities as a sign for ordinary investors to stop adding/buying TSLA shares too.

Technical signs

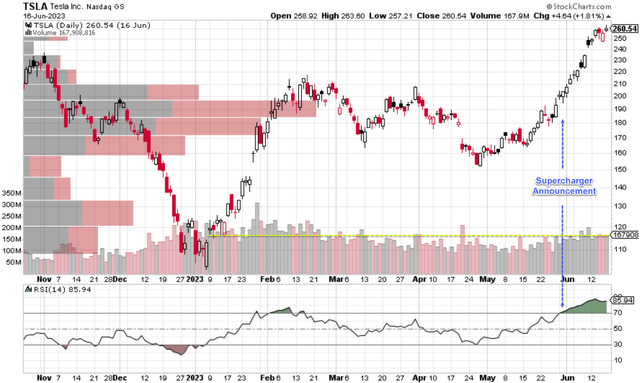

On the technical front, there are a few signs that the stock price has reached a near-term peak. As seen in the chart below, the Relative Strength Index (“RSI”) has been above 70 since around June. And it currently hovers around 86, which is considered to be squarely in overbought territory. The rapid rise really is not accompanied by large/expanding trading volume, either. The current trading volume is substantially lower than that seen in the February rally earlier in the year. In the past six months, the price range with the most trading volume is around $190 to $200, far below the current price of $260.

Overreaction to the supercharge station news

As aforementioned, a crucial catalyst for the latest price surge is the spate of announcements surrounding TSLA Supercharger stations, in my opinion (see the chart above). General Motors announced on June 8th (see this New York Times report for more details) that its electric vehicles will adopt Tesla’s Superchargers. And Ford also announced a similar move shortly afterward. These announcements were interpreted as a sign that Tesla’s charging stations have now become the industry standard for electric vehicles in the United States, paving the way for our EV future.

There are certainly merits in such an interpretation. TSLA CEO Elon Musk himself commented that such unification “is going to be a fundamentally great thing for the advancement of E.V. adoption.” However, I view the degree of the stock price advancement to be an overly optimistic reaction. It is important to remember that the charge station is just one piece of the EV puzzle. Tesla still faces a number of challenges, including the need to continue to improve its vehicles and manufacturing processes, and the need to compete with other automakers that are also investing heavily in EVs.

Even just on the charge station department itself, it is also worth noting that the announcement did not come with any specific details about how Tesla and GM/F would work together to make it happen. For example, it is not clear how much Tesla will charge GM/F to use its Superchargers, or how many Superchargers will be made available to GM/F drivers. These details could have a significant impact on the financial impact of the agreement for Tesla.

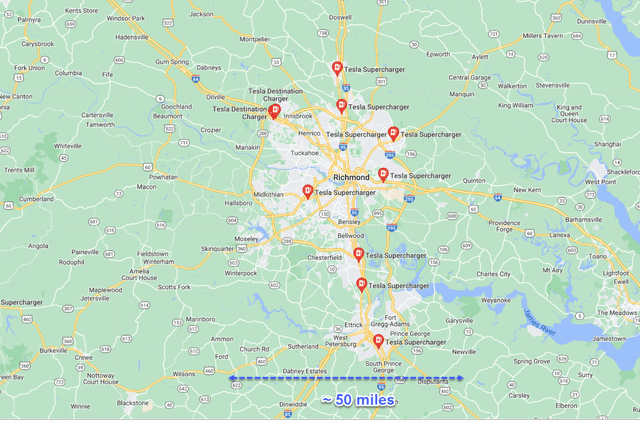

And Tesla has a long way to go to expand its Supercharger station network, requiring a substantial amount of CAPEX investments in the years to come. Take the Richmond, VA, area as an example. This is where I live and have first-hand information (well, you may call it second-hand information). In an area of about 50 miles by 100 miles, there is only a handful of TSLA charge stations (see the chart below). We (my friends and myself) constantly complain about the lack of availability, and most of us are not brave enough to drive out of the area (yet).

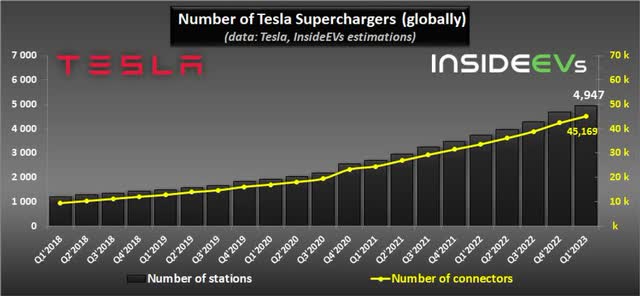

Now, taking a more global view outside my neighborhood, the company recently reported having about a total of 45,000 charging stalls installed globally. It’s an impressive number which makes it the biggest charging network. However, my view is that the network also suffers insufficient availability, very similar to my neighborhood. Out of its current 45k charging stalls, about 5k was added in the last 5 months and about 10k in the past 10 months. Looking ahead, I see the need for it to at least double the number of charging stalls in the next 1~2 years. It’s a demanding task that will cost substantial financial CAPEX, political capital, and also management attention.

Tesla’s insider selling activities

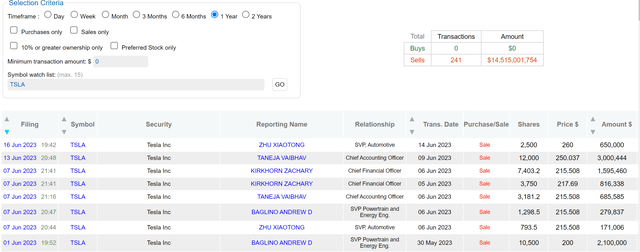

Finally, the insiders’ activities are dominated by selling. Usually, I do not interpret insider selling as a bearish sign. Insiders can sell for a range of reasons unrelated to business fundamentals (buying a new house/yacht, divorce, et al). However, when the activities are so dominated by selling, I have to pay attention.

To wit, in the past 12 months, there have been a total of 241 insider transactions (see the chart below). All of them have been selling activities, with a sizable cumulative amount of $14.5 billion. In June 2023 alone, there had been a total of 8 insider selling activities between prices of $200 and $260.

Other risks and final thoughts

There are a few other downside and upside risks besides those analyzed above. The global semiconductor shortage continues to beset the automotive industry, and TSLA is no exception. In addition, TSLA has a large exposure to China, both as a key market and also a manufacturing site. And China is currently witnessing another COVID-19 surge since it lifted the zero-tolerance policy a few months ago. The country reported 164 deaths in May 2023 alone. The country has experienced a more than 5x surge in the number of people diagnosed with COVID-19 since April 2023.

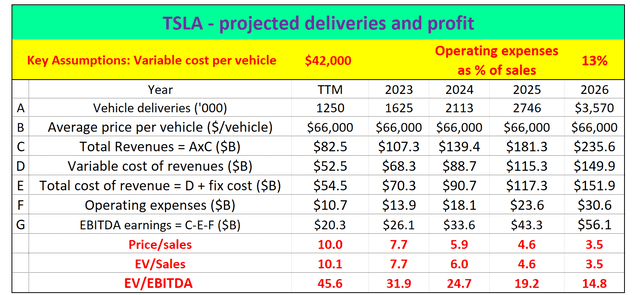

Due to these uncertainties, TSLA may not be able to achieve its manufacturing and delivery goals for 2023. At the same time, raw material prices are currently hovering at elevated levels and like to remain so as inflation remains relatively high, and the Russian/Ukraine situation continues to bottleneck supply. Considering these uncertainties, my model for its growth and profitability is based on a set of more conservative delivery and margin assumptions as shown in the chart below (more details of this model can be found in one of my earlier articles). Also as seen, under these parameters, Tesla’s current valuation is quite expensive. Its EV/EBITDA multiple sits around 46x. It is quite close to the target 40x~50x range assigned by leading institutions such as Bank of America. In terms of upside risk, market momentum really is the main one I see at this point. My view is that the current market price has already factored in all the near-term catalysts.

All told, TSLA has been one of the most successful bull theses I’ve developed recently. However, currently, I see its stock prices reaching a short-term peak. As a result, in the near term, I am seeing more downside risks than upside potential for new buyers. My main concerns about Tesla, Inc. stock include technical signals, the market enthusiasm triggered by the announcements surrounding the supercharging stations, and insider trading activities.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.