Summary:

- Tesla’s robotaxi event left investors underwhelmed, sending the stock down almost 9%.

- After watching the event, I was left with more questions than answers. There was a lack of details regarding production timelines and technical specs.

- The Model 2 and 2nd-gen Roadster weren’t mentioned in the event, which some people didn’t like.

- Tesla’s decision to not use Lidar technology may be seen as more unsafe compared to Waymo’s technology, which can make regulatory hurdles harder to surpass.

- The stock’s high valuation combined with all the unknowns makes me not want to buy the stock.

Sven Piper

Tesla (NASDAQ:TSLA) finally had its robotaxi event, but not everyone was impressed, sending the stock 8.8% lower the following day. Investors were clearly expecting more details about Tesla’s robotaxi plans, including technical specifications and strategies to surpass competitors like Waymo. Further, there was no mention of the Model 2 or the 2nd-gen Roadster, which some investors wanted to hear about.

Other innovations that were introduced, such as the Robovan and the Optimus robot, are exciting, but without knowing when these technologies will be fully developed, the question becomes, “When?” Inductive (wireless) charging for Tesla’s robotaxis also presents some pros and cons and question marks, which I will discuss. Overall, there are just too many unknowns right now. Combined with a high valuation that seems to price in perfection, I am neutral on Tesla stock, rating it a Hold.

Lack Of Details

A common criticism of the event was its lack of detail. For example, Garrett Nelson from CFRA said the event was like “watching a movie with a lot of plot twists and special effects,” but ultimately leaving the audience scratching their heads.

Elon Musk’s presentation had many visionary statements, but was light on actionable info. For instance, regarding the Cybercab, he didn’t talk about details like battery sizes, charging speeds, drivetrain configurations, or production locations.

He also unveiled a Robovan that’s capable of transporting 20 people, but no other details were given. It just looks like a concept vehicle for now that’s many years away.

Ambitious Timelines Are Subject To Criticism

Elon Musk has a history of overpromising and underdelivering when it comes to timelines, and he’s aware of this. In 2015, he said that he’d develop fully autonomous vehicles by 2017. This article title from April 2019 also sums things up: “Elon Musk claims Tesla will have 1 million robotaxis on roads next year, but warns he’s missed the mark before.”

That’s why it’s important to take his projections with a grain of salt.

In the event, Musk stated that Tesla wants to start building the Cybercab by 2026 or, specifically, “before 2027,” and it will be priced under $30,000. Musk also expects the Model 3 and Model Y to drive without supervision in California and Texas by 2025.

Can we trust that deadlines will be met? I’m skeptical, and let’s not forget that regulatory issues can get in the way — not just Tesla’s ability to develop the technology.

Tesla Can Face Regulatory Hurdles, And May Be “Years Behind” Waymo

Tesla’s autonomous ambitions don’t include Lidar (light detection and ranging) technology, and this can cause regulatory hurdles, as the technology may not be perceived as safe relative to Waymo’s technology.

Tesla uses camera-based systems, computer vision, and AI for its autonomous tech. The problem is that cameras may struggle in low-light, fog, rain, or other conditions of that nature, so Tesla will have to find a way around that with advanced software. If it can, then it will be a big advantage because cameras are significantly cheaper to implement than Lidar technology. But that’s an “if.”

For what it’s worth, Matthew Wansley, a professor at New York’s Cardozo School of Law, said, “Tesla software is at least years behind where Waymo is. That’s the hard part. No flashy vehicle design is going to change that.”

Meanwhile, according to automotivedive.com, “The sixth-generation Waymo Driver includes 13 cameras, four lidars, six radar units and an array of external audio receivers. It uses a combination of high-resolution maps, cameras, lidar and radar to monitor the environment and safely navigate autonomously. The system uses the highly detailed custom maps matched with real-time sensor data to determine the vehicle’s precise location at all times.”

In other words, Waymo uses a more comprehensive system, and it’s a very safe one (I talked a bit about Waymo’s safety track record in a recent Uber (UBER) article here). Lidar tech provides highly accurate 3D environment mapping, even in tough conditions.

automotivedive.com also stated that Waymo’s “sixth-generation offers a significantly reduced cost without compromising safety. Advancements in sensor technology combined with their strategic placement on the vehicle allowed Waymo to reduce the number of total sensors in its latest version, while still maintaining a high level of redundancy, including backup steering and braking systems, to prevent any single-point failures in the system.”

Thus, Waymo is finding ways to make its cars cheaper while still maintaining high safety standards, which will make things tougher for Tesla.

Will Tesla be able to get regulatory approval for its autonomous vehicles as quickly as it wants to by following its current methodology? And how long will the tech take to fully develop? Those are big questions, and they cloud the autonomous driving bull thesis, while Waymo is already active in several cities.

Inductive Charging: Another Question Mark

Elon Musk said that the Cybercab would use inductive charging. While this is convenient, especially for autonomous fleets that won’t have humans around to plug them into chargers, there are some drawbacks to note.

I’m no electrical engineer, but Electronic Office Systems mentioned, “Typically, energy losses for inductive charging systems can range from 10% to even 25%, making them less efficient than wired methods.” However, the same article states that the technology is becoming more efficient, with “some newer models claiming to achieve efficiencies that are closely comparable to wired chargers.” Will Tesla’s inductive charging be as efficient as wired charging? Will it be able to charge as fast as wired charging? Those are other unknowns.

On top of that, inductive charging can be expensive to implement. Deploying these charging pads at scale would require lots of CapEx and hurt free cash flow.

To be honest, I trust that Tesla will be able to advance this technology enough, but the question again becomes, how long will it take? And also, how much will it cost to do so?

Optimus Robot Has Huge Potential But Is Years Away

Elon Musk also unveiled Tesla’s humanoid robot, Optimus. He claimed that it could perform human tasks—from walking dogs to babysitting children—and said that it will cost between $20-30,000.

Notably, he said, “I think this will be the biggest product ever, of any kind.” That’s a bold statement, but it can be true. Imagine not having to pay factory employees or bartenders and servers and just replacing them with robots. Or using a robot as your personal housekeeper. That can be a huge market.

Still, the same questions come up again. We don’t know how long this will take to develop and how much it will cost to produce. Perfecting a highly complex humanoid robot capable of doing those tasks is a huge challenge that even specialized robotics companies haven’t achieved yet.

And money generated in the future is worth less than money generated today. Are we valuing Tesla stock on tech that will potentially take 3+ years to properly monetize (in the case of robotaxis) and potentially 10+ years regarding humanoid robots and Robovans?

The Valuation Needs To Come Down

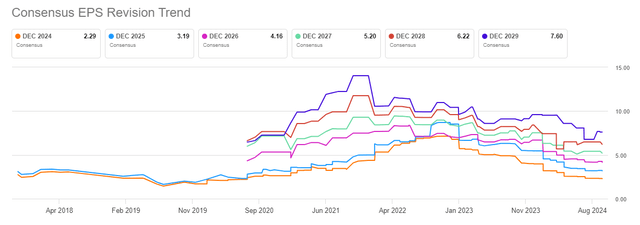

Now, it’s time to analyze TSLA stock’s valuation. Currently, analysts estimate EPS of $2.29, $3.19, and $4.16 for Fiscal 2024, 2025, and 2026, respectively. Keep in mind that these are non-GAAP estimates, which don’t factor in stock-based compensation. Therefore, the GAAP earnings will be lower. For the last four quarters, SBC per share was $0.48.

Anyway, at the current share price of $217.80, these EPS figures imply forward earnings multiples of 95.1x, 68.3x, and 52.35x, respectively. And I’m hesitant to say that Tesla will surprise analysts, as EPS revisions have only been downward for the past couple of years. However, I’ll admit that some of those revisions could have been because of rising interest rates, which are now set to fall.

TSLA Historical EPS Revisions (Seeking Alpha)

Looking at the free cash flow situation, it is even worse. In the past 12 months, Tesla only generated $1.717 billion in FCF, while its SBC net of tax was $1.69 billion. For Fiscal 2024, 2025, and 2026, analysts expect FCF of $2.473 billion, $6.758 billion, and $9.03 billion, respectively. So, on an FCF basis, the 2026 forward multiple is around 77x.

Does Tesla really deserve these valuation multiples? I don’t think so. While it does have lots of potential, it still is mostly a car company in terms of its sales (for now). I’m not saying that it should be valued as cheaply as a legacy auto firm (Ford (F) trades at 5.7x forward earnings), but this much of a premium seems crazy. Essentially, investors are betting on technologies that are extremely hard to predict — both in terms of whether they’ll be successful and how long they’ll take to become reality.

They’re also betting on a company that will have to spend lots of money in the interim to develop these technologies, which will obviously hurt free cash flow.

There are so many unknowns and many other stocks out there with more reasonable valuations and more predictable growth that it makes little sense to me to buy Tesla stock. And if we’re talking about autonomous vehicle potential, I think UBER stock is a better investment in that area at current levels (again, I wrote an article about UBER last month).

The Takeaway

Tesla’s “We, Robot” event highlighted exciting things like the Cybercab, Robovan, and Optimus robot. However, investors were left disappointed. Details such as technical specs, timelines (for some products), and strategies to overtake competitors like Waymo weren’t mentioned. Further, nothing was said about the Model 2 or the Roadster. Overall, this caused TSLA stock to fall by nearly 9%.

The technologies look promising, and Tesla has a great track record of pushing technological boundaries, but the execution part still won’t be easy. Tesla will face regulatory hurdles and may not meet its production deadlines, based on historical trends. It also doesn’t help that Tesla is said to be “years behind” Waymo.

Plus, is inductive charging really the way to go? And how much will it cost to build out all of this infrastructure and develop all the technologies mentioned? Things could work out, but investors want more answers and clarity.

The stock’s high valuation is reflecting future success that may take a long time to materialize. Until clearer progress is shown, there are too many unknowns, with plenty of other stocks offering more predictable growth opportunities.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UBER either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.