Summary:

- Tesla, Inc. is a very volatile stock.

- Tesla’s P/E ratio is very near the lowest it has been.

- Tesla has many spinoff opportunities including Auto Pilot (self driving), Super Chargers, Megapacks, and robotics.

jetcityimage

Why Is Tesla Stock’s Price Up Over 40% This Year?

Tesla, Inc. (NASDAQ:TSLA) has had a very volatile year price-wise, hitting a low below $110 in early January and then exceeding $200 in March. Currently, it sits at about $165.

That 1-year chart above looks a lot like a roller coaster. It shows that indeed TSLA’s price is up by more than 40%, but prior to that it had dropped by 60% between last September and January 2023.

While some investors are concerned about Tesla’s recent volatility if you look at their record historically you can see this is not unusual. Here’s the 3-year chart.

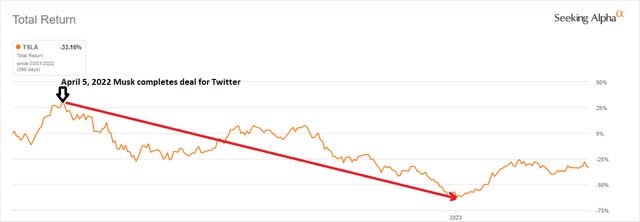

I count 10 times when the TSLA share went up or down by $100 or more in a very short period of time over that 3-year period. So, the answer to why Tesla’s price is up more than 40% in this particular cycle starting in early January was mostly CEO Elon Musk’s fascination and concentration on Twitter at the expense of Tesla in 2022. Now, whether this was really true or not, this is what the market and investors believed. And a look at the chart from the time Musk bought Twitter in April of 2022 shows a long consistent slide. Looks like a new year, a new upcycle, although obviously there were other reasons other than Musk, but I feel this was the biggest one.

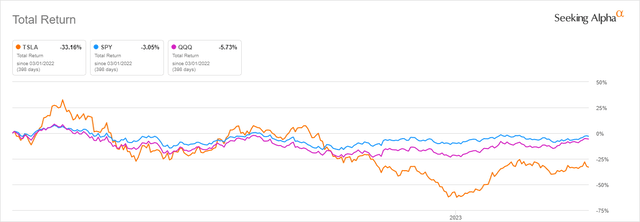

This is further indicated if we compare the S&P 500 (SPY) and the Invesco QQQ Trust ETF (QQQ) to the Tesla chart, where a large divergence appears later in 2022.

Is Tesla Overvalued Now?

Based upon the charts above, Tesla is certainly much more reasonably priced today than it was a year ago.

Here’s the P/E ratio from March 1, 2022, to now. Note it has dropped by more than 75% and now sits at 47 projected forward into 2023 earnings. That has to be among the lowest ever for Tesla. So, history says no, Tesla is not overpriced currently.

Another way to look at Tesla’s value is to look at its historical MV (market value). Note that the current MV is less than half its value 1 year ago and the lowest it has been since November 2020.

Is TSLA Likely To Keep Rising?

As we can easily see from the above charts, Tesla’s share price is by definition volatile. But, long term, I have no doubt it will be much higher priced in the future easily passing the $1 trillion MV.

The reason the price should continue its uptrend (but with great volatility) is the nature of the electric vehicle, or EV, business. With massive government support via purchase credits through at least 2035 the revenue will increase by at least 30% a year and the EV volumes could potentially increase by 50% per year.

Targeted electric share of 50% in 2030 requires a step up

The U.S. government aims to ramp up EV sales to 50% of total sales by 2030. This is a step up from the baseline scenario and matches the IEA’s sustainable development scenario. Nevertheless, as mentioned, several car makers are backing the ambition and there is interest among consumers. A combination of regulatory support with a wider range of affordable models could lead to an acceleration in EV sales in the second half of the decade.

Reaching a 50% EV share in car sales by 2030 (8.8m) requires a step up

To give you an idea of how fast sales will have to grow, EV unit sales in 2022 in the U.S. were 5.6%. Getting to 50% in 7 years will require a compound unit growth rate of over 35%. Tesla is planning for this more rapid transition by building factories all over the world along with battery manufacturing in China, and, of course, more chargers everywhere. With arguably some of the most sophisticated and technologically advanced manufacturing processes in the world, Tesla should be a huge winner in the coming years.

What Should Investors Consider?

One of the issues most investors don’t consider when looking at Tesla is the potential for future, very valuable, spinoffs. Here’s a list of 4 of them.

- Tesla’s self-driving hardware and software are driving 1 million miles per day now. If Intel can spin off Mobileye certainly Tesla can spin off Auto Pilot.

- Megapack has a very bright future and deliveries are expected this year. Not really related to the automobile business why not spin it off?

- Tesla Superchargers are already in demand all over the world why not spin it off?

- Tesla robotics is currently being used in Tesla’s factories. Robotics, of course, are not limited to manufacturing they have other applications such as medical. I think robotics is the most likely spinoff but all of them have potential.

Is Tesla Stock A Buy, A Sell, or A Hold?

Tesla has always been a controversial stock with an extremely controversial leader in Elon Musk. But it has proven over the years to be an outstanding performer not only financially but by market price too. At the current reduced price, Tesla is selling at an extreme discount to its previous lofty values. In addition, the extraordinary political push to build more EVs over the next 10 years should drive Tesla to all-time highs because they are the best in the EV business and probably the most likely to take advantage of the current positive business environment. Therefore, Tesla, Inc. is a Strong Buy for long-term investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you found this article to be of value, please scroll up and click the “Follow” button next to my name.

Note: members of my Turnaround Stock Advisory service receive my articles prior to publication, plus real-time updates.