Summary:

- We’re upgrading Tesla, Inc. stock to a buy.

- Tesla stock is down 15% over the past week, underperforming the S&P 500 by 10%.

- We now think our previous concerns regarding Tesla’s financial underperformance amid macro weakness and price cuts are priced into the stock for the most part.

- While we remain cautious about the EV industry in the near term, we see delivery growth reaccelerating toward 2024 for Tesla with more aggressive pricing supported by cost reductions.

- We now believe the company is better positioned to outperform the Wall Street consensus of 2.3M vehicles in 2024.

xxwp

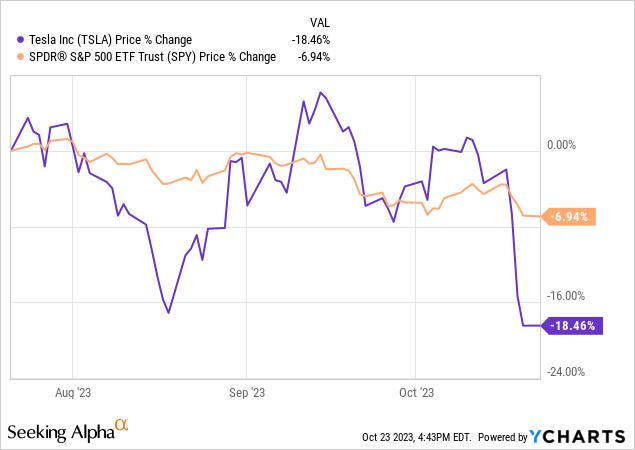

We’re upgrading Tesla, Inc. (NASDAQ:TSLA) to a buy after a long bearish stance. We now think our previous concerns regarding Tesla’s financial performance amid macro weakness and price cuts are factored into the stock for the most part. Tesla’s stock is down ~15% over the past week, underperforming the S&P 500 (SP500) by 10%; over the past three months, the stock is down roughly 18%, underperforming the S&P 500 by around 11%. We remain more cautious about the auto industry in 2H23 due to the auto correction, macro weakness, and end demand weakness from China – the largest car market with a lot of market power over electric vehicles (“EVs”).

To understand the significance of the slower-than-expected recovery in China, it must be noted that China’s EV sales “share is currently double the global average.” We understand investor concern over the company’s exposure to weakness in China at ~23% of total sales. We’re more optimistic now because we think the demand weakness has been priced into the stock at current levels. We think Tesla is better positioned than the competition, including NIO Inc. (NIO), Ford (F), and General Motors (GM), to recover delivery growth toward 2024. We now see a more attractive risk-reward profile for the stock into 2024 after aggressive pricing supported by cost reductions.

The following graph outlines Tesla’s stock performance over the past three months against the S&P 500.

YCharts

Negatives Priced In; Better Horizon Ahead

Our upgrade is partially driven by how negative Musk was on the Q3 2023 earnings call; the stock dropped over 12% after the call due to investor disappointment in the challenges to volume production with the Cybertruck and the longer outlook for positive cash flow for the vehicle coupled with persisting macro weakness and contracting margins. Musk noted:

“I’m worried about the high-interest rate environment we’re in… If interest rates remain high or if they go even higher, it’s that much harder for people to buy the car.”

We continue to be cautious of the auto industry in the near term, as we think a correction is underway and see it reflected in the analog and power management industry on the semi-front. Our upgrade is driven by our belief that Tesla’s economic moat and position in the EV industry will enable it to outperform the peer group into 2024.

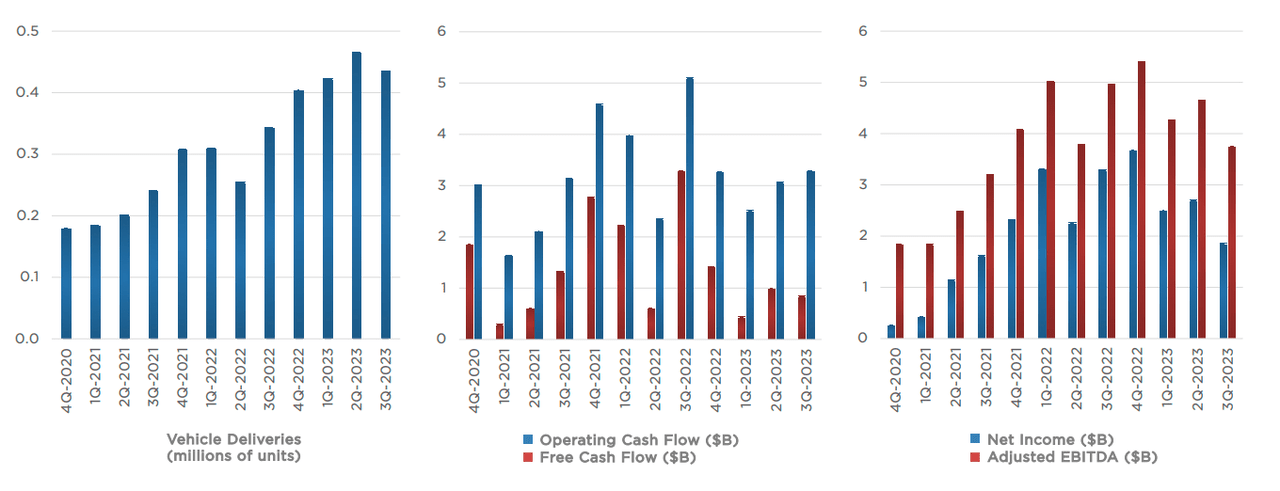

We think our negative thesis of Tesla struggling to achieve financial outperformance played out and expect stabilization towards 2H24. This was the first quarter since July 2019 that Tesla missed on both top and bottom lines; the company reported revenue of $23.35B, missing by $790M, and Non-GAAP EPS of $0.66, missing by $0.07. Our forecast of shrinking margins has also been unfolding, with the company reporting an operating margin of 7.6% this quarter. The following graph outlines Tesla’s vehicle deliveries, operating cash flow, and net income up to 3Q23.

We already anticipated mixed results after the lower production and delivery numbers resulting from the factory upgrades. The market is now factoring in the negatives of the gradual positive free cash flow from Cybertruck, no hot updates on RoboTaxi and A.I., and the growing R&D expense. We believe Tesla is now better positioned to outperform Wall Street’s consensus of 2.3M vehicles in 2024 and remains on track to hit the target of 1.8M this year. Additionally, we think the model upgrades will help push the deliveries higher. We think the company is now better positioned to achieve a surprise upside into 2024.

Valuation

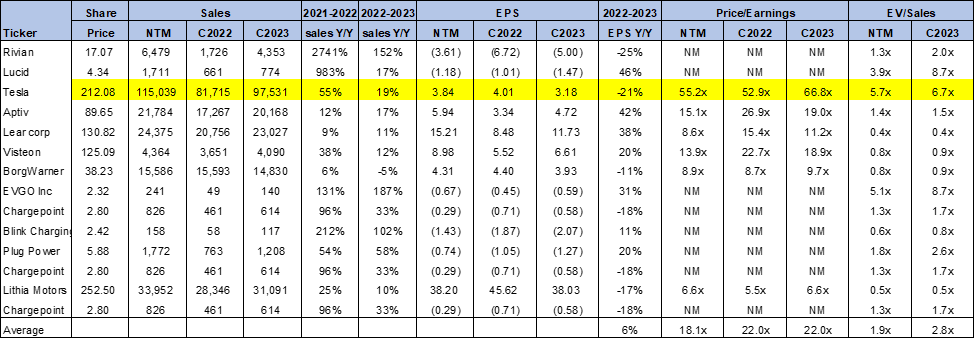

Tesla stock is trading above the peer group average, but we think the higher multiple is justified due to the company’s position in the EV market versus the peer group. On a P/E basis, the stock is trading at 66.8x C2023 EPS $3.18 compared to the peer group average of 22.0x. The stock is trading at 6.7x EV/C2023 Sales versus the peer group average of 2.8x.

The following chart outlines Tesla’s valuation against the peer group average.

TSP

Word on Wall Street

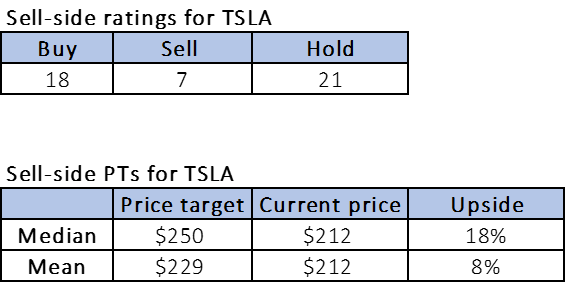

Wall Street is more bearish on the stock. Of the 46 analysts covering the stock, 18 are buy-rated, 21 are hold-rated, and the remaining are sell-rated. We think the more mixed sentiment on the stock now is due to increased competition threatening Tesla’s EV share and macro weakness.

The stock is currently priced at $212 per share. The median sell-side price target is $250, while the mean is $229, with a potential 8-18% upside.

The following charts outline sell-side ratings and price targets for TSLA

TSP

What to do with the stock

We’re upgrading Tesla, Inc. stock to a buy. We see attractive entry points into the stock after the near-term negatives have been priced in. We expect delivery growth to reaccelerate towards 2024 and think cost reductions will help improve profitable growth into 2025. We think Tesla is better positioned now to outperform both expectations and the peer group in 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.