Summary:

- I am downgrading my rating on Tesla to neutral due to its stretched valuation despite its recent rally and potential future growth.

- While bullish on Tesla’s long-term prospects, I believe the current valuation is too high to allocate more capital at this time.

- Risk factors include overemphasis on short-term political benefits, uncertain legislation for FSD, and potential delays in the Optimus robotics platform.

- I remain long on Tesla, driven by its potential in robotics, but will only add to my position if shares drop below $200.

Roman Tiraspolsky

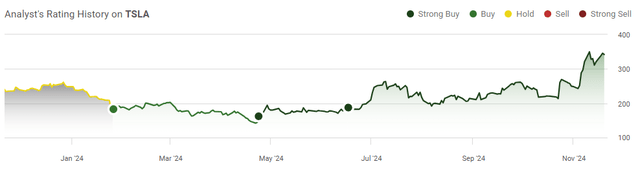

For several years, I got Tesla (NASDAQ:TSLA) wrong as I got hung up on the valuation, and TSLA was just an auto company. At the time, TSLA was generating the lion’s share of its revenue and 100% of its profits from automobiles. This narrative started to change for me when the energy and services businesses started contributing to gross profit. The prospects of Robotaxis and FSD coming to fruition weren’t that appealing to me for several reasons, but the Optimus robotics platform cemented my future investment case. Shares of TSLA have experienced a gigantic rally of more than 140% from their 52-week low of $138.80. Over the past month, shares have appreciated more than 50%, and they have climbed by more than $125. I try not to be political, but right now, TSLA is getting caught up in what some refer to as “The Trump Trade,” I think the move higher is a bit overdone. TSLA now exceeds a $1 trillion market cap, and while this is great for me as a shareholder, the valuation looks very stretched. TSLA is one of the most exciting companies in the market, and I believe that shares will be higher in 5 years from now than where they are today, but for the time being, I wouldn’t be surprised if we see a retracement. There are many unknowns for TSLA over the next year or so and I think there will be better opportunities to add to this position.

Following up on my previous article about Tesla

I have not been a die-hard TSLA bull, as I have been critical of the company and have written more bearish articles on TSLA than bullish ones (can be read here). For quite some time I was only a shareholder by proxy through my wife, but I did become a direct shareholder and have been writing covered calls on my position to generate income. My last article was published on June 17th (can be read here), and since then, shares of TSLA have been up 81.20% compared to the S&P 500 appreciated by 8.69%. I had discussed the shareholder vote to approve Elon Musk’s compensation package, Ark Invests $2,600 target, and why I turned bullish from being bearish for quite some time. Shares of TSLA have ultimately increased by 85.34% since my first bullish article was published, and after the recent run, I am downgrading my view to neutral. Many have tried to short TSLA and failed, so I am not in any way advocating that TSLA is a short play. When I look at this objectively, I think there is a lot of future upside, but there is so much growth priced in that the valuation has been stretched too far based on the current fundamentals. TSLA shares could continue to go up, and the valuation may seem even more expensive, but I am not willing to put any more capital into TSLA unless the valuation gets better through TSLA, generating more profitability or a retracement from the current share price.

The risk factors to investing in Tesla

While it seems like we are witnessing a euphoric phase as President Trump and Elon Musk’s friendship grows stronger, we have no idea what type of legislation is going to get passed. I am not saying that TSLA won’t benefit from a Trump Administration, but I think investors are putting too much emphasis on this in the short term. The elimination of the EV tax credit, which is backed by Elon Musk himself, may not be as bullish as some think for TSLA over the long run. TSLA’s valuation looks very expensive as shares trade for 138 times 2024 earnings and 84.13 times 2026 earnings. We also have no idea when legislation will be passed for FSD and how long implementation will be. I would never bet against Elon, but he has been extremely ambitious with timelines in the past, and the timeline for Optimus could experience delays in the future. Anyone who is interested in allocating capital to TSLA should consider these risk factors and do their own research. I am not bearish, but after the recent run, I think shares will cool off a bit before they continue to rally.

Why I am downgrading my very bullish rating to neutral

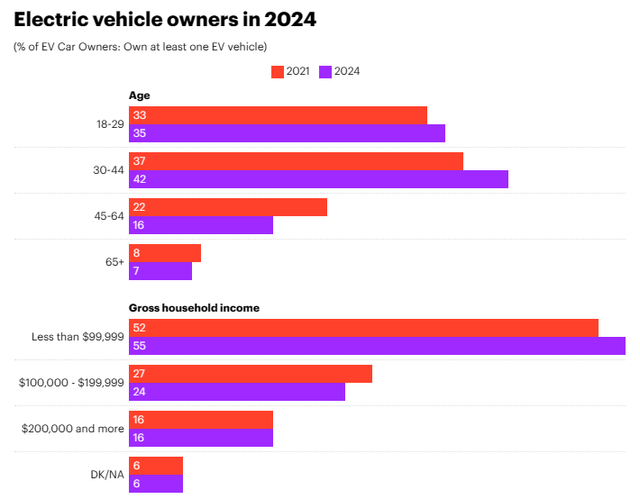

When it comes to investing, I try to be as objective as possible, and I am willing to change my mind if the investment case no longer fits my previous narrative. Even though Elon is in favor of eliminating the EV tax credits, among other types of subsidies from the government, I don’t believe this will be bullish for TSLA. Per the IRS website, individuals qualify for up to $7,500 in EV credits if they make under $150,000 if they are single, $300,000 for married, and $225,000 for head of household. The most likely reason why Elon is supporting eliminating the EV tax credit is because the average household income of a new Tesla owner in 2024 is $150,015. Most individuals who buy a Tesla are excluded from receiving tax credits due to their income. From a vehicle sale methodology, TSLA probably won’t be that impacted if the tax credits for EVs are eliminated next year, but when I look at the next line of derivative income, this will likely impact TSLA’s future earnings.

While the average household income for a new Tesla owner just barely exceeded $150,000, 55% of EV owners in 2024 had a gross household income of less than $99,999. The age demographic suggests that EVs are more popular among drivers under the age of 44, as they represent 77% of the EV market. Regardless of the fact that TSLA has been working on a less expensive model, there is still an entire market of EV vehicles outside of TSLA. Getting rid of the EV tax incentive could negatively impact EV adoption in the United States. The reason why I think that the EV tax incentive is not as bullish as many are making it out to be for TSLA is because if adoption rates fall, it could impact an FSD licensing deal between TSLA and other manufacturers such as Ford (F), General Motors (GM), Nissan, and Hyundai. There could be more money to be made through the combination of selling FSD to Tesla drivers and licensing the technology to other manufacturers than just keeping it internal.

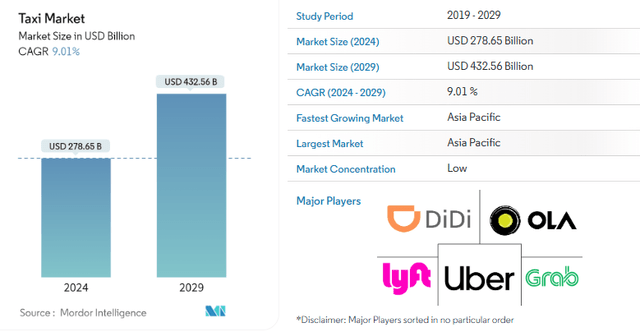

I think the Robotaxi event was a bust, and I still do not like the Robotaxi narrative. I hope it works out, but the data doesn’t support some of the revenue estimates that are being floated out there. Autonomous vehicles are only allowed in several areas throughout the country, and we have no idea when legislation will be passed to allow for national expansion. If I operate under the assumption that over the next year, national expansion occurs there is still an insurance component that needs to be figured out. There is no telling which auto companies will write insurance policies for individuals who wish to enroll their Telsa into a Robotaxi program, and there needs to be clear legislation on who is responsible for the accident if one occurs when a vehicle is operating in the Robotaxi program. Either TSLA or the owner will be responsible through their insurance policy, and we may not see the level of adoption if robotaxis that get into an accident count as an accident on an individual’s auto policy. Under Technologies (UBER) has only generated $41.96 billion in revenue over the TTM, while Lyft Inc (LYFT) has generated $5.46 billion in revenue. The entire taxi market is expected to grow from $278.65 billion to $432.56 billion through 2029. Even if TSLA were to take 100% market share in the taxi market, the revenue generated is still substantially lower than what companies such as Ark Invest are projecting they will generate. Part of the case is that individuals won’t own cars anymore, and it will be more affordable to just hail a Robotaxi. If that comes true, which it may, it’s going to take a very long time as there are almost 300 million cars registered in the United States in 2022. I think too much emphasis is being placed on the Robotaxi business, and it will take years to scale before the revenue generated is impactful.

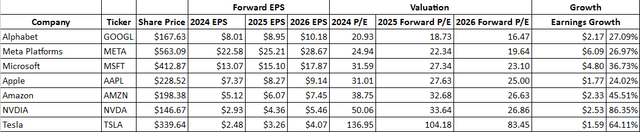

The last reason why I believe that shares of TSLA are going to retrace is because the valuation is overextended. When companies get expensive, I always hear that you pay up for growth or that I don’t understand growth companies. At some point, the underlying financials matter no matter how strong the momentum is. When I look at the Magnificent Seven, they trade as a group at 47.75 times this year’s earnings and 31.59 times 2026 earnings. TSLA is expected to generate $2.48 in EPS for the 2024 fiscal year and trades at 136.95 times 2024 earnings. TSLA also trades at 83.45 times 2026 earnings. On the other hand, Nvidia Corporation (NVDA) delivered an incredible quarter where they produced $19.31 billion in net income, which is more net income than TSLA generated in the entire 2023 fiscal year and potentially more than they will generate in their 2024 fiscal year. TSLA is expected to grow earnings by 64.11% over the next 2 years, so bulls would argue that you’re paying a large valuation for growth. There is no scenario where TSLA at these levels looks attractive compared to NVDA, which is expected to grow EPS by 86.35% over the next 2 years and trades at 26.86 times 2024 earnings. Shares of TSLA may not retrace, but based on the metrics, it seems unlikely that the multiple will continue to expand unless they increase guidance on profitability.

Steven Fiorillo, Seeking Alpha

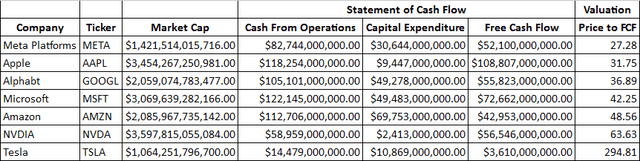

When I look at TSLA on a price-to-free cash flow [FCF] basis, the valuation is still unattractive. TSLA has generated $3.61 billion in FCF over the TTM and trades at 294.81 times its FCF. NVDA, which is expected to grow profitability at a quicker rate than TSLA, has generated $56.55 billion in FCF during the TTM and trades at 63.63 times FCF. Even if TSLA didn’t spend a dime on CapEx and could have a 100% FCF margin, they would still only produce $14.48 billion in FCF over the TTM and trade at 73.50 times their FCF. At some point, the fundamentals will catch up to TSLA, as we have seen in the past, and unless they can scale profitability and guide higher, I won’t be surprised to see a retracement soon.

Steven Fiorillo, Seeking Alpha

Why I am still long Tesla and not going bearish

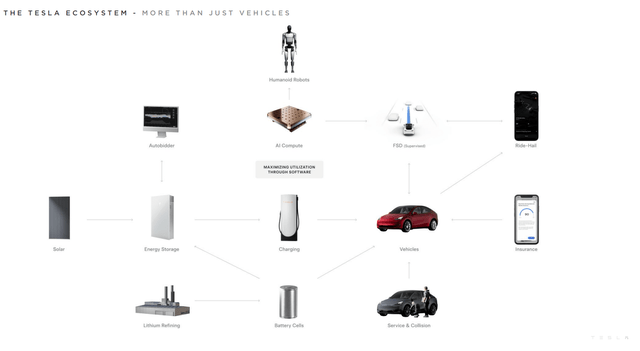

Just because I am downgrading my rating on TSLA, I am not selling my shares. I am also not purchasing more. There are many aspects I am bullish on, especially that TSLA isn’t tapping the debt markets to fuel its growth. TSLA has $33.65 billion in cash and short-term investments on hand, with another $3.31 billion in other long-term assets. TSLA only has $5.28 billion in long-term debt on the books, and a negative net debt position as their cash exceeds their total debt. TSLA has built an incredible company that has been able to build a business that is generating billions in profitability and may crack the $100 billion revenue mark for the 2024 fiscal year. This has allowed TSLA to expand into other areas, including AI, FSD, Robotaxis, and Robotics.

As of now, I believe that TSLA has the potential to become the largest company by market cap in the future, as I am extremely bullish on the robotics industry. If I still believed that TSLA was just a car company, I wouldn’t invest as my Ford (F) shares would pay more than a 7% yield from the dividend. Investing in TSLA is about them pioneering several markets and using the profitability and reputation of the car business to scale. Elon predicted that there will be 10 billion humanoid robots by 2040 at a price tag of $20,000 – $25,000 each. If that comes true, it remains to be seen, but this is likely a market that will have several winners taking most of the market share rather than many companies taking a small slice of the pie. TSLA is in a prime position to utilize its manufacturing expertise to produce Optimus at a scale that its competitors are unlikely to match.

Hypothetically, if the robotics market scales to a tenth of the size that Elon is projecting, there will be 1 billion humanoid robots in existence over the next 15 years. At a $25,000 price point, this would be $25 trillion in revenue. If TSLA can control 10% of the market, that would be $2.5 trillion of revenue, and if they operate at a 20% profit margin, this would be $500 billion of additional profitability over the next 15 years, which works out to $33.33 billion in annualized profits. This doesn’t include TSLA implementing a monthly subscription fee that hooks Optimus up to a learning platform so it can learn from every task every Optimus bot is performing throughout its ecosystem. There are many applications for Optimus across the business landscape and for home use. Businesses may even be incentivized to purchase humanoid robots to perform tasks such as lifting heavy objects or conducting patient handling in healthcare settings to reduce workman’s comp claims. My main reason for becoming a long-term shareholder is because the Optimus platform has the potential to be much larger than TSLA’s entire auto business, even when FSD and Robotaxis are operational.

Conclusion

After going from neutral to bullish to very bullish, I am downgrading my rating back to neutral after shares of TSLA have crossed over the $1 trillion market cap level. I am not exiting my position as I believe in the long-term investment thesis regarding TSLA, but I feel that the valuation has become too expensive to allocate more capital to this position. Ultimately, I would like to add to my position, but I think there are better opportunities in the market today. There are many unknowns and risk factors surrounding TSLA, and the bottom line is that the profitability and cash generated from operations are minimal compared to the rest of the Magnificent Seven. For anyone that wants to validate TSLA’s valuation based on growth, just remember that TSLA is trading at 83.45 times 2026 earnings with 64.11% EPS growth over the next 2 years while NVDA trades at 26.86 times 2026 earnings with 86.35% projected growth in EPS over the same period. I am a buyer of TSLA shares under $200, but as of now, I am just holding my shares and writing covered calls to generate income until the valuation becomes more attractive.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, NVDA, F, AAPL, GOOGL, AMZN, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.