Summary:

- Underwhelming vehicle delivery numbers and the departure of the CIO have TSLA shares dropping.

- I expect the upcoming Robotaxi event will further disappoint investors.

- With bearish sentiment abound, I think the stock should be dropped for the time being.

Sven Piper

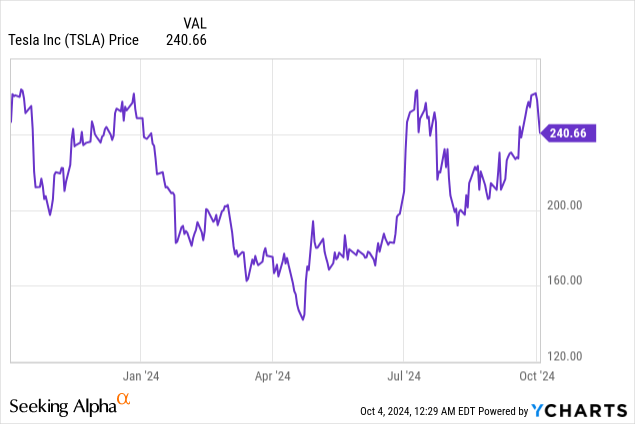

Tesla (NASDAQ:TSLA) (NEOE:TSLA:CA) shares have been bleeding the last few trading days as bad news continues to roll in leading up to the company’s Robotaxi event, dubbed “We, Robot,” next Thursday. Underwhelming delivery numbers, the departure of the company’s CIO, and what is shaping up to be a vaporware Robotaxi exhibition, all have TSLA moving in the wrong direction, and I think this will continue as the hype honeymoon fades. I am downgrading the stock from a Hold to a Sell.

When It Rains, It Pours

During a week where some investors expected a run-up leading up to Tesla’s Robotaxi event on 10/10, it has been nothing but bad news for the company and for shareholders. First, Tesla announced Q3 vehicle deliveries on Tuesday, which came in below consensus estimates despite aggressive incentives. The company delivered 462,890 total vehicles vs estimates of 463,897, including delivering slightly more Model 3/Y than expected and fewer of all other vehicles than expected. This comes even after Tesla has offered low-interest financing, favorable lease deals, and China has significantly boosted subsidies for purchasing electric vehicles.

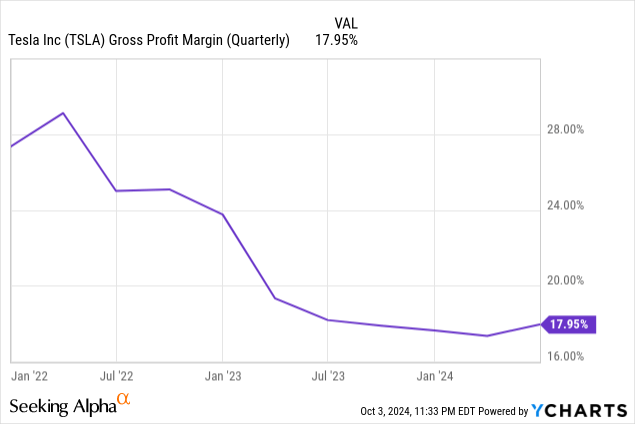

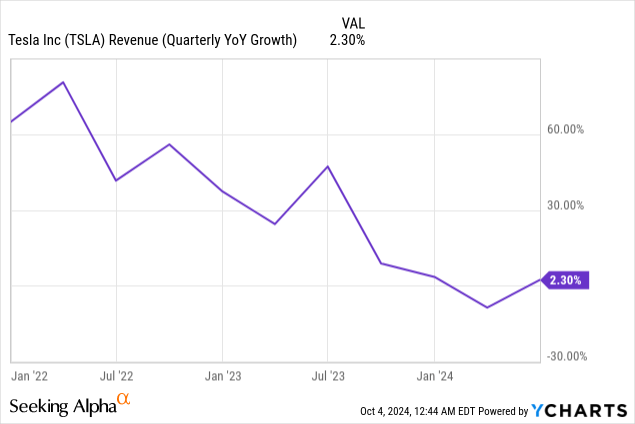

For the company to still miss deliveries despite a multitude of tailwinds indicates to me that competition in China is heating up with the likes of BYD and/or demand for Tesla vehicles is generally slowing. Further, if you consider all of the incentives the company has been offering and the higher mix of lower-margin Model 3 and Model Y vehicles in the deliveries, we can expect that gross margins have also taken a hit, which would continue a worrying trend in recent quarters:

With gross margin falling off precipitously, it appears that competition has finally come for Tesla’s margins. Worse still, even as the company ramps up incentives for buyers, sales have remained stagnant, with quarterly revenue growth nearly flat YoY:

It’s apparent that operating results are under major stress right now. Tesla is determined to keep deliveries afloat, even as the well of willing buyers worldwide appears to be drying up.

It’s important to keep in perspective: Ford (F) sold 23,509 EVs in Q3 and General Motors (GM) sold 32,100, so Tesla still has a massive lead in terms of actual vehicle deliveries. On the other hand, TSLA has a market cap of more than 8x GM and F combined, so expectations are undoubtedly higher. After touting China as a new growth market, these results and Tesla’s middling market share in the country would seem to indicate that deliveries erosion is being prevented by substituting margin erosion at a rate that seems unsustainable.

To make matters worse, Tesla CIO Nagesh Saldi announced Thursday that he would be leaving the company, just one week before the Robotaxi event. He was in part responsible for Tesla’s push into AI and autonomous driving, overseeing the development of the company’s data centers in Texas and New York. While an executive leaving isn’t inherently a bad thing, the timing of this departure in particular is hard to ignore. Saldi’s efforts appear to have been integral to much of the work that would enable a Tesla Robotaxi initiative, and yet, a week before the product’s supposed unveiling, he calls it quits? Without reading too much into this, it certainly can’t be interpreted as a bullish development for an event reveal that, if all goes according to Musk’s plan, should have been a celebration of his efforts.

So now, with this context, how are we to view the upcoming Robotaxi event? As I wrote in an article a few weeks back, which can be read here, Elon Musk has been promising a fully autonomous vehicle/taxi every year for nearly a decade with nothing to show for it. Now he’s apparently ready to reveal it to the world for real this time, but Tesla’s currently available full self-driving (“FSD”) mode is still a Level 2 system at best. It would take a monumental technological leap, kept entirely secret, and withheld from FSD for some inexplicable reason for this upcoming event to show off anything remotely close to Musk’s promised vision.

Meanwhile, Waymo, which has been running an actual autonomous taxi fleet in Phoenix and San Francisco for years, has recently announced an expansion of its service to Austin and Atlanta through a partnership with Uber (UBER). TSLA bulls have argued that Tesla is the only current player in autonomous vehicles that has the necessary production capacity and scale to build a large fleet of AV taxis, and while this may be the case, the company has shown little in the way of progress towards this goal beyond hyped up events like the one next week. Building the autonomous taxi, the hardware, is the easy part. The software that enables the “autonomous” part of the term is the hard part, and, despite the growing number of FSD miles for Tesla to train its models on, it will be many years before the company approaches even Waymo’s current position, in my opinion.

This all leaves the stock in a precarious position going into next Thursday: Sentiment is already fairly bearish following the lackluster delivery numbers and the departure of a key autonomous driving C-suite executive before what is meant to be an autonomous driving breakthrough for Tesla. As I’ve said previously, I think we can expect the event to feature a slick prototype or two perhaps doing a pre-determined route on an empty roadway or track in what will essentially amount to vaporware in terms of its impact on the autonomous vehicle arms race. The company will not suddenly pull a fleet of autonomous taxis out of a hat to challenge Waymo, or even to begin a small-scale rideshare service pilot program. Investors hoping for that should prepare to be disappointed.

To be honest, I’d been mostly assuming that this would be a commonly held opinion, considering how many promises Musk has broken in this arena in particular. But I’ve seen many articles on Seeking Alpha and elsewhere, and comments across forums, hyping this event up as one of the major milestones in the history of autonomous vehicles. While I, of course, cannot predict the future, I think investors would be wise not to buy into such hype, to be realistic about their expectations, and to analytically judge whatever is presented rather than buying into Musk’s promises yet again.

Investor Takeaway

It has been all bad news for Tesla this week, and I expect the news to get worse. Sentiment has turned bearish after weak delivery numbers, which will likely result in gross margin continuing to trend down, the departure of a key autonomous driving executive, and what I expect will be a let-down of a Robotaxi event. While I previously rated TSLA a Hold on what I anticipated would be strong delivery numbers offset by a downbeat Robotaxi reaction, this confluence of negative signals has pushed me to a Sell in the short-term timeframe.

The upcoming trading days before the event could still see an uptrend as hype continues to build (Musk is nothing if not a master promoter), but I expect we will see a negative price reaction when it is revealed that Tesla has not, in fact, cracked the autonomous driving puzzle yet. But hey, maybe next year?

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.